Advertisement

GOLD AT CRITICAL SUPPORT – WILL CPI PUSH IT HIGHER OR LOWER?

Gold has been consolidating around 2883 support, bouncing 10 points in the Asian session ahead of today’s major event – the US CPI release during the New York session.

With inflation data expected to shape the Fed’s next policy move, today’s price action could determine whether gold continues its uptrend or faces another rejection from key resistance levels.

📊 What’s Driving Gold Right Now?📉 Fed stance: No rush for rate cuts.📉 DXY & bond yields: US Dollar is weakening, 10-year Treasury yield remains at 4.52%.📉 Risk sentiment: Stock markets remain mixed as investors shift towards risk-off ahead of CPI.📊 Expected CPI Data:

Headline CPI (YoY): Forecast at 2.9%Core CPI (YoY): Expected 3.1%📌 Key question: If inflation remains sticky, will the Fed hold rates higher for longer? How will this impact gold’s momentum?

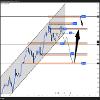

📈 Gold Technical Levels to Watch🔺 Resistance Zones:🔹 2906 - 2915 - 2926 - 2942

🔻 Support Zones:🔹 2884 - 2870 - 2860 - 2840

Gold traders are watching 2910 as a key pivot level – a break above could trigger a test of 2926, while failure to hold above 2883 may lead to another downside test.

🎯 My Trading Approach for Today🔴 Short Setup (Aggressive Sellers)📍 Sell Zone: 2926 - 2928❌ SL: 2932🎯 TP: 2922 - 2918 - 2914 - 2910 - 2905 - 2900

🟢 Long Setup (Buy the Dip)📍 Buy Zone: 2840 - 2838❌ SL: 2834🎯 TP: 2845 - 2850 - 2854 - 2858 - 2862 - 2866 - 2870

📌 Short-term Traders:

Looking for scalp opportunities near 2915 - 2917 (sell) and 2862 - 2860 (buy) based on price reaction.Stop losses are tight due to CPI risk – be ready for volatility spikes during the US session. ❗ Key Considerations Before CPI Release✔ Are we going to see a breakout or another fakeout before CPI?✔ Will gold follow DXY weakness, or will bond yields force another pullback?✔ What’s your take on today’s trade – bullish or bearish?

📢 Drop your thoughts below – let’s discuss before CPI hits! 🚀🔥

Looks like a make or break day for Gold. CPI can shake things up. Whats your bias?

Brenda13 posted:Looks like a make or break day for Gold. CPI can shake things up. Whats your bias?

Bnagr believes tonight will be very important and attract focus because the labor market slows down, CPI will receive even more attention.

Seems like gold will reach $3000 soon

ChelseaR posted:Seems like gold will reach $3000 soon

oh not a bad idea, let's wait and see what the price is when CPI is announced

KevinNguyen_MMF posted:Gold has been consolidating around 2883 support, bouncing 10 points in the Asian session ahead of today’s major event – the US CPI release during the New York session.

With inflation data expected to shape the Fed’s next policy move, today’s price action could determine whether gold continues its uptrend or faces another rejection from key resistance levels.

📊 What’s Driving Gold Right Now?📉 Fed stance: No rush for rate cuts.📉 DXY & bond yields: US Dollar is weakening, 10-year Treasury yield remains at 4.52%.📉 Risk sentiment: Stock markets remain mixed as investors shift towards risk-off ahead of CPI.📊 Expected CPI Data:

Headline CPI (YoY): Forecast at 2.9%Core CPI (YoY): Expected 3.1%📌 Key question: If inflation remains sticky, will the Fed hold rates higher for longer? How will this impact gold’s momentum?

📈 Gold Technical Levels to Watch🔺 Resistance Zones:🔹 2906 - 2915 - 2926 - 2942

🔻 Support Zones:🔹 2884 - 2870 - 2860 - 2840

Gold traders are watching 2910 as a key pivot level – a break above could trigger a test of 2926, while failure to hold above 2883 may lead to another downside test.

🎯 My Trading Approach for Today🔴 Short Setup (Aggressive Sellers)📍 Sell Zone: 2926 - 2928❌ SL: 2932🎯 TP: 2922 - 2918 - 2914 - 2910 - 2905 - 2900

🟢 Long Setup (Buy the Dip)📍 Buy Zone: 2840 - 2838❌ SL: 2834🎯 TP: 2845 - 2850 - 2854 - 2858 - 2862 - 2866 - 2870

📌 Short-term Traders:

Looking for scalp opportunities near 2915 - 2917 (sell) and 2862 - 2860 (buy) based on price reaction.Stop losses are tight due to CPI risk – be ready for volatility spikes during the US session. ❗ Key Considerations Before CPI Release✔ Are we going to see a breakout or another fakeout before CPI?✔ Will gold follow DXY weakness, or will bond yields force another pullback?✔ What’s your take on today’s trade – bullish or bearish?

📢 Drop your thoughts below – let’s discuss before CPI hits! 🚀🔥

o great

KevinNguyen_MMF posted:Gold has been consolidating around 2883 support, bouncing 10 points in the Asian session ahead of today’s major event – the US CPI release during the New York session.

With inflation data expected to shape the Fed’s next policy move, today’s price action could determine whether gold continues its uptrend or faces another rejection from key resistance levels.

📊 What’s Driving Gold Right Now?📉 Fed stance: No rush for rate cuts.📉 DXY & bond yields: US Dollar is weakening, 10-year Treasury yield remains at 4.52%.📉 Risk sentiment: Stock markets remain mixed as investors shift towards risk-off ahead of CPI.📊 Expected CPI Data:

Headline CPI (YoY): Forecast at 2.9%Core CPI (YoY): Expected 3.1%📌 Key question: If inflation remains sticky, will the Fed hold rates higher for longer? How will this impact gold’s momentum?

📈 Gold Technical Levels to Watch🔺 Resistance Zones:🔹 2906 - 2915 - 2926 - 2942

🔻 Support Zones:🔹 2884 - 2870 - 2860 - 2840

Gold traders are watching 2910 as a key pivot level – a break above could trigger a test of 2926, while failure to hold above 2883 may lead to another downside test.

🎯 My Trading Approach for Today🔴 Short Setup (Aggressive Sellers)📍 Sell Zone: 2926 - 2928❌ SL: 2932🎯 TP: 2922 - 2918 - 2914 - 2910 - 2905 - 2900

🟢 Long Setup (Buy the Dip)📍 Buy Zone: 2840 - 2838❌ SL: 2834🎯 TP: 2845 - 2850 - 2854 - 2858 - 2862 - 2866 - 2870

📌 Short-term Traders:

Looking for scalp opportunities near 2915 - 2917 (sell) and 2862 - 2860 (buy) based on price reaction.Stop losses are tight due to CPI risk – be ready for volatility spikes during the US session. ❗ Key Considerations Before CPI Release✔ Are we going to see a breakout or another fakeout before CPI?✔ Will gold follow DXY weakness, or will bond yields force another pullback?✔ What’s your take on today’s trade – bullish or bearish?

📢 Drop your thoughts below – let’s discuss before CPI hits! 🚀🔥

great

I thought the prices would decrease after the peace talks between Russia and Ukraine..... guess who has two thumbs and thinks wrong!!!!

KevinNguyen_MMF posted:Brenda13 posted:Looks like a make or break day for Gold. CPI can shake things up. Whats your bias?

Bnagr believes tonight will be very important and attract focus because the labor market slows down, CPI will receive even more attention.

Do you trade the new or watching for setups after dust settles?

JoeyQuinn posted:Hovering around 2931

It went ATH with the resistance level of $2947 on Feb 19th.

KevinNguyen_MMF posted:Gold has been consolidating around 2883 support, bouncing 10 points in the Asian session ahead of today’s major event – the US CPI release during the New York session.

With inflation data expected to shape the Fed’s next policy move, today’s price action could determine whether gold continues its uptrend or faces another rejection from key resistance levels.

📊 What’s Driving Gold Right Now?📉 Fed stance: No rush for rate cuts.📉 DXY & bond yields: US Dollar is weakening, 10-year Treasury yield remains at 4.52%.📉 Risk sentiment: Stock markets remain mixed as investors shift towards risk-off ahead of CPI.📊 Expected CPI Data:

Headline CPI (YoY): Forecast at 2.9%Core CPI (YoY): Expected 3.1%📌 Key question: If inflation remains sticky, will the Fed hold rates higher for longer? How will this impact gold’s momentum?

📈 Gold Technical Levels to Watch🔺 Resistance Zones:🔹 2906 - 2915 - 2926 - 2942

🔻 Support Zones:🔹 2884 - 2870 - 2860 - 2840

Gold traders are watching 2910 as a key pivot level – a break above could trigger a test of 2926, while failure to hold above 2883 may lead to another downside test.

🎯 My Trading Approach for Today🔴 Short Setup (Aggressive Sellers)📍 Sell Zone: 2926 - 2928❌ SL: 2932🎯 TP: 2922 - 2918 - 2914 - 2910 - 2905 - 2900

🟢 Long Setup (Buy the Dip)📍 Buy Zone: 2840 - 2838❌ SL: 2834🎯 TP: 2845 - 2850 - 2854 - 2858 - 2862 - 2866 - 2870

📌 Short-term Traders:

Looking for scalp opportunities near 2915 - 2917 (sell) and 2862 - 2860 (buy) based on price reaction.Stop losses are tight due to CPI risk – be ready for volatility spikes during the US session. ❗ Key Considerations Before CPI Release✔ Are we going to see a breakout or another fakeout before CPI?✔ Will gold follow DXY weakness, or will bond yields force another pullback?✔ What’s your take on today’s trade – bullish or bearish?

📢 Drop your thoughts below – let’s discuss before CPI hits! 🚀🔥

It looks like gold is at a critical juncture ahead of the CPI release. Given the mixed risk sentiment and the Fed's current stance, I’m leaning toward watching how gold reacts around 2910 for potential breakout or rejection. If inflation remains sticky, gold could face resistance and pull back, but if CPI surprises to the downside, it could drive gold higher. The key today is staying nimble, with tight stop losses due to the potential volatility spikes. Looking for price action around 2915-2917 to consider a short and watching 2840-2838 for potential buying opportunities.

KevinNguyen_MMF posted:ChelseaR posted:Seems like gold will reach $3000 soon

oh not a bad idea, let's wait and see what the price is when CPI is announced

Not sure if its gonna reach now