Edit Your Comment

DEMO ACCOUNT vs LIVE ACCOUNT

Nov 04, 2015 zamanından beri üye

2 iletiler

Dec 04, 2015 at 11:07

Nov 04, 2015 zamanından beri üye

2 iletiler

Hello all

I'm just trying make profit with real account.

I'm just newbie and how is feeling from demo to real...? ;)

I'm just trying make profit with real account.

I'm just newbie and how is feeling from demo to real...? ;)

Sep 12, 2015 zamanından beri üye

1933 iletiler

Dec 04, 2015 at 14:02

Sep 12, 2015 zamanından beri üye

1933 iletiler

Hi Lana1991,your fight or flight response will kick in when your trading live,keep your trades small to begin with until you get used to this powerful emotion,you need nerves of steel at times and you have to think what professional traders are up to.

"They mistook leverage with genius".

Oct 27, 2015 zamanından beri üye

10 iletiler

Dec 04, 2015 at 18:28

Oct 27, 2015 zamanından beri üye

10 iletiler

snapdragon1970 posted:

Hi Lana1991,your fight or flight response will kick in when your trading live,keep your trades small to begin with until you get used to this powerful emotion,you need nerves of steel at times and you have to think what professional traders are up to.

Agreed! Keep your trades small and grow from that after all be super patient it's like watching grass grow, if you know you'll succeed no point in rushing the process and being aggressive you don't want to blow your account and the difference between a demo and live account: 1) your emotions because your actually trading your own money. 2) the spread.

Sep 12, 2015 zamanından beri üye

1933 iletiler

Dec 04, 2015 at 19:02

Sep 12, 2015 zamanından beri üye

1933 iletiler

Trading clients money certainly teaches you to be sure of what your doing,friend of mine once said "be like a farmer"lol.

"They mistook leverage with genius".

Oct 27, 2015 zamanından beri üye

10 iletiler

Dec 05, 2015 at 17:57

Oct 27, 2015 zamanından beri üye

10 iletiler

snapdragon1970 posted:

Trading clients money certainly teaches you to be sure of what your doing,friend of mine once said "be like a farmer"lol.

Yea haha I like that "be like a farmer" saying that's a good one & I have a question trading clients money my friend had told me it was illegal to do it because I brought the idea to him that I wanted to do try it. My question is, can I do that, is it legal?

Jun 14, 2013 zamanından beri üye

127 iletiler

Dec 05, 2015 at 22:58

(Dec 05, 2015 at 23:02 düzenlendi)

Jun 14, 2013 zamanından beri üye

127 iletiler

DNatural posted:snapdragon1970 posted:

Trading clients money certainly teaches you to be sure of what your doing,friend of mine once said "be like a farmer"lol.

Yea haha I like that "be like a farmer" saying that's a good one & I have a question trading clients money my friend had told me it was illegal to do it because I brought the idea to him that I wanted to do try it. My question is, can I do that, is it legal?

This is one of the more intelligent questions I've seen on here for a long time... It depends on the legislation of the country you live in. I'm from South Africa, and here it is illegal to get money from people to trade with, UNLESS you are registered as a Bank, and that's extremely hard to do in our country. We had a case where a person (not going to mention names, 'cause I don't want to get involved) took money (approximately 24 Million dollars) from hundreds of people with the intentions of trading and giving them a return of 60% per year. This turned our to be the biggest Ponzi scheme in South Africa of on record. Lots of people lost their Retirement Funds (their own fault if you ask me)... and it caused a drastic change in the law and regulations on personal investments in SA.

So to summarize, it would probably be illegal to receive money from anyone for the purpose of trading, again, depending on the law and regulations of the country you live in. Rather ask the client to open their own trading account, and then you trade for them using their account details, for a commission. This way you don't handle the client's money, and if you have any idea what you are doing in terms of trading, you can earn good money for almost no financial risk to yourself. Just make sure you specify in your client's contract that you don't take any responsibility for any losses.

Anyway, that's my personal view...

Keep it simple, be disciplined, get rich slowly and above all protect your equity!

Jul 16, 2013 zamanından beri üye

94 iletiler

Dec 06, 2015 at 01:24

Jul 16, 2013 zamanından beri üye

94 iletiler

I agree with Jaco Ferreira. The best thing to trade others money may be on a commision based account. The account might still be in the name of the funder but the external trader handling the trades gets a commision on the trades made. The question is what kind of a return is expected to be received to the trader, trading the account? A general rule is 30-40% if the account makes a profit, and if it makes a loss nothing will be given back to the trader. The trading however has to be very regulated with RMM features whatever account and platform is used to trade on.

RMMRobot.com is heavely into risk & money management and free information can be read there.

RMMRobot.com is heavely into risk & money management and free information can be read there.

" Lock in the profit and minimize the draw down "

Oct 27, 2015 zamanından beri üye

10 iletiler

Dec 06, 2015 at 08:29

Oct 27, 2015 zamanından beri üye

10 iletiler

kricka posted:

I agree with Jaco Ferreira. The best thing to trade others money may be on a commision based account. The account might still be in the name of the funder but the external trader handling the trades gets a commision on the trades made. The question is what kind of a return is expected to be received to the trader, trading the account? A general rule is 30-40% if the account makes a profit, and if it makes a loss nothing will be given back to the trader. The trading however has to be very regulated with RMM features whatever account and platform is used to trade on.

RMMRobot.com is heavely into risk & money management and free information can be read there.

Yea definitely, that's how I was going to do it. Thank you for the help and information

Sep 12, 2015 zamanından beri üye

1933 iletiler

Dec 06, 2015 at 13:57

Sep 12, 2015 zamanından beri üye

1933 iletiler

You can't advise clients on financial matters unless they ask specific questions,clients come to me because they see my experience and trading record and are made fully aware of the risks,each client has to have a report of their financial situation draw up by their accountant .Contracts are signed and held by both parties ,commissions and % of profit are discussed in detail.I trade a % of my own money on the same trades ,so I have a vested interest in the care of my clients profits .when I was working in London the commission was 30% plus a bonus for each round trip.The round trip was still paid even if it turned negative.80% of the time on the phone to clients until you build a client base ,then this % comes down depending on how many clients you burn,20% looking at trades that I'd research the night before,otherwise trading the DAX and eur/usd,more of a bonus for trading the index.I could trade position at any location.More difficult to trade accounts in Europe than the Uk,don't know about any other country.I had no interest in trading other people's money until it was pointed out to me ,good news travels fast .

"They mistook leverage with genius".

Nov 19, 2014 zamanından beri üye

157 iletiler

Dec 06, 2015 at 14:24

(Dec 06, 2015 at 14:30 düzenlendi)

Nov 19, 2014 zamanından beri üye

157 iletiler

Yep...DEMO is 99.9% the same as REAL once your system has worked and proven profitable..

Charts are exactly the same, except for maybe spread etc. and other small issues that shouldnt affect profitability (assuming you arent in it to just make a few Pips & $$)

But part of the problem with the transition is what most people believe is "success" or "profitability" on a demo account.

A few days or weeks making a large % return of 50%, or even 100% might sound good and is often good enough for many persons to quickly jump into live only to fail and wonder why. The problem is that this performance was not supported by several factors that lead to success on Live Accounts..

- Firstly, not many people have a plan as to how much money or Return they want from Forex to begin with - or its not realistic. This leads them to quickly jump into Live as soon as they make any amount of profit or return, no matter how small. Without establishing that Profit plan that is realistic in terms of your financial targets/needs and practicing to hit that target on a Demo, you are gonna be trading aimlessly. Remember, you cant take % to the bank or supermarket- only money.

- not enough time spent ensuring that you have a plan to deal with losses and gains so that emotions do not take over

- Demo Account isnt taken seriously- it might just be fake money, but like all things in life, whatever you practice in a simulated environment with a clear set of rules, scenario analysis etc...will always be what you get in the real environment.

- you may have just traded using one new technique which is not enough to be a comprehensive System. Support and Resistance are great techniques to have for entry and exit, but understanding the overall pattern and direction of the market requires using other tools that S&R cannot provide by themselves.

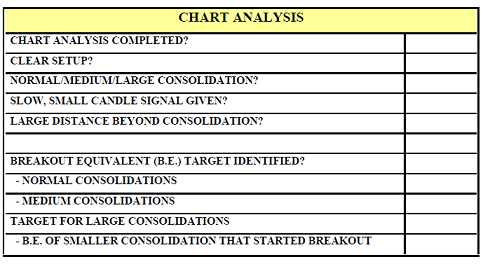

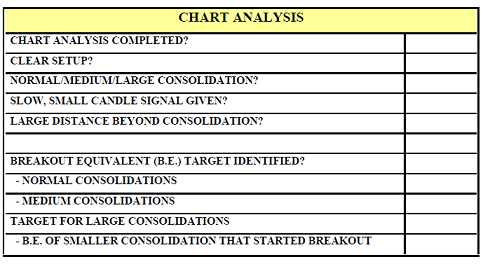

- the trades that led to these returns werent supported by a clear set of Rules and Guidelines that are followed ALL the time. Many people just look at the screens and make decisions without using a Trading Plan that tells them when to trade and not to trade. For example, this is just one part of Trade Sheets that I use for my trades...

For every single trade that you make, you must have a clear set of criteria that control all your decisions. Otherwise, emotions will play more of a role than it should and you wont be able to assess each gain/loss against a benchmark.

This is why nerves and anxiety play a bigger role than they should when trading with real money. If you havent ironed out all the details and issues of your system and taken Demo seriously, nerves will kick in when you start seeing situations that you havent dealt with on Demo or have a plan for.

Get a Plan, practice it a system that can achieve that Plan and then move to Live.

Charts are exactly the same, except for maybe spread etc. and other small issues that shouldnt affect profitability (assuming you arent in it to just make a few Pips & $$)

But part of the problem with the transition is what most people believe is "success" or "profitability" on a demo account.

A few days or weeks making a large % return of 50%, or even 100% might sound good and is often good enough for many persons to quickly jump into live only to fail and wonder why. The problem is that this performance was not supported by several factors that lead to success on Live Accounts..

- Firstly, not many people have a plan as to how much money or Return they want from Forex to begin with - or its not realistic. This leads them to quickly jump into Live as soon as they make any amount of profit or return, no matter how small. Without establishing that Profit plan that is realistic in terms of your financial targets/needs and practicing to hit that target on a Demo, you are gonna be trading aimlessly. Remember, you cant take % to the bank or supermarket- only money.

- not enough time spent ensuring that you have a plan to deal with losses and gains so that emotions do not take over

- Demo Account isnt taken seriously- it might just be fake money, but like all things in life, whatever you practice in a simulated environment with a clear set of rules, scenario analysis etc...will always be what you get in the real environment.

- you may have just traded using one new technique which is not enough to be a comprehensive System. Support and Resistance are great techniques to have for entry and exit, but understanding the overall pattern and direction of the market requires using other tools that S&R cannot provide by themselves.

- the trades that led to these returns werent supported by a clear set of Rules and Guidelines that are followed ALL the time. Many people just look at the screens and make decisions without using a Trading Plan that tells them when to trade and not to trade. For example, this is just one part of Trade Sheets that I use for my trades...

For every single trade that you make, you must have a clear set of criteria that control all your decisions. Otherwise, emotions will play more of a role than it should and you wont be able to assess each gain/loss against a benchmark.

This is why nerves and anxiety play a bigger role than they should when trading with real money. If you havent ironed out all the details and issues of your system and taken Demo seriously, nerves will kick in when you start seeing situations that you havent dealt with on Demo or have a plan for.

Get a Plan, practice it a system that can achieve that Plan and then move to Live.

Trade Less, Earn More

Sep 12, 2015 zamanından beri üye

1933 iletiler

Dec 06, 2015 at 16:41

Sep 12, 2015 zamanından beri üye

1933 iletiler

Demo and live account are not 99% the same,false information,you sound like a broker!

"They mistook leverage with genius".

Oct 25, 2012 zamanından beri üye

64 iletiler

Dec 07, 2015 at 11:48

Oct 25, 2012 zamanından beri üye

64 iletiler

Demo account trading is nothing like a live account

It is good to get started on a demo account to get used to things but there is a substantial difference

There is nothing that simulates losing and earning real money than losing and earning real money

There is a massive difference psychologically being down 100 PIPs in a demo account compared to in a live account

It will hurt so much more in a real account, but in a demo it will not matter and you will not let it affect your process/system

It is good to get started on a demo account to get used to things but there is a substantial difference

There is nothing that simulates losing and earning real money than losing and earning real money

There is a massive difference psychologically being down 100 PIPs in a demo account compared to in a live account

It will hurt so much more in a real account, but in a demo it will not matter and you will not let it affect your process/system

When you lose, don't lose the Lesson

Oct 14, 2015 zamanından beri üye

9 iletiler

Dec 07, 2015 at 13:55

Oct 14, 2015 zamanından beri üye

9 iletiler

sareen posted:

Demo account trading is nothing like a live account

It is good to get started on a demo account to get used to things but there is a substantial difference

There is nothing that simulates losing and earning real money than losing and earning real money

There is a massive difference psychologically being down 100 PIPs in a demo account compared to in a live account

It will hurt so much more in a real account, but in a demo it will not matter and you will not let it affect your process/system

It's just a training ground, anyway. Unless you're moving to live account, you'll never feel the real impact of losing or wining in trading...

Dec 11, 2015 zamanından beri üye

1462 iletiler

Dec 13, 2015 at 08:34

Dec 11, 2015 zamanından beri üye

1462 iletiler

Practicing what you've learned on a demo account is a very necessary thing, but it's different when you trade on a live account. Knowing that you're dealing with real money definitely affects one's trading decisions.

Oct 14, 2015 zamanından beri üye

13 iletiler

Dec 14, 2015 at 14:16

Oct 14, 2015 zamanından beri üye

13 iletiler

mlawson71 posted:

Practicing what you've learned on a demo account is a very necessary thing, but it's different when you trade on a live account. Knowing that you're dealing with real money definitely affects one's trading decisions.

Agree. You need to change your mindset when you're about to trade with your own money. Start it first and trade it carefully, use everything that you've learned from demo account. The impact of winning or losing in real account is more affecting than the demo one.

Dec 31, 2014 zamanından beri üye

102 iletiler

Dec 15, 2015 at 11:26

Dec 31, 2014 zamanından beri üye

102 iletiler

correct apip .people are loosing money with real money.

Top Forex Robot

Jun 14, 2013 zamanından beri üye

127 iletiler

Dec 16, 2015 at 07:31

Jun 14, 2013 zamanından beri üye

127 iletiler

I feel there are two major differences between trading a Demo Account vs. trading a Live Account. And in my opinion it does not matter if you trade manually or with an EA, these factors still affect the way you trade:

Firstly...

With a Demo Account you trade with "pretend money" and therefore you will take greater risks, i.e. large Stop Loss, or none at all and large Lot Sizes, etc. This "risk-it-all" attitude will have no impact on a trader's emotions, as the money is not real. So you will have no FEAR of losing a trade or giving back profits by not using stop losses or take profit levels. You will have a great appetite for GREED so you keep your losing trades open through huge drawdowns and let your profits run too far for that "home-run monster trade". You will keep the HOPE alive while sitting through a massive losing trade in case the market turns in your favour. You will have take REVENGE on the market for that last losing trade by doubling down on the next... with "great balls-of-steel". You will not PANICK during volatile trading like NFP's or rate decisions if your trades run against you. You will feel ELATED when you gambled on a big trade and won, but oddly you will never feel SAD when you lose.... because why would you, its only a Demo Account, and if you blow the account, you just quickly open another, and gamble on...

This may seem a bit extreme, but most new traders don't even realize they go through this lack of real trader emotions, which breeds a culture of excessive risk-taking in them, before they trade with a Real Account. And then they get absolutely hammered by an emotional rollercoaster of a ride in their first week or two of trading with real money on a Real Account. This in my opinion is the biggest reason most new traders fail horribly with their first Real Account (or even few accounts).

Secondly...

There is a noticeable difference in the speed of execution of orders between a Demo Server and a Live Server. When you trade on a Demo Server, the orders get filled immediately by the actual Demo Server of your broker. So you basically have a two-way transaction route from your PC to your Broker's Demo Server. And just clarify I'm talking about Forex here not Stocks or Options.

With a Real Account this works completely different. Your order will go from your PC to your Broker's Live Server, where it will then be passed onto a "Market Maker" or ECN Broker (unless your broker is already an ECN Broker), which is mostly a large bank or financial institution that can deal directly with an EBS (Electronic Brokering Service) machine or Reuters Dealing Spot-Matching machine to find a willing Buyer or Seller for your order. Once an order is matched the filled order instruction then gets passed all the way back in reverse-order to your PC. Now this process happens extremely fast in milliseconds. The problem is that there are millions (if not billions) of these orders flowing to and from the EBS and Reuters machines all over the world. During times of high volatility the volume of orders can be so great that your order sits in a queue and wait to be filled, and this is where the delay comes into play. Ever wondered why you get "Re-quotes" and slippages or markets that run straight through your Stop-Loss or Take Profit levels without triggering them. This is the reason. It has nothing to do with Brokers trading against clients or "Stop Hunting". It's just the way an inter-connected electronic brokering market works.

Think of it this way, trading on a Demo Server is like having your own personal bank where there are no queue (line of people waiting to be served). Trading a Live Server is like going into a bank and there is a long queue of people waiting to be served before you. The effect is you have to wait (delay in order execution) or in some cases you don't' get served due to too many people in line and the bank closes (slippage). This is a simple analogy, but it kind of puts it in perspective.

I'm not a pro, but I paid my school fees in the trading world, and my advise to new traders is when practicing on a demo server you actually try your hardest to trade like you would if it is real money. Keep your risk low, use stop-losses correctly, use take-profits correctly and apply a good risk/reward strategy. I would advise not to use large lot sizes or high leverage (try not to use leverage above 200). Develop your own Trading Plan that spells out how and when you trade and what your Risk and Money Management plan would be. Create a set of rules that govern the actions of your trading plan. This helps to keep you disciplined and keep your emotions in check. And develop a Trading Strategy (rules for actual order entry, order management and order exit) and practice this on your demo server. A Demo Account is meant to used to prepare yourself as best you can before going live.

But once you start trading live, only experience will make you a successful trader. It's like training to be a Soldier, you go through rigorous, tough training for months, but nothing can train you for the emotions you experience when in a battle for life or death. Trading a live account is similar. You will be fighting for your "Trading Life" out there...

Anyway, before I start writing a novel, I think I'm done ranting on about this. But I hope this may shed some light to new traders on what they can expect going from a Demo Account to a Live Account. Good luck trading out there guys, and may you be profitable on your next trade...

Cheers

Jaco Ferreira

Firstly...

With a Demo Account you trade with "pretend money" and therefore you will take greater risks, i.e. large Stop Loss, or none at all and large Lot Sizes, etc. This "risk-it-all" attitude will have no impact on a trader's emotions, as the money is not real. So you will have no FEAR of losing a trade or giving back profits by not using stop losses or take profit levels. You will have a great appetite for GREED so you keep your losing trades open through huge drawdowns and let your profits run too far for that "home-run monster trade". You will keep the HOPE alive while sitting through a massive losing trade in case the market turns in your favour. You will have take REVENGE on the market for that last losing trade by doubling down on the next... with "great balls-of-steel". You will not PANICK during volatile trading like NFP's or rate decisions if your trades run against you. You will feel ELATED when you gambled on a big trade and won, but oddly you will never feel SAD when you lose.... because why would you, its only a Demo Account, and if you blow the account, you just quickly open another, and gamble on...

This may seem a bit extreme, but most new traders don't even realize they go through this lack of real trader emotions, which breeds a culture of excessive risk-taking in them, before they trade with a Real Account. And then they get absolutely hammered by an emotional rollercoaster of a ride in their first week or two of trading with real money on a Real Account. This in my opinion is the biggest reason most new traders fail horribly with their first Real Account (or even few accounts).

Secondly...

There is a noticeable difference in the speed of execution of orders between a Demo Server and a Live Server. When you trade on a Demo Server, the orders get filled immediately by the actual Demo Server of your broker. So you basically have a two-way transaction route from your PC to your Broker's Demo Server. And just clarify I'm talking about Forex here not Stocks or Options.

With a Real Account this works completely different. Your order will go from your PC to your Broker's Live Server, where it will then be passed onto a "Market Maker" or ECN Broker (unless your broker is already an ECN Broker), which is mostly a large bank or financial institution that can deal directly with an EBS (Electronic Brokering Service) machine or Reuters Dealing Spot-Matching machine to find a willing Buyer or Seller for your order. Once an order is matched the filled order instruction then gets passed all the way back in reverse-order to your PC. Now this process happens extremely fast in milliseconds. The problem is that there are millions (if not billions) of these orders flowing to and from the EBS and Reuters machines all over the world. During times of high volatility the volume of orders can be so great that your order sits in a queue and wait to be filled, and this is where the delay comes into play. Ever wondered why you get "Re-quotes" and slippages or markets that run straight through your Stop-Loss or Take Profit levels without triggering them. This is the reason. It has nothing to do with Brokers trading against clients or "Stop Hunting". It's just the way an inter-connected electronic brokering market works.

Think of it this way, trading on a Demo Server is like having your own personal bank where there are no queue (line of people waiting to be served). Trading a Live Server is like going into a bank and there is a long queue of people waiting to be served before you. The effect is you have to wait (delay in order execution) or in some cases you don't' get served due to too many people in line and the bank closes (slippage). This is a simple analogy, but it kind of puts it in perspective.

I'm not a pro, but I paid my school fees in the trading world, and my advise to new traders is when practicing on a demo server you actually try your hardest to trade like you would if it is real money. Keep your risk low, use stop-losses correctly, use take-profits correctly and apply a good risk/reward strategy. I would advise not to use large lot sizes or high leverage (try not to use leverage above 200). Develop your own Trading Plan that spells out how and when you trade and what your Risk and Money Management plan would be. Create a set of rules that govern the actions of your trading plan. This helps to keep you disciplined and keep your emotions in check. And develop a Trading Strategy (rules for actual order entry, order management and order exit) and practice this on your demo server. A Demo Account is meant to used to prepare yourself as best you can before going live.

But once you start trading live, only experience will make you a successful trader. It's like training to be a Soldier, you go through rigorous, tough training for months, but nothing can train you for the emotions you experience when in a battle for life or death. Trading a live account is similar. You will be fighting for your "Trading Life" out there...

Anyway, before I start writing a novel, I think I'm done ranting on about this. But I hope this may shed some light to new traders on what they can expect going from a Demo Account to a Live Account. Good luck trading out there guys, and may you be profitable on your next trade...

Cheers

Jaco Ferreira

Keep it simple, be disciplined, get rich slowly and above all protect your equity!

Dec 11, 2015 zamanından beri üye

1462 iletiler

Dec 16, 2015 at 07:46

Dec 11, 2015 zamanından beri üye

1462 iletiler

Apipfx posted:mlawson71 posted:

Practicing what you've learned on a demo account is a very necessary thing, but it's different when you trade on a live account. Knowing that you're dealing with real money definitely affects one's trading decisions.

Agree. You need to change your mindset when you're about to trade with your own money. Start it first and trade it carefully, use everything that you've learned from demo account. The impact of winning or losing in real account is more affecting than the demo one.

Absolutely. I've long noticed that I am much more cautious, sometimes too cautious even, when I'm trading with a live account.

Jul 16, 2013 zamanından beri üye

94 iletiler

Dec 28, 2015 at 02:13

(Dec 28, 2015 at 02:18 düzenlendi)

Jul 16, 2013 zamanından beri üye

94 iletiler

mlawson71, yes that is the way a live account affects us. We start thinking more about protecting the account and not to take too many unnecessary chances to jeopardize it. RMM protection of the account becomes suddenly more in focus and learning about how it works and how it can become an advantage in our trading. There is good info to be had at RMMRobot.com about this subject, how to protect the trading account regardless of the platform or the broker we use.

" Lock in the profit and minimize the draw down "

Jan 14, 2014 zamanından beri üye

166 iletiler

Dec 28, 2015 at 03:30

Jan 14, 2014 zamanından beri üye

166 iletiler

It doesn't matter you trade demo or real but how your system works!

*Ticari kullanım ve istenmeyen e-postalara müsamaha gösterilmez ve hesabın feshedilmesine neden olabilir.

İpucu: Bir resim/youtube urlsi yayınlamak, onu otomatik olarak gönderinize gömer!

İpucu: Bu tartışmaya katılan bir kullanıcı adını otomatik olarak tamamlamak için @ işaretini yazın.