Demand for safe assets lingers

US presidential election is firmly on the market's radar

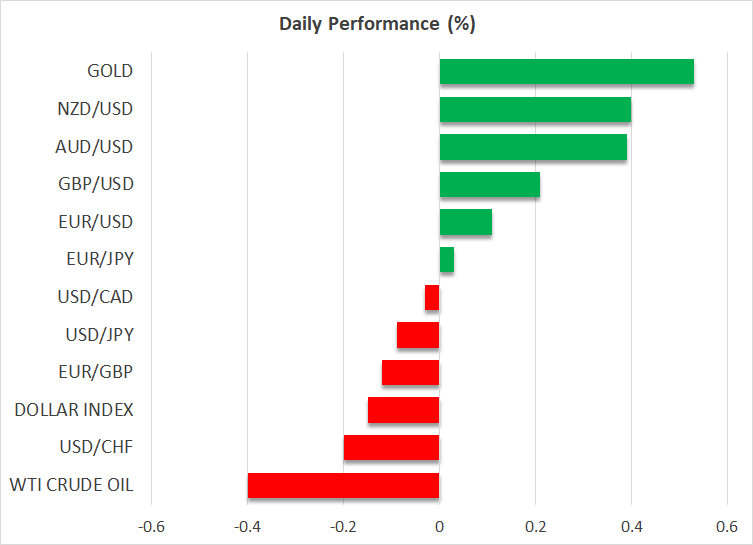

The US dollar continues to enjoy strong demand, outperforming its main counterparts. In particular, euro/dollar is trading at the lowest level since early August, and dollar/yen is hovering a tad below the 151 area. At the same time, gold is continuing its journey north, recording new all-time highs almost daily. Several reasons have been touted, with geopolitics, strong buying from Asian central banks and diversification away from the dollar being at the top of the list.

In the meantime, the 10-year US Treasury yield has reached 4.2%, the highest yield since end-July, after climbing by more than 55bps from the mid-September trough. This move is counter-intuitive considering the fact that the Fed is preparing for another cut on November 7 and around 150bps of easing are currently priced in over the next 16 months.

Having said that, there is a common theme that could explain these movements. The US presidential election is acting as the rising tide that lifts all boats with investors seeking protection from a potentially negative market outcome. It is up to the market to decide if a Trump or a Harris win will produce a risk-off reaction, but market participants could also be preparing for a repeat of the 2000 presidential election, when the result was declared in courts almost one month after the election date.

Interestingly, stocks are also starting to feel the election pressure, with the S&P 500 index starting the week in the red and the Dow Jones index suffering the most during Monday’s session. Indicative of the current situation is the fact that the best performing stock in the Dow was Trump Media and Technology, potentially benefiting from the latest polls showing increased support for the former president.

Lighter calendar today, IMF and BRICS meetings under way

With most Fed speakers openly supporting the November rate cut, the focus today turns to the annual IMF meeting, which will take place in Washington, D.C. and will last until Saturday, October 26. A plethora of central bank members will be on the wires again today, mostly from the Fed, the ECB and the BoE, including ECB President Lagarde and BoE Governor Bailey.

Comments from BoE members will attract extra interest as the next BoE meeting, which will also feature the quarterly projections, is around the corner. The recent weaker CPI report has cemented the November rate cut despite the strong retail sales figures, with the market fully pricing a 25bps rate cut. However, the size of the rate cut could be affected by the Autumn budget published on October 30 with reports pointing to significant tax increases that will potentially dent the current momentum of the UK economy.

This week the 16th BRICS summit is also taking place in Russia. Five new members, including Iran and UAE, will officially join this bloc with Turkey, a NATO member, apparently considering membership. These summits do not tend to be market moving, but the world will pay extra attention to comments about the Middle East conflict and the rumoured announcement of a BRICS currency.