EBC Markets Briefing | Euro wobbles near one-year low after Powell’s speech

The euro was on solid footing on Friday but on track for its worst weekly performance in seven months. The currency hit its lowest level in a year amid speculation that it could fall to parity with the greenback.

Some analysts reckon that scenario will depend on the extent of tariffs. Tax cuts could also fuel US inflation and limit Fed rate cuts, making the dollar potentially more attractive than the euro.

Fed Chair Powell said on Thursday the central bank does not need to rush to lower interest rates, citing ongoing economic growth, a solid job market and sticky inflation as reasons for caution against rapid easing.

The eurozone economy grew 0.4% in Q3, faster than forecast. The collapse of Germany's government that potentially paves the way for growth-boosting spending under the next one could be supportive.

A weak euro also bodes well for Germany that has suffered from weaker exports to China. The situation may well get worse as Trump suggested he could put blanket tariffs of 10% to 20% on almost all imports.

Morningstar DBRS meanwhile identified autos and chemicals as two of the sectors most exposed to potential tariffs — both of which historically have been key pillars of the country’s industry.

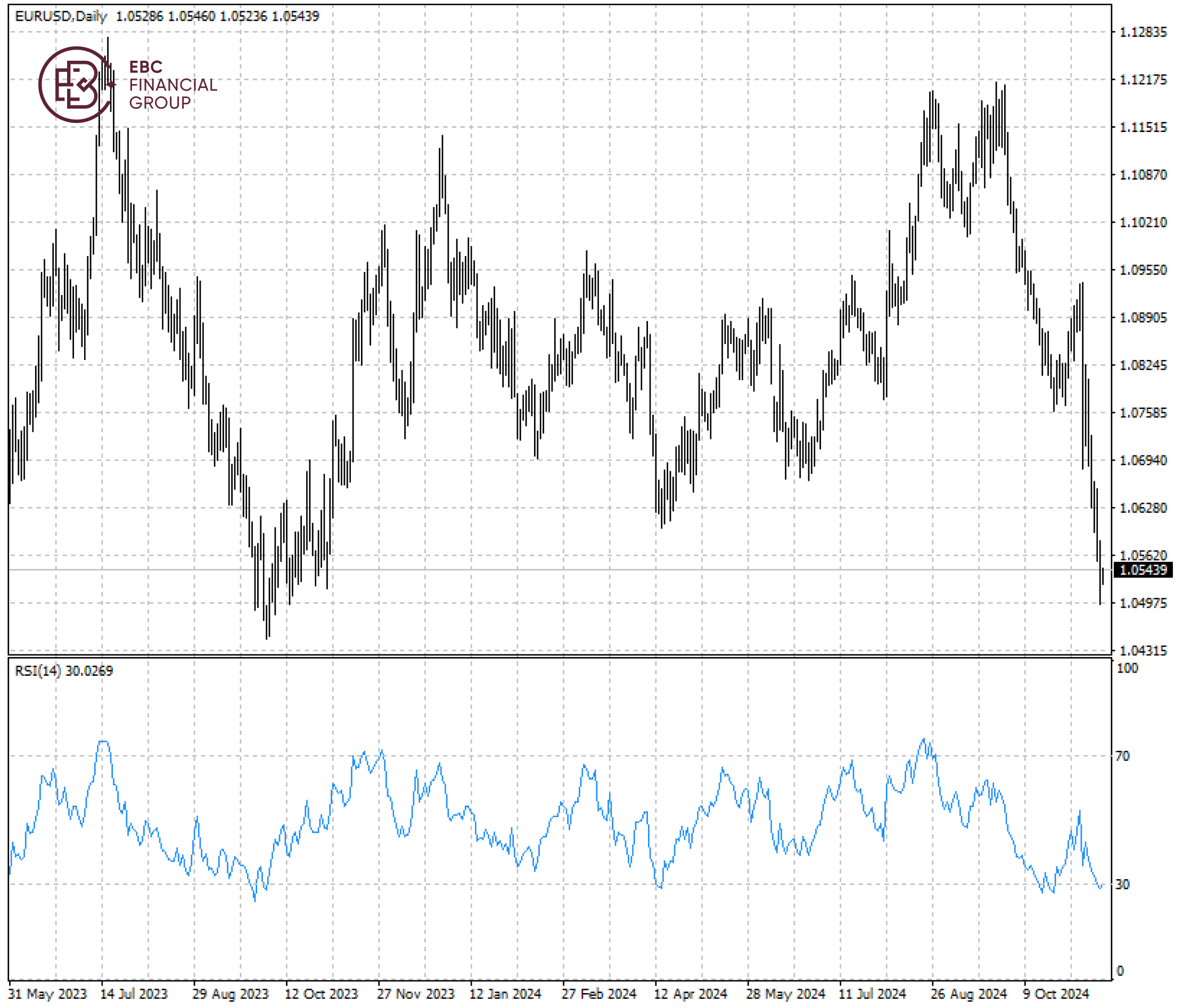

The single currency bottomed out around 1.0500 with RSI indicative of some more gains. The first resistance is seen at 1.0600 – a low hit in mid-April.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.