US GDP to provide clues on next week's US monetary policy update

OVERNIGHT

Asian equity markets are mostly up this morning despite further falls in European and US markets yesterday. In a further signal that markets may be stabilising after a difficult few day, US equity futures prices are also currently highly signalling a positive opening today. Markets have been steadied by some positive earnings reports although concerns about the banking sector linger. The oil price has also steadied for now after falling sharply in recent days with Brent crude holding at about $78bbl.

THE DAY AHEAD

US Q1 GDP will be today’s most keenly awaited data. Markets are becoming increasingly remain concerned that the US economy will slip into recession this year but today’s release is not expected to suggest that this imminent. Indeed, overall growth is expected to be a respectable 2% annualised, down only modestly from the 2.6% rise seen in Q4 2022. Moreover, the balance between inventory accumulation and final demand looks set to be more positive than in Q4 with consumer spending accounting for the bulk of growth. However, less positively, the surge in consumption was primarily concentrated in January and the subsequent deceleration means that there may not have been much momentum heading into Q2.

Also of interest in a busy US calendar will be initial jobless claims. Those have picked up in recent weeks, a possible signal that previous reports of job layoffs are now starting to show up. Consequently, a further rise will boost expectations that monthly jobs growth is set to slow which would reinforce the case for the Federal Reserve soon ending its current series of interest rate hikes.

In the Eurozone, the EU’s industrial confidence index is expected to be up on the month in April while the services measure is forecast to be down modestly. Neither of the predicted moves looks large enough to catch the eye of European Central Bank policymakers who still seem set to raise interest rates next week.

Early Wednesday, the Bank of Japan will reveal the results of its latest monetary policy meeting, which was the first under new BoJ Governor Ueda. The appointment of a new head has prompted speculation that, with Japanese inflation now above target, the BoJ may soon start to consider a rise in interest rates even though Ueda has indicated that he is not planning an immediate move. So, while a policy change is unlikely today, markets will be alert for any indications of the criteria he would want to trigger some action.

MARKETS

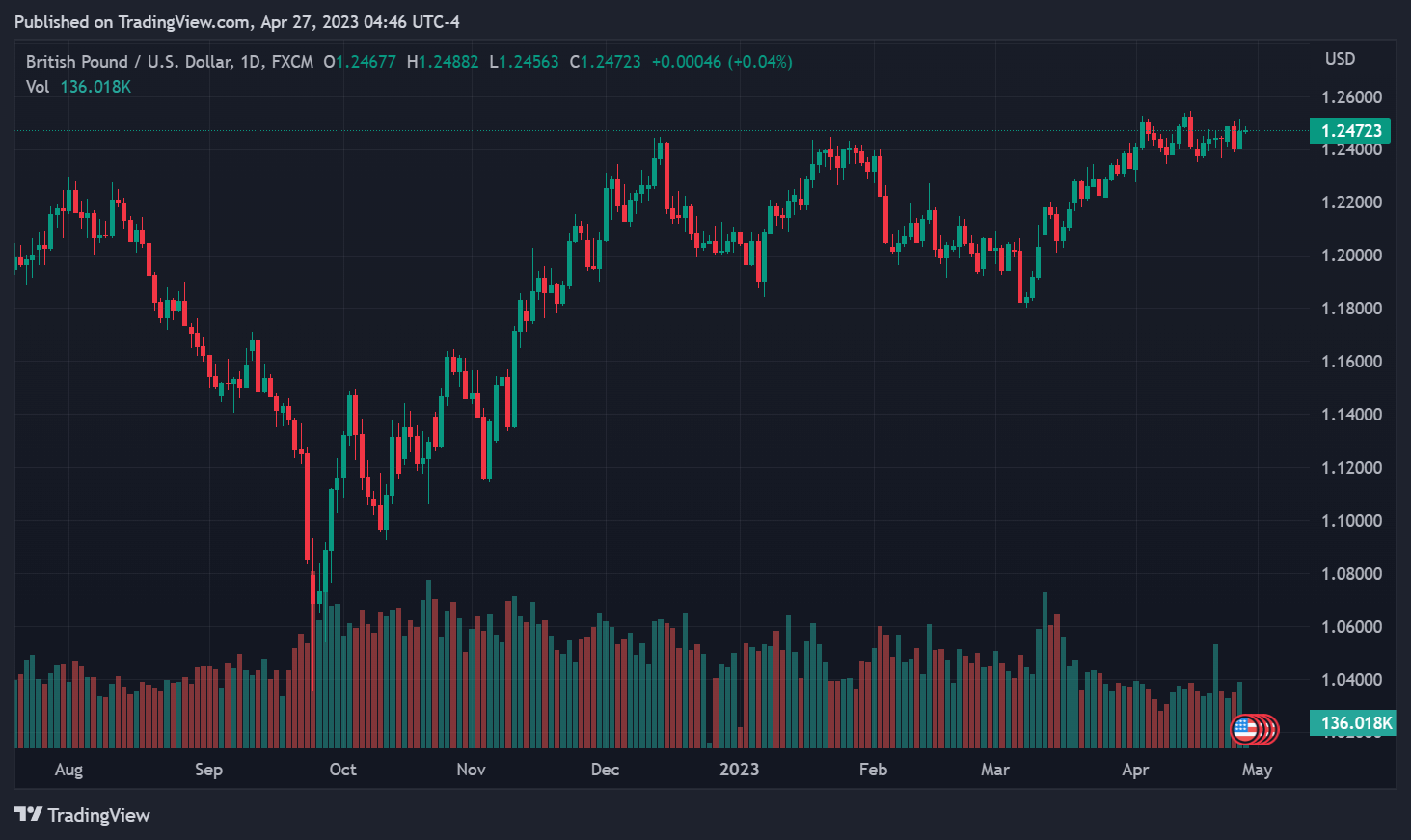

US Treasury yields rose from recent lows yesterday although they are still down sharply on the week. Bond yields in other markets, including UK gilts, also rose yesterday. In currency markets, the US dollar remains under pressure as it hit a new low for the year against the euro and also slipped against sterling. The pound depreciated against a generally strong euro and is now back in the lower half of this year’s trading range.