Advertisement

EUR/USD Technical Analysis: Downtrend Strengthens as Key Levels Hold

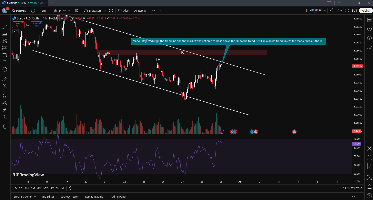

OverviewThe EUR/USD pair continues to follow a well-established downtrend, respecting the descending channel on the lower timeframes. A recent rejection from the upper trendline reinforces bearish momentum, while a significant structural break on the daily timeframe further solidifies the downward bias.

Technical Breakdown1. Trendline Rejection and Lower High ConfirmationOn the 1-hour chart, the price tested the upper boundary of the descending channel but failed to break through, leading to a strong rejection. This rejection aligns with a previous Lower High (LH), indicating that sellers remain dominant. Unless the market successfully breaks and closes above the LH, the downtrend remains intact.

2. Daily Timeframe Confirms Bearish StructureLooking at the daily timeframe, the market has broken below a key Higher Low (HL), marking a major shift in structure. This breakdown confirms that the previous uptrend has now transitioned into a confirmed downtrend, adding confluence to the bearish outlook.

3. Resistance Zone Holding StrongA critical resistance area, highlighted in red on the chart, continues to act as a supply zone, preventing further bullish attempts. The failure to breach this level indicates that sellers are aggressively defending it, further reinforcing the bearish trend structure.

4. Volume and RSI IndicationsVolume Analysis: The recent rejection was accompanied by an increase in selling volume, suggesting strong bearish participation.Relative Strength Index (RSI): The RSI is currently around 64 on the 1-hour timeframe, nearing overbought conditions. If RSI starts to decline, it could indicate potential selling pressure in the near term.Trading OutlookBearish Bias Until Key Resistance BreaksAs long as the market remains within the descending channel and below the Lower High (LH) on the 1H timeframe, the trend remains bearish.The break of the Higher Low (HL) on the daily timeframe confirms a larger downtrend, increasing the probability of continued downside movement.Traders should look for shorting opportunities near resistance zones, with downside targets aligning with previous support levels.Bullish ScenarioFor a trend reversal, buyers must reclaim the lost Higher Low (HL) on the daily timeframe and push the price above the Lower High (LH) on the 1H chart. A sustained breakout above the descending channel would indicate a shift in momentum, opening the door for bullish continuation.

ConclusionEUR/USD remains in a confirmed downtrend, both on the lower timeframes and the daily timeframe, where the break of a key Higher Low (HL) strengthens the bearish outlook. Until price action decisively breaks above the resistance zone and reclaims previous highs, the market remains favorable for sellers. Traders should align their strategies accordingly and watch for key price action confirmations.

According to trading on the daily chart, downward pressure on the EUR/USD pair will increase if bears manage to stabilize below the 1.0800 support level. Technically, the next most important support levels will be 1.0720 and 1.0600, respectively. From the latter level, technical indicators will move towards strong oversold levels. Conversely, based on the performance on the daily chart, no real and strong trend reversal will occur unless the EUR/USD price moves above the psychological resistance of 1.1000.

The EUR/USD pair will be affected in the coming days by the US administration's reaction to the imposition of tariffs that could harm the European economy, in addition to signals from global central bank officials regarding tightening or not.