GBPUSD bulls hit a wall; support nearby

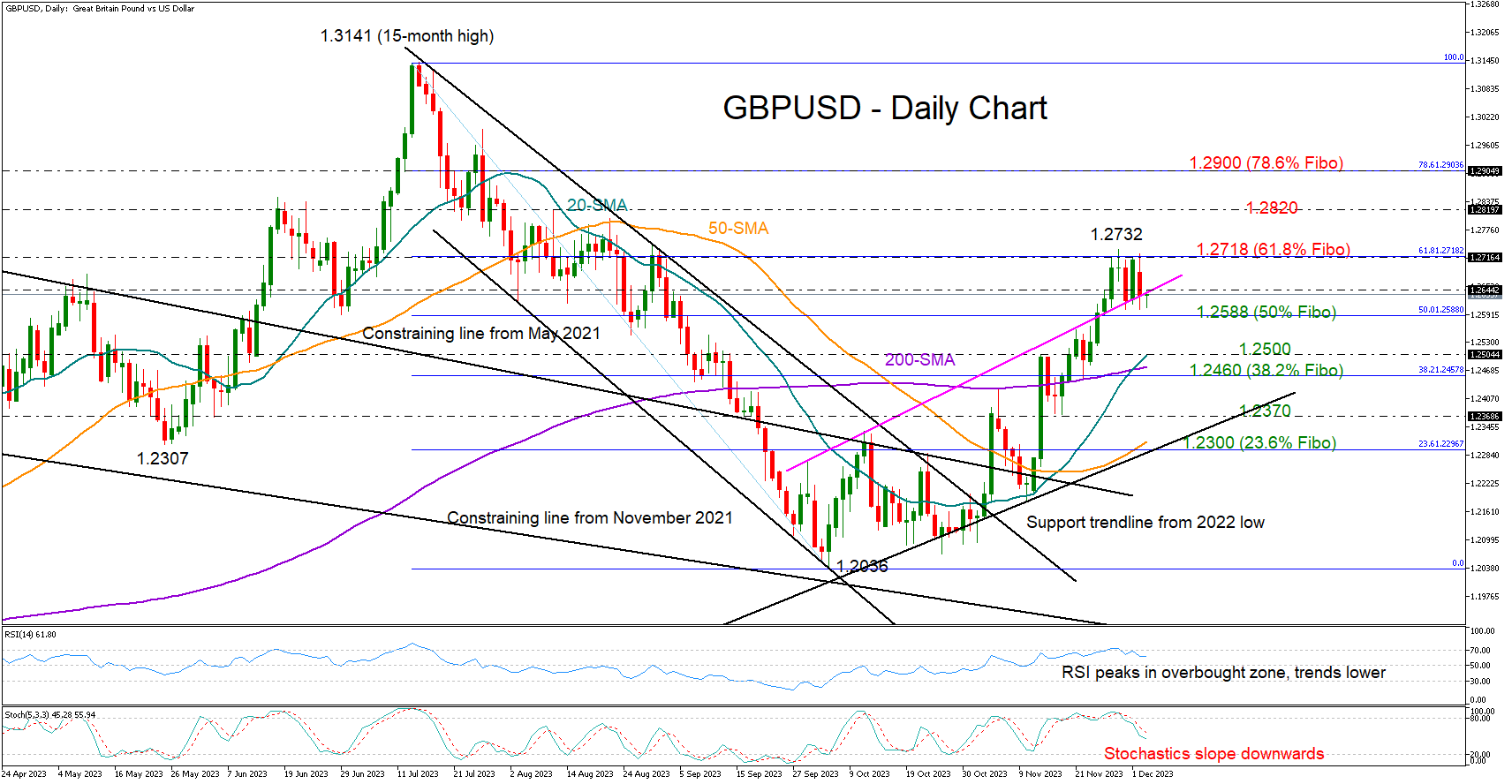

GBPUSD flatlined around the familiar 1.2720 resistance region, which was last tested at the end of August, after three constructive bullish weeks. The area also overlaps with the 61.8% Fibonacci retracement of the July-October downleg.

The ongoing consolidation phase could develop into a bearish wave according to the technical indicators. Both the RSI and the stochastic oscillators have peaked near their overbought levels and are trending southwards at the moment.

Nevertheless, sellers might stay patient until the price drops below the 23.6% Fibonacci level of 1.2588. If that floor collapses, the decline could pick up pace towards the 20-day simple moving averages (SMA) at 1.2500. The 38.2% Fibonacci mark of 1.2457 could also be on guard, protecting the market from a deep downfall to 1.2370. Should the bearish sentiment hold up, the price could next stall somewhere between the 50-day SMA and the support trendline from the 2022 low at 1.2300.

In the event upside forces resume above the nearby resistance of 1.2640, buyers will eagerly look for a sustainable move above the 1.2720 ceiling. A victory there could prompt an advance towards the 1.2820 barrier, while a steeper increase could battle the 23.6% Fibonacci of 1.2900.

Overall, GBPUSD is expected to switch into a corrective mode, with selling pressures likely intensifying below 1.2588. Otherwise, the pair might push for an uptrend resumption above the 1.2720 bar.

.jpg)