EBC Markets Briefing | BOC business survey puts loonie on back foot

The Canadian dollar languished around a 12-day low on Tuesday as a BOC business survey pointed to a decline in inflation, raising bets on interest rate cuts further this month.

Canadian "businesses expect the growth of their input prices and selling prices to slow, suggesting that inflation will continue to decline over the coming year," the central bank said in its latest Business Outlook Survey.

Businesses reported below-average sales growth over the last 12 months and do not expect the pace to pick up going forward with 20% of them expecting a significant economic downturn in the next year.

Chances of further loosening at next week's policy announcement rose to 80% from 77% before the survey's release, swaps market data showed. That will make Canada the first among G7 to cut rates twice if so.

Oil prices were on the back foot on worries about a slowing Chinese economy crimping demand, though a growing consensus that the Fed will begin cutting interest rate as soon as September limited declines.

Russian Deputy Prime Minister Alexander Novak said on Monday the global oil market will be balanced in the second half of the year and thereafter due to a production deal among the OPEC+.

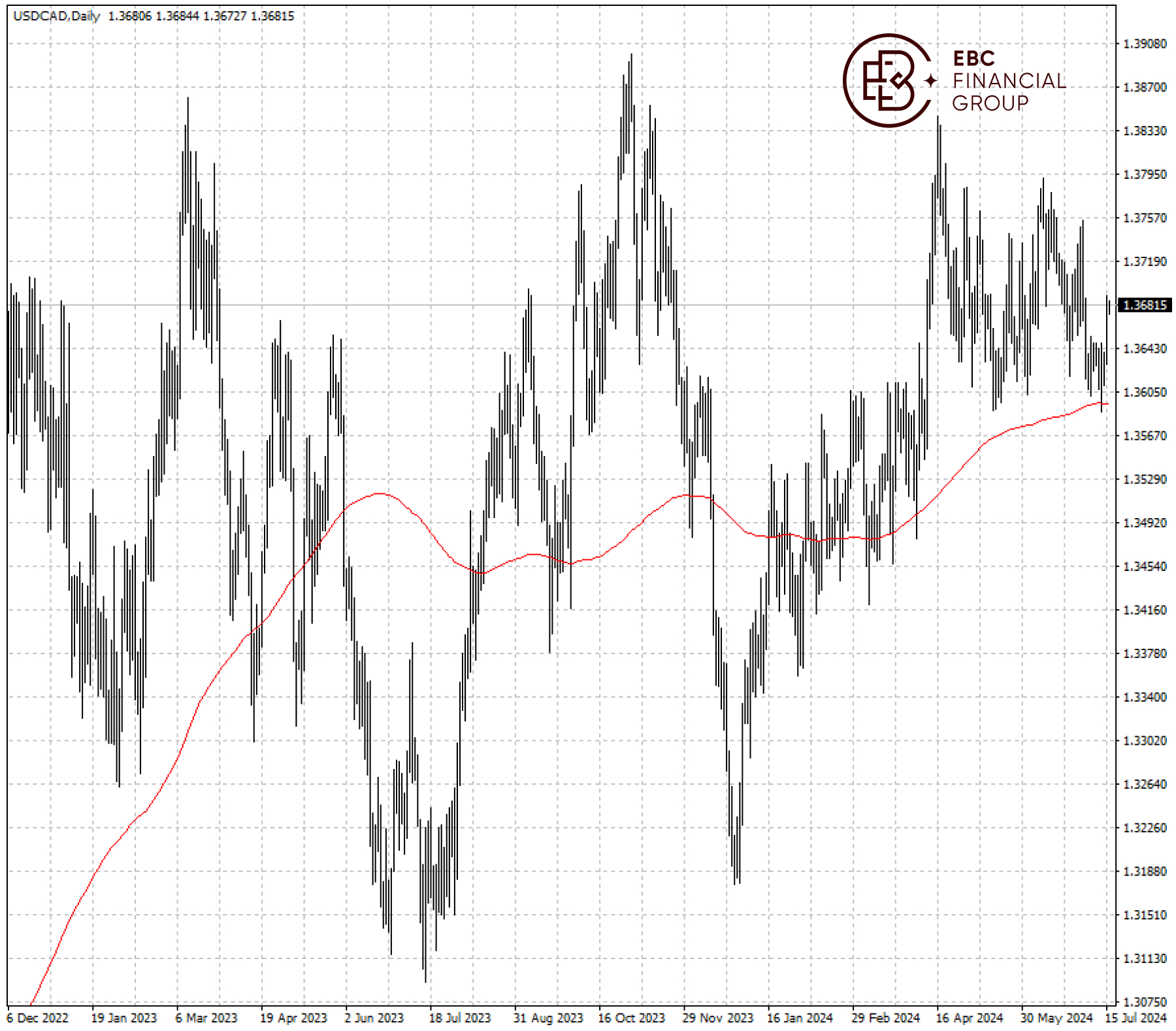

The US dollar resumed the uptrend against the Canadian dollar right after touching the 200 SMA. The next resistance lies at 1.3700 and then 1.3740 and a failed breakout attempt could lead to a retreat towards 1.3650.

EBC Trading Platform Security Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Online Trading Support or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.