FXCharger (Od forexstore)

The user has made his system private.

Edit Your Comment

FXCharger diskuse

Členem od Dec 21, 2015

24 příspěvků

Jun 05, 2020 at 09:10

Členem od Dec 21, 2015

24 příspěvků

LongVision posted:Afron posted:Drolph posted:

Based on the 100% risk this account is currently running at the moment ...

.. it is likely gone now.

www.forexpeacearmy.com/forex-strategies/1358/fx_charger

Yes this is END. Update is off.

This is true for every martingale system sooner or later only blown account.

That is not true.

Although FXCharger had an interesting basic concept, it was simply curve fitted to a specific market situation which existed the last years. Just ask yourself why it was not possible to backtest the system for periods before 2013!

I have developed my own system based on the basic idea, but managed to make it viable for a much wider range of market conditions resulting in surviving any tests since 2003 including the financialc crisis 2008/2009 and the current Covid-19 period.

Členem od Feb 22, 2011

4573 příspěvků

Jun 11, 2020 at 06:56

Členem od Feb 22, 2011

4573 příspěvků

fxcharger posted:

Hello everyone!

Yes, it's very sad, but our account is gone. Unfortunately Covid-19 period was too complex for FXCharger. Our Forex robot successfully traded for more than 4 years. We are working on some good update and I hope we will back with even better results in the future.

We are really sorry and upset about the loss that our clients got. We tried to do all we can from our side to avoid this. Anyway, it's Forex and unfortunately, no one is completely safe 😞

I said so

Členem od Dec 21, 2015

24 příspěvků

Jun 12, 2020 at 08:17

Členem od Dec 21, 2015

24 příspěvků

Afron posted:Drolph posted:LongVision posted:Afron posted:Drolph posted:

Based on the 100% risk this account is currently running at the moment ...

.. it is likely gone now.

www.forexpeacearmy.com/forex-strategies/1358/fx_charger

Yes this is END. Update is off.

This is true for every martingale system sooner or later only blown account.

That is not true.

Although FXCharger had an interesting basic concept, it was simply curve fitted to a specific market situation which existed the last years. Just ask yourself why it was not possible to backtest the system for periods before 2013!

I have developed my own system based on the basic idea, but managed to make it viable for a much wider range of market conditions resulting in surviving any tests since 2003 including the financialc crisis 2008/2009 and the current Covid-19 period.

Sorry but backtest has no value in forex. It is based on the past and does not guarantee future results.

Hard to imagine how wrong you are. Backtesting is the only way to find a true statistical edge in this business. But I guess you rely on the MT4 backtester when talking about backtesting. Well, then you just have no clue.

True (paid) tickdata with variable spreads and slippage simulation gives you an even worse environment than you would ever experience in live trading. Here you can look for a real diamond!

Wanna know what indeed has no value? Forward testing! Why? Because you do not have 20 years of lifetime to waste evaluating a strategy just to find out after 13 years it is rubbish. And thats the point. Market behavior changes in cycles of more than 2-5 years. Thats what I was referring to in my last comment. Having sth that works for the last years only is most likely curve fitted - just like FXCharger.

But what do I know, my own strategy using the basic concept survived to Covid 19 period without any trouble.

Členem od Nov 26, 2016

93 příspěvků

Jun 12, 2020 at 09:09

Členem od Nov 26, 2016

93 příspěvků

But what do I know, my own strategy using the basic concept survived to Covid 19 period without any trouble.

Then proof it, with a verified myFxbook Account.

Členem od Jan 27, 2013

427 příspěvků

Jun 12, 2020 at 09:42

Členem od Jan 27, 2013

427 příspěvků

MicF posted:But what do I know, my own strategy using the basic concept survived to Covid 19 period without any trouble.

Then proof it, with a verified myFxbook Account.

He has "MicroBot" on his profile: https://www.myfxbook.com/members/Drolph/microbot/1457483

Not very appealing, but maybe he has another account not listed in myfxbook...

Členem od Dec 21, 2015

24 příspěvků

Jun 12, 2020 at 13:51

Členem od Dec 21, 2015

24 příspěvků

MicF posted:But what do I know, my own strategy using the basic concept survived to Covid 19 period without any trouble.

Then proof it, with a verified myFxbook Account.

Im not sharing my own coded projects in the FXCharger comments section.

But you can PM me to have a look for yourself in case of any doubts.

Členem od Aug 18, 2010

67 příspěvků

Jun 12, 2020 at 20:28

Členem od Aug 18, 2010

67 příspěvků

But what do I know, my own strategy using the basic concept survived to Covid 19 period without any trouble.

Be kind enough to share your strategy, even if paid with verified results, thank you.

It's amazing what you can accomplish if you don't care who gets the credit.

Členem od Apr 06, 2018

242 příspěvků

Jun 13, 2020 at 04:55

Členem od Apr 06, 2018

242 příspěvků

Drolph posted:Afron posted:Drolph posted:LongVision posted:Afron posted:Drolph posted:

Based on the 100% risk this account is currently running at the moment ...

.. it is likely gone now.

www.forexpeacearmy.com/forex-strategies/1358/fx_charger

Yes this is END. Update is off.

This is true for every martingale system sooner or later only blown account.

That is not true.

Although FXCharger had an interesting basic concept, it was simply curve fitted to a specific market situation which existed the last years. Just ask yourself why it was not possible to backtest the system for periods before 2013!

I have developed my own system based on the basic idea, but managed to make it viable for a much wider range of market conditions resulting in surviving any tests since 2003 including the financialc crisis 2008/2009 and the current Covid-19 period.

Sorry but backtest has no value in forex. It is based on the past and does not guarantee future results.

Hard to imagine how wrong you are. Backtesting is the only way to find a true statistical edge in this business. But I guess you rely on the MT4 backtester when talking about backtesting. Well, then you just have no clue.

True (paid) tickdata with variable spreads and slippage simulation gives you an even worse environment than you would ever experience in live trading. Here you can look for a real diamond!

Wanna know what indeed has no value? Forward testing! Why? Because you do not have 20 years of lifetime to waste evaluating a strategy just to find out after 13 years it is rubbish. And thats the point. Market behavior changes in cycles of more than 2-5 years. Thats what I was referring to in my last comment. Having sth that works for the last years only is most likely curve fitted - just like FXCharger.

But what do I know, my own strategy using the basic concept survived to Covid 19 period without any trouble.

Using Martingale does not improve your statistical edge. It only delays your loss so your equity curve looks beautiful. It is very easy to make EA based on Grid & Martingale that survive 15-20 years of backtesting. I also develop this type of EA which survive tick data testing since 2003 but never uses that EA because this is a simple curve-fitting on past data.

The market will trade through it’s path of least resistance .

Členem od Apr 06, 2018

242 příspěvků

Jun 13, 2020 at 06:58

Členem od Apr 06, 2018

242 příspěvků

Drolph posted:LongVision posted:Afron posted:Drolph posted:

Based on the 100% risk this account is currently running at the moment ...

.. it is likely gone now.

www.forexpeacearmy.com/forex-strategies/1358/fx_charger

Yes this is END. Update is off.

This is true for every martingale system sooner or later only blown account.

That is not true.

Although FXCharger had an interesting basic concept, it was simply curve fitted to a specific market situation which existed the last years. Just ask yourself why it was not possible to backtest the system for periods before 2013!

I have developed my own system based on the basic idea, but managed to make it viable for a much wider range of market conditions resulting in surviving any tests since 2003 including the financialc crisis 2008/2009 and the current Covid-19 period.

Let's talk facts about high-risk trading such as Gird and Martingale.

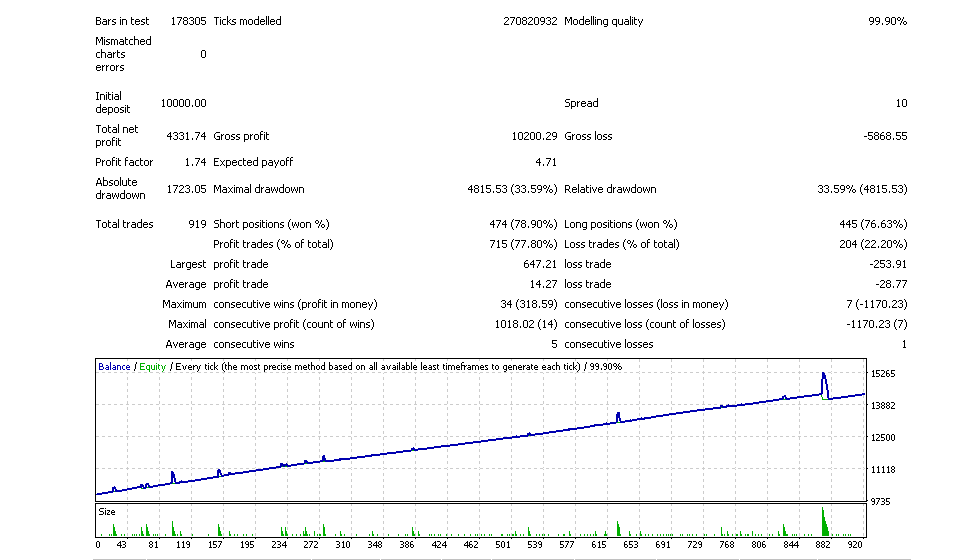

I also develop an EA based on the Martingale strategy(Which I never use on real account). I am here sharing backtest of the strategy which I backtested since 2003 on tickdata. Look at the equity curve consistent profit without losing any month. This backtesting works on multiple currency pairs. Look like a money-printing machine.

So what is the catch here?

The answer is that I curve fitted Entry, Exit and Risk in such a way that EA backtesting should survive downswing since 2003. But there is a high probability that account will crash on future data and drawdown can be easily surpassed in future.

It is very easy for me to sell this EA as a holygrail of Trading and earn easy money. But my conscience never allows it as I know at some point there will be only blown account. Remember you can earn 10000% but you can only lose 100% only.

If you are still not convinced then I can provide some statistical data to prove my point that there is no advantage of using high-risk idea such as martingale .

The market will trade through it’s path of least resistance .

Členem od Nov 26, 2016

93 příspěvků

Jun 13, 2020 at 09:05

Členem od Nov 26, 2016

93 příspěvků

WayneO posted:But what do I know, my own strategy using the basic concept survived to Covid 19 period without any trouble.

Be kind enough to share your strategy, even if paid with verified results, thank you.

The more polite version of my claim ;-)

Členem od Apr 06, 2018

242 příspěvků

Jun 13, 2020 at 14:38

Členem od Apr 06, 2018

242 příspěvků

So Martingale trading is basically about curve fitting the max drawdown so that account survive for longer period. More aggressive the trading most likely your account blown early and less aggressive the trading your account will survive for longer period.

The market will trade through it’s path of least resistance .

Členem od Dec 21, 2015

24 příspěvků

Jun 14, 2020 at 07:17

Členem od Dec 21, 2015

24 příspěvků

LongVision posted:Drolph posted:LongVision posted:Afron posted:Drolph posted:

Based on the 100% risk this account is currently running at the moment ...

.. it is likely gone now.

www.forexpeacearmy.com/forex-strategies/1358/fx_charger

Yes this is END. Update is off.

This is true for every martingale system sooner or later only blown account.

That is not true.

Although FXCharger had an interesting basic concept, it was simply curve fitted to a specific market situation which existed the last years. Just ask yourself why it was not possible to backtest the system for periods before 2013!

I have developed my own system based on the basic idea, but managed to make it viable for a much wider range of market conditions resulting in surviving any tests since 2003 including the financialc crisis 2008/2009 and the current Covid-19 period.

Let's talk facts about high-risk trading such as Gird and Martingale.

I also develop an EA based on the Martingale strategy(Which I never use on real account). I am here sharing backtest of the strategy which I backtested since 2003 on tickdata. Look at the equity curve consistent profit without losing any month. This backtesting works on multiple currency pairs. Look like a money-printing machine.

So what is the catch here?

The answer is that I curve fitted Entry, Exit and Risk in such a way that EA backtesting should survive downswing since 2003. But there is a high probability that account will crash on future data and drawdown can be easily surpassed in future.

It is very easy for me to sell this EA as a holygrail of Trading and earn easy money. But my conscience never allows it as I know at some point there will be only blown account. Remember you can earn 10000% but you can only lose 100% only.

If you are still not convinced then I can provide some statistical data to prove my point that there is no advantage of using high-risk idea such as martingale .

Basically your post is a yes and a no.

Averaging does NOT make a system profitable by itself. In consequence it does not turn a losing system into a profitable one.

But you did not mention aspects like comfort to drawdown phases or general "peace of mind" growth of equity curves.

A standard trading system with fixed SL and TP and positive risk/reward on each and every trade will have time periods where your balance will decrease constantly and you never know when the situation changes again. Something not everyone wants to live with, having several consecutive months losing money. Here, averaging provides an undisputable advantage.

EVERY system lives from risk/reward - this is also valid for martingales and grids.

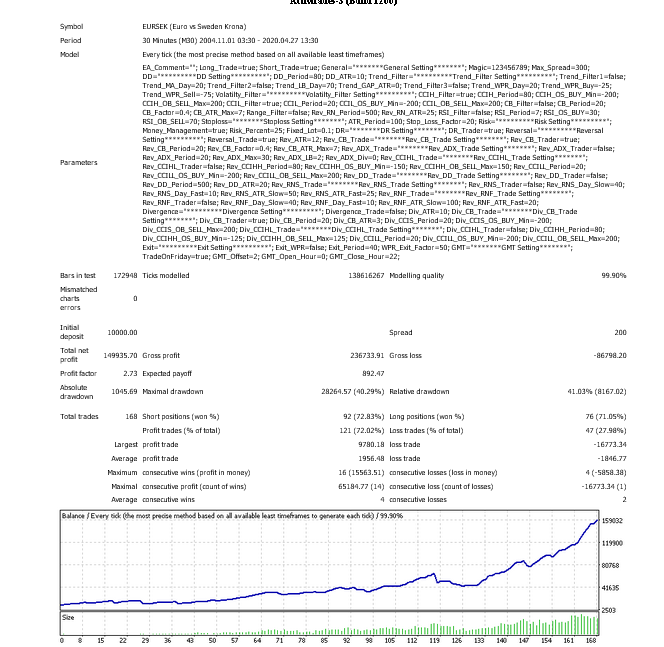

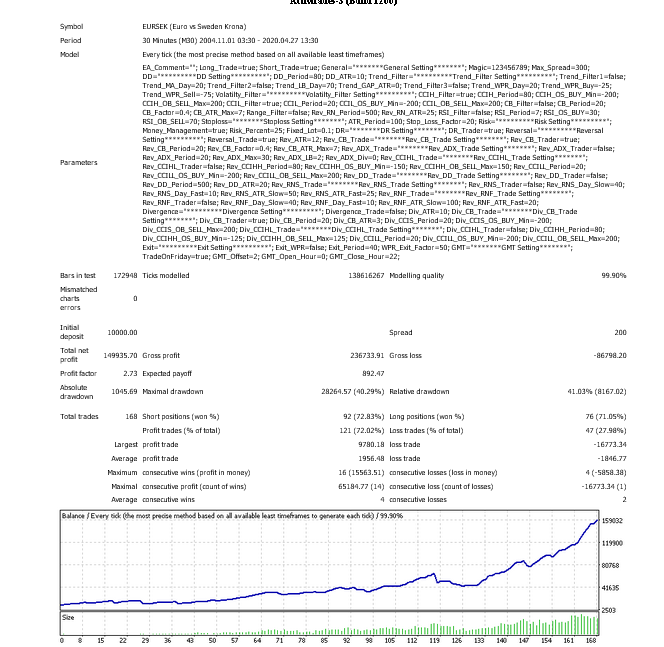

If your grid is making 100% in six months but crashes on average every two years you still have an incredible risk/reward to earn money in the longer run. Earning 20% a year and have a 100% crash every two years leads to a horrible risk/reward. Two grids, but two totally different stories! I am showing you a backtest of my EA undermining my argumentation. It is not about the possibilty of a single loss, it is about the longterm perspective.

Talking about horrible risk/reward, your shown performance is exactly that. 30% gain with 30% max drawdown after 17 years!? TIME is a factor that makes the difference here.

So your shown example system is not a holygrail. Why did you hide the backtesting period by the way? ;)

Based on my longyear journey it is everything but NOT EASY to develop a system (also an averaging one) that proves success for 15-20 years.

Členem od Oct 28, 2018

21 příspěvků

Jun 14, 2020 at 08:35

Členem od Oct 28, 2018

21 příspěvků

Your results are AWEFUL!

Very huge Drawdown relative to profit.

You need to learn what needs to be tested. Profit is not all.

Risk Reward for example, is one of the most important parameters.

My Fxcharger EA with some improvements shows better results.

Much better!

Very huge Drawdown relative to profit.

You need to learn what needs to be tested. Profit is not all.

Risk Reward for example, is one of the most important parameters.

My Fxcharger EA with some improvements shows better results.

Much better!

Členem od Apr 06, 2018

242 příspěvků

Jun 14, 2020 at 08:52

Členem od Apr 06, 2018

242 příspěvků

Drolph posted:LongVision posted:Drolph posted:LongVision posted:Afron posted:Drolph posted:

Based on the 100% risk this account is currently running at the moment ...

.. it is likely gone now.

www.forexpeacearmy.com/forex-strategies/1358/fx_charger

Yes this is END. Update is off.

This is true for every martingale system sooner or later only blown account.

That is not true.

Although FXCharger had an interesting basic concept, it was simply curve fitted to a specific market situation which existed the last years. Just ask yourself why it was not possible to backtest the system for periods before 2013!

I have developed my own system based on the basic idea, but managed to make it viable for a much wider range of market conditions resulting in surviving any tests since 2003 including the financialc crisis 2008/2009 and the current Covid-19 period.

Let's talk facts about high-risk trading such as Gird and Martingale.

I also develop an EA based on the Martingale strategy(Which I never use on real account). I am here sharing backtest of the strategy which I backtested since 2003 on tickdata. Look at the equity curve consistent profit without losing any month. This backtesting works on multiple currency pairs. Look like a money-printing machine.

So what is the catch here?

The answer is that I curve fitted Entry, Exit and Risk in such a way that EA backtesting should survive downswing since 2003. But there is a high probability that account will crash on future data and drawdown can be easily surpassed in future.

It is very easy for me to sell this EA as a holygrail of Trading and earn easy money. But my conscience never allows it as I know at some point there will be only blown account. Remember you can earn 10000% but you can only lose 100% only.

If you are still not convinced then I can provide some statistical data to prove my point that there is no advantage of using high-risk idea such as martingale .

Basically your post is a yes and a no.

Averaging does NOT make a system profitable by itself. In consequence it does not turn a losing system into a profitable one.

But you did not mention aspects like comfort to drawdown phases or general "peace of mind" growth of equity curves.

A standard trading system with fixed SL and TP and positive risk/reward on each and every trade will have time periods where your balance will decrease constantly and you never know when the situation changes again. Something not everyone wants to live with, having several consecutive months losing money. Here, averaging provides an undisputable advantage.

EVERY system lives from risk/reward - this is also valid for martingales and grids.

If your grid is making 100% in six months but crashes on average every two years you still have an incredible risk/reward to earn money in the longer run. Earning 20% a year and have a 100% crash every two years leads to a horrible risk/reward. Two grids, but two totally different stories! I am showing you a backtest of my EA undermining my argumentation. It is not about the possibilty of a single loss, it is about the longterm perspective.

Talking about horrible risk/reward, your shown performance is exactly that. 30% gain with 30% max drawdown after 17 years!? TIME is a factor that makes the difference here.

So your shown example system is not a holygrail. Why did you hide the backtesting period by the way? ;)

Based on my longyear journey it is everything but NOT EASY to develop a system (also an averaging one) that proves success for 15-20 years.

I did not hide period. I also shared backtest file. Backtested since 2003. Grid and martingale are only illusion of edge nothing else. Few settings change I can make my systems that show incredible gains but I don't want to waste my energy and time on grid and martingale. Goodluck for your high risk system.

The market will trade through it’s path of least resistance .

Členem od Apr 06, 2018

242 příspěvků

Jun 14, 2020 at 09:03

Členem od Apr 06, 2018

242 příspěvků

Drolph posted:LongVision posted:Drolph posted:LongVision posted:Afron posted:Drolph posted:

Based on the 100% risk this account is currently running at the moment ...

.. it is likely gone now.

www.forexpeacearmy.com/forex-strategies/1358/fx_charger

Yes this is END. Update is off.

This is true for every martingale system sooner or later only blown account.

That is not true.

Although FXCharger had an interesting basic concept, it was simply curve fitted to a specific market situation which existed the last years. Just ask yourself why it was not possible to backtest the system for periods before 2013!

I have developed my own system based on the basic idea, but managed to make it viable for a much wider range of market conditions resulting in surviving any tests since 2003 including the financialc crisis 2008/2009 and the current Covid-19 period.

Let's talk facts about high-risk trading such as Gird and Martingale.

I also develop an EA based on the Martingale strategy(Which I never use on real account). I am here sharing backtest of the strategy which I backtested since 2003 on tickdata. Look at the equity curve consistent profit without losing any month. This backtesting works on multiple currency pairs. Look like a money-printing machine.

So what is the catch here?

The answer is that I curve fitted Entry, Exit and Risk in such a way that EA backtesting should survive downswing since 2003. But there is a high probability that account will crash on future data and drawdown can be easily surpassed in future.

It is very easy for me to sell this EA as a holygrail of Trading and earn easy money. But my conscience never allows it as I know at some point there will be only blown account. Remember you can earn 10000% but you can only lose 100% only.

If you are still not convinced then I can provide some statistical data to prove my point that there is no advantage of using high-risk idea such as martingale .

Based on my longyear journey it is everything but NOT EASY to develop a system (also an averaging one) that proves success for 15-20 years.

Obviously you are correct that it is difficult to developed a long term EA with consistent Edge but It doesn't mean you go for high risk trading.

The market will trade through it’s path of least resistance .

Členem od Apr 06, 2018

242 příspěvků

Jun 14, 2020 at 17:04

Členem od Apr 06, 2018

242 příspěvků

I don't know why Martingale Money Management is so popular in forex. There are other better Money Management Strategy such as Kelly Criterion exist. As per kelly Criterion your risk increase in the following case only-

1. Higher the winrate higher the risk per trade.

2. Higher the Reward/Risk ratio higher the risk per trade.

I am here sharing the backtest where risk is 50% of the kelly Criterion.No Grid, No Martingale and No average of an existing position

It is possible to earn money with simple MM without crash your accout.

1. Higher the winrate higher the risk per trade.

2. Higher the Reward/Risk ratio higher the risk per trade.

I am here sharing the backtest where risk is 50% of the kelly Criterion.No Grid, No Martingale and No average of an existing position

It is possible to earn money with simple MM without crash your accout.

The market will trade through it’s path of least resistance .

Členem od Oct 28, 2018

21 příspěvků

Jun 15, 2020 at 05:50

Členem od Oct 28, 2018

21 příspěvků

Your backtest is very poor.

Only 168 trades from 2004.

And not only this but above 40% drawdown. This is just a big NO.

I would never consider that a professional backtest.

Only 168 trades from 2004.

And not only this but above 40% drawdown. This is just a big NO.

I would never consider that a professional backtest.

Členem od Dec 21, 2015

24 příspěvků

Jun 15, 2020 at 05:52

Členem od Dec 21, 2015

24 příspěvků

LongVision posted:

I don't know why Martingale Money Management is so popular in forex. There are other better Money Management Strategy such as Kelly Criterion exist. As per kelly Criterion your risk increase in the following case only-

1. Higher the winrate higher the risk per trade.

2. Higher the Reward/Risk ratio higher the risk per trade.

I am here sharing the backtest where risk is 50% of the kelly Criterion.No Grid, No Martingale and No average of an existing position

It is possible to earn money with simple MM without crash your accout.

Well, the answer is given in my last post. Please read carefully.

Drolph posted:

A standard trading system with fixed SL and TP and positive risk/reward on each and every trade will have time periods where your balance will decrease constantly and you never know when the situation changes again. Something not everyone wants to live with, having several consecutive months losing money. Here, averaging provides an undisputable advantage.

And now we have a look at your backtest example once again. There is a huge timespan (roughly but at least more than a full year), where you would suffer from a continous decreasing account balance. Looks easy to overcome in theory, but trust me you would not let a strategy run for 1-2 years without visible gains. You would start to fiddle around with the settings and get caught in the curve fitting trap!

Nobody said that martingale or averaging is the jack of all trades solution. It is not. But until now your examples only undermine the benefits of averaging techniques.

There is no risk free easy jack of all trades solution in this business. All approaches got two sides of the medal. Everyone has to choose what comforts him most. But to fully understand this, you need many years of experience.

But maybe you can solve this problem with a few changes, time and energy again. ;)

Členem od Feb 22, 2011

4573 příspěvků

Jun 15, 2020 at 06:41

Členem od Feb 22, 2011

4573 příspěvků

LongVision posted:

I don't know why Martingale Money Management is so popular in forex. There are other better Money Management Strategy such as Kelly Criterion exist. As per kelly Criterion your risk increase in the following case only-

1. Higher the winrate higher the risk per trade.

2. Higher the Reward/Risk ratio higher the risk per trade.

I am here sharing the backtest where risk is 50% of the kelly Criterion.No Grid, No Martingale and No average of an existing position

It is possible to earn money with simple MM without crash your accout.

It is easy to do profit in BT

While it is hard to face real market conditions

Členem od Apr 06, 2018

242 příspěvků

Jun 15, 2020 at 07:32

Členem od Apr 06, 2018

242 příspěvků

togr posted:LongVision posted:

It is easy to do profit in BT

While it is hard to face real market conditions

Thats true, BT is different from real market conditions.

The market will trade through it’s path of least resistance .

*Komerční použití a spam nebudou tolerovány a mohou vést ke zrušení účtu.

Tip: Zveřejněním adresy URL obrázku /služby YouTube se automaticky vloží do vašeho příspěvku!

Tip: Zadejte znak @, abyste automaticky vyplnili jméno uživatele, který se účastní této diskuse.