Mad Gold and Oil

Mad Gold and Oil

GoldMovements in metals have been monumental. A 3% rise deep into all-time highs for Gold was followed by a collapse of more than $100 from $3,170 to $3,050 an ounce. On Friday, trading stabilised near $3100, minimally adding to levels at the opening of the week.

Tactically, this is a good time for the bulls to exhale, rest, and lock in profits. This is confirmed by the achievement of an important growth target and the entry into extreme overbought on weekly timeframes on RSI. Multi-week corrections started in similar conditions in 2024.

Oil

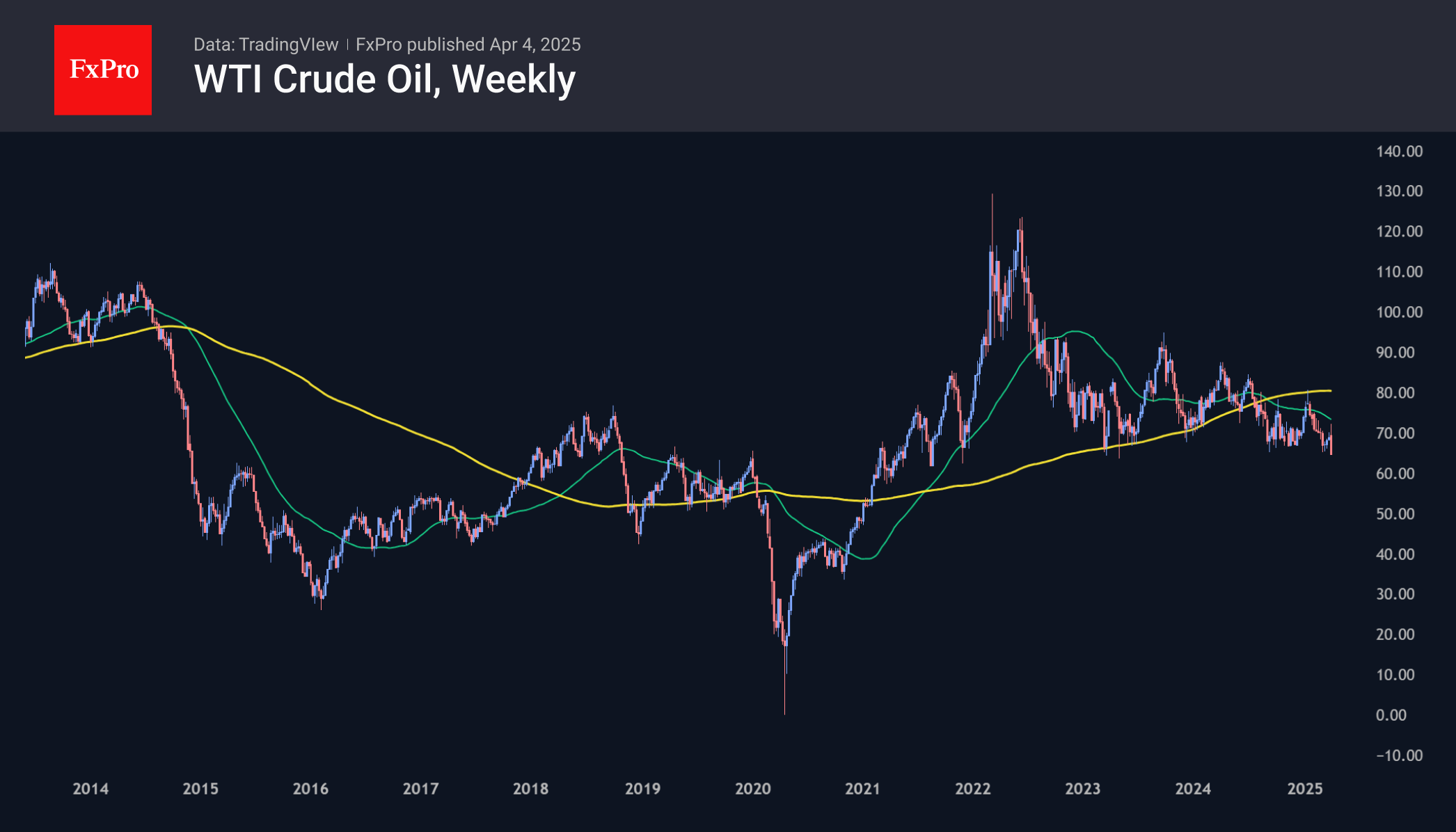

Oil took a double hit in less than 24 hours when the macroeconomy pressured it due to tariffs and OPEC+ actions. Tired of waiting for the global economy to accelerate, the Cartel switched gears in the battle for market share, pledging to ramp up production faster than the previously announced plan.

Similar moments occurred in March 2020 and December 2014. On both occasions, oil dipped below $30 a barrel before finding support in the form of coordinated action by global producers. In theory, coordination is now at a higher level, but that doesn't negate the powerful pressures expected due to the trade shock and supply expansion.

Technically, oil is breaking through the bottom of the three-year range, and the 50-week moving average worked as resistance for the third time since September.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)