Edit Your Comment

Crude

Mitglied seit Oct 11, 2013

769 Posts

Mitglied seit Oct 02, 2014

905 Posts

Mitglied seit Oct 02, 2014

905 Posts

Mitglied seit Dec 11, 2015

1462 Posts

Aug 28, 2016 at 10:54

Mitglied seit Dec 11, 2015

1462 Posts

I agree. Even after Yellen's speech it just formed a whipsaw.

Mar 23, 2017 at 07:12

Mitglied seit Dec 22, 2016

20 Posts

U.S. crude lengthened its gains by ending higher at $48.78, strengthened by a sluggish dollar

Source: http://www.funds-money.com/us-crude-ended-higher/

Source: http://www.funds-money.com/us-crude-ended-higher/

Apr 23, 2017 at 07:13

Mitglied seit Mar 23, 2017

38 Posts

Analysis For 24th April 2017:

The WTI Crude Oil market fell significantly during the session on Friday, cracking below the $50 level. If we can continue lower, and break below the bottom of the daily range, oil markets could find themselves dropping somewhat significantly. Ultimately, this market looks as if it is going to continue dropping, and because of that bearish.

There’s a lot of noise near the $47.50 level, so not necessarily that were going to break down drastically. Rallies this point in time should be selling opportunities, and with that being the case it’s only a matter of time before you short of the market. As far as buying is concerned, you would need to see some type of impulsive candle to convince that the market is going to go higher. Right now, we don’t see it.

The WTI Crude Oil market fell significantly during the session on Friday, cracking below the $50 level. If we can continue lower, and break below the bottom of the daily range, oil markets could find themselves dropping somewhat significantly. Ultimately, this market looks as if it is going to continue dropping, and because of that bearish.

There’s a lot of noise near the $47.50 level, so not necessarily that were going to break down drastically. Rallies this point in time should be selling opportunities, and with that being the case it’s only a matter of time before you short of the market. As far as buying is concerned, you would need to see some type of impulsive candle to convince that the market is going to go higher. Right now, we don’t see it.

Apr 24, 2017 at 07:07

Mitglied seit Mar 23, 2017

38 Posts

WTI spot has rallied at 0.5% this morning, partially unwinding Friday’s 2% sell-off in both it and Brent. A Macron victory in France has reduced uncertainty, but an OPEC/non-OPEC working group recommending an extension to the production cut deal has probably had the greater influence.

The reality is though that the world is awash in oil, and the Baker-Hugh’s Rig Count’s mandatory rise on Friday for the 14th consecutive week shows that U.S. shale isn’t going away at these levels. Barring supply disruptions or geopolitical events, and with shale producers still heavy futures sellers on any rally, sustained rallies could be difficult ahead of late May’s OPEC/Non-OPEC meeting.

Today WTI spot trades at 49.88 with resistance at 50.00 and support at 48.50, its 200-day moving average.

The reality is though that the world is awash in oil, and the Baker-Hugh’s Rig Count’s mandatory rise on Friday for the 14th consecutive week shows that U.S. shale isn’t going away at these levels. Barring supply disruptions or geopolitical events, and with shale producers still heavy futures sellers on any rally, sustained rallies could be difficult ahead of late May’s OPEC/Non-OPEC meeting.

Today WTI spot trades at 49.88 with resistance at 50.00 and support at 48.50, its 200-day moving average.

Mitglied seit May 09, 2017

32 Posts

Jun 05, 2017 at 06:56

Mitglied seit May 09, 2017

32 Posts

Oil markets were subdued on Monday, with Brent struggling to maintain US$50 per barrel as efforts led by Opec to tighten the market were undermined by persistently rising US production.

Brent crude oil futures briefly rose above US$50 per barrel in early trading, but had dipped back to US$49.94 by 0040 GMT.

US West Texas Intermediate futures were at US$47.69 a barrel, weighed down by ongoing climbs in US production.

Investors continue to doubt the ability of Opec to rebalance the oil market, with crude oil prices remaining under pressure amid further signs of rising US oil production.

Reference: https://uaefinancialmarket.blogspot.com/2017/06/bigger-oil-production-cuts-to-consider.html

Brent crude oil futures briefly rose above US$50 per barrel in early trading, but had dipped back to US$49.94 by 0040 GMT.

US West Texas Intermediate futures were at US$47.69 a barrel, weighed down by ongoing climbs in US production.

Investors continue to doubt the ability of Opec to rebalance the oil market, with crude oil prices remaining under pressure amid further signs of rising US oil production.

Reference: https://uaefinancialmarket.blogspot.com/2017/06/bigger-oil-production-cuts-to-consider.html

Mitglied seit Oct 11, 2013

769 Posts

Jun 07, 2017 at 16:02

Mitglied seit Oct 11, 2013

769 Posts

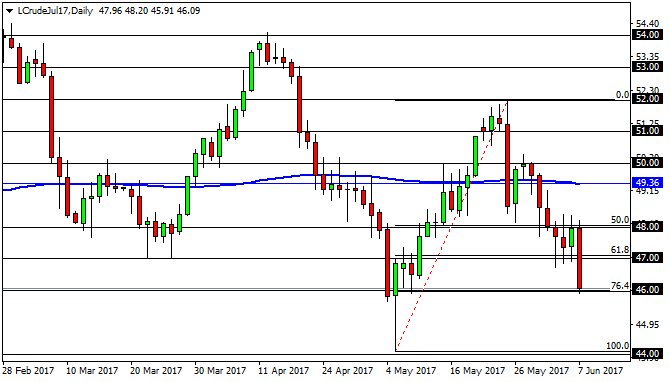

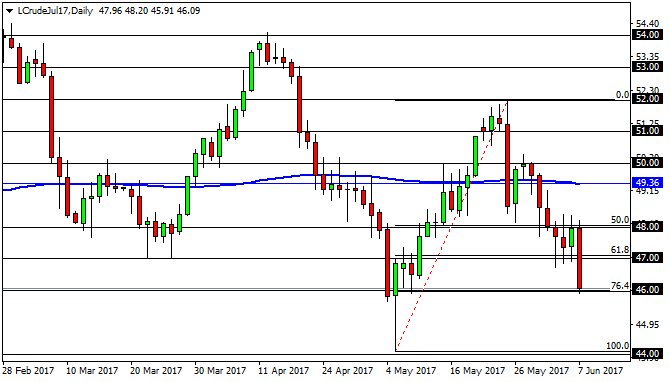

Amazing drop on WTI oil during today's session. The commodity has fallen from the 48.00 level, breaking below the 47.00 level and reaching the 46.00 level where we can find a 76.4% Fibo retracement on the daily chart. That zone of the 46.00 level could act as support for WTI oil, but the bearish momentum is still in place.

Mitglied seit May 09, 2017

32 Posts

Jun 23, 2017 at 11:33

Mitglied seit May 09, 2017

32 Posts

Oil recovery may lead to risk-reset in the markets and yield a steeper treasury yield curve and a strong US dollar. Thus, the GBP / USD pair may end the week below the 50-week MA if the oil recovery gathers steam.

On the other hand, a fresh sell-off in oil would yield a flatter yield curve and keep the dollar bulls at the bay, thus helping the GBP bulls defend the weekly 50-MA support.

On the other hand, a fresh sell-off in oil would yield a flatter yield curve and keep the dollar bulls at the bay, thus helping the GBP bulls defend the weekly 50-MA support.

Jul 03, 2017 at 06:05

Mitglied seit Jun 21, 2017

12 Posts

From July 2nd to July 3rd

Hello, Open at 46.2.

I expect 46.6 to 47 to be reached around Monday 3rd noon time.

A move down below the 46 area would probably change this forecast, but I expect price to go straight up off the open.

Based on my trading tools and slight knowledge of the market, a few years.

From July 2nd to July 12th +-

Let's expect crude to reach 49.50 or so.

A move below 45 would change things, however I don't expect it.

So that would be a 100tick SL to 300 tick TG from the open at 46.2.

However It is not recommendable, better take several longs along the way if they happen with few-tick stop losses as the plan might be invalidated.

Please see pictures attached.

Hello, Open at 46.2.

I expect 46.6 to 47 to be reached around Monday 3rd noon time.

A move down below the 46 area would probably change this forecast, but I expect price to go straight up off the open.

Based on my trading tools and slight knowledge of the market, a few years.

From July 2nd to July 12th +-

Let's expect crude to reach 49.50 or so.

A move below 45 would change things, however I don't expect it.

So that would be a 100tick SL to 300 tick TG from the open at 46.2.

However It is not recommendable, better take several longs along the way if they happen with few-tick stop losses as the plan might be invalidated.

Please see pictures attached.

Jul 04, 2017 at 06:28

Mitglied seit Jun 21, 2017

12 Posts

Jul 04, 2017 at 06:50

Mitglied seit Jun 21, 2017

12 Posts

July 4th

July 4th activity may decrease a slight bit due to holidays, but I still believe oil is bullish and oughtta reach 47.60/47.80 if not slightly higher.

Currently at 46.80, Below 46.60 I don't see anything at the moment. Wait till tomorrow morning to confirm. Well, everything summed up in the charts. Let's see.

July 4th activity may decrease a slight bit due to holidays, but I still believe oil is bullish and oughtta reach 47.60/47.80 if not slightly higher.

Currently at 46.80, Below 46.60 I don't see anything at the moment. Wait till tomorrow morning to confirm. Well, everything summed up in the charts. Let's see.

Jul 04, 2017 at 14:52

Mitglied seit Jun 21, 2017

12 Posts

Got something interesting here.

This model I made is kind of telling me we have a potential 5tick stop loss for a 60 tick objective.

as picture suggests we are at 46.91

So SL would be 46.86.

it is 7.10 eastern time

Basically it shouldnt go below the first blue line.

Watch your charts.

This model I made is kind of telling me we have a potential 5tick stop loss for a 60 tick objective.

as picture suggests we are at 46.91

So SL would be 46.86.

it is 7.10 eastern time

Basically it shouldnt go below the first blue line.

Watch your charts.

Jul 04, 2017 at 14:52

Mitglied seit Jun 21, 2017

12 Posts

Jul 05, 2017 at 11:16

Mitglied seit Jun 21, 2017

12 Posts

Jul 05, 2017 at 14:56

Mitglied seit Jun 21, 2017

12 Posts

*Kommerzielle Nutzung und Spam werden nicht toleriert und können zur Kündigung des Kontos führen.

Tipp: Wenn Sie ein Bild/eine Youtube-Url posten, wird diese automatisch in Ihren Beitrag eingebettet!

Tipp: Tippen Sie das @-Zeichen ein, um einen an dieser Diskussion teilnehmenden Benutzernamen automatisch zu vervollständigen.