- Home

- Community

- Erfahrene Trader

- Low time frame trading vs. High time frame trading.

Advertisement

Edit Your Comment

Low time frame trading vs. High time frame trading.

Mitglied seit Apr 24, 2015

3 Posts

Nov 06, 2015 at 12:25

Mitglied seit Apr 24, 2015

3 Posts

Hi richadi36,

I don't think there is a "best" timeframe. It is about how/when you can trade (people can trade during the day, others only have 15-30 minutes per day/week), and then finding a system that fits your availability and trading style.

I have personally tried small & high time frame and the longer timeframe (day/week/month) fits me better : I am much more relaxed and stressless when having opened positions and make clearer and more thought of decisions as to when to enter and get out.

I know other traders who suceed extremely well trading smaller time frame like 5/15/30 minutes with the same level of relaxation and "no stress" than I have.

Like I said, it is about finding a style and system that fits you, practice, practice and practice. But that's only my 2 pips :)

I don't think there is a "best" timeframe. It is about how/when you can trade (people can trade during the day, others only have 15-30 minutes per day/week), and then finding a system that fits your availability and trading style.

I have personally tried small & high time frame and the longer timeframe (day/week/month) fits me better : I am much more relaxed and stressless when having opened positions and make clearer and more thought of decisions as to when to enter and get out.

I know other traders who suceed extremely well trading smaller time frame like 5/15/30 minutes with the same level of relaxation and "no stress" than I have.

Like I said, it is about finding a style and system that fits you, practice, practice and practice. But that's only my 2 pips :)

florent.norroy@

Nov 06, 2015 at 14:45

Mitglied seit Oct 17, 2015

19 Posts

Hi florentnorroy,

I totally agree with you. If we feel relaxed and no stress while trading, I think it is one of the main point that we should get becoming pro in this field.

I totally agree with you. If we feel relaxed and no stress while trading, I think it is one of the main point that we should get becoming pro in this field.

Constant Stable Monthly Account Growth Makes You Successful

forex_trader_29148

Mitglied seit Feb 11, 2011

1768 Posts

Nov 06, 2015 at 17:53

Mitglied seit Feb 11, 2011

1768 Posts

florentnorroy posted:

Hi richadi36,

I don't think there is a "best" timeframe. It is about how/when you can trade (people can trade during the day, others only have 15-30 minutes per day/week), and then finding a system that fits your availability and trading style.

I have personally tried small & high time frame and the longer timeframe (day/week/month) fits me better : I am much more relaxed and stressless when having opened positions and make clearer and more thought of decisions as to when to enter and get out.

I know other traders who suceed extremely well trading smaller time frame like 5/15/30 minutes with the same level of relaxation and "no stress" than I have.

Like I said, it is about finding a style and system that fits you, practice, practice and practice. But that's only my 2 pips :)

\

yes acc to me that is the right way to go

Nov 07, 2015 at 08:04

Mitglied seit Dec 07, 2010

189 Posts

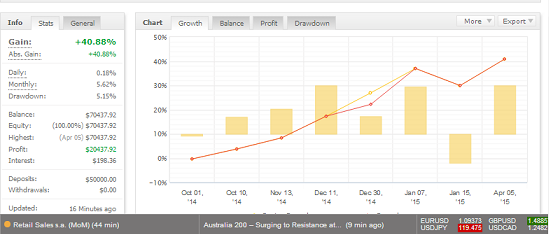

I use to trade only on high timeframe... low are very dangerous https://www.myfxbook.com/members/systemafx/spread-trading-forex/1363841

Follow the momentum

Mitglied seit Nov 19, 2014

157 Posts

Nov 10, 2015 at 15:03

Mitglied seit Nov 19, 2014

157 Posts

Swing Trading on the higher time frames..less stress as you said, more stable and reliable signals.

Smaller time frames can be fun and exciting and there might be people who are successful doing it this way. But the large number of economic, political, financial factors that lead to erratic moves each day can make it extremely difficult to find a model that can predict these movements at such short time intervals.

Most people trade the lower time frames and most people fail at trading...there might be a relationship there.

Duane

DRFXTRADING

Smaller time frames can be fun and exciting and there might be people who are successful doing it this way. But the large number of economic, political, financial factors that lead to erratic moves each day can make it extremely difficult to find a model that can predict these movements at such short time intervals.

Most people trade the lower time frames and most people fail at trading...there might be a relationship there.

Duane

DRFXTRADING

Trade Less, Earn More

Nov 11, 2015 at 07:49

Mitglied seit Oct 17, 2015

19 Posts

DRFXTRADING posted:

Swing Trading on the higher time frames..less stress as you said, more stable and reliable signals.

Smaller time frames can be fun and exciting and there might be people who are successful doing it this way. But the large number of economic, political, financial factors that lead to erratic moves each day can make it extremely difficult to find a model that can predict these movements at such short time intervals.

Most people trade the lower time frames and most people fail at trading...there might be a relationship there.

Duane

DRFXTRADING

Hi DRFXTRADING,

Most people fail at trading cause they don't have enough patience to trade on higher timeframes...

Constant Stable Monthly Account Growth Makes You Successful

Nov 11, 2015 at 07:51

Mitglied seit Nov 08, 2015

2 Posts

I would say that a higher time frame has been the most successful for myself. I would consider myself a green trader since I have been in the game less than a year, breaking down the fundamentals on the higher time frames such as the 1hr, 4hr, and Daily have been more reliable in my opinion. I am in this for the long haul so I try to frame my strategy as such.

With that being said, I do try to practice low time frame trading on the demo side during less volatile hours.

With that being said, I do try to practice low time frame trading on the demo side during less volatile hours.

Mitglied seit Nov 19, 2014

157 Posts

Nov 11, 2015 at 10:55

Mitglied seit Nov 19, 2014

157 Posts

Yes...impatience... which comes from the belief that profitability is only possible on the lower time frames...thanks to brokers, marketing companies..

Switching from Higher to Lower Time Frames sounds good on paper and I`ve tried it, but its kinda of like switching from Drive into Reverse at 100 MPH. The level of impatience that the LTFs almost demands of us is very difficult to switch off when going back on the HTFs.

One of the bad habits that the LTFs creates in us is to constantly monitor our trades...this might help in the short-run by allowing us to cut losses early. But by continuing to do so, we can also cut our profits at the first sign of a pullback that might turn out to just be temporary.

Take this GBP CAD trade on the 4H Chart I made last week. After entering the trade just below Resistance, half-way towards the target it started to stall and then pullback - which would have tempted many to exit for around 50 Pips. But if you did, you would have missed out on another valuable 50 Pips as it U-Turned to resume the move to the target.

&feature=youtu.be

/SEP_3_AUD_USD_LIVE_RESULT_4D.png" target="_blank" rel="noopener noreferrer nofollow">

This is why I tell my Subscribers to NEVER look at their trades once they have executed them. This bad habit can cut your Long-Term profitability tremendously so that is why discourage any use of the Lower Time Frames even on Demo..

Trade Less, Earn More

Mitglied seit Nov 01, 2015

98 Posts

Nov 14, 2015 at 09:11

Mitglied seit Nov 01, 2015

98 Posts

The higher the TF, the less accurate your entries will be. The patients which most of you are referring to isn't holding profit, but holding losses and waiting for the position to come back to you. It clearly is evident by the amount of time you spend in a position, and the ratio of the pips you are in red, compared to the pips you take profit.

Mitglied seit Nov 01, 2015

98 Posts

Nov 14, 2015 at 09:11

Mitglied seit Nov 01, 2015

98 Posts

DRFXTRADING posted:

Yes...impatience... which comes from the belief that profitability is only possible on the lower time frames...thanks to brokers, marketing companies..

Switching from Higher to Lower Time Frames sounds good on paper and I`ve tried it, but its kinda of like switching from Drive into Reverse at 100 MPH. The level of impatience that the LTFs almost demands of us is very difficult to switch off when going back on the HTFs.

One of the bad habits that the LTFs creates in us is to constantly monitor our trades...this might help in the short-run by allowing us to cut losses early. But by continuing to do so, we can also cut our profits at the first sign of a pullback that might turn out to just be temporary.

Take this GBP CAD trade on the 4H Chart I made last week. After entering the trade just below Resistance, half-way towards the target it started to stall and then pullback - which would have tempted many to exit for around 50 Pips. But if you did, you would have missed out on another valuable 50 Pips as it U-Turned to resume the move to the target.

&feature=youtu.be

/SEP_3_AUD_USD_LIVE_RESULT_4D.png" target="_blank" rel="noopener noreferrer nofollow">/SEP_3_AUD_USD_LIVE_RESULT_4D.png"/>

This is why I tell my Subscribers to NEVER look at their trades once they have executed them. This bad habit can cut your Long-Term profitability tremendously so that is why discourage any use of the Lower Time Frames even on Demo..

It is very easy to speak about a position once it has developed, but those long candles which you see, are based on current events. Current events which no one could have the results of prior, which also goes against the sentiment of the hurd. All in all you WOULD of made 150 pips by holding, but on the lower tf you would of made more pips, and positioning your self better based on your bias of what you see on the higher tf.

Mitglied seit Nov 01, 2015

98 Posts

Nov 14, 2015 at 09:11

Mitglied seit Nov 01, 2015

98 Posts

DRFXTRADING posted:

Yes...impatience... which comes from the belief that profitability is only possible on the lower time frames...thanks to brokers, marketing companies..

You speak about "impatience" but look what having "patience" did to your account...

You were willing to lose 60% of your account on a position and hold it for days on in. That my friend is lack of discipline in accepting a loss. Patients isn't something which determines the price of a currency. Having "patients" can lead to profits most times, but look at what it does eventually! I'd love to hear your argument for those positions.

Mitglied seit Nov 19, 2014

157 Posts

Nov 14, 2015 at 18:11

(bearbeitet Nov 14, 2015 at 18:13)

Mitglied seit Nov 19, 2014

157 Posts

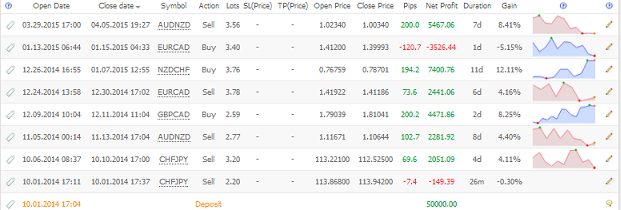

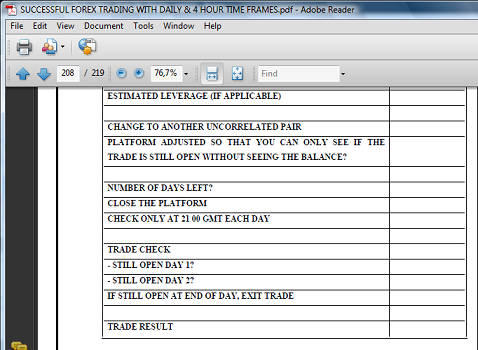

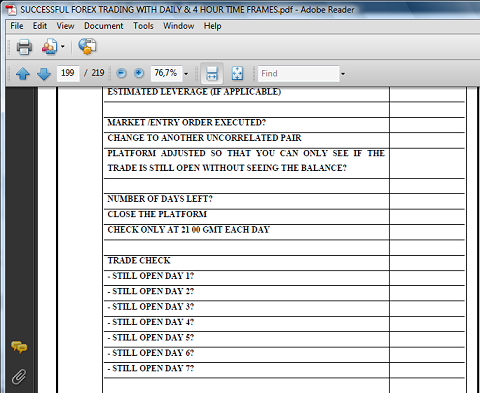

1. These trades are from the system labelled Day Trading. It was part of my use of the Lower Time Frames which failed miserably. The trades that were held for days represented my first attempts at experimenting with Swing Trading along side Day Trading but for the most part, this system represented the use and failure of smaller time frame day trading.

2. The System that shows the benefits of Swing Trading and patient trading is this one...

https://www.myfxbook.com/members/DRFXTRADING/swing-trading-part-1/1079693

..you didnt see this one?

This is the one that reflects the results of all the experimentation I did over several years. It reflects the Methodology in the Trading Manual that is used by my Subscribers who use it for their trading. Holding trades for longer periods allows you to take advantage of the larger Pip movements for better results. You avoid the spikes etc. that take place on the STFs while focusing on steady, stable Long-Term profitability.

3. Patience-

- Most successful trades do not go to their targets in a straight line because the natural dynamic of the market is to wave up and down. So after entry, your trade may go into the red for awhile before heading into the green. Patience and discipline involves having the confidence to allow the market to do this until your targets are hit despite the temporary floating losses. It is a lack of discipline/confidence in your system that leads you to always cut your trades just because they are in the red.

- Whats the point of having Stop Losses if you cut your trades just because they are in the red? if you have a Stop Loss of 90 Pips and your trade is down 50 Pips, arent you going to regret it if the trade turns positive after you exited?

- The only time I cut trades that are in the red is when they have reached the limit of the Holding Period for that trade. Depending on the type of trade, some are set to be held for 2 days, some 7 days....

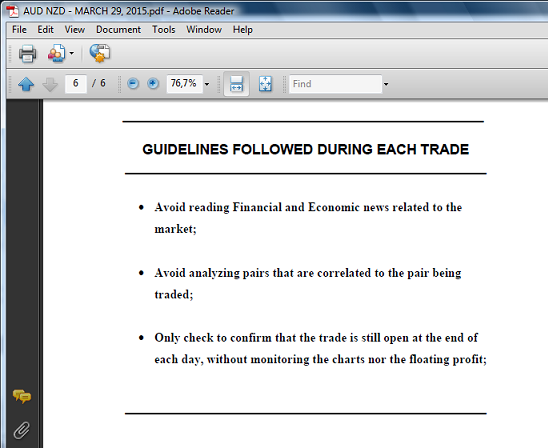

This is a way of ensuring that we do not spend an unncessary amount of time on a trade while at the same time allowing the market to do its thing without our emotional interference. This emotional intereference is at the heart of the failure of most traders. That is why I do not watch a trade until it is closed nor follow news or even check these forums while I am in a trade. It is also one of the guidelines I set out to my Subscribers when I send them info. on upcoming trades...

- By using the smaller time frames, we are tempted to do things like unnecessarily watching trades and cutting them short too quickly that create bad habits that affect our profitability

Trade Less, Earn More

Mitglied seit Nov 01, 2015

98 Posts

Nov 15, 2015 at 08:56

Mitglied seit Nov 01, 2015

98 Posts

DRFXTRADING posted:

1. These trades are from the system labelled Day Trading. It was part of my use of the Lower Time Frames which failed miserably. The trades that were held for days represented my first attempts at experimenting with Swing Trading along side Day Trading but for the most part, this system represented the use and failure of smaller time frame day trading.

2. The System that shows the benefits of Swing Trading and patient trading is this one...

https://www.myfxbook.com/members/DRFXTRADING/swing-trading-part-1/1079693

..you didnt see this one?

This is the one that reflects the results of all the experimentation I did over several years. It reflects the Methodology in the Trading Manual that is used by my Subscribers who use it for their trading. Holding trades for longer periods allows you to take advantage of the larger Pip movements for better results. You avoid the spikes etc. that take place on the STFs while focusing on steady, stable Long-Term profitability.

3. Patience-

- Most successful trades do not go to their targets in a straight line because the natural dynamic of the market is to wave up and down. So after entry, your trade may go into the red for awhile before heading into the green. Patience and discipline involves having the confidence to allow the market to do this until your targets are hit despite the temporary floating losses. It is a lack of discipline/confidence in your system that leads you to always cut your trades just because they are in the red.

- Whats the point of having Stop Losses if you cut your trades just because they are in the red? if you have a Stop Loss of 90 Pips and your trade is down 50 Pips, arent you going to regret it if the trade turns positive after you exited?

- The only time I cut trades that are in the red is when they have reached the limit of the Holding Period for that trade. Depending on the type of trade, some are set to be held for 2 days, some 7 days....

This is a way of ensuring that we do not spend an unncessary amount of time on a trade while at the same time allowing the market to do its thing without our emotional interference. This emotional intereference is at the heart of the failure of most traders. That is why I do not watch a trade until it is closed nor follow news or even check these forums while I am in a trade. It is also one of the guidelines I set out to my Subscribers when I send them info. on upcoming trades...

- By using the smaller time frames, we are tempted to do things like unnecessarily watching trades and cutting them short too quickly that create bad habits that affect our profitability

By using the smaller TF, it gives you the ability to earn much more pips then what the daily range of the currency pair was. Clearly you have failed at trading the lower tf, but that is only because of your "patients" notion, which doesn't apply to price action. Price action, creates everything you see on the higher tf, and since you ignored it on the lower tf, it caused you to drain your account over just a few days, with very small risk per pip.

As for stop losses, the reality is swing traders look at stop losses much differently then scalpers do. Take myself for instance. 40% profit with 2% drawdown is obtained based on keeping your stop losses small, and taking the reverse trade as soon as you stop out. What is the sense of using a stop loss to a long, and the second you stop out, you long again? You my friend may do better on swing trades because you lack the ability of reading price action, yet once this market hits over drive and starts moving in all sorts of directions, we shall see how well your patient theory holds.

Mitglied seit Nov 01, 2015

98 Posts

Nov 15, 2015 at 08:56

Mitglied seit Nov 01, 2015

98 Posts

@DRFXTRADING By the way, the reason why I didn't look at https://www.myfxbook.com/members/DRFXTRADING/swing-trading-part-1/1079693 after checking your profile was because it is a DEMO ACCOUNT! Demo accounts should clearly be ignored by anyone who is looking for someone to manage their accounts. Why is that? Well because a Pilot has tons of simulation experience, but would you feel comfortable with having him pilot a plane with your family on board if he has only flown simulation?

Nov 15, 2015 at 09:00

Mitglied seit Oct 17, 2015

19 Posts

HolyGrailPTY posted:DRFXTRADING posted:

Yes...impatience... which comes from the belief that profitability is only possible on the lower time frames...thanks to brokers, marketing companies..

Switching from Higher to Lower Time Frames sounds good on paper and I`ve tried it, but its kinda of like switching from Drive into Reverse at 100 MPH. The level of impatience that the LTFs almost demands of us is very difficult to switch off when going back on the HTFs.

One of the bad habits that the LTFs creates in us is to constantly monitor our trades...this might help in the short-run by allowing us to cut losses early. But by continuing to do so, we can also cut our profits at the first sign of a pullback that might turn out to just be temporary.

Take this GBP CAD trade on the 4H Chart I made last week. After entering the trade just below Resistance, half-way towards the target it started to stall and then pullback - which would have tempted many to exit for around 50 Pips. But if you did, you would have missed out on another valuable 50 Pips as it U-Turned to resume the move to the target.

&feature=youtu.be

/SEP_3_AUD_USD_LIVE_RESULT_4D.png" target="_blank" rel="noopener noreferrer nofollow">/SEP_3_AUD_USD_LIVE_RESULT_4D.png"/>

This is why I tell my Subscribers to NEVER look at their trades once they have executed them. This bad habit can cut your Long-Term profitability tremendously so that is why discourage any use of the Lower Time Frames even on Demo..

It is very easy to speak about a position once it has developed, but those long candles which you see, are based on current events. Current events which no one could have the results of prior, which also goes against the sentiment of the hurd. All in all you WOULD of made 150 pips by holding, but on the lower tf you would of made more pips, and positioning your self better based on your bias of what you see on the higher tf.

Hi HolyGrailPTY,

I see you like or are working on lower timeframe. Of course no one can predict the price movement in advance, but we know that most LTF signals are false. Thus it is high probability to hit your stoploss. And also trading in LTF you should always stare at the monitor looking for signals and if your hard earned money is on line you worry about not losing every time you enter the market. Here, in my opinion, working on LTF equal to overtrading. As professionals advise us (I think they all felt in their skin) that overtrading is an enemy number 1 of a trader we should concentrate more on HTF trading which leads to high probability winning trade over the long period of time. If any ideas, pls welcome...

Constant Stable Monthly Account Growth Makes You Successful

Mitglied seit Nov 01, 2015

98 Posts

Nov 15, 2015 at 13:15

Mitglied seit Nov 01, 2015

98 Posts

@richadi36

The term "overtrading"is merely that; a term. There is no such thing as over trading such as their is no such thing as over bought or under sold. Those terms have been put out there based on bias and a justification to enter a position. Many people speak about "long term", yet we see that the market can take U-TURNS at a drop of time, thus wiping out profits in 1 - 2 days. Higher tf, is more profitable in pips, but it also leads to higher draw-downs. So my question to you is why not focus on accurate entries, instead of only focusing on just profit.

How many systems have we seen here on myfxbook, that have been both long and short term and fail sometime in the further? The reality is ALL! The best systems are the systems which can profit, and based on the trade history you can see consistency in the sl. Since you believe in overtrading, well UNDERTRADING also exsist. Undertrading exsist when swing trades don't hedge positions "both green and red"and allow them to end up turning to deeper red, or green positions which turn into BE or red!

The term "overtrading"is merely that; a term. There is no such thing as over trading such as their is no such thing as over bought or under sold. Those terms have been put out there based on bias and a justification to enter a position. Many people speak about "long term", yet we see that the market can take U-TURNS at a drop of time, thus wiping out profits in 1 - 2 days. Higher tf, is more profitable in pips, but it also leads to higher draw-downs. So my question to you is why not focus on accurate entries, instead of only focusing on just profit.

How many systems have we seen here on myfxbook, that have been both long and short term and fail sometime in the further? The reality is ALL! The best systems are the systems which can profit, and based on the trade history you can see consistency in the sl. Since you believe in overtrading, well UNDERTRADING also exsist. Undertrading exsist when swing trades don't hedge positions "both green and red"and allow them to end up turning to deeper red, or green positions which turn into BE or red!

Mitglied seit Nov 19, 2014

157 Posts

Nov 15, 2015 at 14:11

(bearbeitet Nov 15, 2015 at 14:22)

Mitglied seit Nov 19, 2014

157 Posts

Wow, it is amazing how strangers over the internet can make assumptions about someone based on a little information and consider it as factual..

Holygrail,

1. Clearly you and I have different definitions of what Price Action is and what "Patience" is.

2. Who said anything about re-entering the same position after being Stopped Out? Not me..

3. "You my friend may do better on swing trades because you lack the ability of reading price action"

If as you said, I do better at Swing Trading than Day/Scalping Trading, then does it really matter whether I can read price action better than you or not?

4. When the market hits overdrive? I have no idea what you mean by that.

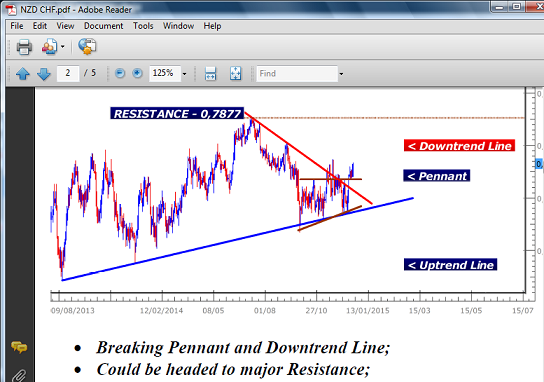

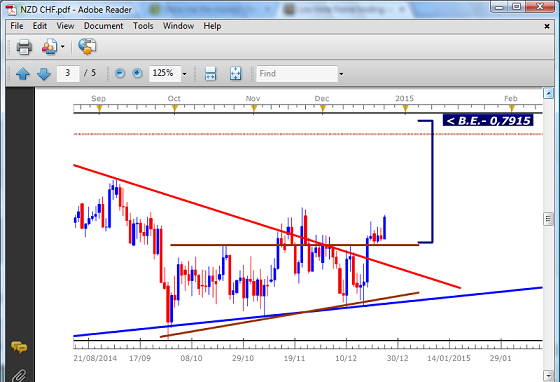

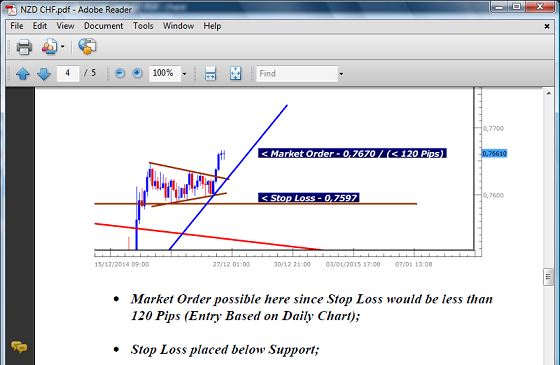

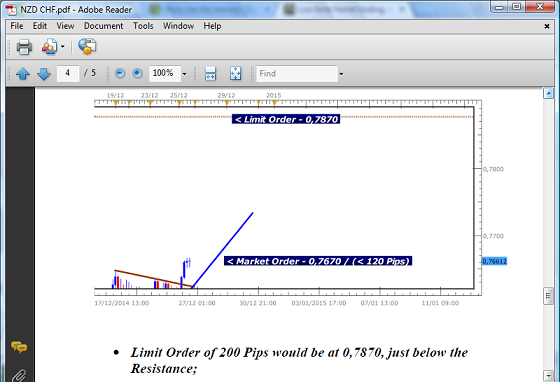

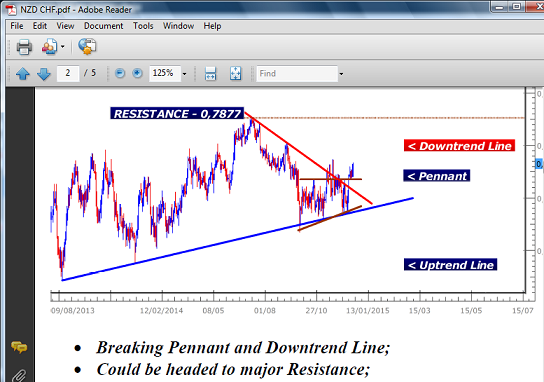

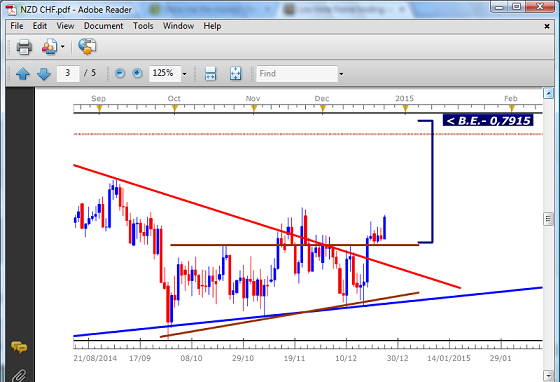

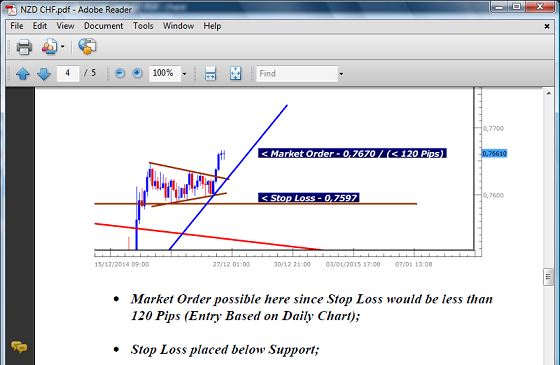

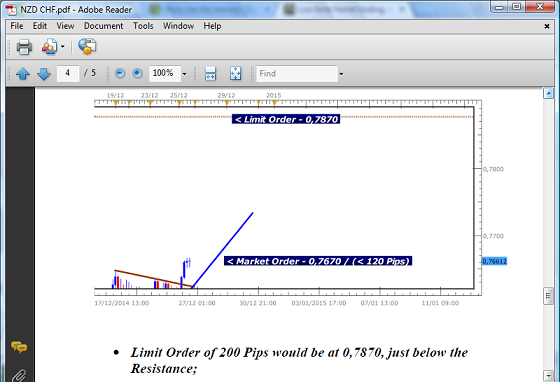

I dont know what you mean by overdrive but lets take the most recent period of "craziness" that hit the market - the sharp CHF appreciation in January...as you can see from the charts below, this was the trade setup sent to my Subscribers to go long on the NZD CHF ...

The Daily Chart was being used to identify the expected movement and target...

The 4H Chart was being used for entry...

(FXCM Charts are used for my Trade Setups because they use the New York Close of the Daily Chart which is crucial to Price Action and my Methodology)

As you can see from the chart below, the market rallied sharply and hit my/our target....

(I do my Live Trading on Dukascopy Live Account)

Soon after, we then had the sharp reversal caused by the removal of exchange rate peg...

If my target was set beyond that level and I/we were still in that trade, we would have lost everything...

In my opinion, this clearly shows an accurate ability to predict the expected movement of the market and where to exit to avoid reversals..even when the market is in "overdrive" based on my definition of Price Action.

4. DEMO VS LIVE

Yes..you are right..Live accounts are better than Demo in showing/proving success etc. However, the Demo Trades done on that System you see were also done on my Live Duk account, but the jforex platform of Dukascopy cannot be tracked/verified by myfxbook. This is why I showed my individual Live Account trades in the Discuss section of that system http://www.myfxbook.com/community/trading-systems/swing-trading-part-1/859880,2#?pt=2&p=1&ts=11&o=859880 to show that they were the same ones done on the Demo - such as the one I just showed you.

At the end of the day, I and others like me are likely to continue to make much more money over the long-term with much less stress on the HTFs than if we traded on the LTFs. If you make money on the LTFs and can sustain it then good for you...but you are in the minority.

The fact remains that most people who trade on the LTFs fail, regardless of which strategy they use because...

1. There is much less time to recover from losses.

2. There is a lot more pressure to make money in the very short 24 hour period.

3. You have to consider how your trades will be affected by new reports - EVERY DAY

4. You have to constantly be glued to your monitor to look for and wait for trades as richadi36 said..

..among several other factors.

Again, you might be successful at this despite these problems, but you are among the few.

At the end of the day, if people are given a choice between becoming a Millionaire using the HTFs or the LTFs most will choose the HTFs because you have more time to do other things in the "real world" etc. Who really wants to be tied to a computer everyday if given a choice?

Holygrail,

1. Clearly you and I have different definitions of what Price Action is and what "Patience" is.

2. Who said anything about re-entering the same position after being Stopped Out? Not me..

3. "You my friend may do better on swing trades because you lack the ability of reading price action"

If as you said, I do better at Swing Trading than Day/Scalping Trading, then does it really matter whether I can read price action better than you or not?

4. When the market hits overdrive? I have no idea what you mean by that.

I dont know what you mean by overdrive but lets take the most recent period of "craziness" that hit the market - the sharp CHF appreciation in January...as you can see from the charts below, this was the trade setup sent to my Subscribers to go long on the NZD CHF ...

The Daily Chart was being used to identify the expected movement and target...

The 4H Chart was being used for entry...

(FXCM Charts are used for my Trade Setups because they use the New York Close of the Daily Chart which is crucial to Price Action and my Methodology)

As you can see from the chart below, the market rallied sharply and hit my/our target....

(I do my Live Trading on Dukascopy Live Account)

Soon after, we then had the sharp reversal caused by the removal of exchange rate peg...

If my target was set beyond that level and I/we were still in that trade, we would have lost everything...

In my opinion, this clearly shows an accurate ability to predict the expected movement of the market and where to exit to avoid reversals..even when the market is in "overdrive" based on my definition of Price Action.

4. DEMO VS LIVE

Yes..you are right..Live accounts are better than Demo in showing/proving success etc. However, the Demo Trades done on that System you see were also done on my Live Duk account, but the jforex platform of Dukascopy cannot be tracked/verified by myfxbook. This is why I showed my individual Live Account trades in the Discuss section of that system http://www.myfxbook.com/community/trading-systems/swing-trading-part-1/859880,2#?pt=2&p=1&ts=11&o=859880 to show that they were the same ones done on the Demo - such as the one I just showed you.

At the end of the day, I and others like me are likely to continue to make much more money over the long-term with much less stress on the HTFs than if we traded on the LTFs. If you make money on the LTFs and can sustain it then good for you...but you are in the minority.

The fact remains that most people who trade on the LTFs fail, regardless of which strategy they use because...

1. There is much less time to recover from losses.

2. There is a lot more pressure to make money in the very short 24 hour period.

3. You have to consider how your trades will be affected by new reports - EVERY DAY

4. You have to constantly be glued to your monitor to look for and wait for trades as richadi36 said..

..among several other factors.

Again, you might be successful at this despite these problems, but you are among the few.

At the end of the day, if people are given a choice between becoming a Millionaire using the HTFs or the LTFs most will choose the HTFs because you have more time to do other things in the "real world" etc. Who really wants to be tied to a computer everyday if given a choice?

Trade Less, Earn More

Mitglied seit Nov 01, 2015

98 Posts

Nov 16, 2015 at 07:37

Mitglied seit Nov 01, 2015

98 Posts

@DRFXTRADING I'm sorry sir, but you are going on to much of a rant on your post. How about you stop mentioning your subscribers and open a live account and show us what you can do. Clearly people rather charge peanuts per month, instead of trading themselves or setting up a Pamm TO EARN profit for all of those involved. The reality is you have failed in trading in a live account, and now you are here pumping DEMO stats, and constantly speaking about subscribers. Who in their right mind would subscribe to you when you blow accounts?

As for HTF being "less stressful"that is a crock of a bull my friend. How do you think a person who ends up in red the moment he/she enters his swing trade feels, once they end up 100-500 pips in red? They are not only stressed but checking their positions more times daily compared to if they were in a floating profit.

You're also linking demo to reals, saying that the real is copying the demo, but the reality is that live account is 11%red, and had not updated since july..... We are currently in November. Please sir,stop preaching to us all about trading, when clearly you have no idea to what it is your doing. How about you make 100% profit then come back. Maybe then we consider you a trader, and not someone who is here on myfxbook trying to pump his 50usd per month subscription because he no longer has money to trade live in his own account.

As for HTF being "less stressful"that is a crock of a bull my friend. How do you think a person who ends up in red the moment he/she enters his swing trade feels, once they end up 100-500 pips in red? They are not only stressed but checking their positions more times daily compared to if they were in a floating profit.

You're also linking demo to reals, saying that the real is copying the demo, but the reality is that live account is 11%red, and had not updated since july..... We are currently in November. Please sir,stop preaching to us all about trading, when clearly you have no idea to what it is your doing. How about you make 100% profit then come back. Maybe then we consider you a trader, and not someone who is here on myfxbook trying to pump his 50usd per month subscription because he no longer has money to trade live in his own account.

Nov 16, 2015 at 07:45

Mitglied seit Nov 08, 2015

2 Posts

When did this become such a tumultuous post? Find a system that works for your trading style. Are we not all on here to support each other, are we all here for the same end result...profitability and consistency? Come on, lets prop each other up and be constructive instead of critical.

*Kommerzielle Nutzung und Spam werden nicht toleriert und können zur Kündigung des Kontos führen.

Tipp: Wenn Sie ein Bild/eine Youtube-Url posten, wird diese automatisch in Ihren Beitrag eingebettet!

Tipp: Tippen Sie das @-Zeichen ein, um einen an dieser Diskussion teilnehmenden Benutzernamen automatisch zu vervollständigen.