Advertisement

Edit Your Comment

Magic Martingale - breaking stereotypes

Mitglied seit Dec 07, 2016

15 Posts

Mar 30, 2017 at 06:23

Mitglied seit Dec 07, 2016

15 Posts

Hello my friends!

I wanna bring to your advice the topic where we can discuss very popular and contestable trading style contained martingale and grid. I've worked under this style for a long period of time and finally found needed management facilities that allow to make stable profit using martingale. To modify trading algorythm constantly I achieved harmony in risk and money management. And I want to share my experience with you. Just look at my performance, analyze trading history and you will see that "to domesticate" martingale is realizable goal. I am ready to discuss all topical matters here. Everyone is welcome to discuss ))

I wanna bring to your advice the topic where we can discuss very popular and contestable trading style contained martingale and grid. I've worked under this style for a long period of time and finally found needed management facilities that allow to make stable profit using martingale. To modify trading algorythm constantly I achieved harmony in risk and money management. And I want to share my experience with you. Just look at my performance, analyze trading history and you will see that "to domesticate" martingale is realizable goal. I am ready to discuss all topical matters here. Everyone is welcome to discuss ))

Power is nothing without control

Mitglied seit Dec 07, 2016

15 Posts

Mar 30, 2017 at 12:08

Mitglied seit Dec 07, 2016

15 Posts

I search points where risk can be reduced. But it is not only way to control drawdown and manage martingale. Entry points are also very important. Entry points are detected automatically according the algorythm integrated to robot, but the rest work is semi-automatic. I may switch off robot if I do not understand market in high-volatility phase or limit risks for some assets only. I do not impose all responsibility on martin. No way, man! Huge work is made by myself (manually) - to stop increasing lot size, step, lot multiplier etc. Everything is considered - volatility, news background, time, contiguous markets and assets.

Power is nothing without control

Mitglied seit Jan 01, 2015

231 Posts

Mar 30, 2017 at 13:56

Mitglied seit Jan 01, 2015

231 Posts

I also have a martingale EA that I am using successfully. The results are better than yours. On average month, it does between 30~50%. There are two EAs - one for Buys and another for sells. starting lot size, lot multiplier and step can be modified to suit the currency pair. The best pair so far has been is EURUSD, and the next one is AUDUSD.

When DD increases, I close one chart and wait for trades to close. If one follows strict money management rules, this is the easiest way to make money.

When DD increases, I close one chart and wait for trades to close. If one follows strict money management rules, this is the easiest way to make money.

Succeed in Forex trading

Mitglied seit Jan 01, 2015

231 Posts

Mar 30, 2017 at 15:32

Mitglied seit Jan 01, 2015

231 Posts

There could be many ways to reduce the risk: one I already mentioned - closed the chart or stop the max lot to suit the account balance or equity. Other method I use is to hedge the open trades with equal and opposite lot size, when currency retraces, I close one side and then other. If you need insight, PM me and we can do one to one.

Succeed in Forex trading

Mitglied seit Dec 07, 2016

15 Posts

Mar 31, 2017 at 09:03

Mitglied seit Dec 07, 2016

15 Posts

Schiessl posted:

Could you give us an example? I mean, How do you identify those points where risk can be reduced?

For example, I have indicators that signal me about emerging volatility. Or if I know about sheduled events (political/economical) - I consider that to manage my open positions: to close all positions or part of them, to stop opening new ones etc.

Power is nothing without control

Mar 31, 2017 at 10:19

Mitglied seit Mar 25, 2013

1 Posts

ZKFXtrader posted:

I also have a martingale EA that I am using successfully. The results are better than yours. On average month, it does between 30~50%. There are two EAs - one for Buys and another for sells. starting lot size, lot multiplier and step can be modified to suit the currency pair. The best pair so far has been is EURUSD, and the next one is AUDUSD.

When DD increases, I close one chart and wait for trades to close. If one follows strict money management rules, this is the easiest way to make money.

The gains are always based on the risk taken.

Magic Martingale has amazing resulta and he has demostrated it in an account from two years.

I also do Martingale and my priority is in the management of the position, don't such as try to hit the entrance.

What do you think about that?

Mar 31, 2017 at 10:39

Mitglied seit Jul 25, 2016

220 Posts

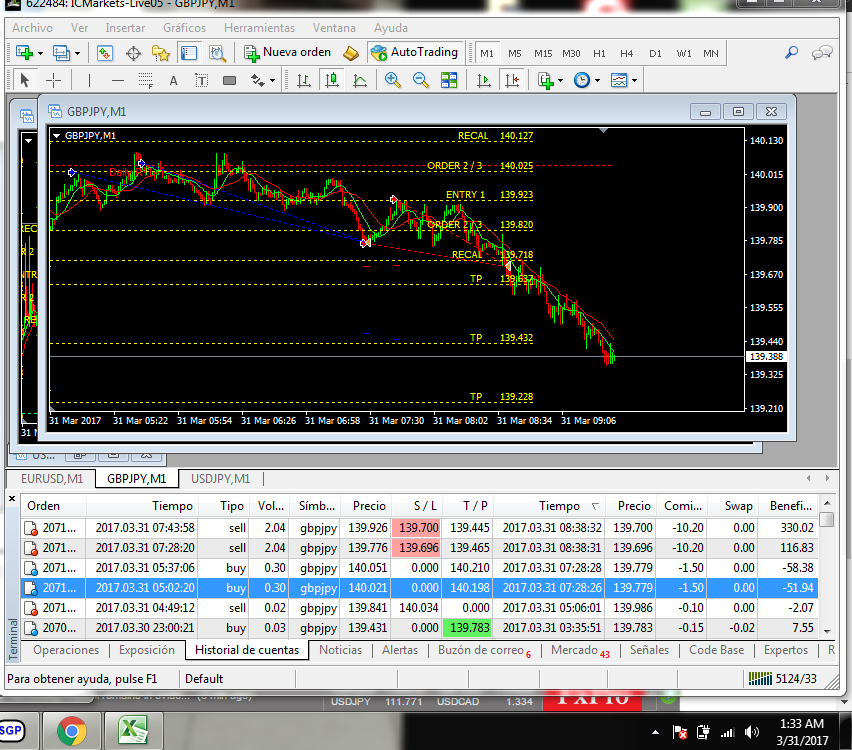

A "low risk" trade is a trade in which your probability of being stopped out is much lower than any of the last positions which you have taken within the martingale sequence.

I use my martingale money management system based on the basis that I won't experience more than 3 straight losses. If you look at the picture below, you will see not only did I first buy, but once the stop loss was hit, I reversed for a bigger sell, and you see how well it paid off! I recovered my loss more than 3 fold!

I use my martingale money management system based on the basis that I won't experience more than 3 straight losses. If you look at the picture below, you will see not only did I first buy, but once the stop loss was hit, I reversed for a bigger sell, and you see how well it paid off! I recovered my loss more than 3 fold!

@GJscalper for more information

forex_trader_314834

Mitglied seit Mar 25, 2016

58 Posts

Mar 31, 2017 at 10:39

Mitglied seit Mar 25, 2016

58 Posts

MagicMartingail posted:

I search points where risk can be reduced. But it is not only way to control drawdown and manage martingale. Entry points are also very important. Entry points are detected automatically according the algorythm integrated to robot, but the rest work is semi-automatic. I may switch off robot if I do not understand market in high-volatility phase or limit risks for some assets only. I do not impose all responsibility on martin. No way, man! Huge work is made by myself (manually) - to stop increasing lot size, step, lot multiplier etc. Everything is considered - volatility, news background, time, contiguous markets and assets.

So when volatility increases above historical limit you avoid trading it? Eg GBPUSD after brexit?

forex_trader_314834

Mitglied seit Mar 25, 2016

58 Posts

Mar 31, 2017 at 10:51

Mitglied seit Mar 25, 2016

58 Posts

MagicMartingail posted:Schiessl posted:

Could you give us an example? I mean, How do you identify those points where risk can be reduced?

For example, I have indicators that signal me about emerging volatility. Or if I know about sheduled events (political/economical) - I consider that to manage my open positions: to close all positions or part of them, to stop opening new ones etc.

I see...you can use weekly ATR or look at https://www.mataf.net/en/forex/tools/volatility

Thanks. Will see if I can improve my trading then.

Mitglied seit Dec 07, 2016

15 Posts

Apr 02, 2017 at 06:18

Mitglied seit Dec 07, 2016

15 Posts

johndoe2016 posted:MagicMartingail posted:

I search points where risk can be reduced. But it is not only way to control drawdown and manage martingale. Entry points are also very important. Entry points are detected automatically according the algorythm integrated to robot, but the rest work is semi-automatic. I may switch off robot if I do not understand market in high-volatility phase or limit risks for some assets only. I do not impose all responsibility on martin. No way, man! Huge work is made by myself (manually) - to stop increasing lot size, step, lot multiplier etc. Everything is considered - volatility, news background, time, contiguous markets and assets.

So when volatility increases above historical limit you avoid trading it? Eg GBPUSD after brexit?

Yes, of course, to avoid or to reduce frequency of new trades.

Power is nothing without control

*Kommerzielle Nutzung und Spam werden nicht toleriert und können zur Kündigung des Kontos führen.

Tipp: Wenn Sie ein Bild/eine Youtube-Url posten, wird diese automatisch in Ihren Beitrag eingebettet!

Tipp: Tippen Sie das @-Zeichen ein, um einen an dieser Diskussion teilnehmenden Benutzernamen automatisch zu vervollständigen.