Edit Your Comment

Why 90% of retail traders fail...

forex_trader_194159

Mitglied seit Jun 09, 2014

38 Posts

Jun 24, 2014 at 09:56

Mitglied seit Jun 09, 2014

38 Posts

The answer, in my humble opinion, is that traders do not controll their emotions and money management. They think and treat fx market like a gamble or casino. Of course, the brokerage company you choose matters.

If you want to know more about good execution and small spreads borkers you can add me on skype . My id is gabriel.urse

Take care and control your emotions!

If you want to know more about good execution and small spreads borkers you can add me on skype . My id is gabriel.urse

Take care and control your emotions!

Mitglied seit Apr 07, 2011

69 Posts

Aug 28, 2014 at 15:37

Mitglied seit Apr 07, 2011

69 Posts

OP - I assume this is your site? http://www.fulltimeforex.com/90-of-retail-traders-fail/

"Taking responsibility is the cornerstone to a winning attitude"

Aug 29, 2014 at 11:26

Mitglied seit Jun 09, 2013

89 Posts

When I was newbie at forex- I am also failed.

And got margin call!

I was not giving up,

I studied and made a lot of researches, then I started to make my own systems, EA's and so on.

And now, after a years, I am totally financially independent and also giving my opinion and tools to other traders.

I just want, that so many traders who have previously lost their money, won't give up, but instead of this try to understand what they have done wrong.

I am always opened to help people, that's why I am also here and this is only reason why I am sharing my trading tools. I really like this feeling that I have helped some people to bring wealth.

And got margin call!

I was not giving up,

I studied and made a lot of researches, then I started to make my own systems, EA's and so on.

And now, after a years, I am totally financially independent and also giving my opinion and tools to other traders.

I just want, that so many traders who have previously lost their money, won't give up, but instead of this try to understand what they have done wrong.

I am always opened to help people, that's why I am also here and this is only reason why I am sharing my trading tools. I really like this feeling that I have helped some people to bring wealth.

Stable 20% per month without manual intervention...

Mitglied seit Jun 28, 2011

444 Posts

Aug 29, 2014 at 16:30

Mitglied seit Jun 28, 2011

444 Posts

"I really like this feeling that I have helped some people to bring wealth."

I know what you mean. It is a knee jerk reaction to scoff and say BS, because to many people , that statement has no meaning. But when you can help someone understand something, you have brought a little more intelligence into the world and we begin to actually change the world one student at a time. And when you do, you get so much more back than you ever gave.

I don't help traders as there is plenty of that to go around. I want to help the guy working his ass off just to get by and has no idea how he is going to pay for the new child much less put something away for retirement. No one has quantified or named this almost mystical feeling that enriches you and your life, at least I never heard it named before, but for those that have no idea what I am talking about, I guess it's OK to blow it off as BS. However, for me, this experience is a lot more real than the money that I am working for.

Bob

I know what you mean. It is a knee jerk reaction to scoff and say BS, because to many people , that statement has no meaning. But when you can help someone understand something, you have brought a little more intelligence into the world and we begin to actually change the world one student at a time. And when you do, you get so much more back than you ever gave.

I don't help traders as there is plenty of that to go around. I want to help the guy working his ass off just to get by and has no idea how he is going to pay for the new child much less put something away for retirement. No one has quantified or named this almost mystical feeling that enriches you and your life, at least I never heard it named before, but for those that have no idea what I am talking about, I guess it's OK to blow it off as BS. However, for me, this experience is a lot more real than the money that I am working for.

Bob

where research touches lives.

Sep 01, 2014 at 12:33

Mitglied seit Jun 09, 2013

89 Posts

But when you can help someone understand something, you have brought a little more intelligence into the world and we begin to actually change the world one student at a time. And when you do, you get so much more back than you ever gave.

Totally agree!

Stable 20% per month without manual intervention...

Sep 16, 2014 at 11:23

Mitglied seit Sep 16, 2014

2 Posts

actually i think this 95% losers(if its right name for how make wrong decision ) its same as our world, 5% of people just have 95% of world capital.

so losing money or gain money in any trade has nothing to do with just 1reason, as market is not 100% mathematic.

market for me after 4 years trading has lots of lessons. put in nutshel , winner trader should have some factors together : 1-emotional free trading 2-follow ur plan 3-have working time plan 4-1% profit per day is better 200% trade in a first day(I guarantee )

good luck

so losing money or gain money in any trade has nothing to do with just 1reason, as market is not 100% mathematic.

market for me after 4 years trading has lots of lessons. put in nutshel , winner trader should have some factors together : 1-emotional free trading 2-follow ur plan 3-have working time plan 4-1% profit per day is better 200% trade in a first day(I guarantee )

good luck

1% everyday

Sep 16, 2014 at 15:36

Mitglied seit Jul 16, 2013

94 Posts

The reason most new traders fail is, mainly they lack the insight of risk & money management (RMM). This should be the number one attribute for the trader to learn about. New traders usually put this at the end of their priority list so they end up with being amongst the 90% who fails. Protection right from the start for a new trader is what is needed. I'm going to list two points here that are of importance.

Protect the individual positions with a predefined stop loss ( 1% risk of the trading account ) and have a predefined rule on how many positions can be opened at the same time. 2-4 opened positions.

Guard the trading account with a solid RMM strategy. For example a maximum loss for the day of 1-4% when you stop trading.

Lock in profit on the upside when the trading is going good because the market will eventually turn against the trader.

Protect the individual positions with a predefined stop loss ( 1% risk of the trading account ) and have a predefined rule on how many positions can be opened at the same time. 2-4 opened positions.

Guard the trading account with a solid RMM strategy. For example a maximum loss for the day of 1-4% when you stop trading.

Lock in profit on the upside when the trading is going good because the market will eventually turn against the trader.

" Lock in the profit and minimize the draw down "

Oct 03, 2014 at 11:27

Mitglied seit Aug 08, 2014

116 Posts

It depends of whom we call traders. I call traders only professionals who understand the market, take it seriously. There is another category of people who treat Forex as a casino, as a way of making a fast and easy money. They do not control their emotions, lose and then complain that the forex is a fraud, thereby creating a negative image of the whole industry.😑

So my opinion is 90-95% of Forex users fail, but there are 5% of traders who win 😎

So my opinion is 90-95% of Forex users fail, but there are 5% of traders who win 😎

Mitglied seit Nov 19, 2014

157 Posts

Mitglied seit Nov 19, 2014

157 Posts

Dec 13, 2014 at 21:47

Mitglied seit Nov 19, 2014

157 Posts

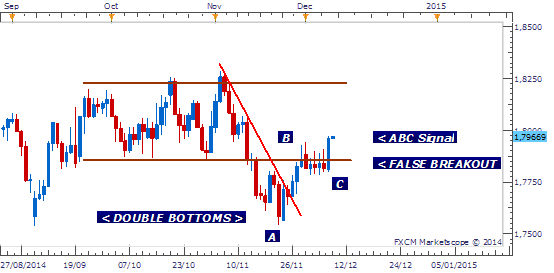

Risk Management is only part of the problem..

Sometimes people violate their Risk Guidelines to compensate for the relatively smaller Pips available per trade each day.

With Swing Trading, no need/temptation to break your rule. Larger Pips are on offer per trade and when you target the best opportunities, consistent gains are likely.

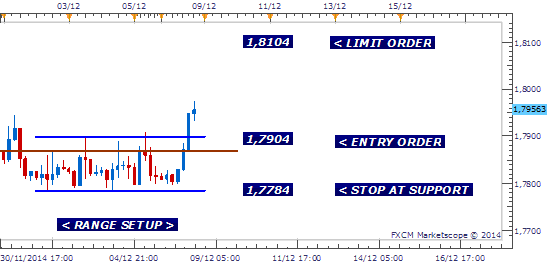

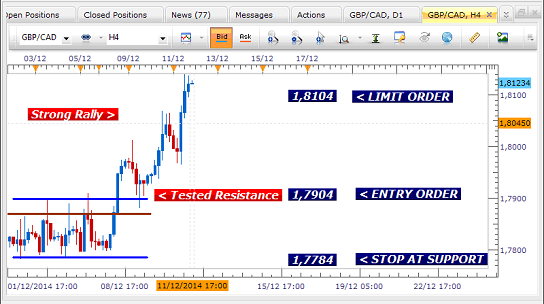

The most recent trade with my Methodology provided us with 200 Pips on the GBP CAD after only 3 days.

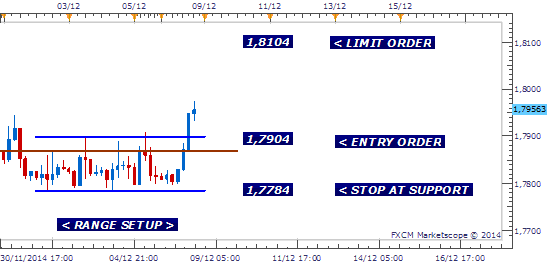

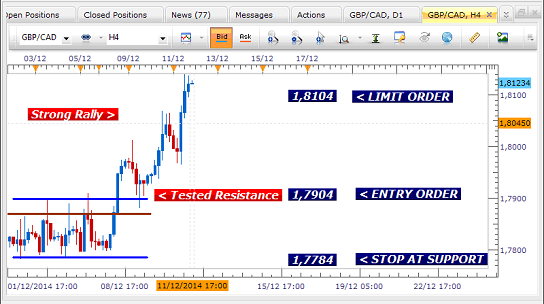

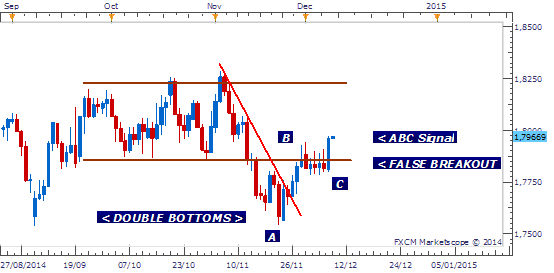

The strategy utilizes the Daily Chart signals of the New York Close from FXCM. This was the setup for the trade.

After determining that the trade was in sync with the rules of our Methodology, an entry setup was executed on the 4 Hour Chart..

After pulling back to test the Resistance of this Range and trigger our Entry Order, the market U-Turned to rally sharply to our 200 Pip target.

One of the rules that we follow is to NEVER watch a chart or the floating profit while a trade is in motion. This signficantly reduces the Emotional factor from our trading which iis also a major reason for the failure rate of traders. Set your trades, allow to go to its target, reap the rewards.

http://www.myfxbook.com/members/DRFXTRADING/duane/1079693

Swing Trading all the way.

Duane

DRFXTRADING

Sometimes people violate their Risk Guidelines to compensate for the relatively smaller Pips available per trade each day.

With Swing Trading, no need/temptation to break your rule. Larger Pips are on offer per trade and when you target the best opportunities, consistent gains are likely.

The most recent trade with my Methodology provided us with 200 Pips on the GBP CAD after only 3 days.

The strategy utilizes the Daily Chart signals of the New York Close from FXCM. This was the setup for the trade.

After determining that the trade was in sync with the rules of our Methodology, an entry setup was executed on the 4 Hour Chart..

After pulling back to test the Resistance of this Range and trigger our Entry Order, the market U-Turned to rally sharply to our 200 Pip target.

One of the rules that we follow is to NEVER watch a chart or the floating profit while a trade is in motion. This signficantly reduces the Emotional factor from our trading which iis also a major reason for the failure rate of traders. Set your trades, allow to go to its target, reap the rewards.

http://www.myfxbook.com/members/DRFXTRADING/duane/1079693

Swing Trading all the way.

Duane

DRFXTRADING

Trade Less, Earn More

Dec 16, 2014 at 07:35

Mitglied seit May 09, 2011

2 Posts

Consistency with risk reward

Mitglied seit Apr 04, 2010

12 Posts

Jul 11, 2015 at 23:29

Mitglied seit Apr 04, 2010

12 Posts

Outside of psychology, I would suggest that a key oversight is ignorance of, or a failure to understand Profit Factor.

In very general terms, look at the average broker sponsored competition. Generally, 90% of traders in a competition lose money. Sign up, put in one trade and a $2 profit, leave it as is and you will make the top 10%-12% of competitors.

The other thing is that for the average losing account, +/-65% of trades are profitable. 1:1 risk reward and a 65% expectancy gives a PF of 1.86 yet many profitable traders with publicly viewable stats have PFs lower than this.

Understanding PF also brings a trader to a certain realisation.

Say a trader works on 1:1 risk reward and on average wins 30 pips. Down the line any trade setup with a stop loss greater than 30 pips can potentially negatively affect their PF so the trader would have to pass on the trade in order not to risk damaging his PF. This forces a trader to look for better than 1:1 setups because if successful, the higher average win per trade can be used to carry bigger stops on future setups.

So risk:reward could start at 30:30 then go 30:45 once the trader ups his skill and starts working on 1:1.5 risk:reward, the 45 can then be fed back into risk for 45:45 or 45:67.5 and so on. Point being focusing on a PF forces a move away from 1:1 setups and taking trades were the stop loss is a lot higher than (average) winning pips.

Incidentally, working on a 60% win rate and 1:1.5 risk reward gives a PF of 2.25

In very general terms, look at the average broker sponsored competition. Generally, 90% of traders in a competition lose money. Sign up, put in one trade and a $2 profit, leave it as is and you will make the top 10%-12% of competitors.

The other thing is that for the average losing account, +/-65% of trades are profitable. 1:1 risk reward and a 65% expectancy gives a PF of 1.86 yet many profitable traders with publicly viewable stats have PFs lower than this.

Understanding PF also brings a trader to a certain realisation.

Say a trader works on 1:1 risk reward and on average wins 30 pips. Down the line any trade setup with a stop loss greater than 30 pips can potentially negatively affect their PF so the trader would have to pass on the trade in order not to risk damaging his PF. This forces a trader to look for better than 1:1 setups because if successful, the higher average win per trade can be used to carry bigger stops on future setups.

So risk:reward could start at 30:30 then go 30:45 once the trader ups his skill and starts working on 1:1.5 risk:reward, the 45 can then be fed back into risk for 45:45 or 45:67.5 and so on. Point being focusing on a PF forces a move away from 1:1 setups and taking trades were the stop loss is a lot higher than (average) winning pips.

Incidentally, working on a 60% win rate and 1:1.5 risk reward gives a PF of 2.25

If you like it, buy it. If you don't sell it.

Aug 08, 2015 at 09:19

Mitglied seit Aug 04, 2015

124 Posts

FX-Parity posted:

Check out the blog - you might like it :)

http://fx-parity.tumblr.com/

Thanks Good one... :) 😄

To achieve 3-5% portfolio growth a month

Aug 12, 2015 at 06:14

Mitglied seit Jan 05, 2015

33 Posts

and 50% or more of all businesses fail within the first 3 years too.

I started an online business in 2007 and pulled a profit the first year and every year since then!

You can beat the odds if you plan and choose wisely. I chose the cosmetic field, a market with over 300 billion in sales per year worldwide. I knew just a small slice of that pie would be just fine with me ;)

Point is...many people rush into things, markets, business, etc...without doing their homework.

I've been trading forex for about 9 months now. I've run the full gammit from gurus that charge for signal rooms, to having my screen full of indicators. I've lost more money than I've made so far, bus nothing huge, as I'm taking baby steps as I learn. My approach is:

Learn>practice>document if the strategy doesn't pan out in a month I change it. Then...

Learn>Practice>Document again.

I'm down to clean charts with just volume under it and Supply and Demand zones. Full circle.

I WILL BE one of the 5% of successful traders because I am patient, persistent and follow my own rules.

You must have this balance to achieve success in anything.

When Edison was asked about his numerous failures when trying to invent a light bulb, he replied "“I have not failed. I've just found 10,000 ways that won't work.”

― Thomas A. Edison

I started an online business in 2007 and pulled a profit the first year and every year since then!

You can beat the odds if you plan and choose wisely. I chose the cosmetic field, a market with over 300 billion in sales per year worldwide. I knew just a small slice of that pie would be just fine with me ;)

Point is...many people rush into things, markets, business, etc...without doing their homework.

I've been trading forex for about 9 months now. I've run the full gammit from gurus that charge for signal rooms, to having my screen full of indicators. I've lost more money than I've made so far, bus nothing huge, as I'm taking baby steps as I learn. My approach is:

Learn>practice>document if the strategy doesn't pan out in a month I change it. Then...

Learn>Practice>Document again.

I'm down to clean charts with just volume under it and Supply and Demand zones. Full circle.

I WILL BE one of the 5% of successful traders because I am patient, persistent and follow my own rules.

You must have this balance to achieve success in anything.

When Edison was asked about his numerous failures when trying to invent a light bulb, he replied "“I have not failed. I've just found 10,000 ways that won't work.”

― Thomas A. Edison

"Do or Do Not. There is No Try"....Yoda

Mitglied seit Jan 06, 2015

22 Posts

Sep 06, 2015 at 10:59

Mitglied seit Jun 24, 2015

10 Posts

forexlife.me

Mitglied seit Apr 04, 2010

12 Posts

*Kommerzielle Nutzung und Spam werden nicht toleriert und können zur Kündigung des Kontos führen.

Tipp: Wenn Sie ein Bild/eine Youtube-Url posten, wird diese automatisch in Ihren Beitrag eingebettet!

Tipp: Tippen Sie das @-Zeichen ein, um einen an dieser Diskussion teilnehmenden Benutzernamen automatisch zu vervollständigen.