KeltnerFlow (bei forex_trader_165856)

Der Benutzer hat dieses System gelöscht.

Edit Your Comment

KeltnerFlow Diskussion

Mitglied seit Mar 22, 2010

30 Posts

Apr 27, 2015 at 06:35

Mitglied seit Mar 22, 2010

30 Posts

RedRhinoLab posted:

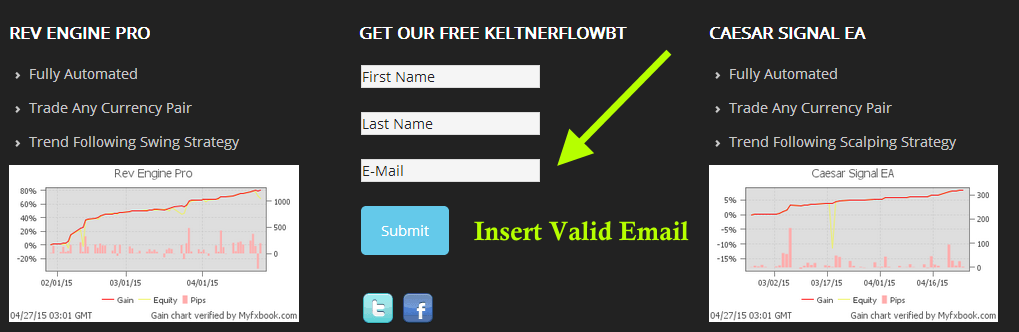

follow instructions please. If you do, you will get the password via email in auto responder.

http://redrhinofx.com/product/keltnerflow-bt/

Must include Correct Email address

Password to unzip folder is sent to your email address. You must scroll down to the bottom of this page ( Footer) and insert your email address inside the Sign Up Box. Without doing so, you will not receive the password to unzip the folder automatically.

That's exactly what I've done - yet the password is nowhere to be seen in the confirmation email message which I received. I have forwarded that message to your support email address for assistance.

Mitglied seit Mar 22, 2010

30 Posts

Apr 27, 2015 at 06:42

Mitglied seit Mar 22, 2010

30 Posts

I started off with the comparative regular data backtests of the original KeltnerPro EA and KeltnerFlow - much to my disappointment with the latter.

Here's the original KeltnerPro EU backtest with the 5% risk over 2008-2015 with its default settings:

And this is the KeltnerFlow backtest with the same 5% risk over the same period of 2008-2015 (using the vendor's 2001-2015 EU set file):

As we see, the profitability is hughely in favor of KeltnerPro. KeltnerFlow's higher profit factor is of no real benefit here - at the 5% risk, the KeltnerFlow drawdown is already 23% - even higher than that of KeltnerPro (21%), so we can't really benefit much from increasing the KeltnerFlow lot size further without incurring a dangerous level of drawdown.

That falls well in line with the previously raised point that over-optimising a bot by limiting the number of its market entries doesn't make it more profitable on its subsequent live tests.

As such, I currently have no plans of replacing KeltnerPro with KeltnerFlow on my live tests - unless and until I am clearly demonstrated the advantage of KeltnerFlow over KeltnerPro.

Here's the original KeltnerPro EU backtest with the 5% risk over 2008-2015 with its default settings:

And this is the KeltnerFlow backtest with the same 5% risk over the same period of 2008-2015 (using the vendor's 2001-2015 EU set file):

As we see, the profitability is hughely in favor of KeltnerPro. KeltnerFlow's higher profit factor is of no real benefit here - at the 5% risk, the KeltnerFlow drawdown is already 23% - even higher than that of KeltnerPro (21%), so we can't really benefit much from increasing the KeltnerFlow lot size further without incurring a dangerous level of drawdown.

That falls well in line with the previously raised point that over-optimising a bot by limiting the number of its market entries doesn't make it more profitable on its subsequent live tests.

As such, I currently have no plans of replacing KeltnerPro with KeltnerFlow on my live tests - unless and until I am clearly demonstrated the advantage of KeltnerFlow over KeltnerPro.

Mitglied seit Mar 22, 2010

30 Posts

Apr 27, 2015 at 06:42

Mitglied seit Mar 22, 2010

30 Posts

I don't know why and how the second backtest's graph would not load in my previous post (without me further being able to edit the post), so I'm reposting my message again:

I started off with the comparative regular data backtests of the original KeltnerPro EA and KeltnerFlow - much to my disappointment with the latter.

Here's the original KeltnerPro EU backtest with the 5% risk over 2008-2015 with its default settings:

And this is the KeltnerFlow backtest with the same 5% risk over the same period of 2008-2015 (using the vendor's 2001-2015 EU set file):

As we see, the profitability is hughely in favor of KeltnerPro. KeltnerFlow's higher profit factor is of no real benefit here - at the 5% risk, the KeltnerFlow drawdown is already 23% - even higher than that of KeltnerPro (21%), so we can't really benefit much from increasing the KeltnerFlow lot size further without incurring a dangerous level of drawdown.

That falls well in line with the previously raised point that over-optimising a bot by limiting the number of its market entries doesn't make it more profitable on its subsequent live tests.

As such, I currently have no plans of replacing KeltnerPro with KeltnerFlow on my live tests - unless and until I am clearly demonstrated the advantage of KeltnerFlow over KeltnerPro.

I started off with the comparative regular data backtests of the original KeltnerPro EA and KeltnerFlow - much to my disappointment with the latter.

Here's the original KeltnerPro EU backtest with the 5% risk over 2008-2015 with its default settings:

And this is the KeltnerFlow backtest with the same 5% risk over the same period of 2008-2015 (using the vendor's 2001-2015 EU set file):

As we see, the profitability is hughely in favor of KeltnerPro. KeltnerFlow's higher profit factor is of no real benefit here - at the 5% risk, the KeltnerFlow drawdown is already 23% - even higher than that of KeltnerPro (21%), so we can't really benefit much from increasing the KeltnerFlow lot size further without incurring a dangerous level of drawdown.

That falls well in line with the previously raised point that over-optimising a bot by limiting the number of its market entries doesn't make it more profitable on its subsequent live tests.

As such, I currently have no plans of replacing KeltnerPro with KeltnerFlow on my live tests - unless and until I am clearly demonstrated the advantage of KeltnerFlow over KeltnerPro.

forex_trader_165856

Mitglied seit Dec 03, 2013

599 Posts

Apr 27, 2015 at 07:59

Mitglied seit Dec 03, 2013

599 Posts

I would recommend backtesting a different pair . A pair where KeltnerPro doesn't do so well. Then you will see the advantage of KeltnerFlow with the ability to make adjustments. Its obvious that KP has been fine tuned for only EURUSD and vendor only display 1 backtest of EURUSD - http://www.myfxbook.com/strategies/keltnerproeurusd/68921 - Also keep in mind that KF is on version 1.0 and I haven't had any suggestions to improve the system besides the volume filter. Did you try the volume filter when running your backtests because my setfile doesn't use it since my data wasn't Tick Quality with correct volume?

The whole purpose of sharing a backtesting version is for suggestions and sharing results, not to just run my setfile and say " Oh there's no advantage". I would expect a little more work on your behalf then a straight comparison of what I've already done.

The whole purpose of sharing a backtesting version is for suggestions and sharing results, not to just run my setfile and say " Oh there's no advantage". I would expect a little more work on your behalf then a straight comparison of what I've already done.

Mitglied seit Mar 22, 2010

30 Posts

Apr 27, 2015 at 12:48

Mitglied seit Mar 22, 2010

30 Posts

RedRhinoLab posted:

I would recommend backtesting a different pair .

OK, here's GU. First, the original KeltnerPro GU backtest with the 5% risk over 2008-2015 with its default settings:

Then, the KeltnerFlow backtest with the same 5% risk over the same period of 2008-2015 (using the vendor's GU set file):

That was enough for me to see that the KeltnerPro strategy has not been reverse-engineered successfully in KletnerFlow. If you maintain I'm wrong, kindly provide us with set files that would deliver the same (or very similar) backtesting results for EU and GU with KeltnerFlow as with KeltnerPro.

Mitglied seit Apr 25, 2013

102 Posts

*Kommerzielle Nutzung und Spam werden nicht toleriert und können zur Kündigung des Kontos führen.

Tipp: Wenn Sie ein Bild/eine Youtube-Url posten, wird diese automatisch in Ihren Beitrag eingebettet!

Tipp: Tippen Sie das @-Zeichen ein, um einen an dieser Diskussion teilnehmenden Benutzernamen automatisch zu vervollständigen.