EBC Markets Briefing | Dow outperforms on strong bank stocks

The S&P 500 and the Nasdaq 100 tumbled on Wednesday with the ongoing rotation out of the tech sector. The Dow held onto a modest gain and logged its third straight record closing high.

Global hedge funds have been reducing their exposure to US tech stocks in seven of the last eight trading sessions, according to Goldman Sachs. Bank stocks regain appeal after several rosy earnings reports.

Wall Street has posted its best quarter for investment banking in more than two years with the five largest investment banks together reporting a 40% increase in investment banking fees from a year earlier.

All those banks except Goldman announced higher than expected investment banking revenues for the quarter. Each of the five stocks has outperformed the S&P 500 index over the past three months.

Fees from debt deals have outstripped other areas of investment banking, as corporate borrowers look to refinance or raise new debt as interest rates have stabilised. Citi and Morgan Stanley were particularly benefited.

Some analysts have expressed scepticism about whether the rebound will stick, however, as there are more signs of tempering of the inflation prints and some normalisation in rates.

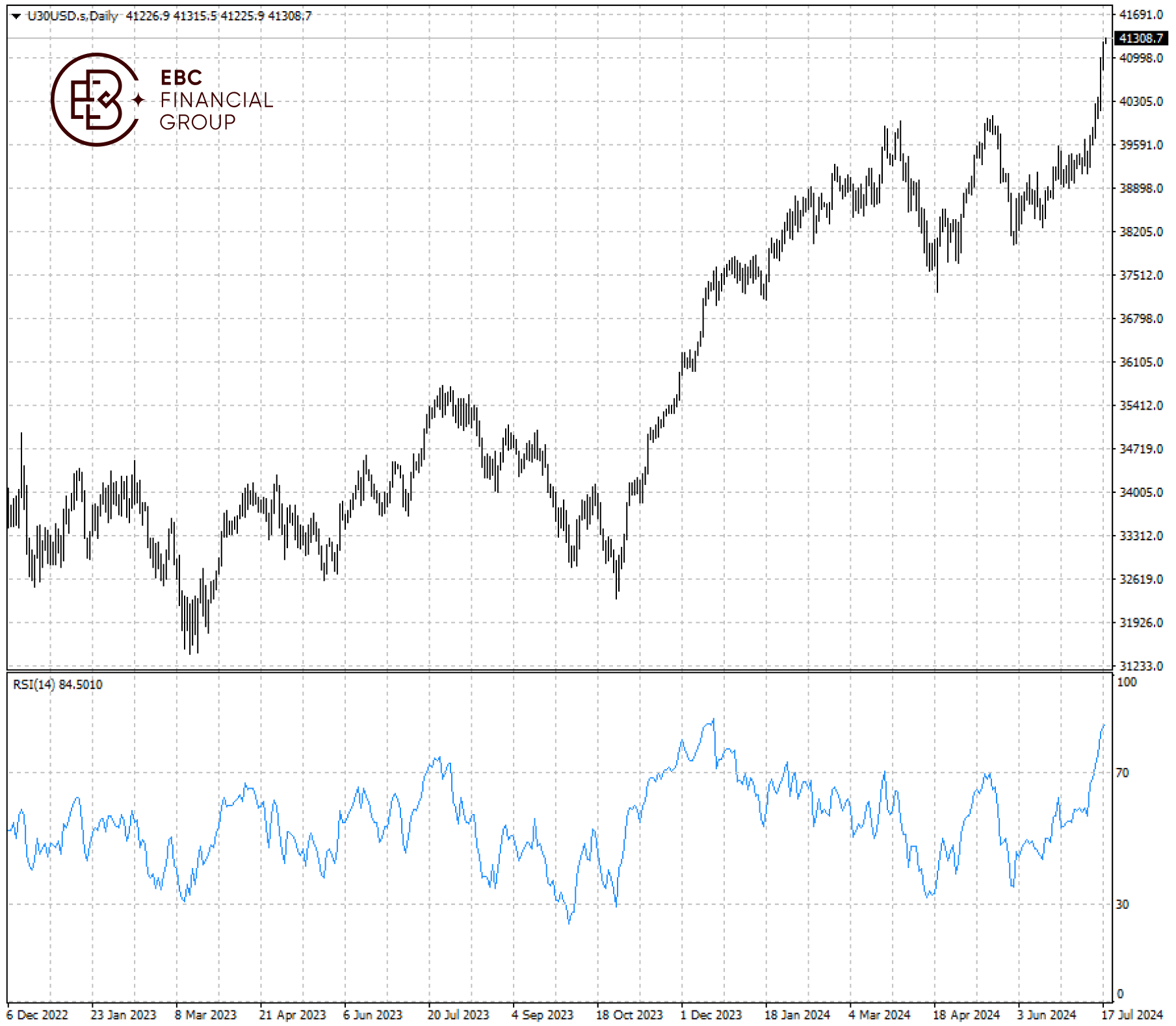

The Dow crossed 41,000 for the very first time in its history, but it looks quite overbought. If the index fails to hold above the level, a steep correction is more likely than not.

EBC Trading Platform Security Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Online Trading Support or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.