EBC Markets Briefing | Euro parity is more likely now

The euro steadied on Monday after the ECB delivered a second rate cut in a row as expected last week. It suffered a third straight week of losses against the greenback and its worst weekly drop against the pound this year.

The risk of the euro sliding to parity with the dollar is mounting in financial markets after the interest-rate cut and stark reminder that a Donald Trump presidency could spark a global trade war.

Pictet and Deutsche Bank no longer consider a scenario where one euro buys a single dollar to be far-fetched, while JP Morgan Private Bank see the risk that the common currency could fall toward that level this year.

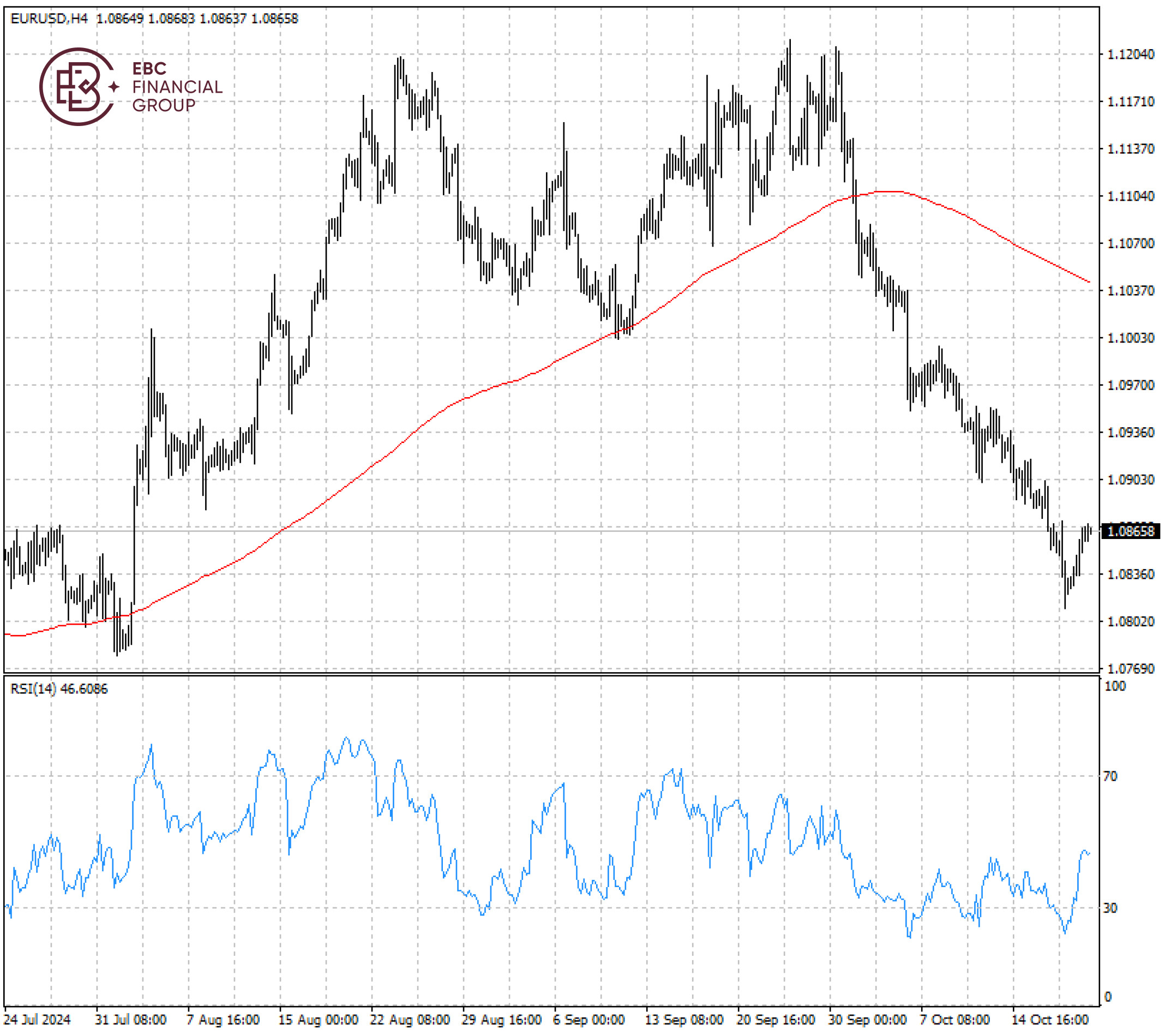

A gauge of risk reversals over the next month is now the most negative on the euro-dollar in three months, and the near-term puts are concentrated on a fall to the $1.08-$1.07 area.

Money markets imply a 20% chance the ECB will deliver a half-point cut at the final meeting of the year and are almost fully priced for quarter-point reductions at every meeting through April.

Governor Lagarde did not provide hints about future moves but sources close to the matter told Reuters a fourth cut in December is likely unless economic or inflation data turns around in the coming weeks.

The pair has rebounded off the oversold territory, but still traded below the 200 SMA. If the level is not cleared, we could see a fresh drop towards 1.0800.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.