Gold hits new all-time high, before sharp reversal

Gold tested $2480 last week, after a remarkable surge that solidified its status as a preferred safe-haven asset during times of economic uncertainty. With the Federal Reserve hinting at potential rate cuts and political developments influencing market sentiment, the price of gold has surged to unprecedented levels.

This year, gold has risen more than 14%, supported by expectations of Federal Reserve rate cuts, geopolitical tensions, and substantial purchases by central banks.

On Monday last week, Federal Reserve Chair Jerome Powell indicated that the Fed would not wait for inflation to hit the 2% target before initiating rate cuts, due to the delayed impact of policy changes.

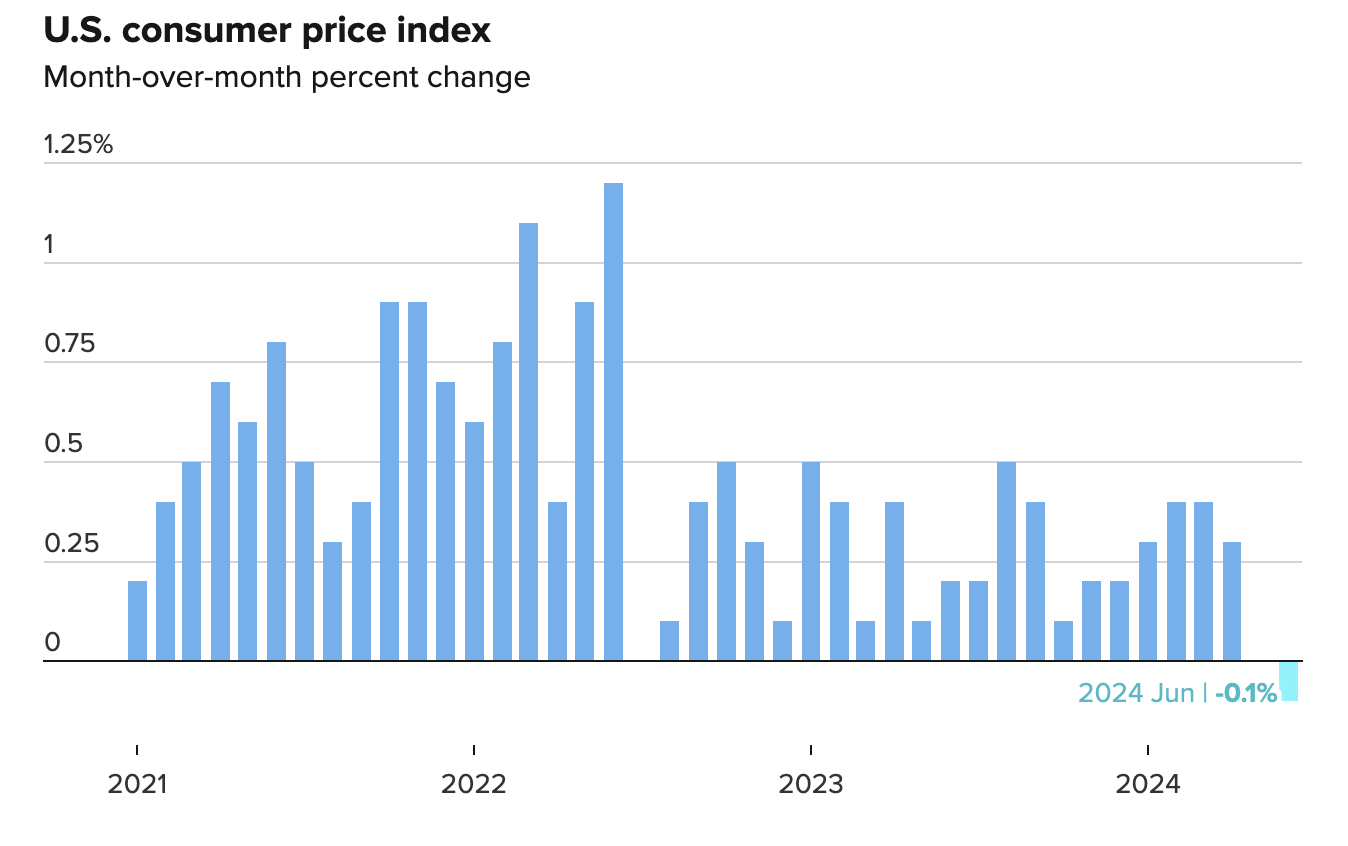

This statement, coupled with a 0.1% month-to-month decline in the June consumer price index, bolstered market confidence in imminent rate cuts.

Source: U.S. Bureau of Labor Statistics

Traders, as reflected in the CME FedWatch tool, are now almost certain of a September rate cut. Analysts from JPMorgan have noted that the anticipation of lower interest rates significantly boosts gold's appeal. Gold, being a non-interest bearing asset, performs well when interest rates fall. JPMorgan predicts that gold prices could rise to $2,500 per ounce by the fourth quarter of 2024, driven by increased investor demand through futures and ETF holdings.

ANZ's senior commodity strategist, Daniel Hynes, highlighted that the move in gold prices has been sparked by signs of slowing inflation and weak economic data. Similarly, Vivek Dhar from the Commonwealth Bank of Australia emphasized gold's ability to gain support regardless of the conditions, predicting that prices could exceed $2,500 per ounce by year-end.

The upcoming US election has also played a role in gold's price movements. A potential second term for Donald Trump, with his tariff and tax policies, is seen as a factor that could boost inflation and deepen the budget deficit. UBS analysts have noted that political uncertainty could lead to market volatility, further enhancing gold's attractiveness as a safe-haven asset.

Despite gold prices soaring to unprecedented levels, other commodities did not follow suit, presenting a potential challenge for traders. Pro-cyclical commodities like copper and oil, which typically perform well in a healthy economy, saw price drops. This divergence suggests underlying troubles in the global economy, with investors flocking to gold amid fears of economic instability.

Copper, often seen as a bellwether for economic health due to its widespread use in construction and manufacturing, was not trending up like gold. Similarly, oil prices have been lackluster, indicating that while investors are hedging with gold, confidence in overall economic growth remains shaky. For traders, this split presents a nuanced landscape: the robust performance of gold signals caution, whereas the underperformance of pro-cyclical commodities hints at deeper economic issues that could impact broader market strategies.

Gold's rise indicates that investors are increasingly worried about the global economic outlook. The yellow metal's appeal as a safe-haven asset is heightened during times of uncertainty, as it provides a hedge against economic turbulence and inflationary pressures.

Despite the concerning economic signs, US equity investors remain optimistic. They believe that the economic situation is "bad enough" to justify supportive monetary policy from the Federal Reserve, such as lower interest rates, but not so dire as to trigger a major economic crisis. This delicate balance has been described as a "Goldilocks economy"—not too hot, not too cold. However, this equilibrium is fragile and may not endure.

Since last week, gold has retreated from its all-time high due to profit-taking, joining most other commodities in a sell-off. At the time of writing, Gold is sitting at a technical support level of around $2,370. A further move down could find support around the $2356 and the $2334 support levels. On the upside, resistance is identified at two key levels around $2392 and $2408, with bulls previously failing to test the $2500 mark.

The Relative Strength Index (RSI) is currently at around 40, indicating that the asset is in slight oversold territory. This suggests that there may be a potential for a rebound if buying interest picks up.

Source: Deriv MT5

Disclaimer:

The information contained within this blog article is for educational purposes only and is not intended as financial or investment advice. The performance figures quoted refer to the past, and past performance is not a guarantee of future performance or a reliable guide to future performance. We recommend you do your own research before making any trading decisions. No representation or warranty is given as to the accuracy or completeness of this information.