Oil price trying to bottom on limited supply

Oil is trying to find a bottom. At the same time, political commentary and market sentiment are moving in the same direction, increasing the chances of a rebound.

The price of a barrel of WTI has been falling in a narrow trading range for almost two weeks now, an orderly retreat after a fairly sharp sell-off that began on 20 October.

Last week, the price began to find support as it approached $80 per barrel of WTI. Increased demand for risk assets did not prevent another attempt to push oil lower.

Since Friday, however, the arguments of the buyers have become louder. Russia and Saudi Arabia reiterated that they would extend their voluntary restrictions of 300K bpd and 1M bpd until December and the end of the year, respectively - a timely reminder of the big players' desire to keep the market in a deficit.

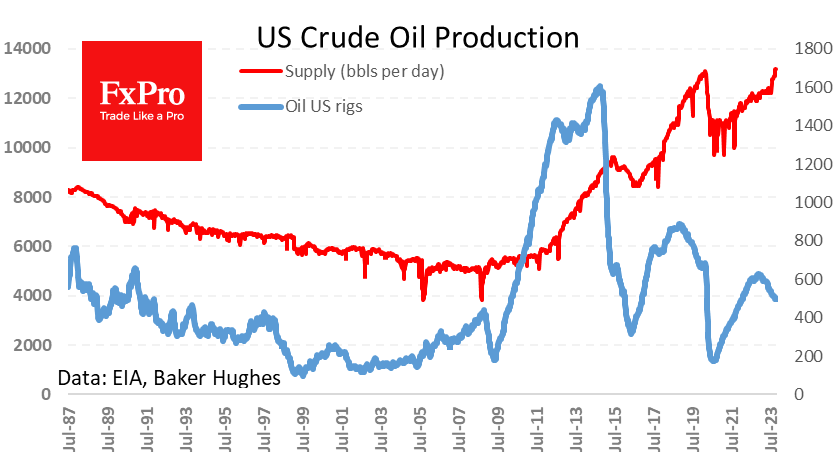

But interestingly, the number of working oil rigs in the US has also collapsed. Baker Hughes reported a drop to 496 (-8), the lowest since January 2022. This calls into question the upward trend of the previous three weeks, which saw consecutive increases to 501, 502 and 504.

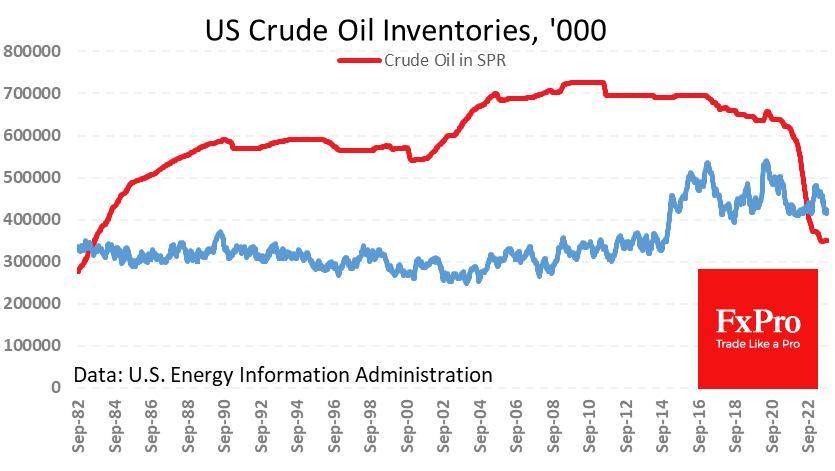

An earlier report last week showed that US companies had maintained a record pace of 13.2 million bpd for the past four weeks but were not ramping up. The high production figures are not translating into a rise in inventories, which are falling at a rate of 3.4% y/y to 422M barrels, remaining at the lower end of the range of the past eight years (around 400M barrels).

Insufficient commercial storage capacity may prevent the US presidential administration from replenishing the Strategic Stockpile.

On the other hand, time seems to be on the side of the bears, with more of the world's significant economies slowing down or already in contractionary phases. Interest rates are starting to bite, and government stimulus is unlikely to return soon. This would help oil rally as the authorities are now on the other side of the barricades in the fight against inflation.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)