Edit Your Comment

EUR/USD

Nov 25, 2016 at 11:39

Miembro desde Apr 09, 2016

posts 419

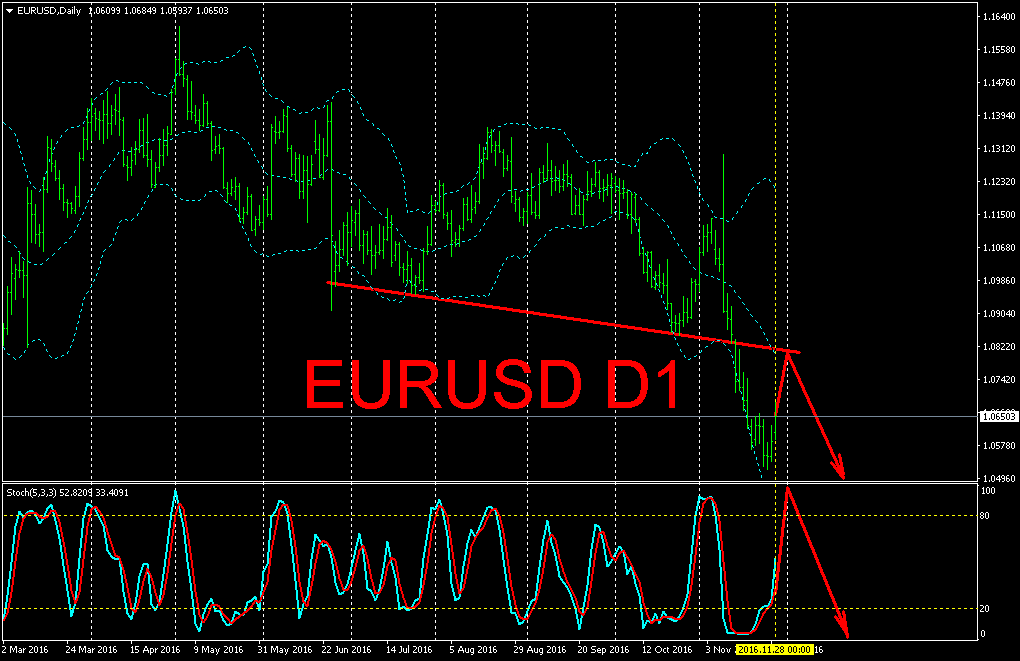

Sberbank CIB believes that EUR / USD is headed to parity. The exchange rate fell below the key support level of 1.0525, which is its lowest level since December last year when the ECB did not meet market expectations for further easing of monetary policy, remind analysts. In their view, this increases the likelihood that the pair will reach parity in the coming months. Another argument to wait parity is a supportive fiscal policy in the US and politically busy calendar in the EU.

Miembro desde Sep 12, 2015

posts 1933

Nov 25, 2016 at 12:06

Miembro desde Sep 12, 2015

posts 1933

Don't believe all you read , I cant see it happening in the coming months, unless Trump does something drastic , which is doubtful.

"They mistook leverage with genius".

Miembro desde Jul 10, 2014

posts 1114

Nov 25, 2016 at 14:56

(editado Nov 25, 2016 at 15:19)

Miembro desde Jul 10, 2014

posts 1114

EUR/USD broke above 1.0600 again today after forming an impressive doji candlestick on the daily time-frame above the support at 1.0500. Next target is likely 1.0645.

Nov 25, 2016 at 22:28

Miembro desde May 01, 2015

posts 675

During the last two weeks the EUR/USD pair is staying below the middle lines while technical indicators has been elevated after spending sure time within the oversold area. While price is placed below 1.0505, next target is seen at 1.0460.

Miembro desde Oct 02, 2014

posts 905

Miembro desde Nov 13, 2015

posts 12

Miembro desde Mar 12, 2016

posts 29

Miembro desde Apr 08, 2014

posts 1140

Nov 28, 2016 at 09:55

Miembro desde Apr 08, 2014

posts 1140

On the last Friday’s session the EURUSD rose with a wide range and closed near the high of the day, also managed to close above Thursday’s high, which suggests a strong bullish momentum.

The pair still closed below the 10, 50 and the 200-day moving averages that should act as dynamic resistances.

The key levels to watch are: a daily resistance at 1.0819 (resistance), a Fibonacci extension at 1.0666 (resistance), a daily resistance at 1.0622, the 10-day moving average at 1.0618 (resistance) and the all-time low at 1.0462.

The pair still closed below the 10, 50 and the 200-day moving averages that should act as dynamic resistances.

The key levels to watch are: a daily resistance at 1.0819 (resistance), a Fibonacci extension at 1.0666 (resistance), a daily resistance at 1.0622, the 10-day moving average at 1.0618 (resistance) and the all-time low at 1.0462.

"I trade to make money not to be right."

Nov 28, 2016 at 10:55

Miembro desde Feb 12, 2016

posts 507

There will be a lot of playing around to finish the monthly candle on Wednesday but I see it as the correction side up on monthly basis going to around 1.07 first. There would be a lot of power or some impact needed to break the triple bottom in December. It’s the Feds meeting that could make it possible but not before that.

Miembro desde Jul 10, 2014

posts 1114

Nov 28, 2016 at 13:14

(editado Nov 28, 2016 at 13:15)

Miembro desde Jul 10, 2014

posts 1114

I agree, EUR/USD bounced off 1.0685 after forming a pair of shooting star candlesticks on the four-hour time-frame. It's currently testing the support at 1.0580 and if it breaks out below that level it will likely reach the next support at 1.0520 - 1.0510.

Miembro desde Sep 12, 2015

posts 1933

Nov 28, 2016 at 16:11

Miembro desde Sep 12, 2015

posts 1933

BaldoN posted:

Too much pressure already it looks quite bearish now. If The daily pivot didn’t hold as I don’t see much buying pressure it might further go down. Lets see what happens with the US Open.

You might get some bullish move as GBP/USD is bullish looking its just bounced off 24000,time will tell if it breaks new levels.

"They mistook leverage with genius".

Nov 28, 2016 at 21:07

Miembro desde May 01, 2015

posts 675

It’s an importnat week for the US dollar with the NFP data upcoming on Friday, along with the preliminary estimates on Q3 GDP and the ADP numbers on Wednesday. Meanwhile Europe offers a major event with risk behaviour on markets – the Italian referendum. The coincidence and the combnations of these fundaments implies strong influence on the pair.

Nov 29, 2016 at 08:15

Miembro desde May 01, 2015

posts 675

The single currency marked slight increase against the US dollar on Monday. The EUR/USD pair reached a daily high at 1.0685 and low at 1.0563. The pair remains at risk of further decline and the next target appears to be the levels at 1.0550.

*El uso comercial y el spam no serán tolerados y pueden resultar en el cierre de la cuenta.

Consejo: Al publicar una imagen o una URL de YouTube, ésta se integrará automáticamente en su mensaje!

Consejo: Escriba el signo @ para completar automáticamente un nombre de usuario que participa en esta discusión.