- Inicio

- Comunidad

- Corredores Experimentados

- From losing for more than 1 yr to losing for more than 1 yr ...

Advertisement

Edit Your Comment

From losing for more than 1 yr to losing for more than 1 yr ?

forex_trader_199099

Miembro desde Jul 11, 2014

posts 2

Sep 27, 2014 at 19:01

Miembro desde Jul 11, 2014

posts 2

Hi,

I am wondering if those who are now profitable trading for more than a year and have been losing money from trading during a year or more before are willing to let me/us know how they made it. Is there any particular change that made the difference?

Maybe there's already a thread about that I didn't found... anyway, I would really appreciate to have fresh stories and maybe get in touch with profitable traders to become one my self.

I could write so many questions I have but, I guess many traders trade differently and have ''their own plan'' so it's almost impossible to have a concensus... anyway here's some:

Do you uses paid software like eikon, metastock, ransquawk, bloomberg pro, etc ?

Do you trade fundamental or only technical ?

What is your average risk-reward ratio ?

How much time per day trading take you?

Do you have a written plan you follow?

How much % of your account are your risking/trade ?

Hope my english is fine!

Regards,

Alex

I am wondering if those who are now profitable trading for more than a year and have been losing money from trading during a year or more before are willing to let me/us know how they made it. Is there any particular change that made the difference?

Maybe there's already a thread about that I didn't found... anyway, I would really appreciate to have fresh stories and maybe get in touch with profitable traders to become one my self.

I could write so many questions I have but, I guess many traders trade differently and have ''their own plan'' so it's almost impossible to have a concensus... anyway here's some:

Do you uses paid software like eikon, metastock, ransquawk, bloomberg pro, etc ?

Do you trade fundamental or only technical ?

What is your average risk-reward ratio ?

How much time per day trading take you?

Do you have a written plan you follow?

How much % of your account are your risking/trade ?

Hope my english is fine!

Regards,

Alex

forex_trader_139412

Miembro desde Jul 16, 2013

posts 352

Sep 27, 2014 at 19:36

Miembro desde Jul 16, 2013

posts 352

My 2 cents..

I traded and failed miserably, then I learnt how to backtest and it went a little better. Then I learnt about the importance of spread, once again it went a little better. So in my experience I gained a bit of knowledge and I suppose that would distinguish me from being a newbie. But the road is still long, and my account is definitely not performing how I would like it yet.

I traded and failed miserably, then I learnt how to backtest and it went a little better. Then I learnt about the importance of spread, once again it went a little better. So in my experience I gained a bit of knowledge and I suppose that would distinguish me from being a newbie. But the road is still long, and my account is definitely not performing how I would like it yet.

Sep 29, 2014 at 06:31

Miembro desde Mar 25, 2014

posts 21

Hi Alex.

After becoming profitable, the money I lost on trading was using EA's and copying a so called JohnPaul77.

However, I had only a bit of my equity exposed to these systems.

I can have a bad week sometimes, but what matters is the long run.

Do you uses paid software like eikon, metastock, ransquawk, bloomberg pro, etc ? No.

Do you trade fundamental or only technical ? Mostly fundamental, but the technical part is important when it comes to exit trades.

What is your average risk-reward ratio ? Very hard to say. I aim for big moves so I don't have a fixed risk-reward ratio. Sometimes the trend doesn't seem to stop and you make more money than you are expecting (exemple EUR/USD that I am selling since 1.34100). Other times, the trend reverts and you make less money that you were expecting (exemple AUD/JPY where I was planning to have a bigger profit than I had.)

Also, I don't start with all my line when I trade. I begin with small positions, increasing my exposure if I see the price going in the right direction, in the right time and with the right speed and volume.

How much time per day trading take you?

Atleast 4 hours, on average I would say 6 hours.

Do you have a written plan you follow?

I have my own rules that I use for trading and they are very important specially when it comes to risk-managment.

How much % of your account are your risking/trade ?

More important than having a fixed % is to ajust your % depending the odds.

At no point I let my account go below 2% on a single pair and 6% in general.

Just one more thing Alex, when you are trading, especially at the beginning, you will notice a rush and emotion side participating on your trading. Don't let them happen! Learn to control yourself.

Also this is a golden rule: Cut your losses and let your profits run. Be more willing to risk when you are already in the money than when you are out of the money, that is how big bucks are done!

Cheers!

After becoming profitable, the money I lost on trading was using EA's and copying a so called JohnPaul77.

However, I had only a bit of my equity exposed to these systems.

I can have a bad week sometimes, but what matters is the long run.

Do you uses paid software like eikon, metastock, ransquawk, bloomberg pro, etc ? No.

Do you trade fundamental or only technical ? Mostly fundamental, but the technical part is important when it comes to exit trades.

What is your average risk-reward ratio ? Very hard to say. I aim for big moves so I don't have a fixed risk-reward ratio. Sometimes the trend doesn't seem to stop and you make more money than you are expecting (exemple EUR/USD that I am selling since 1.34100). Other times, the trend reverts and you make less money that you were expecting (exemple AUD/JPY where I was planning to have a bigger profit than I had.)

Also, I don't start with all my line when I trade. I begin with small positions, increasing my exposure if I see the price going in the right direction, in the right time and with the right speed and volume.

How much time per day trading take you?

Atleast 4 hours, on average I would say 6 hours.

Do you have a written plan you follow?

I have my own rules that I use for trading and they are very important specially when it comes to risk-managment.

How much % of your account are your risking/trade ?

More important than having a fixed % is to ajust your % depending the odds.

At no point I let my account go below 2% on a single pair and 6% in general.

Just one more thing Alex, when you are trading, especially at the beginning, you will notice a rush and emotion side participating on your trading. Don't let them happen! Learn to control yourself.

Also this is a golden rule: Cut your losses and let your profits run. Be more willing to risk when you are already in the money than when you are out of the money, that is how big bucks are done!

Cheers!

Sep 29, 2014 at 11:34

(editado Sep 29, 2014 at 12:04)

Miembro desde Sep 19, 2014

posts 2

I agree with [topastop] in many regards.

One thing I have found that fundamental to any trading is that a good trading plan/rules/system must have a good exit technique. One of my largest educations in making profit was to split my risk into two areas, a rigid risk/reward system rarely psychologically works for me. My stop loss is actually there to help assist against larger losses, to safe guard my account. Not as a systematic way to exit a trade. Any techniques I use for entering a trade I have to have a plan to exit the trade. So the bottom line "Risk" is my stop loss, but if a trade goes sour, I am usually out of the trade long before any stop loss is hit. I am sorry to say it for those who want an instant idea as to risk it doesn't exist, but your taste for risk as well as the average loss of your trading activity is about as far as you can determine. If you are asking me where my stop loss is and the position size, well that is a tougher question. My average loss at the moment is 3.1% but my Stop is nearer the 10% mark. Now I have only been hit on my stop loss twice in the last year. My average wins are 8.3% and I have a 85.29% of my trades profitable.

Being aware of potential overly high-volatile times. I also set take profits for the opposite reason, I put them way-out there to catch mega-moves in the right direction, usually beyond key areas where a so-called 'breakout' can occur.

I rarely use demo accounts, if I do they are for development purposes. I find low value accounts (around $1000-$5000) a much greater way to experiment with ideas; it is the cost of doing business. Lesser accounts ($50) might work as well. The only downside and unrealistic thing about the little accounts is the high leverage.

Don't spend much time at the charts, come up with a way to make decisions quickly, hovering hours over charts leads to over-thinking. I make all my decisions at key times in the day, I started out limiting myself to 30 minutes at a time. Now it just happens that I look at the data and say, yes or no quite quickly for each instrument.

In addition, I think the reason a lot of people fail is that they find a way to get into good initial entries, hold on for to that same technique for too long. People stack up all of their previous experiences into the 'latest thing' that makes them a bit of money without looking at a larger picture. They think they have 'gotten here' going through all previous iterations of systems etc... In a way you have, but largely this is a false picture. You need a diverse understanding and set of techniques that works for you psychologically and actually.

Run it like a business, is your business healthy placing all plans on one way of doing something? Redundancy is a requirement for any business.

One thing I have found that fundamental to any trading is that a good trading plan/rules/system must have a good exit technique. One of my largest educations in making profit was to split my risk into two areas, a rigid risk/reward system rarely psychologically works for me. My stop loss is actually there to help assist against larger losses, to safe guard my account. Not as a systematic way to exit a trade. Any techniques I use for entering a trade I have to have a plan to exit the trade. So the bottom line "Risk" is my stop loss, but if a trade goes sour, I am usually out of the trade long before any stop loss is hit. I am sorry to say it for those who want an instant idea as to risk it doesn't exist, but your taste for risk as well as the average loss of your trading activity is about as far as you can determine. If you are asking me where my stop loss is and the position size, well that is a tougher question. My average loss at the moment is 3.1% but my Stop is nearer the 10% mark. Now I have only been hit on my stop loss twice in the last year. My average wins are 8.3% and I have a 85.29% of my trades profitable.

Being aware of potential overly high-volatile times. I also set take profits for the opposite reason, I put them way-out there to catch mega-moves in the right direction, usually beyond key areas where a so-called 'breakout' can occur.

I rarely use demo accounts, if I do they are for development purposes. I find low value accounts (around $1000-$5000) a much greater way to experiment with ideas; it is the cost of doing business. Lesser accounts ($50) might work as well. The only downside and unrealistic thing about the little accounts is the high leverage.

Don't spend much time at the charts, come up with a way to make decisions quickly, hovering hours over charts leads to over-thinking. I make all my decisions at key times in the day, I started out limiting myself to 30 minutes at a time. Now it just happens that I look at the data and say, yes or no quite quickly for each instrument.

In addition, I think the reason a lot of people fail is that they find a way to get into good initial entries, hold on for to that same technique for too long. People stack up all of their previous experiences into the 'latest thing' that makes them a bit of money without looking at a larger picture. They think they have 'gotten here' going through all previous iterations of systems etc... In a way you have, but largely this is a false picture. You need a diverse understanding and set of techniques that works for you psychologically and actually.

Run it like a business, is your business healthy placing all plans on one way of doing something? Redundancy is a requirement for any business.

Sep 29, 2014 at 21:06

Miembro desde Mar 25, 2014

posts 21

Elogos posted:

I rarely use demo accounts, if I do they are for development purposes. I find low value accounts (around $1000-$5000) a much greater way to experiment with ideas; it is the cost of doing business. Lesser accounts ($50) might work as well. The only downside and unrealistic thing about the little accounts is the high leverage.

Let me just add that there is one thing called Micro-accounts where you can trade normally but with a contract lot x100 smaller, they can be usefull for those who are getting started.

Also, be aware that there are no perfect indicators nor perfect indicator combinations.

Don't fall for all of those EA scams. If any of them could get you the money they announce they wouldn't be selling it for 50$, 500$ not even 5000$.

Learn to hear and understand your sub-consious. It can be greedy but if you can control it, it can be your friend and alert you for some danger situations before they happen.

Sep 30, 2014 at 06:46

Miembro desde Apr 17, 2014

posts 11

Elogos posted:

I agree with [topastop] in many regards.

One thing I have found that fundamental to any trading is that a good trading plan/rules/system must have a good exit technique. One of my largest educations in making profit was to split my risk into two areas, a rigid risk/reward system rarely psychologically works for me. My stop loss is actually there to help assist against larger losses, to safe guard my account. Not as a systematic way to exit a trade. Any techniques I use for entering a trade I have to have a plan to exit the trade. So the bottom line "Risk" is my stop loss, but if a trade goes sour, I am usually out of the trade long before any stop loss is hit. I am sorry to say it for those who want an instant idea as to risk it doesn't exist, but your taste for risk as well as the average loss of your trading activity is about as far as you can determine. If you are asking me where my stop loss is and the position size, well that is a tougher question. My average loss at the moment is 3.1% but my Stop is nearer the 10% mark. Now I have only been hit on my stop loss twice in the last year. My average wins are 8.3% and I have a 85.29% of my trades profitable.

Being aware of potential overly high-volatile times. I also set take profits for the opposite reason, I put them way-out there to catch mega-moves in the right direction, usually beyond key areas where a so-called 'breakout' can occur.

I rarely use demo accounts, if I do they are for development purposes. I find low value accounts (around $1000-$5000) a much greater way to experiment with ideas; it is the cost of doing business. Lesser accounts ($50) might work as well. The only downside and unrealistic thing about the little accounts is the high leverage.

Don't spend much time at the charts, come up with a way to make decisions quickly, hovering hours over charts leads to over-thinking. I make all my decisions at key times in the day, I started out limiting myself to 30 minutes at a time. Now it just happens that I look at the data and say, yes or no quite quickly for each instrument.

In addition, I think the reason a lot of people fail is that they find a way to get into good initial entries, hold on for to that same technique for too long. People stack up all of their previous experiences into the 'latest thing' that makes them a bit of money without looking at a larger picture. They think they have 'gotten here' going through all previous iterations of systems etc... In a way you have, but largely this is a false picture. You need a diverse understanding and set of techniques that works for you psychologically and actually.

Run it like a business, is your business healthy placing all plans on one way of doing something? Redundancy is a requirement for any business.

Great points.

Miembro desde Sep 26, 2014

posts 7

Sep 30, 2014 at 08:55

Miembro desde Sep 26, 2014

posts 7

The little experience that I have in forex trading has come from making improvements in my self. From a failed trader with losses to a successful trader with profits has been quite a journey. I started off with over-confidence and ended up with losses.(many losses in first few months) After doing thorough RCA (Root Cause Analysis) of my trades what I learnt is that I was a dumb fool lacking self discipline like patience , risk tolerance , not following my strategy as previously planned , pathetic money management , making changes to existing trade plan , etc.

Self Discipline if what matters most. Other things like technical/fundamental stuff is of little importance when compared to discipline.

Improve yourself by doing thorough RCA and then see the difference.

All the above is my personal opinion based on my experience.

As for my trading based on your questions :

Do you uses paid software like eikon, metastock, ransquawk, bloomberg pro, etc ? No. I trust myself only

Do you trade fundamental or only technical ? both

What is your average risk-reward ratio ?differs on market situation Average generally 1:1

How much time per day trading take you? Trading is not even a minute a day. However I am always watching the market movements from the time I wake up till the time I sleep. I am quite mobile during the entire day attending others duties . My android phone helps me observe market movements.

Do you have a written plan you follow? Mentally embedded into my brain.

How much % of your account are your risking/trade ? I don't calculate individual trade. However with leverage of 1:200 my total margin money should not be more than 10% of Equity.(This is new addition to my strategy and I am yet to incorporate it perfectly in my trading)

Hope I could be helpful.

I wish you a happy and successful forex journey.

Self Discipline if what matters most. Other things like technical/fundamental stuff is of little importance when compared to discipline.

Improve yourself by doing thorough RCA and then see the difference.

All the above is my personal opinion based on my experience.

As for my trading based on your questions :

Do you uses paid software like eikon, metastock, ransquawk, bloomberg pro, etc ? No. I trust myself only

Do you trade fundamental or only technical ? both

What is your average risk-reward ratio ?differs on market situation Average generally 1:1

How much time per day trading take you? Trading is not even a minute a day. However I am always watching the market movements from the time I wake up till the time I sleep. I am quite mobile during the entire day attending others duties . My android phone helps me observe market movements.

Do you have a written plan you follow? Mentally embedded into my brain.

How much % of your account are your risking/trade ? I don't calculate individual trade. However with leverage of 1:200 my total margin money should not be more than 10% of Equity.(This is new addition to my strategy and I am yet to incorporate it perfectly in my trading)

Hope I could be helpful.

I wish you a happy and successful forex journey.

"Together We Grow"---Minimum of 100% every year with compounding

Miembro desde Jun 28, 2011

posts 444

Sep 30, 2014 at 14:45

Miembro desde Jun 28, 2011

posts 444

Everyone loses in the beginning. When you first tried to ride a bicycle, you fell then also but with intelligence and persistence, you succeed. There are ways to learn faster and pay less for your education. First use demo accounts to learn, that is why they exist. You need to learn the system first, once you do that your emotions will be in control because your confidence will be in the system, not put all on you.

The second short cut is to get a trainer. They already made the mistakes that you are going to make, there are two ways to learn, either from their mistakes or from yours.

Here are your answers.

Do you uses paid software like eikon, metastock, ransquawk, bloomberg pro, etc ? (Yes, I use every tool I can.)

Do you trade fundamental or only technical ? (A type of fundamental called systemic.)

What is your average risk-reward ratio ? (Sharpe Ratio 3.09, Profit Factor 291.12)

How much time per day trading take you? ( Maybe 10 minutes, But I have been doing this for over 7 years, you will need more time as you are just learning.)

Do you have a written plan you follow? (I use robots for over 95% of time but help out as the system needs it.)

How much % of your account are your risking/trade ? (All of it, and so do you but you may not think of it as such. If your money is not in you hands, then it is at risk. Understand that and never put money at risk that you can't afford to lose.)

By the way, your English is better than mine, but I am an American.

May the Forex be with you....

Bob

The second short cut is to get a trainer. They already made the mistakes that you are going to make, there are two ways to learn, either from their mistakes or from yours.

Here are your answers.

Do you uses paid software like eikon, metastock, ransquawk, bloomberg pro, etc ? (Yes, I use every tool I can.)

Do you trade fundamental or only technical ? (A type of fundamental called systemic.)

What is your average risk-reward ratio ? (Sharpe Ratio 3.09, Profit Factor 291.12)

How much time per day trading take you? ( Maybe 10 minutes, But I have been doing this for over 7 years, you will need more time as you are just learning.)

Do you have a written plan you follow? (I use robots for over 95% of time but help out as the system needs it.)

How much % of your account are your risking/trade ? (All of it, and so do you but you may not think of it as such. If your money is not in you hands, then it is at risk. Understand that and never put money at risk that you can't afford to lose.)

By the way, your English is better than mine, but I am an American.

May the Forex be with you....

Bob

where research touches lives.

Miembro desde Oct 29, 2014

posts 8

Nov 14, 2014 at 12:19

Miembro desde Oct 29, 2014

posts 8

i have been trading for 3 and half years now.

it's not easy, first 2 years i ended lost. But i have never blown up.

you need to use real money to learn, cos you care about the money.

in my opinion,risk management is easy, profit management is hard, i reviewed all 3 years trade, using different profit management strategy to find best option that suit my system then i made profits.

http://www.myfxbook.com/members/vincentpbt/ming-chen/1060092

For your questions:

Do you uses paid software like eikon, metastock, ransquawk, bloomberg pro, etc ?

-No, MT4 only.

Do you trade fundamental or only technical ?

-Pure technical, but not open any trades before NFP, etc. If opened a day+ before, that's fine.

What is your average risk-reward ratio ?

-Don't expect 3:1+, most time you only get 2:1 or less, massive movements are rare, if you keep chasing that you could lost a lot winning trade or end up BE. you are not sure your 50% winning trades can cover up those lost.

How much time per day trading take you?

-I'm part time, my charts are there for 4-6 hours a day, but i'm not looking at it that long, maybe 1 hour each day, most analyzing work are done in weekend, made plan on weekends.

Do you have a written plan you follow?

-Yes, trading plan is a must have.

How much % of your account are your risking/trade ?

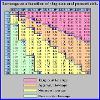

-I hold each position for average 7 days, so I risk 2% each trade, max 3 trades at the same time. i'm quite conservative. see table.

it's not easy, first 2 years i ended lost. But i have never blown up.

you need to use real money to learn, cos you care about the money.

in my opinion,risk management is easy, profit management is hard, i reviewed all 3 years trade, using different profit management strategy to find best option that suit my system then i made profits.

http://www.myfxbook.com/members/vincentpbt/ming-chen/1060092

For your questions:

Do you uses paid software like eikon, metastock, ransquawk, bloomberg pro, etc ?

-No, MT4 only.

Do you trade fundamental or only technical ?

-Pure technical, but not open any trades before NFP, etc. If opened a day+ before, that's fine.

What is your average risk-reward ratio ?

-Don't expect 3:1+, most time you only get 2:1 or less, massive movements are rare, if you keep chasing that you could lost a lot winning trade or end up BE. you are not sure your 50% winning trades can cover up those lost.

How much time per day trading take you?

-I'm part time, my charts are there for 4-6 hours a day, but i'm not looking at it that long, maybe 1 hour each day, most analyzing work are done in weekend, made plan on weekends.

Do you have a written plan you follow?

-Yes, trading plan is a must have.

How much % of your account are your risking/trade ?

-I hold each position for average 7 days, so I risk 2% each trade, max 3 trades at the same time. i'm quite conservative. see table.

Miembro desde Nov 12, 2012

posts 6

Jun 03, 2015 at 07:30

Miembro desde Nov 12, 2012

posts 6

core principle to make successful in trading keep it very consistent 100 percent of the time. Even 99 won't cut it. Just pick pattern of ur choice like support/resistance, Fibonacci etc. and test it for at least 3 months. Key thing is you need to keep every variable constant every time you execute and also you need to take every trade when pattern shows up with out hesitation and regardless of market conditions. All you should care, when pattern shows up just take it. The variables are contract size, stop loss, profit target. keep these variables constant and taking every trade when pattern shows is very crucial to beat randomness in the market. Also trade outcome distribution will be very random and no way to know which trade will be winner or loser or streak of wins r streak of loss. Remember every trade outcome is unique by itself. So don't carry on with what previous trade r series of trade outcome did. Once you get hang of it, you can try different patterns and refine further to improve efficiency. Pick your timeframe/contract size/ stop loss / profit target. Once you take the trade, your job is done. Market will take it from here.

Our objective in the market is not to be just right but to make a killing when we are right.

forex_trader_250523

Miembro desde May 18, 2015

posts 17

Jun 05, 2015 at 07:59

Miembro desde May 18, 2015

posts 17

Hi,

I consistently lost money due to my emotions getting in the way. Now I trade fully automatic and my trading became profitable on my demo account. I have now sufficient trust in my EA to have activated it on my real account and I am glad and relieved that I don't need to make anymore decisions myself.

I consistently lost money due to my emotions getting in the way. Now I trade fully automatic and my trading became profitable on my demo account. I have now sufficient trust in my EA to have activated it on my real account and I am glad and relieved that I don't need to make anymore decisions myself.

Jul 23, 2015 at 11:30

Miembro desde May 23, 2014

posts 30

Do you uses paid software like eikon, metastock, ransquawk, bloomberg pro, etc ?

no.

Do you trade fundamental or only technical ?

statistical + technical

What is your average risk-reward ratio ?

Reward is greater than 2

How much time per day trading take you?

1,5-2h

Do you have a written plan you follow?

not anymore because i have the few rules in my head

How much % of your account are your risking/trade ?

1-2%

one good idea is if you still loosing, focus more on finding the reasons than getting profitable.

There are ~4 Possible reasons, they can be all together.

your emotions drive you to bad descisions

your money management/ trade managements isn't optimal

your strategy does not work

you trade the wrong pair / time

on good idea to start keep it simple in the first place.

One thing which helped me a lot to save time for testing if a strategy works is ForexTester2.

Also statistic is a great tool, most traders never heard about :D i use OpenOffice Calc, and some

own programmed indicators in mq4.

greetings

no.

Do you trade fundamental or only technical ?

statistical + technical

What is your average risk-reward ratio ?

Reward is greater than 2

How much time per day trading take you?

1,5-2h

Do you have a written plan you follow?

not anymore because i have the few rules in my head

How much % of your account are your risking/trade ?

1-2%

one good idea is if you still loosing, focus more on finding the reasons than getting profitable.

There are ~4 Possible reasons, they can be all together.

your emotions drive you to bad descisions

your money management/ trade managements isn't optimal

your strategy does not work

you trade the wrong pair / time

on good idea to start keep it simple in the first place.

One thing which helped me a lot to save time for testing if a strategy works is ForexTester2.

Also statistic is a great tool, most traders never heard about :D i use OpenOffice Calc, and some

own programmed indicators in mq4.

greetings

trade or die

*El uso comercial y el spam no serán tolerados y pueden resultar en el cierre de la cuenta.

Consejo: Al publicar una imagen o una URL de YouTube, ésta se integrará automáticamente en su mensaje!

Consejo: Escriba el signo @ para completar automáticamente un nombre de usuario que participa en esta discusión.