Advertisement

Edit Your Comment

Profit / loss analysis and trading talks

Sep 01, 2024 at 19:47

Miembro desde Feb 12, 2016

posts 133

que76648 posted:Oscar555 posted:NochillFX posted:Oscar555 posted:ZanLanYu posted:

But to follow the markets while having a full time job is so difficult. That is why I like to use trading robots and signals providers .They do the hard analysis while I have full time job

A short story from my personal experience. I'm the person who left a full-time job to pursue a career as a trader. I'll tell you right away how my first attempt turned out—I failed and had to go back to work. It was tough, but I didn't give up on trading. I started spending less time on it, but gradually, little by little, I began to make a profit. I won't give any advice on this matter, as it's a personal decision for everyone. Some might get lucky.

My nephew just called telling he resigned to trade Forex and blew his cash payout. He resigned two months ago 😭

That’s tough, but unfortunately, it’s a common story. Trading isn’t easy, and it’s crucial to have a solid plan and backup before diving in. Tell your nephew not to give up, but to approach it more cautiously next time. It’s a learning curve.

Could you please tell me sir how exactly did you cope with failure in trading? What helped you not to give up? I'm just afraid that I might give in and go back to working for hire... and I want to earn money by trading you know.

Try to strike balance between paid job and trading. Hard to go full-time when you don't have experience. You always have to have a backup plan.

Miembro desde Sep 02, 2024

posts 9

Sep 02, 2024 at 16:47

Miembro desde Sep 02, 2024

posts 9

Luigi_gi223 posted:Raven1209 posted:MarcellusLux posted:Ollie33 posted:

Hi,

my short analysis: unfortunately, I had to take a loss before the holidays and accept the fact that I believed in further growth of the euro dollar when it reached a bright high at Friday. The Fibo showed a good opportunity to reach 1.1100, the level of 1.10300 was passed quickly, but I was too optimistic for the holiday market.

Anyway I remain positive and wish you have a great time these days.

I agree that a new highly probable case is now available: reaching the level of 1.11000 that you mentioned.

I would pay attention to the weekly EMA 200. The line was reached and the price even went higher, but it was an uncertain and weak breakout, which can be considered false. Therefore, this level (1.10140) will be a marker for further buy trading. The long term MACD indicates growth while the short-term hourly and four-hour MACD are in a rather unstable, intermediate position. This may mean that the correction has a chance to continue within one day, at least to 1.1000.

I would also pay attention to the midway resistance level 1.1070, which may become an unpleasant surprise for those who decide to enter the market too late.

It's a smart move to consider these intermediate resistance levels, as they often catch traders off guard. Does anyone have a strategy for dealing with such midway resistance points in their trading?

I would also like to know, please share your experience. How do you get out? Do you place stops or delays? How? And what works best for you?

Do you journal your trades?

Live to trade another day

Miembro desde May 19, 2020

posts 321

Sep 04, 2024 at 11:17

Miembro desde May 19, 2020

posts 321

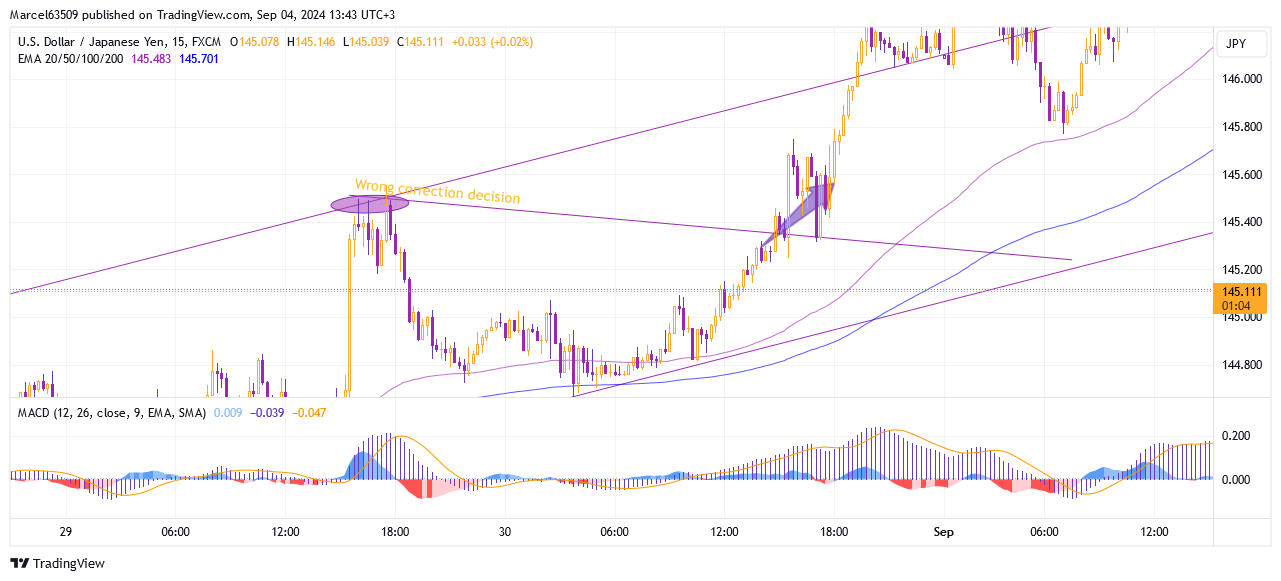

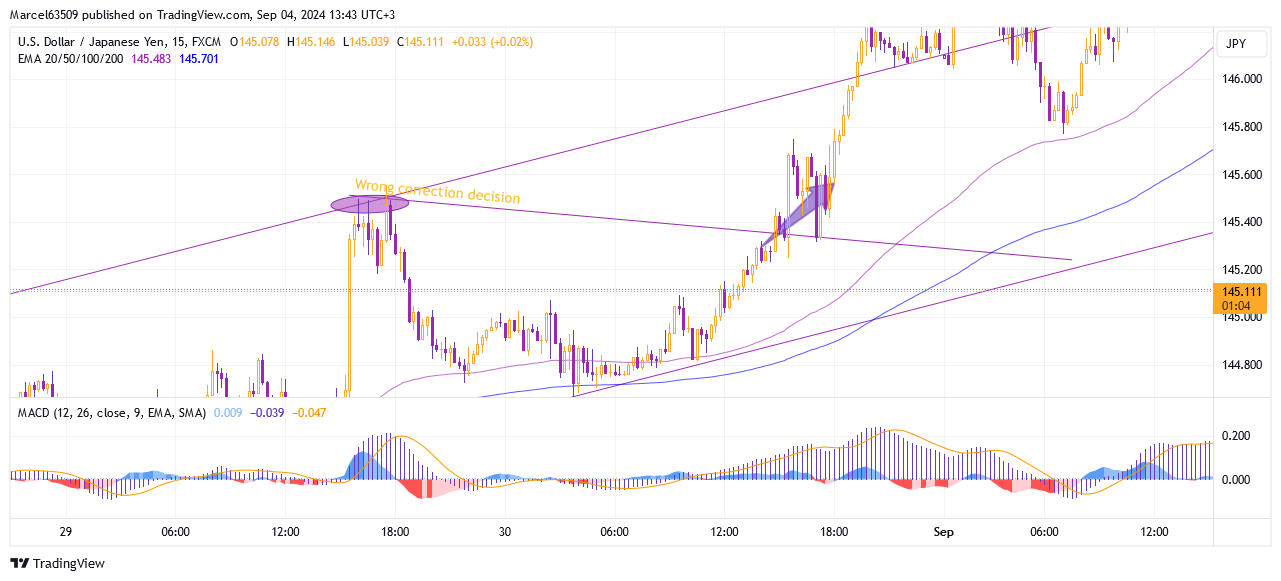

My trading in August was quite active, with several record profit values, but the set goal was not achieved. I am already actively working on my mistakes and would like to share with you the analysis of recent trading.

The USDJPY (August 30) trade was a clear example of bias towards the market situation. Despite the fact that the market showed clear signals for continued growth, at least within the trend channel, I decided that a more likely scenario is the formation of a correction with a narrowing amplitude. For such a signal and correction trading, it was necessary to wait for the decline back below EMA 200 on the hourly chart.

I exited the market in time when I realized that continued growth was inevitable and the resistance of 145.500 was no longer an obstacle to growth.

EURZAR trading (August 30) was started on the initial MACD signal on a 15 minutes timeframe , where the intersection of the signal line gave an understanding that a significantly strong support of 19.52 would not be passed and further movement should be expected growth and a return to the formation of a correction channel, clearly visible on the 4-hour chart. The trade was closed after the growth stopped in the EMA 100 area on the 15-minute chart.

The USDJPY (August 30) trade was a clear example of bias towards the market situation. Despite the fact that the market showed clear signals for continued growth, at least within the trend channel, I decided that a more likely scenario is the formation of a correction with a narrowing amplitude. For such a signal and correction trading, it was necessary to wait for the decline back below EMA 200 on the hourly chart.

I exited the market in time when I realized that continued growth was inevitable and the resistance of 145.500 was no longer an obstacle to growth.

EURZAR trading (August 30) was started on the initial MACD signal on a 15 minutes timeframe , where the intersection of the signal line gave an understanding that a significantly strong support of 19.52 would not be passed and further movement should be expected growth and a return to the formation of a correction channel, clearly visible on the 4-hour chart. The trade was closed after the growth stopped in the EMA 100 area on the 15-minute chart.

@Marcellus8610

Miembro desde Aug 19, 2021

posts 203

Sep 06, 2024 at 11:52

Miembro desde Aug 19, 2021

posts 203

que76648 posted:

What do i need to do to trade like you sir MarcellusLux? Please help me.

Oh if you just want to make money like him, then if I remember correctly, it's an investment account, isn't it @MarcellusLux

Sep 09, 2024 at 06:57

Miembro desde Sep 02, 2022

posts 57

que76648 posted:

What do i need to do to trade like you sir MarcellusLux? Please help me.

Trade, study, apply. And also stock up on patience for 10 years to start earning for sure. Or yes, investments like @WhiteWitcher told you. If you don't have that much patience and time.

Miembro desde Sep 09, 2024

posts 2

Sep 09, 2024 at 15:09

Miembro desde Sep 09, 2024

posts 2

lexusxxx posted:que76648 posted:

What do i need to do to trade like you sir MarcellusLux? Please help me.

Trade, study, apply. And also stock up on patience for 10 years to start earning for sure. Or yes, investments like @WhiteWitcher told you. If you don't have that much patience and time.

Well, one doesn't need this much patience and time to become profitable in forex, that's why it's important to learn from experienced traders already.

Miembro desde Sep 09, 2024

posts 5

Sep 09, 2024 at 17:23

Miembro desde Sep 09, 2024

posts 5

MarcellusLux posted:

My trading in August was quite active, with several record profit values, but the set goal was not achieved. I am already actively working on my mistakes and would like to share with you the analysis of recent trading.

The USDJPY (August 30) trade was a clear example of bias towards the market situation. Despite the fact that the market showed clear signals for continued growth, at least within the trend channel, I decided that a more likely scenario is the formation of a correction with a narrowing amplitude. For such a signal and correction trading, it was necessary to wait for the decline back below EMA 200 on the hourly chart.

I exited the market in time when I realized that continued growth was inevitable and the resistance of 145.500 was no longer an obstacle to growth.

EURZAR trading (August 30) was started on the initial MACD signal on a 15 minutes timeframe , where the intersection of the signal line gave an understanding that a significantly strong support of 19.52 would not be passed and further movement should be expected growth and a return to the formation of a correction channel, clearly visible on the 4-hour chart. The trade was closed after the growth stopped in the EMA 100 area on the 15-minute chart.

What FX pair do you trade? I never considered EURZAR before

Miembro desde May 19, 2020

posts 321

Sep 10, 2024 at 13:08

Miembro desde May 19, 2020

posts 321

WhiteWitcher posted:que76648 posted:

What do i need to do to trade like you sir MarcellusLux? Please help me.

Oh if you just want to make money like him, then if I remember correctly, it's an investment account, isn't it @MarcellusLux

Yes you are right.

contact me by email mentioned in bio https://www.myfxbook.com/members/MarcellusLux for further details

@Marcellus8610

Miembro desde May 19, 2020

posts 321

Sep 10, 2024 at 22:21

Miembro desde May 19, 2020

posts 321

que76648 posted:

What do i need to do to trade like you sir MarcellusLux? Please help me.

I don't want to seem rude, but to trade like me you have to be me. I mean every trader has own path, personal trading specifics, style and vision. You have to find yours.

@Marcellus8610

Miembro desde Sep 11, 2024

posts 1

Sep 11, 2024 at 12:05

Miembro desde Mar 07, 2023

posts 22

MarcellusLux posted:que76648 posted:

What do i need to do to trade like you sir MarcellusLux? Please help me.

I don't want to seem rude, but to trade like me you have to be me. I mean every trader has own path, personal trading specifics, style and vision. You have to find yours.

Yeah I like this answer. I would advise @que76648 to look for his own style, not an idol. Cheers.

Sep 13, 2024 at 04:57

Miembro desde Jul 30, 2024

posts 13

MarcellusLux posted:que76648 posted:

What do i need to do to trade like you sir MarcellusLux? Please help me.

I don't want to seem rude, but to trade like me you have to be me. I mean every trader has own path, personal trading specifics, style and vision. You have to find yours.

You know sir. I may suppose that when you spend years studying and thousands of dollars trading and end up losing everything, there comes a time when you just want to follow those who succeeded.

Sep 17, 2024 at 16:16

Miembro desde Jan 15, 2024

posts 37

que76648 posted:MarcellusLux posted:que76648 posted:

What do i need to do to trade like you sir MarcellusLux? Please help me.

I don't want to seem rude, but to trade like me you have to be me. I mean every trader has own path, personal trading specifics, style and vision. You have to find yours.

You know sir. I may suppose that when you spend years studying and thousands of dollars trading and end up losing everything, there comes a time when you just want to follow those who succeeded.

I think that everyone who is successful now has gone through this period of despair and dozens more like it before becoming successful.

Sep 17, 2024 at 18:24

Miembro desde Sep 29, 2022

posts 68

que76648 posted:MarcellusLux posted:que76648 posted:

What do i need to do to trade like you sir MarcellusLux? Please help me.

I don't want to seem rude, but to trade like me you have to be me. I mean every trader has own path, personal trading specifics, style and vision. You have to find yours.

You know sir. I may suppose that when you spend years studying and thousands of dollars trading and end up losing everything, there comes a time when you just want to follow those who succeeded.

I'd like to support you. Not everyone becomes a trader, and that's absolutely normal. You need to learn to accept this, and then perhaps you'll find yourself in something else within this field—for example, as a successful analyst or investor, etc.

Miembro desde May 19, 2020

posts 321

Sep 24, 2024 at 08:41

Miembro desde May 19, 2020

posts 321

The daily EUR/USD is forming a narrowing of the correction channel after sharp growth in August. If we consider the correction in more detail, this situation suggests growth to the resistance level of 1.11500 or the beginning of a new wave and decline to 1.10320.

It is interesting that a weak MACD divergence is forming on the four-hour timeframe. At the same time, the probability of moving to the MACD negative zone remains, which will open up some space for selling, but at the same time, the EMA 100 and 200 levels are below the price, which suggests their influence as support. For trading on the four-hour, I would note the probability of a fall, with marker levels on the EMA lines.

The hourly timeframe on the EUR/USD has a clearly visible buy after crossing the EMA 100 and 200 lines, as well as the MACD signal. But it seems to me that short-term growth will not be higher than 1.11500. The current short-term growth can be explained by the formation of the second shoulder on the four-hour chart, which will likely be followed by a fall with marker levels of 1.11000 and 1.10600.

It is interesting that a weak MACD divergence is forming on the four-hour timeframe. At the same time, the probability of moving to the MACD negative zone remains, which will open up some space for selling, but at the same time, the EMA 100 and 200 levels are below the price, which suggests their influence as support. For trading on the four-hour, I would note the probability of a fall, with marker levels on the EMA lines.

The hourly timeframe on the EUR/USD has a clearly visible buy after crossing the EMA 100 and 200 lines, as well as the MACD signal. But it seems to me that short-term growth will not be higher than 1.11500. The current short-term growth can be explained by the formation of the second shoulder on the four-hour chart, which will likely be followed by a fall with marker levels of 1.11000 and 1.10600.

@Marcellus8610

Miembro desde Aug 19, 2021

posts 203

Sep 24, 2024 at 13:05

Miembro desde Aug 19, 2021

posts 203

MarcellusLux posted:

The daily EUR/USD is forming a narrowing of the correction channel after sharp growth in August. If we consider the correction in more detail, this situation suggests growth to the resistance level of 1.11500 or the beginning of a new wave and decline to 1.10320.

It is interesting that a weak MACD divergence is forming on the four-hour timeframe. At the same time, the probability of moving to the MACD negative zone remains, which will open up some space for selling, but at the same time, the EMA 100 and 200 levels are below the price, which suggests their influence as support. For trading on the four-hour, I would note the probability of a fall, with marker levels on the EMA lines.

The hourly timeframe on the EUR/USD has a clearly visible buy after crossing the EMA 100 and 200 lines, as well as the MACD signal. But it seems to me that short-term growth will not be higher than 1.11500. The current short-term growth can be explained by the formation of the second shoulder on the four-hour chart, which will likely be followed by a fall with marker levels of 1.11000 and 1.10600.

https://www.myfxbook.com/files/MarcellusLux/eur_usd_Sep_24_%28hI8y0a%29.png

Oh great analysis. Thank you @MarcellusLux

Sep 24, 2024 at 16:57

Miembro desde Jul 30, 2024

posts 13

Raven1209 posted:que76648 posted:MarcellusLux posted:que76648 posted:

What do i need to do to trade like you sir MarcellusLux? Please help me.

I don't want to seem rude, but to trade like me you have to be me. I mean every trader has own path, personal trading specifics, style and vision. You have to find yours.

You know sir. I may suppose that when you spend years studying and thousands of dollars trading and end up losing everything, there comes a time when you just want to follow those who succeeded.

I'd like to support you. Not everyone becomes a trader, and that's absolutely normal. You need to learn to accept this, and then perhaps you'll find yourself in something else within this field—for example, as a successful analyst or investor, etc.

Thank you sir. You may be right.

*El uso comercial y el spam no serán tolerados y pueden resultar en el cierre de la cuenta.

Consejo: Al publicar una imagen o una URL de YouTube, ésta se integrará automáticamente en su mensaje!

Consejo: Escriba el signo @ para completar automáticamente un nombre de usuario que participa en esta discusión.

.png)

.png)

.png)