James Harrison (de MIA491)

| Ganancia : | -51.04% |

| Disminución | 94.97% |

| Pips: | 47857.0 |

| Transacciones | 348 |

| Ganado: |

|

| Perdido: |

|

| Tipo: | Real |

| Apalancamiento: | 1:100 |

| Trading: | Manual |

Edit Your Comment

Discusión James Harrison

Sep 17, 2018 at 08:06

Miembro desde Aug 23, 2018

posts 26

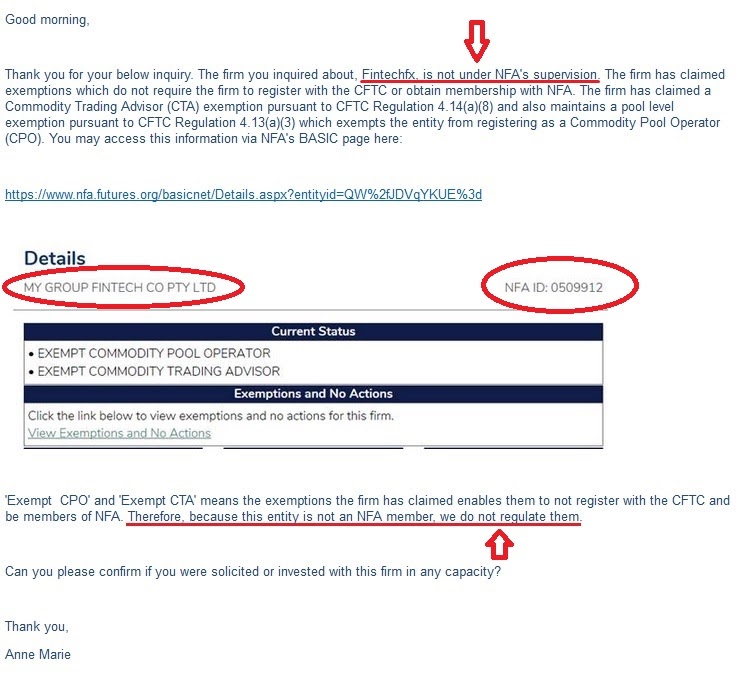

NFA reply regarding FintechFX status :

so FintechFX is not registered to NFA...

but for common people when they see FintechFX shown on NFA website they just believe it without understanding what exempt mean.

Oh yeah, just got info that their withdrawal process either profit or capital are very very delayed if not ignored.. it seems more than 12,000 withdrawal request is submitted on this month.

Sep 17, 2018 at 10:49

Miembro desde Aug 23, 2018

posts 26

AxeTrader posted:

they exampted because the fintech does not take usa customer? you are customer also? im investor so far dont have issue here....

The point is FintechFX claimed to be regulated by NFA and ASIC ... but evidences proofed that they DO NOT have NFA & ASIC licenses as Forex Broker.

Are you sure there is no issue now :D just try to withdraw your capital, and see if they can keep their SLA (5 - 7 working days)

I have many friend that complained that their profit and capital withdraw from fintechfx has been delayed OR ignored ... the status already "RELEASED" in fintechfx website, but the money is not coming to the bank accounts.

one even got status "RELEASED" from 3-sept-2018 but no money transferred til now.

Sep 17, 2018 at 13:35

Miembro desde Aug 11, 2018

posts 25

oh.. can you ask Your friend to post the case here for study? is the bank info correct? so far i have many friends include myself has No issue.. bring Your case to thier customer service to check.. im interested to know what happen also...

Sep 18, 2018 at 06:49

Miembro desde Aug 23, 2018

posts 26

AxeTrader posted:

oh.. can you ask Your friend to post the case here for study? is the bank info correct? so far i have many friends include myself has No issue.. bring Your case to thier customer service to check.. im interested to know what happen also...

I'll inform them .. if they want they can post them-self here ...

And their bank info should be CORRECT, because they already WD small amount of capital and also WD profit last month, and it came very fast in the past (only 2 days from submit in fintechfx to their bank account)

Of course they also escalate this issue to their MIA sponsor / manager in their group to be followed up to MIA management / fintechfx, but still got no further info right now.

Btw in their MIA group (whatsapp group), they're warned to not promote MIA or discuss MIA issue in social media (facebook, twitter, forums, etc), if one already post then they MUST DELETE their post / discussion, if their MIA group manager found out that they still have activities in social media talking about MIA then their account will be FROZEN !!!

I wonder how can MIA / FintechFx froze their client account? client should have full authority to their account, not MIA or FintechFX

Sep 18, 2018 at 06:50

Miembro desde Aug 23, 2018

posts 26

oh yeah @AxeTrader what do you think about MIA & FintechFX claim about ASIC and NFA License, that found out to be FALSE ?

Are you still have trust in MIA - FintechFX ? With no regulation, unknown segregate account, fishy fake trading.

The point is they lied to you even from the start when they approach you. Are you okay to be LIED ON ?

what do you think as investor? as trader ? is it okay to be fooled ?

Are you still have trust in MIA - FintechFX ? With no regulation, unknown segregate account, fishy fake trading.

The point is they lied to you even from the start when they approach you. Are you okay to be LIED ON ?

what do you think as investor? as trader ? is it okay to be fooled ?

Miembro desde Sep 18, 2018

posts 3

Sep 23, 2018 at 06:53

Miembro desde Sep 21, 2011

posts 27

I am a member of MIA491 and enjoying consistent high returns on my investment every month. For those who wish to know more details, please pm me. I will give you my investor's password to see for yourself how safe are the trades being executed.

Sep 23, 2018 at 06:55

Miembro desde Mar 09, 2017

posts 11

The NFA is only a registration but not an approval to be an NFA Member.

Next, if you are not getting US Clients why did you even get a NFA License or applied to be a member?

Also all NFA Member will requires to be use a properly regulated 3rd party FCM aka broker like interactive brokers and so on and not own inhouse broker to run their trading.

Also did they not know the NFA requirement is >20M? lol

Jokers

Next, if you are not getting US Clients why did you even get a NFA License or applied to be a member?

Also all NFA Member will requires to be use a properly regulated 3rd party FCM aka broker like interactive brokers and so on and not own inhouse broker to run their trading.

Also did they not know the NFA requirement is >20M? lol

Jokers

1111

Sep 23, 2018 at 06:55

Miembro desde Mar 09, 2017

posts 11

1. Fund transfers to Fintechfx are through individual collectors, which of course is very strange (quibble is a money changer, but does not have a license as a money changer or illegal). The withdrawal of funds was also sent from the collectors, which consisted of many names.

2. If the MIA / FintechFx is a money game, there is a possibility that the final way to play will be James Harrison losing trading, so they will blame and blame James Harrison. Or you can also wash your hands by creating new crypto coins like financial.org with a crypton named FOIN, then the crypto coins falling in price or stagnant cannot be sold. (For information, MIA itself is already in the crypto development program, so it might lead to it)

The plot is no different from IGOFX, just merely using an ASIC registration to smoke their foolish investors this time round.

2. If the MIA / FintechFx is a money game, there is a possibility that the final way to play will be James Harrison losing trading, so they will blame and blame James Harrison. Or you can also wash your hands by creating new crypto coins like financial.org with a crypton named FOIN, then the crypto coins falling in price or stagnant cannot be sold. (For information, MIA itself is already in the crypto development program, so it might lead to it)

The plot is no different from IGOFX, just merely using an ASIC registration to smoke their foolish investors this time round.

1111

Miembro desde Apr 08, 2018

posts 6

Sep 24, 2018 at 06:06

Miembro desde Aug 11, 2018

posts 25

fxbreaker posted:

oh yeah @AxeTrader what do you think about MIA & FintechFX claim about ASIC and NFA License, that found out to be FALSE ?

Are you still have trust in MIA - FintechFX ? With no regulation, unknown segregate account, fishy fake trading.

The point is they lied to you even from the start when they approach you. Are you okay to be LIED ON ?

what do you think as investor? as trader ? is it okay to be fooled ?

It took few day to reply on these thread to see how much the damage the outsider try to post damage to the this platform.. here is some fact that we need to recognize, fintechfx claim they have licences on NFA and ASIC, yes, they have licences on NFA as exempted operator pool and commodity trading, and register with ASIC as investment company due to the fact that the marketing strategic that they use in investment plan. if any one is concern about the MT4 platform that is fact.. please do download them and use and try to use them also to trade any other broker and login.. it is the public platform that can use no made by fintechfx to make fake data..

for the fact of the withdrawal.. at the moment there are more than 100k investor worldwide and consistent make profit and withdrawal include myself for latest withdrawal after this thread trigger IGNORE from fintechfx, that i just want to test latest services from the company, in fact, the withdrawal take < 5 working days to the bank without issue, that is same with my previous withdrawal speed..

as investor or trader, we are all educated people .. im not trying to protect this system as im not the owner, im just one of the investor who enjoy the profit and withrawal happily since investing.. have a good day!

for the fact comparison with IGOFX, the trading is not being verified by myfxbook despite the trading looks look, please do check agian before post--> here you can find some example of the trading profile --> https://www.myfxbook.com/members/Vladislav77/vladislav/2030078

Sep 24, 2018 at 10:19

Miembro desde Mar 09, 2018

posts 132

AxeTrader posted:fxbreaker posted:

oh yeah @AxeTrader what do you think about MIA & FintechFX claim about ASIC and NFA License, that found out to be FALSE ?

Are you still have trust in MIA - FintechFX ? With no regulation, unknown segregate account, fishy fake trading.

The point is they lied to you even from the start when they approach you. Are you okay to be LIED ON ?

what do you think as investor? as trader ? is it okay to be fooled ?

It took few day to reply on these thread to see how much the damage the outsider try to post damage to the this platform.. here is some fact that we need to recognize, fintechfx claim they have licences on NFA and ASIC, yes, they have licences on NFA as exempted operator pool and commodity trading, and register with ASIC as investment company due to the fact that the marketing strategic that they use in investment plan. if any one is concern about the MT4 platform that is fact.. please do download them and use and try to use them also to trade any other broker and login.. it is the public platform that can use no made by fintechfx to make fake data..

for the fact of the withdrawal.. at the moment there are more than 100k investor worldwide and consistent make profit and withdrawal include myself for latest withdrawal after this thread trigger IGNORE from fintechfx, that i just want to test latest services from the company, in fact, the withdrawal take < 5 working days to the bank without issue, that is same with my previous withdrawal speed..

as investor or trader, we are all educated people .. im not trying to protect this system as im not the owner, im just one of the investor who enjoy the profit and withrawal happily since investing.. have a good day!

for the fact comparison with IGOFX, the trading is not being verified by myfxbook despite the trading looks look, please do check agian before post--> here you can find some example of the trading profile --> https://www.myfxbook.com/members/Vladislav77/vladislav/2030078

Every Ponzi keeps paying out "profits" for a while, until there are no new investors. Only a fool believes these scammers and invests their money with them. Same thing will happen as with SakuraFx. There is a thread about it on myfxbook, everyone should read it.

Sep 24, 2018 at 10:21

Miembro desde Mar 09, 2017

posts 11

It took few day to reply on these thread to see how much the damage the outsider try to post damage to the this platform.. here is some fact that we need to recognize, fintechfx claim they have licences on NFA and ASIC, yes, they have licences on NFA as exempted operator pool and commodity trading, and register with ASIC as investment company due to the fact that the marketing strategic that they use in investment plan. if any one is concern about the MT4 platform that is fact.. please do download them and use and try to use them also to trade any other broker and login.. it is the public platform that can use no made by fintechfx to make fake data..

You can find the broker name above the 'Info' box.

I'm not sure how do you define "fake" accounts - we can only validate

the data is the same as in the MT4 terminal; you can read here about

the verification system http://www.myfxbook.com/help#help_34

Thanks,

Ethan,

Myfxbook support

## The verification comes from both end of Broker's Terminal and Myfxbook. It does not actually guarantees the authenticity of the live trading results. Try duplicating the said entries and results on another recognized platform such as Pepperstone and Tickmill FCA. Then all the damage will stop.

Obviously, this is manipulated results, Mt4 can be manipulated nuff said.

Wait a few more months, it's over.

1111

Sep 24, 2018 at 11:06

Miembro desde Aug 23, 2018

posts 26

AxeTrader posted:

It took few day to reply on these thread to see how much the damage the outsider try to post damage to the this platform.. here is some fact that we need to recognize, fintechfx claim they have licences on NFA and ASIC, yes, they have licences on NFA as exempted operator pool and commodity trading, and register with ASIC as investment company due to the fact that the marketing strategic that they use in investment plan. if any one is concern about the MT4 platform that is fact.. please do download them and use and try to use them also to trade any other broker and login.. it is the public platform that can use no made by fintechfx to make fake data..

for the fact of the withdrawal.. at the moment there are more than 100k investor worldwide and consistent make profit and withdrawal include myself for latest withdrawal after this thread trigger IGNORE from fintechfx, that i just want to test latest services from the company, in fact, the withdrawal take < 5 working days to the bank without issue, that is same with my previous withdrawal speed..

as investor or trader, we are all educated people .. im not trying to protect this system as im not the owner, im just one of the investor who enjoy the profit and withrawal happily since investing.. have a good day!

for the fact comparison with IGOFX, the trading is not being verified by myfxbook despite the trading looks look, please do check agian before post--> here you can find some example of the trading profile --> https://www.myfxbook.com/members/Vladislav77/vladislav/2030078

Ah .. I Understand now ... so you are MIA - FintechFx person, thats why you defend it even with nonsense reasoning :)

for NFA, just see NFA email reply in my previous post regarding FintechFX status.

and you said FintechFX registered in ASIC as Investment Company, so you ACKNOWLEDGE NOW that FintechFX is UNLINCENSED to be a FOREX BROKER, so as Forex Broker, FintechFX is NOT REGULATED by ASIC.

Just from this two point it is clear that MIA - FintechFX already MISLEAD their new investor candidate to think that FintechFX is REGULATED by NFA & ASIC. (see your MIA_PPT EN_v8 2018.PDF page 28)

For investor, just read this forum below, there are many testimony from ex MIA member, about fishy things around MIA - FintechFX, from licenses, deposit, withdrawal, etc:

https://forum.lowyat.net/topic/3774126/+1560

like withdrawal that come from "CASH DEPOSIT" :D hahaha, where is in the world that when client withdraw their 23K money from broker come from "CASH DEPOSIT" on local bank.

For sure your clients that aware are already withdrawing their fund (> 13,000 request below 1 month), so you must be get a headache how to continue give "profit" to existing client.

And good luck on your renewal of ASIC License that will EXPIRE on Oct. 16, 2018 ... Just hope that ASIC is still not read about complaint that filed because of your FALSE CLAIM.

for you that want to help complain to ASIC, just submit your complaint to: https://www.asic.gov.au/about-asic/contact-us/how-to-complain/report-misconduct-to-asic/

Sep 25, 2018 at 13:41

Miembro desde Mar 09, 2017

posts 11

Those who refused to heed the advice from real traders in the market will eventually succumb to their doom.

All the telltale signs aligned and pointing to the same directions

1 - Non-Regulated Broker with poor history and lack of transparency of the management.

2 - Smoke Screen and misleading Facts

3 - Non-Segregated account from properly regulated broker following AML Law

4 - Manipulated MT4 History without live trading with interesting dashboards with CRM For MLM Tracking Purposes

5 - Same Master IB, Own Brokerage Firm

6 - Unable to duplicate said results on a properly recognized broker from other ASIC or FCA broker (Because traders can write in to verify :)

7 - Real Trading has real DD and floats, and not no DD and positive equity float to hide the losses or no trading is done

8 - Professional traders or veteran traders not seen trading on such platform as compared to other known markets like pepperstone, tickmill, ICMarkets etc

9 - Using Local Depositors/Money Changers - Breaching Broker's AML Regulations and Safety of Funds for Clients

10 - Heavy marked up on spreads to payout rebates, using martingale and high leverage but not seen on trading account or no trading is done.

11 - New Funds and Money to reduce and soften the real DD for example 100,000 - DD was 20%, but after new 100,000 in, the DD will now be 10% and so on. So once the payout is unable to meet in the inflow, the whole thing will collapsed

12 - Won't last longer than 2 years, the longest in the industry is 3TGFX

13 - Claiming Hide trading to prevent copying but do not allow investors to choose better brokerage, claiming to save costs and so on, is pure lies, trading conditions can be much better at POP and Prime Brokers with Fixed API.

Money game and Ex-TP Eagle or JJPTR salesperson are now heavily promoting Mia491 or FintechFX

I2investment (Boom)

3TGFX - Perfectofx (Plotted Force Majeure)

JJPTR (Claimed Hacked)

IGOFX (Plotted Force Majeure)

TP EAGLE (Boom)

Blue Trading (Soon) - Same people of i2investment

Evidence Threads:

1 - https://www.myfxbook.com/reviews/signal-providers/sakura-fx-trading/1363902,1#?pt=2&p=5&ts=49&o=1363902 (Sakura)

2 - https://www.myfxbook.com/members/Perfecto_FX/perfecto-fx-emerald-3tgfx/373988 (3TGFX)

https://www.myfxbook.com/members/Perfecto_FX

3 - https://www.thestar.com.my/news/nation/2017/07/07/couple-in-hiding-after-rm19bil-scam/ (IGOFX)

4 - https://twitter.com/weiducna/status/971208355032133632?lang=en (TP Eagle without myfxbook)

5 - Just GOOGLE MAN

Investors You have been warned by fellow traders, play your money game more. And you will suffer, your friends, relatives and people who trusted you will hate you and haunt you for life.

All the telltale signs aligned and pointing to the same directions

1 - Non-Regulated Broker with poor history and lack of transparency of the management.

2 - Smoke Screen and misleading Facts

3 - Non-Segregated account from properly regulated broker following AML Law

4 - Manipulated MT4 History without live trading with interesting dashboards with CRM For MLM Tracking Purposes

5 - Same Master IB, Own Brokerage Firm

6 - Unable to duplicate said results on a properly recognized broker from other ASIC or FCA broker (Because traders can write in to verify :)

7 - Real Trading has real DD and floats, and not no DD and positive equity float to hide the losses or no trading is done

8 - Professional traders or veteran traders not seen trading on such platform as compared to other known markets like pepperstone, tickmill, ICMarkets etc

9 - Using Local Depositors/Money Changers - Breaching Broker's AML Regulations and Safety of Funds for Clients

10 - Heavy marked up on spreads to payout rebates, using martingale and high leverage but not seen on trading account or no trading is done.

11 - New Funds and Money to reduce and soften the real DD for example 100,000 - DD was 20%, but after new 100,000 in, the DD will now be 10% and so on. So once the payout is unable to meet in the inflow, the whole thing will collapsed

12 - Won't last longer than 2 years, the longest in the industry is 3TGFX

13 - Claiming Hide trading to prevent copying but do not allow investors to choose better brokerage, claiming to save costs and so on, is pure lies, trading conditions can be much better at POP and Prime Brokers with Fixed API.

Money game and Ex-TP Eagle or JJPTR salesperson are now heavily promoting Mia491 or FintechFX

I2investment (Boom)

3TGFX - Perfectofx (Plotted Force Majeure)

JJPTR (Claimed Hacked)

IGOFX (Plotted Force Majeure)

TP EAGLE (Boom)

Blue Trading (Soon) - Same people of i2investment

Evidence Threads:

1 - https://www.myfxbook.com/reviews/signal-providers/sakura-fx-trading/1363902,1#?pt=2&p=5&ts=49&o=1363902 (Sakura)

2 - https://www.myfxbook.com/members/Perfecto_FX/perfecto-fx-emerald-3tgfx/373988 (3TGFX)

https://www.myfxbook.com/members/Perfecto_FX

3 - https://www.thestar.com.my/news/nation/2017/07/07/couple-in-hiding-after-rm19bil-scam/ (IGOFX)

4 - https://twitter.com/weiducna/status/971208355032133632?lang=en (TP Eagle without myfxbook)

5 - Just GOOGLE MAN

Investors You have been warned by fellow traders, play your money game more. And you will suffer, your friends, relatives and people who trusted you will hate you and haunt you for life.

1111

Sep 25, 2018 at 13:42

Miembro desde Mar 09, 2017

posts 11

Run a check on ASIC Site :

https://connectonline.asic.gov.au/RegistrySearch/faces/landing/SearchRegisters.jspx?_adf.ctrl-state=drhwjx2lr_30

Search for : NEO SUPER MASS CORP PTY LTD

And you will find out that although this company is founded since 2005, this empty shell company has been sold to FintechFX's And Mia guys in 2017.

Next review date: 11/02/2019

Former name(s): AU MASS PTY LTD, STRATGRO PTY LTD

13/12/2017 7E9739292

Change to Company Details Change Member Name or Address (484A2)

2

$17.00 Select uncertified document

$36.00 Select certified document

11/12/2017 7E9733417

Notification of Resolution Changing Company Name (205A)

3

$17.00 Select uncertified document

$36.00 Select certified document

1/12/2017 7E9705482

Show sub documents (484)

2

There's obviously no way a properly run company will risk doing such a thing in Australia, so good luck to this empty shell company as well this coming Feb 2019.

ASIC will report this over then news very soon when everything unfolded.

https://connectonline.asic.gov.au/RegistrySearch/faces/landing/SearchRegisters.jspx?_adf.ctrl-state=drhwjx2lr_30

Search for : NEO SUPER MASS CORP PTY LTD

And you will find out that although this company is founded since 2005, this empty shell company has been sold to FintechFX's And Mia guys in 2017.

Next review date: 11/02/2019

Former name(s): AU MASS PTY LTD, STRATGRO PTY LTD

13/12/2017 7E9739292

Change to Company Details Change Member Name or Address (484A2)

2

$17.00 Select uncertified document

$36.00 Select certified document

11/12/2017 7E9733417

Notification of Resolution Changing Company Name (205A)

3

$17.00 Select uncertified document

$36.00 Select certified document

1/12/2017 7E9705482

Show sub documents (484)

2

There's obviously no way a properly run company will risk doing such a thing in Australia, so good luck to this empty shell company as well this coming Feb 2019.

ASIC will report this over then news very soon when everything unfolded.

1111

Sep 25, 2018 at 13:43

Miembro desde Mar 09, 2017

posts 11

https://web.archive.org/web/20161021104032/http://massfinancial.com

Check, there was no such site before 2017 or 2018.

The creator of Massfinancial and fintechfx are the same guys, look how poorly the site is done with ugly logos and color theme.

This empty shell company was bought from former entity, and then rebranded into neo super mass corp, and then created another mygroup fintechfx under it as subsidary while applying a simple license that is not allowed to be a broker.

Check, there was no such site before 2017 or 2018.

The creator of Massfinancial and fintechfx are the same guys, look how poorly the site is done with ugly logos and color theme.

This empty shell company was bought from former entity, and then rebranded into neo super mass corp, and then created another mygroup fintechfx under it as subsidary while applying a simple license that is not allowed to be a broker.

1111

*El uso comercial y el spam no serán tolerados y pueden resultar en el cierre de la cuenta.

Consejo: Al publicar una imagen o una URL de YouTube, ésta se integrará automáticamente en su mensaje!

Consejo: Escriba el signo @ para completar automáticamente un nombre de usuario que participa en esta discusión.