Dollar headed for third weekly gains as stock rally cools

Fed cut hopes not enough to dent the dollar

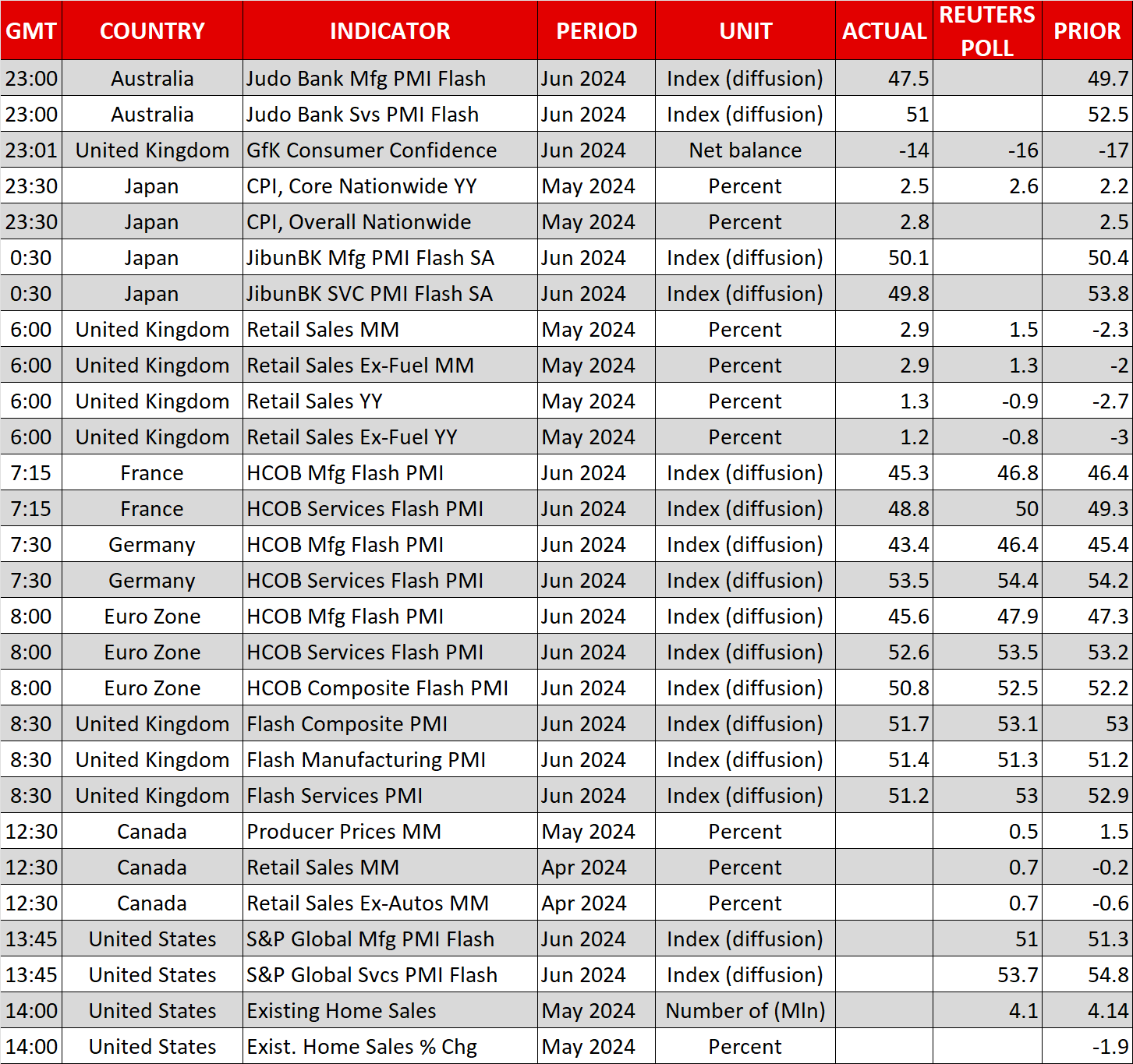

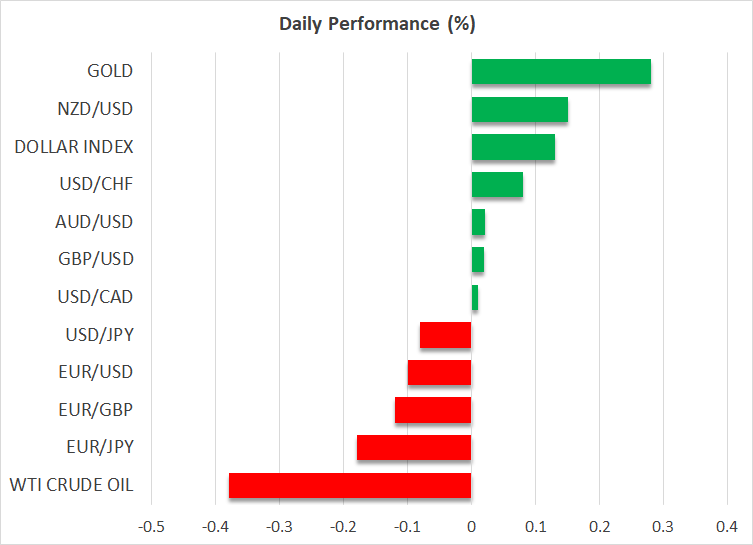

The US dollar looks set to finish the week higher, extending its winning streak to a third week. Whilst signs of a cooldown in inflationary pressures as well as the broader economy have bolstered expectations that the Federal Reserve may be able to deliver two rate cuts after all in 2024, with the first eyed in September, other central banks appear to be ahead in the race to ease policy.

The Swiss National Bank cut its policy rate on Thursday for the second meeting in a row, becoming the third central bank this month to do so. The Bank of England kept its borrowing costs unchanged yesterday, but the minutes revealed that the decision was “finely balanced”, opening the door to a cut in August when the UK general election will be out of the way.

The Swiss franc, which had been on a bullish run since late May, sank against its major peers, while the pound slipped to one month lows against the dollar, extending its slide today as upbeat UK retail sales were offset by soft PMIs. Even if the incoming US data continues to go in the right direction and the Fed cuts in September, it will be among the last to begin its easing cycle and this is keeping the dollar supported.

Euro and yen underperform

Rocked by political turmoil in France, the euro has been having a terrible month, propped up only by diminishing bets of back-to-back rate cuts by the ECB. However, dovish expectations got a boost today by a shock plunge in the Eurozone’s flash PMI readings for June. The composite PMI for the euro area fell to the lowest since March, pushing the single currency back below $1.07.

It hasn’t been a good month for the yen either, as the Japanese currency is facing renewed selling pressure. The Bank of Japan’s decision to postpone an announcement on bond tapering until the July meeting was perceived as a dovish move, despite Governor Ueda suggesting that a rate hike is possible next month.

But markets aren’t convinced, with today’s CPI figures reinforcing those doubts. A measure of CPI that excludes all volatile items fell to 1.7% in June, even as core CPI that only excludes fresh foods accelerated to 2.5%. The dollar briefly popped above 159 yen following the data, prompting the usual intervention warning by Japan’s top currency official, Masato Kanda.

Stocks on alert for US PMIs and triple witching

The focus is now on the S&P Global PMIs for the US due at 13:45 GMT. Any unexpected slowdown in the US economy could spark some jitters after yesterday’s large drop in housing starts raised some concerns. But investors will be hoping to see a moderation in price pressures, which would be positive for risk sentiment.

With Wall Street hit by profit taking after almost uninterrupted gains during June, there is a risk of some further volatility on Friday as it’s that time of the quarter when stock options, stock index futures and stock index options all expire on the same day – a phenomenon called triple witching.

Nvidia and Apple were among the biggest losers among the mega caps on Thursday, dragging the Nasdaq 100 lower by 0.8%.

The selloff appears to be undermining risk appetite today, with equities slipping globally and oil futures paring some of the week’s strong gains.