German Ifo and BoE Bailey speech due

OVERNIGHT

Currencies remain in tight ranges as investors brace for volatility, and US 10-year Treasury yields are slightly higher at around 3.40%. Asian equity markets were mixed as a potential volatile week for financial markets lies ahead. Investors continue to assess concerns about parts of the global bank sector which may complicate central banks’ aim to reduce inflation. They are also taking note of Russia’s decision to station tactical nuclear weapons in Belarus. At the weekend, the US Federal Reserves’ Kashkari, who is a voter on monetary policy this year, said that they are watching the impact of banking stresses on the economy very closely and that recent events bring the economy closer to a recession.

THE DAY AHEAD

UK focus will likely be BoE Governor Bailey’s keynote speech this evening at 18:00BST at the LSE. The speech is part of a wider LSE series on ‘understanding the UK economy’ including research on the state of the economy, its global context and its future. The BoE last week increased rates by 25bp to 4.25% which was largely anticipated by markets especially after the unexpected rise in February CPI inflation to 10.4%. The rate rise, however, was the smallest since June 2022 which suggests Bank Rate may be close to a peak. The MPC nevertheless signalled that the door remained open for further hikes if there were to be evidence of more persistent inflationary pressures. Last week, Governor Bailey indicated that UK economic prospects are ‘considerably better’.

The CBI’s UK distributive trades survey is released this morning and will provide a timely gauge of retail activity at the end of Q1. With attention remaining on the inflation outlook, the BRC’s shop price index for March released early tomorrow may also draw some attention. In politics, the new SNP leader is expected to be announced this afternoon.

The key Eurozone report today is the closely watched German Ifo business survey. We expect a mixed report, with the expectations index predicted to fall for the first time since September following concerns about the international banking sector and the impact on risks to the economic outlook. We expect the overall headline index to be steady at 91.1 after having risen in the previous five months. Eurozone money supply data are also due today and are forecast to show a further decline in the annual growth rate. Scheduled ECB speakers today include Bundesbank President Nagel who last week said the fight against inflation is not over.

US Fed policymaker Jefferson discusses monetary policy later today. Markets are pricing in rate cuts in the second half of the year in contrast with the Fed’s dot plot of policymakers’ expectations indicating that rates are unlikely to fall anytime soon. The only US data today is the Dallas Fed’s regional manufacturing survey.

MARKETS

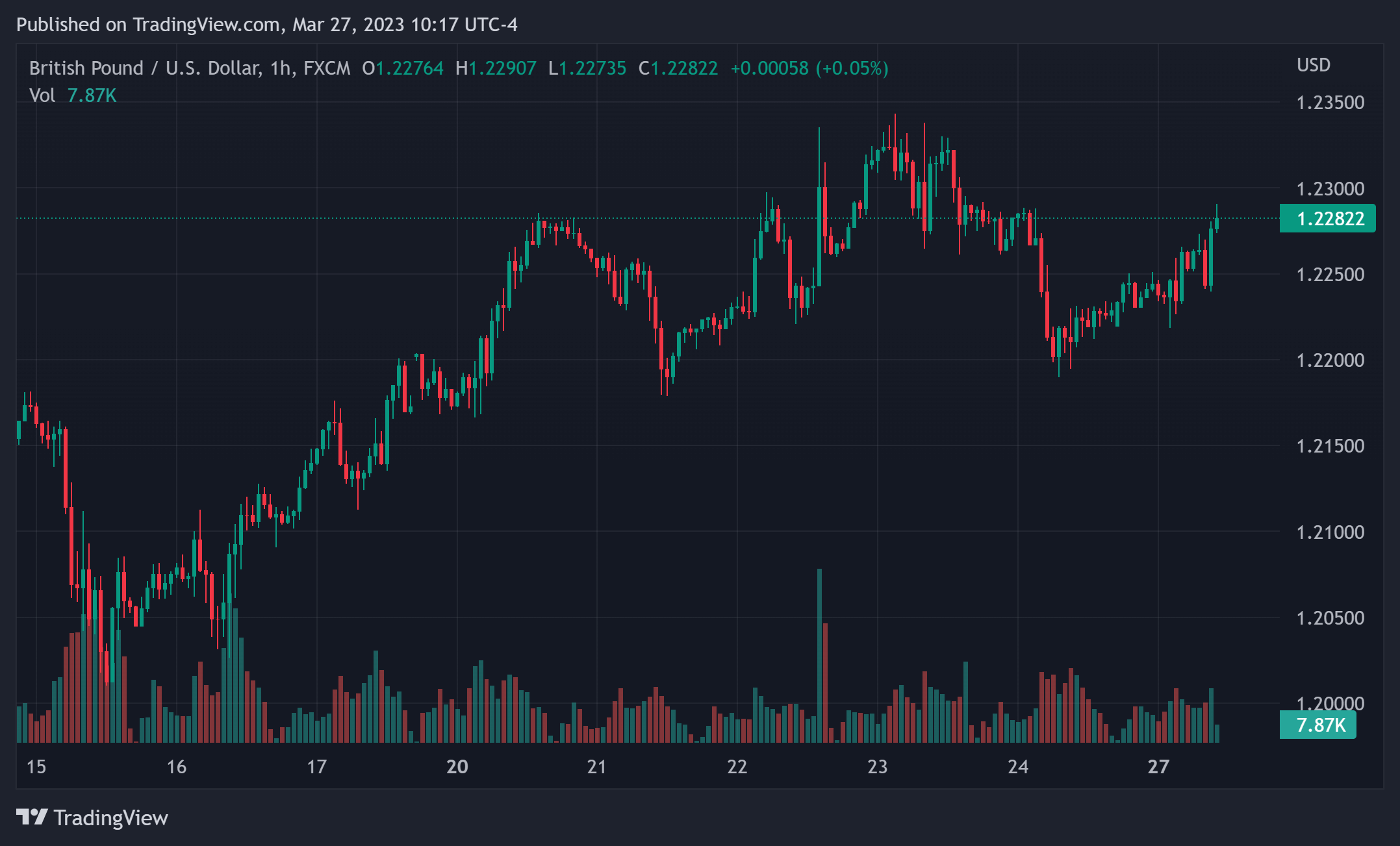

Currencies were in tight ranges overnight in Asia as market participants brace for another volatile week. The pound was little changed against both the US dollar and the euro. US 10 year Treasury yields were slightly higher at around 3.40%.