KeltnerPRO - Jared (Oleh keltnerpro)

| Keuntungan : | +5645.75% |

| Drawdown | 58.74% |

| Pip: | 4744.8 |

| Perdagangan | 1003 |

| Menang: |

|

| Rugi: |

|

| Jenis: | Nyata |

| Leveraj: | 1:100 |

| Berdagang: | Tidak diketahui |

Edit Your Comment

KeltnerPRO - Jared Perbincangan

forex_trader_67253

Ahli sejak Feb 26, 2012

95 hantaran

Apr 30, 2015 at 23:30

Ahli sejak Feb 26, 2012

95 hantaran

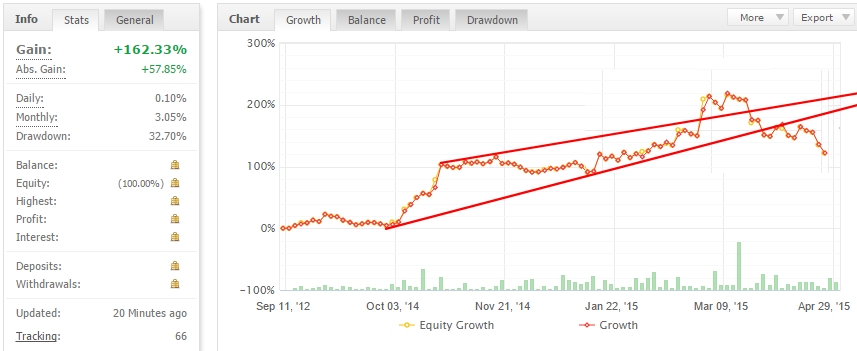

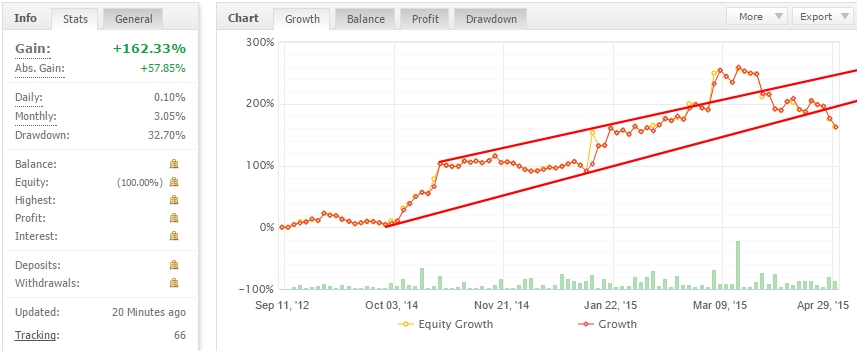

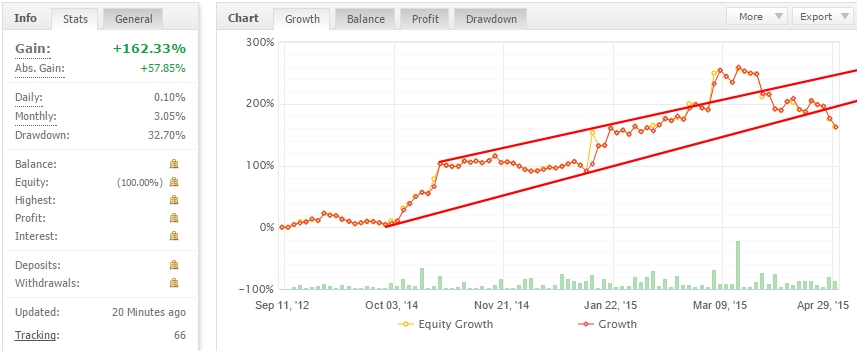

The reason I'm asking about the next maximum/minimum prediction methodology is as follows: if we remove the January 15 USDCHF once-in-decades 'big swan' jump (which doubled this vendor's live account yet blew the other one), the chart will show that the bot's recovery is just about overdue. But then, again, the vendor manually more than doubled a trade's lot value from an average of 8.5 lots under the automatic money management before March 4 to a fixed value of 19.30 lots after March 4. So that makes me wonder how relevant the charting of lines connecting minimums/maximums on this live test's graph would be, considering this aspect.

forex_trader_67253

Ahli sejak Feb 26, 2012

95 hantaran

Apr 30, 2015 at 23:46

Ahli sejak Feb 26, 2012

95 hantaran

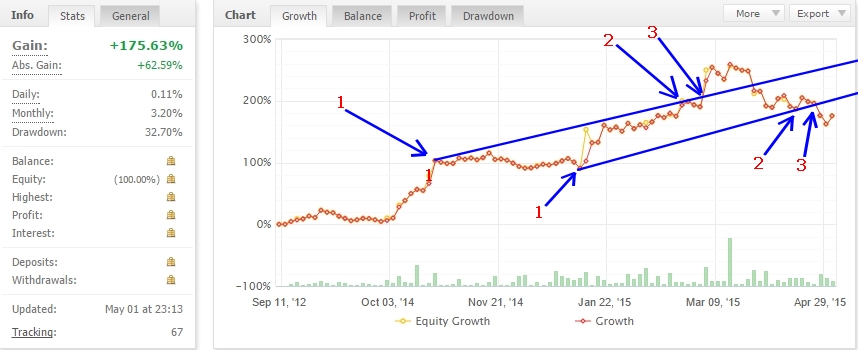

For the above reasons, it would be more logical to use a live forward test's chart where the MM was not manually interfered with. One example of such a forward test of this bot is that by ForexGermany at https://www.myfxbook.com/members/forexgermany/keltnerpro/983876 where the EA has been run continuously on the recommended five currency pairs with the default settings from the very start. That live test's graph also suggests the bot's recovery is just about overdue.

Yet how reliable is the very method of connecting a forward test's chart's three upper and lower extremes to predict a retracement/recovery? Where can I read more about this method?

Yet how reliable is the very method of connecting a forward test's chart's three upper and lower extremes to predict a retracement/recovery? Where can I read more about this method?

forex_trader_67253

Ahli sejak Feb 26, 2012

95 hantaran

May 01, 2015 at 00:15

Ahli sejak Feb 26, 2012

95 hantaran

forex_trader_190177

Ahli sejak May 12, 2014

21 hantaran

May 04, 2015 at 07:00

Ahli sejak May 12, 2014

21 hantaran

BigSteve is just connecting the three last upper and lower points of a the chart with straight lines (where a line last crosses a chart at least thrice at the top and at the bottom). It's a standard technique used to determine trends on price charts: https://www.dailyfx.com/forex/education/trading_tips/trend_of_the_day/2013/08/20/3_Tips_For_Trendline_Trading.html

He appears to be applying it to the bot's profits chart to determine its profit trend. Note that the points connected with the lines need to be the LAST three lower and upper ones (not the three all-time lower and upper ones). I've sketched these lines for your convenience on Forex Germany's chart. True, the reversal indeed appears to be overdue if this approach is correct.

Yet, charts cannot be seen sepatrately from the market conditions out there. What used to be relevant over a period of time (however long) might no longer be. One can't reasonably expect big breakouts on a pair of two weakening currencies traded against each other (EURUSD, that is).

He appears to be applying it to the bot's profits chart to determine its profit trend. Note that the points connected with the lines need to be the LAST three lower and upper ones (not the three all-time lower and upper ones). I've sketched these lines for your convenience on Forex Germany's chart. True, the reversal indeed appears to be overdue if this approach is correct.

Yet, charts cannot be seen sepatrately from the market conditions out there. What used to be relevant over a period of time (however long) might no longer be. One can't reasonably expect big breakouts on a pair of two weakening currencies traded against each other (EURUSD, that is).

forex_trader_190177

Ahli sejak May 12, 2014

21 hantaran

forex_trader_67253

Ahli sejak Feb 26, 2012

95 hantaran

May 05, 2015 at 00:55

Ahli sejak Feb 26, 2012

95 hantaran

The current EU losing streak started on March 25. From there on, it has been only losing days on EU. On multi-year EU backtests, 2012-2013 has been the worst period for this bot. On a backtest over that specific period, the longest single EU losing streaks lasted since September 17, 2012 till January 02, 2013 (that's three and a half months) and since April 23 till June 18 (that's almost two months). If memory serves me, it was also due to the Greek drama back then.

Difference between then and now? Back then, Greece wasn't facing a tough choice to either pay back the IMF (not doing which would constitute a spiraling default on all of its other obligations) or pay its domestic pensions and salaries. Back then, it was just a matter of defaulting or not defaulting on its debts owed to private bondholders (who were eventually forced to take a significant debt haircut during the so-called 'restructuring'). So deadlines kept shifting for months and the whole thing dragged on for nearly a year. With IMF, there's no such thing as shifting deadlines. It's either you pay on time or within 30 calendar days you have a 'credit event' served to you in cold blood. That's how that fund works - ask Argentina. Dats how dous bruhs roll, yo - as some Harlem boys would say. :) The same is the case with the domestic paychecks - regrettably, the pensioners and the government employees need to eat daily, so they need to have their paychecks on time. :) So no deadline shifting for months here, it's either up or down and soon. Watch May 6 and May 12 as deadlines (the dates of the IMF paybacks totaling 1 billion EUR). Party time!

Difference between then and now? Back then, Greece wasn't facing a tough choice to either pay back the IMF (not doing which would constitute a spiraling default on all of its other obligations) or pay its domestic pensions and salaries. Back then, it was just a matter of defaulting or not defaulting on its debts owed to private bondholders (who were eventually forced to take a significant debt haircut during the so-called 'restructuring'). So deadlines kept shifting for months and the whole thing dragged on for nearly a year. With IMF, there's no such thing as shifting deadlines. It's either you pay on time or within 30 calendar days you have a 'credit event' served to you in cold blood. That's how that fund works - ask Argentina. Dats how dous bruhs roll, yo - as some Harlem boys would say. :) The same is the case with the domestic paychecks - regrettably, the pensioners and the government employees need to eat daily, so they need to have their paychecks on time. :) So no deadline shifting for months here, it's either up or down and soon. Watch May 6 and May 12 as deadlines (the dates of the IMF paybacks totaling 1 billion EUR). Party time!

Ahli sejak Jan 06, 2014

256 hantaran

May 05, 2015 at 10:29

Ahli sejak Jan 06, 2014

256 hantaran

Long term BT from 2004 shows on EURUSD a max stagnation period of 835 days with a max DD of 35%. Anyway stats shows that only 2006 closes with 122 pips loss and 2007 with 111 pips gain. So the longer stagnation period was from the end of 2005 till 2007. I personally think that the current DD on EU is normal and that the strategy will conrinue to work. On GBPUSD currently is working nicely, but BTs are not good as on EU

Running only Expert advisors with good long term backtests and nice forward tests

forex_trader_67253

Ahli sejak Feb 26, 2012

95 hantaran

May 05, 2015 at 22:26

Ahli sejak Feb 26, 2012

95 hantaran

corre71 posted:

Long term BT from 2004 shows on EURUSD a max stagnation period of 835 days with a max DD of 35%. Anyway stats shows that only 2006 closes with 122 pips loss and 2007 with 111 pips gain. So the longer stagnation period was from the end of 2005 till 2007. I personally think that the current DD on EU is normal and that the strategy will conrinue to work. On GBPUSD currently is working nicely, but BTs are not good as on EU

Unless your BT was done on tick data, the earlier years might be largely inaccurate due to compressed MetaQuotes data from back then. Also, there wasn't a divergent central banks' policy between ECB/BoE on one hand and the US Fed on the other one, like there's now. Breakouts are best not only when Europe screw it up big time yet again but when the US situation improves at the same time (and vice versa).

Run it since fall 2008 (when the global fun started) and you'll see fall 2012-fall 2013 as the longest stagnation period due to the Greek drama Act II on one hand and the US debt ceiling ordeal on the other one at the same time. With the Pound, it was some two years earlier in 2010-2011 when the UK got its first hung parliament since the 1970s while the US suddenly figured QE Round I proved a failure around the same time.

Divergent central banks' policies will bring you breakouts and profits with this bot. Or a string of economic surprises on our way to the promised recovery - as long as they don't occur in both the US and Europe at the same time.

Ahli sejak Jan 06, 2014

256 hantaran

May 06, 2015 at 05:09

Ahli sejak Jan 06, 2014

256 hantaran

I use only Tick datas for my BTs. Currently BTing other breakout strategy and i expect to see the longest stagnation period also on These from th end of 2005 up to 2006

Running only Expert advisors with good long term backtests and nice forward tests

forex_trader_67253

Ahli sejak Feb 26, 2012

95 hantaran

May 06, 2015 at 12:11

Ahli sejak Feb 26, 2012

95 hantaran

corre71 posted:

Currently BTing other breakout strategy

Which one?

Ahli sejak Jan 06, 2014

256 hantaran

May 06, 2015 at 12:51

Ahli sejak Jan 06, 2014

256 hantaran

btanalysis posted:I have already BTed Monetizer and Forex growth Bot. Currently BTing Fe Combination, which has a 'Vola' strategy, and Forex real Profit Strategy 5 breakout on EURUSD. These are hihgly protected eas so i will need many weeks to complete the BTs. I expect the max DD and stagnation period also for these during the end of 2005 up the middle to 2007. Anyway let's wait for the resultscorre71 posted:

Currently BTing other breakout strategy

Which one?

Running only Expert advisors with good long term backtests and nice forward tests

forex_trader_165856

Ahli sejak Dec 03, 2013

631 hantaran

May 06, 2015 at 13:15

Ahli sejak Dec 03, 2013

631 hantaran

That reminds me of RObin Vol. https://www.myfxbook.com/strategies/robin-vol-20/25049 - backtested well through those stagnation periods.

Ahli sejak Jan 06, 2014

256 hantaran

May 06, 2015 at 13:31

(disunting May 06, 2015 at 13:33)

Ahli sejak Jan 06, 2014

256 hantaran

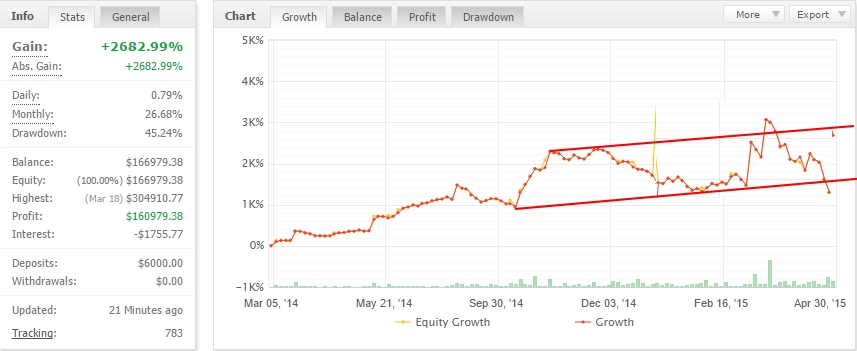

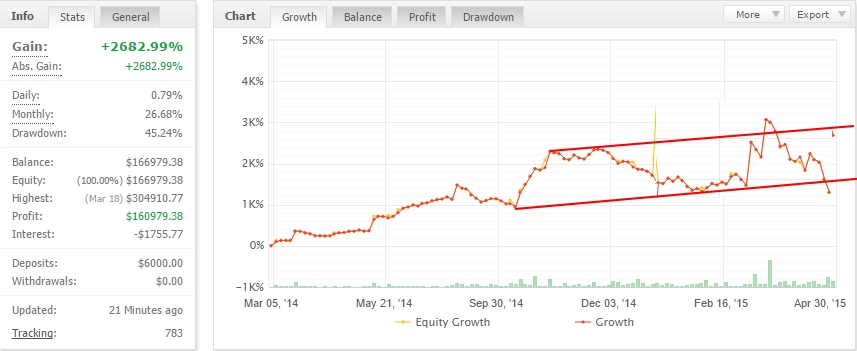

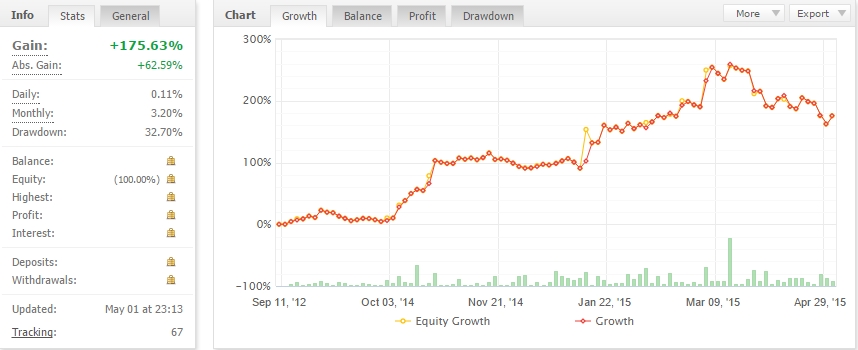

Yes, there are many EA for which Bts are unusefull. Infact, once BTed you have to compare trades from the Bt with trades triggered on a real account and then take your conclusions. As for Monetizer there is a very good match rate; for Keltner PRO i have checked at the time i have finished the BT and it was good too. Once finished with curretn BTs will run again the BT on Keltner on all pairs from 2004. Anyway i think the problem about Keltner is that the vendor uses a too high risk. I consider as benchmark the Birt account:

https://www.myfxbook.com/members/birt/keltner-pro/984991

It is running with very low DD (and of course low return)

Or the ForexGermany account:

https://www.myfxbook.com/members/forexgermany/keltnerpro/983876

But this has amuch higher DD. Also i think Keltner should be runned only on EURUSD and GBPUSD: like this DD would be much lower. As for NZDUSD, from what i remember from my BTs, it is much better if used on the 15 min tf. But again i would use only EURUSD and GBPUSD. But this is an EA which can lead to very long stagnation periods, but in my opinion (and of course i can be wrong) the strategy it uses can be considered a long term strategy. Of course anyone should make his own considerations

https://www.myfxbook.com/members/birt/keltner-pro/984991

It is running with very low DD (and of course low return)

Or the ForexGermany account:

https://www.myfxbook.com/members/forexgermany/keltnerpro/983876

But this has amuch higher DD. Also i think Keltner should be runned only on EURUSD and GBPUSD: like this DD would be much lower. As for NZDUSD, from what i remember from my BTs, it is much better if used on the 15 min tf. But again i would use only EURUSD and GBPUSD. But this is an EA which can lead to very long stagnation periods, but in my opinion (and of course i can be wrong) the strategy it uses can be considered a long term strategy. Of course anyone should make his own considerations

Running only Expert advisors with good long term backtests and nice forward tests

forex_trader_67253

Ahli sejak Feb 26, 2012

95 hantaran

May 08, 2015 at 07:37

Ahli sejak Feb 26, 2012

95 hantaran

Losses for KeltnerPro have extended further this week. Today's US NFP will be its make it or break it moment - if it meets or exceeds the consensus expectations, there's hope for this bot; if the figure underscores the expectations yet again, it will mean there's no US economic recovery - then say good-bye to the Fed rate hike this year and a divergent central bank policies between the Fed and ECB, so much needed for a successful performance of this bot.

Ahli sejak Jan 06, 2014

256 hantaran

May 08, 2015 at 08:05

Ahli sejak Jan 06, 2014

256 hantaran

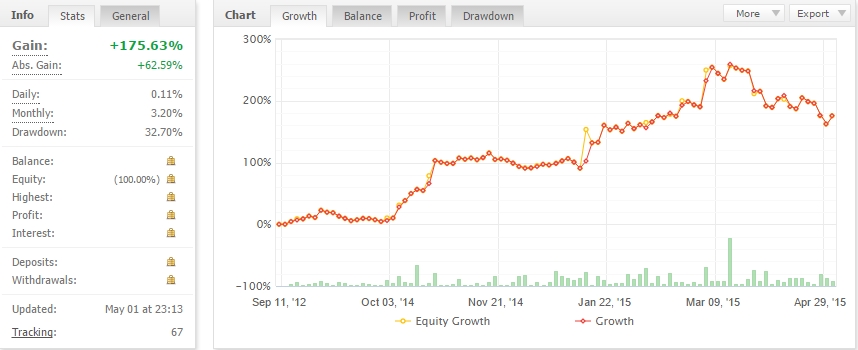

Yes, i saw these losses on the ref account and also on other accounts. I run many accounts on many brokers with many EAs and yesterady at 10:00 PM (end of British elections) i was carefully watching the various brokers behaviour and noted that some of them (Ic Markets for example) stopped completely the feed for some minutes. So on these brokers Keltner entered too late imo. Don't know about Synergy since i do not have any accounts with them. Anyway on my Activtrades account yesterday i have earned from Keltner: 1 trade in loss and 3 trades closed in gain. But to be honest i have managed the 3 trades manually: volatility was too high and so have closed them maually before to go to sleep; don't know how was the result if the trades was managed by the EA (probably they were stopped out on the downmove cable had before to going again up)

So what i can assume is that Keltner is broker sensitive (and that is unusual for breakout Eas)

My opinion is that Keltner is a good EA but the risk should be setted at low levels, because it can generate DD and long stagnation periods

Attached a screen about my stats on Keltner GBPUSD (on EURUSD i am in loss, but the gains of GU are higher than the losses on EU)

So what i can assume is that Keltner is broker sensitive (and that is unusual for breakout Eas)

My opinion is that Keltner is a good EA but the risk should be setted at low levels, because it can generate DD and long stagnation periods

Attached a screen about my stats on Keltner GBPUSD (on EURUSD i am in loss, but the gains of GU are higher than the losses on EU)

Running only Expert advisors with good long term backtests and nice forward tests

Ahli sejak Oct 23, 2014

83 hantaran

May 08, 2015 at 08:13

Ahli sejak Oct 23, 2014

83 hantaran

corre71 posted:

Yes, i saw these losses on the ref account and also on other accounts. I run many accounts on many brokers with many EAs and yesterady at 10:00 PM (end of British elections) i was carefully watching the various brokers behaviour and noted that some of them (Ic Markets for example) stopped completely the feed for some minutes. So on these brokers Keltner entered too late imo. Don't know about Synergy since i do not have any accounts with them. Anyway on my Activtrades account yesterday i have earned from Keltner: 1 trade in loss and 3 trades closed in gain. But to be honest i have managed the 3 trades manually: volatility was too high and so have closed them maually before to go to sleep; don't know how was the result if the trades was managed by the EA (probably they were stopped out on the downmove cable had before to going again up)

So what i can assume is that Keltner is broker sensitive (and that is unusual for breakout Eas)

My opinion is that Keltner is a good EA but the risk should be setted at low levels, because it can generate DD and long stagnation periods

Attached a screen about my stats on Keltner GBPUSD (on EURUSD i am in loss, but the gains of GU are higher than the losses on EU)

i had 3 wins 97 pips 93 pips 50 pips and 1 loss 53 pips.on fx choice with breakeven and overbought/sell signal.

Ahli sejak Jan 06, 2014

256 hantaran

May 08, 2015 at 08:27

Ahli sejak Jan 06, 2014

256 hantaran

On my previous post i have made a mistake: the stats were referred at Keltner all pairs, so also including the EURUSD losses (but anyway the stats shows a gain). Attached my stats on Keltner only GU

Running only Expert advisors with good long term backtests and nice forward tests

forex_trader_67253

Ahli sejak Feb 26, 2012

95 hantaran

May 08, 2015 at 10:10

Ahli sejak Feb 26, 2012

95 hantaran

I had losses, just like the vendor. Anyway, they're largely irrelevant in the long run - today's NFP release is what will determine this bot's prospects for this year. If the NFP stats are weak, there won't be many good breakouts, whereas both the US and the EU economies will find themselves in a simultaneous slowdown for the months to come.

Ahli sejak Jan 06, 2014

256 hantaran

May 08, 2015 at 10:15

Ahli sejak Jan 06, 2014

256 hantaran

btanalysis posted:Totally agree: losses are a part of the game and they shake out from godd startegy weak players. Important are the long run results

I had losses, just like the vendor. Anyway, they're largely irrelevant in the long run - today's NFP release is what will determine this bot's prospects for this year. If the NFP stats are weak, there won't be many good breakouts, whereas both the US and the EU economies will find themselves in a simultaneous slowdown for the months to come.

Running only Expert advisors with good long term backtests and nice forward tests

forex_trader_165856

Ahli sejak Dec 03, 2013

631 hantaran

May 08, 2015 at 10:22

Ahli sejak Dec 03, 2013

631 hantaran

KeltnerFlow has the same dumb trades on GBPUSD. Will need an overhaul shortly.

*Penggunaan komersil dan spam tidak akan diterima, dan boleh mengakibatkan penamatan akaun.

Petua: Menyiarkan url gambar/youtube akan menyisipkannya secara automatik dalam siaran hantaran anda!

Tip: Taipkan tanda @ untuk melengkapkan nama pengguna yang menyertai perbincangan ini secara automatik.