December PPI eases fears of hawkish Fed

December PPI eases fears of hawkish Fed

US producer prices rose at a slower-than-expected pace in December, easing fears of tighter monetary policy.

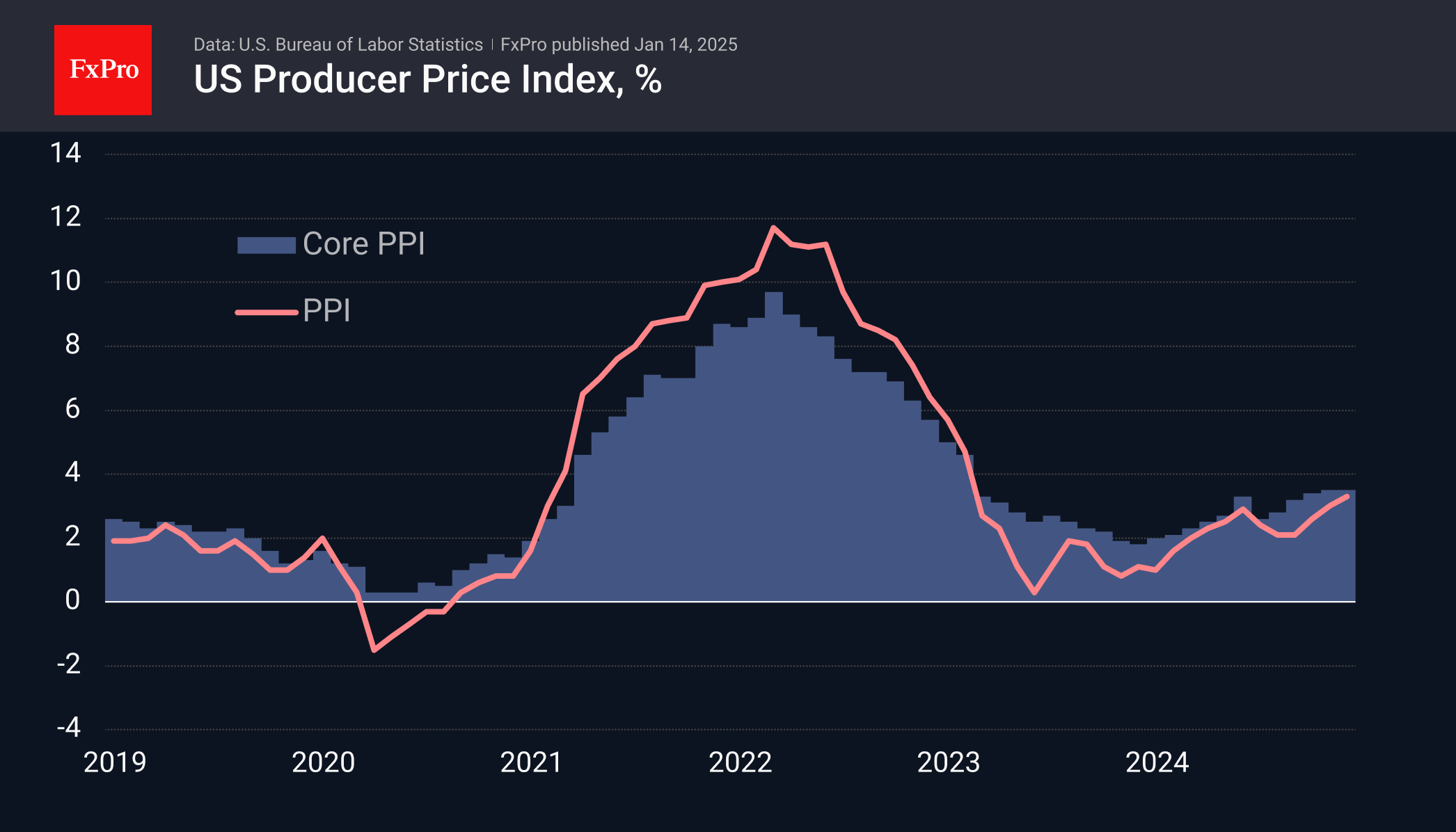

The PPI rose 0.2% in December, down from 0.4% in the previous month. And while price growth accelerated to 3.3% from 3.0% a year earlier, this was below the average forecast of 3.5%. Core PPI, which excludes volatile food and energy, was virtually unchanged over the month and maintained its year-over-year growth rate at 3.5% against the expected acceleration to 3.8%.

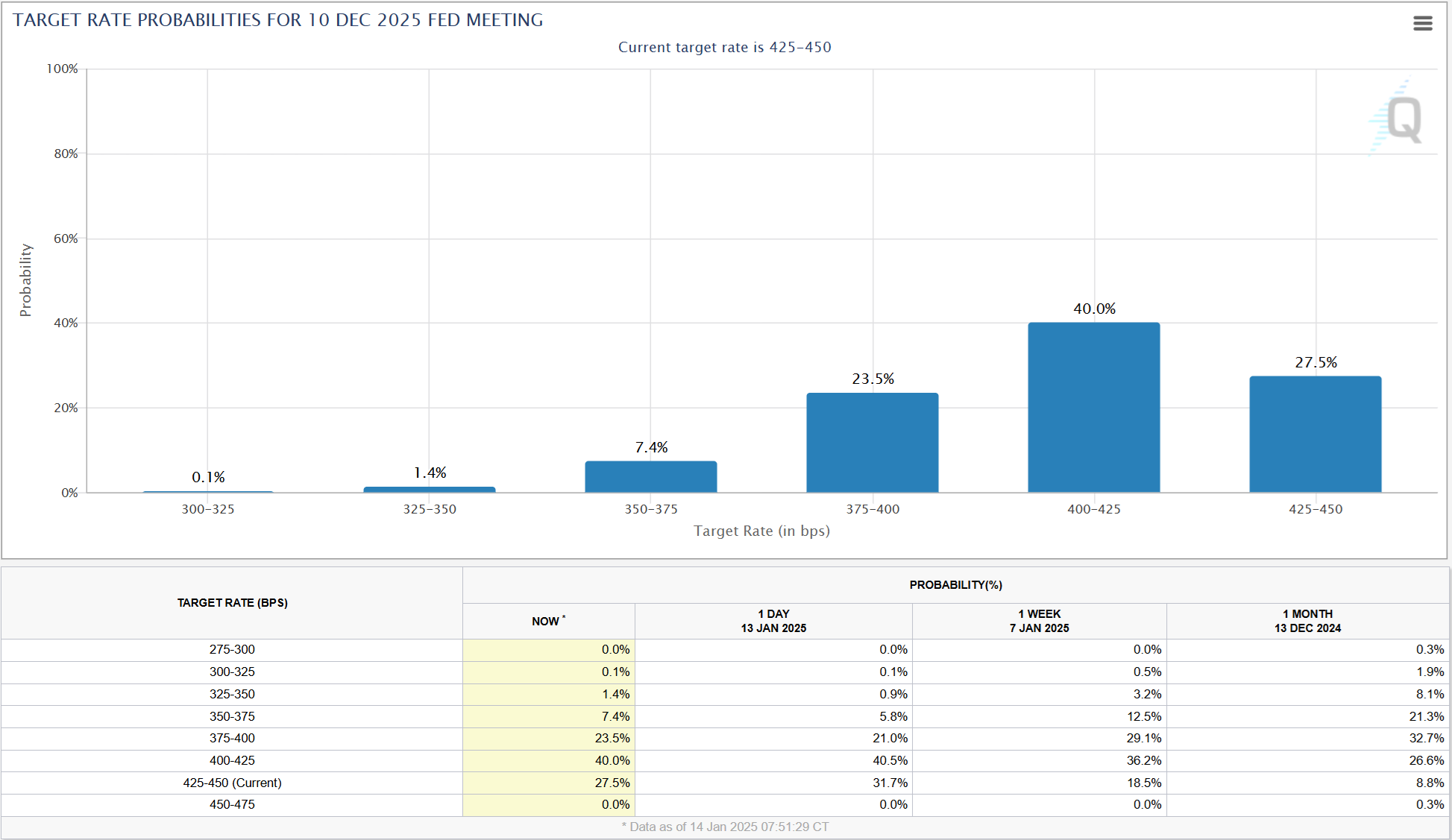

This is positive news for markets, where expectations of a more hawkish Fed in 2025 have gained momentum in recent weeks. The local high was reached on Monday morning when markets were pricing in a 32% probability of no change in the Fed Funds rate by the end of the year. The latest data shows that this estimate has fallen to 27.5%.

The softer report fuels tentative hopes that we may be seeing the start of a turnaround. This would be especially true if such a shift is confirmed in Wednesday's consumer inflation report. Typically, these two publications miss expectations by about the same amount. However, the CPI has much greater potential to influence market prices, and it would be too presumptuous to rule out surprises altogether.

The Dollar Index fell 0.2% on release but quickly recovered its initial losses. In this case, the logic is clear: the dollar's main competitors will have to ease policy by 50-100 points in the face of a significant cooling of the economy. This is the main factor in the tug-of-war over whether we will see 25 or 50 points of Fed easing within a year.

If confirmed on Wednesday, soft inflation could trigger profit-taking by dollar bulls, who took the DXY to 110 the previous afternoon. That said, a reversal for the dollar seems unlikely in the near future. It is more likely that the medium-term consolidation of positions will be followed by a new growth impulse towards the 112-113 area.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)