EBC Markets Briefing | Oil poised to rise with potential trade deals

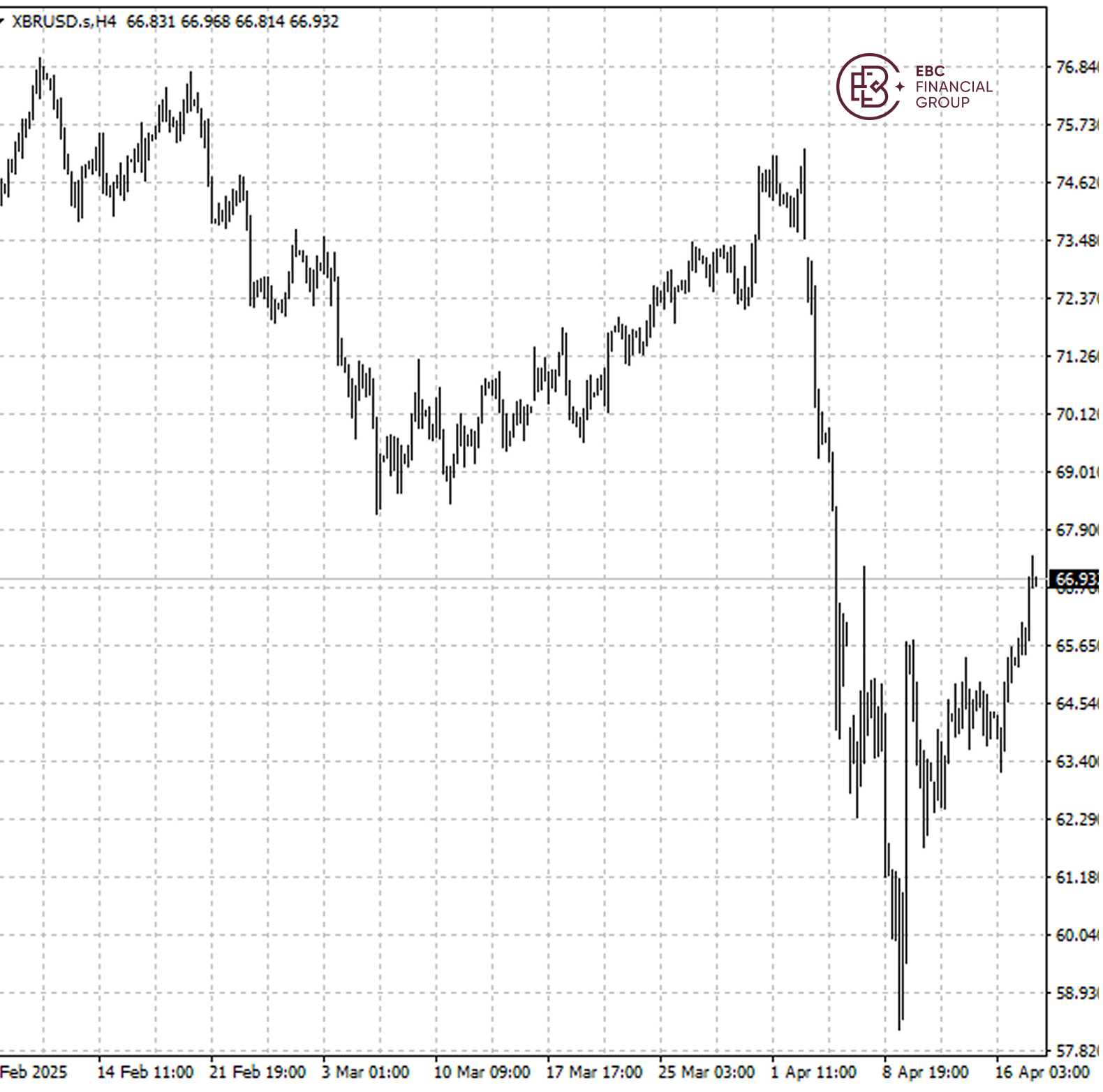

Thursday is the last settlement day of the week ahead of the Easter holidays and trade volumes were thin. For the week, both Brent and WTI gained about 5%, their first weekly gain in three weeks.

They settled more than 3% higher on Thursday, supported by hopes for a trade deal between the US and the EU and new sanctions to curb Iranian oil exports, which continued to elevate supply concerns.

Trump and Italian PM Giorgia Meloni met in Washington and expressed optimism about resolving trade tensions. Vice-President JD Vance said earlier there was a "good chance" of a deal with the UK.

The US president touted "big progress" in tariff talks with Japan on Wednesday, in one of the first rounds of face-to-face negotiations. He also said he expected to make a trade deal with China.

Crude inventories rose by 515,000 barrels the week ended 11 April, the EIA said, compared with analysts' expectations for a 507,000-barrel rise. Meanwhile, crude exports hit the highest in about a year.

"In the next four years we'll almost certainly see lower average energy prices than we saw in the last four years of the previous administration," said US Energy Secretary Chris Wright last week.

Brent crude extended it rally amid improving market sentiment and the risk remains skewed towards the upside. The next major hurdle could be the previous support around $68.2.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.