- Главная

- Сообщество

- Опытные трейдеры

- Technical & Fundamental Analysis by Sold ECN Securities

Advertisement

Edit Your Comment

Technical & Fundamental Analysis by Sold ECN Securities

Участник с Dec 08, 2021

325 комментариев

Apr 07, 2022 at 14:33

Участник с Dec 08, 2021

325 комментариев

EURUSD, the US Federal Reserve intends to speed up the rate hike

In the absence of positive drivers that can reverse or temporarily stop the current downtrend, the European currency continues to lose value, correcting around 1.0913 actively.

The problems associated with the energy confrontation between the EU and Russia are growing, and after statements by several German officials about the refusal of gas supplies, the press secretary of the President of the Russian Federation, Dmitry Peskov, in an interview with the LCI television channel, said that the EU countries could permanently lose access to cheap "blue fuel" in in the event of termination of cooperation since Russia will look for other markets. The recently published data on the producer price index also did not add positively to traders, which was worse than expected: the February indicator was 1.1%, which is below the forecasted 1.3%, and the annual growth was recorded at 31.4%, which is also below preliminary estimates of the market at 31.5%.

The index of the American currency could not overcome the psychologically important level of around 100 points and remained lower, around 99.600. The minutes of the meeting of the Open Market Committee of the US Federal Reserve (FOMC) published yesterday confirmed analysts' forecasts that the regulator consolidates to accelerate the increase in the interest rate and also has plans to significantly reduce the balance sheet capital, according to preliminary estimates, in the amount of up to 2T dollars.

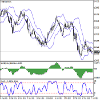

The asset is moving within a wide downward channel and has begun working out the local Flag pattern. Technical indicators maintain a global sell signal: fast EMAs on the Alligator indicator are below the signal line, and the AO oscillator histogram forms down bars in the sell zone.

Resistance levels: 1.1070, 1.1232 | Support levels: 1.0850, 1.0600

In the absence of positive drivers that can reverse or temporarily stop the current downtrend, the European currency continues to lose value, correcting around 1.0913 actively.

The problems associated with the energy confrontation between the EU and Russia are growing, and after statements by several German officials about the refusal of gas supplies, the press secretary of the President of the Russian Federation, Dmitry Peskov, in an interview with the LCI television channel, said that the EU countries could permanently lose access to cheap "blue fuel" in in the event of termination of cooperation since Russia will look for other markets. The recently published data on the producer price index also did not add positively to traders, which was worse than expected: the February indicator was 1.1%, which is below the forecasted 1.3%, and the annual growth was recorded at 31.4%, which is also below preliminary estimates of the market at 31.5%.

The index of the American currency could not overcome the psychologically important level of around 100 points and remained lower, around 99.600. The minutes of the meeting of the Open Market Committee of the US Federal Reserve (FOMC) published yesterday confirmed analysts' forecasts that the regulator consolidates to accelerate the increase in the interest rate and also has plans to significantly reduce the balance sheet capital, according to preliminary estimates, in the amount of up to 2T dollars.

The asset is moving within a wide downward channel and has begun working out the local Flag pattern. Technical indicators maintain a global sell signal: fast EMAs on the Alligator indicator are below the signal line, and the AO oscillator histogram forms down bars in the sell zone.

Resistance levels: 1.1070, 1.1232 | Support levels: 1.0850, 1.0600

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 08, 2022 at 10:49

Участник с Dec 08, 2021

325 комментариев

GBPUSD, consolidation near the level of 1.306

Current Trend

GBPUSD has been fluctuating in a wide range of 1.3045-1.3106 over the past three trading sessions, continuing to lose value after consolidating below the April 6 low at 1.3045 following the release of "hawkish" Minutes from the US Federal Open Market Committee (FOMC). At the moment, quotes are consolidating near the level of 1.3060.

The situation around Ukraine is still in the spotlight. Western countries continue to introduce new restrictions against the Russian economy, primarily aimed at reducing or completely banning energy imports. The export of high-tech equipment, cars and agricultural machinery is also noticeably limited. However, these measures have not yet brought the expected effect, since the special military operation continues. At the same time, the position of the Western authorities has become a catalyst for updating record highs in commodity markets, which threatens to increase inflation in many regions of the world. Against this background, British Prime Minister Boris Johnson said that the UK intends to use more fossil fuels and commission one new nuclear reactor per year in order to maintain energy security. In addition, the country's government intends to abandon imported oil and gas in order to avoid a rapid increase in energy tariffs in the future, so this autumn another round of distribution of licenses for the development of the North Sea shelf by British oil and gas enterprises will be held.

The macroeconomic statistics of the United Kingdom released the day before only confirmed the fact of a rapid increase in inflation: the Halifax House Price Index accelerated from 0.8% to 1.4% in March, while analysts expected a slowdown in dynamics to 0.4%.

Bollinger Bands in D1 chart demonstrate a moderate decrease. The price range is narrowing, reflecting ambiguous dynamics of trading in the short term. MACD indicator is trying to reverse upwards and form a new buy signal (the histogram is trying to consolidate above the signal line). Stochastic is showing similar dynamics, trying to retreat from the oversold area (below the level of "20").

Resistance levels: 1.31, 1.315, 1.32, 1.325 | Support levels: 1.305, 1.3, 1.296, 1.29.

Current Trend

GBPUSD has been fluctuating in a wide range of 1.3045-1.3106 over the past three trading sessions, continuing to lose value after consolidating below the April 6 low at 1.3045 following the release of "hawkish" Minutes from the US Federal Open Market Committee (FOMC). At the moment, quotes are consolidating near the level of 1.3060.

The situation around Ukraine is still in the spotlight. Western countries continue to introduce new restrictions against the Russian economy, primarily aimed at reducing or completely banning energy imports. The export of high-tech equipment, cars and agricultural machinery is also noticeably limited. However, these measures have not yet brought the expected effect, since the special military operation continues. At the same time, the position of the Western authorities has become a catalyst for updating record highs in commodity markets, which threatens to increase inflation in many regions of the world. Against this background, British Prime Minister Boris Johnson said that the UK intends to use more fossil fuels and commission one new nuclear reactor per year in order to maintain energy security. In addition, the country's government intends to abandon imported oil and gas in order to avoid a rapid increase in energy tariffs in the future, so this autumn another round of distribution of licenses for the development of the North Sea shelf by British oil and gas enterprises will be held.

The macroeconomic statistics of the United Kingdom released the day before only confirmed the fact of a rapid increase in inflation: the Halifax House Price Index accelerated from 0.8% to 1.4% in March, while analysts expected a slowdown in dynamics to 0.4%.

Bollinger Bands in D1 chart demonstrate a moderate decrease. The price range is narrowing, reflecting ambiguous dynamics of trading in the short term. MACD indicator is trying to reverse upwards and form a new buy signal (the histogram is trying to consolidate above the signal line). Stochastic is showing similar dynamics, trying to retreat from the oversold area (below the level of "20").

Resistance levels: 1.31, 1.315, 1.32, 1.325 | Support levels: 1.305, 1.3, 1.296, 1.29.

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 11, 2022 at 14:57

Участник с Dec 08, 2021

325 комментариев

EURUSD, "bears" leveled the price gap at the opening of trading

During the Asian session, the EURUSD pair is declining, opening with a slight positive gap. Now the "bears" have leveled the gap, and the instrument is retesting 1.0880 for a downward breakdown.

The market's general situation changes slightly, and the demand for risky assets remains under pressure. Despite the growing sanctions, Russia continues to conduct a special military operation on the territory of Ukraine, while peace negotiations have almost completely faded. Last week, the EU countries agreed on a new, already the fifth package of sanctions, which, among other things, provides for new restrictions on the import of Russian coal: a complete ban on the purchase, import, or transit of solid fuel. The bill will take effect from August 10, and before that, the parties can fulfill contracts concluded before April 9. Thus, the EU authorities want to prevent the worsening of the situation with inflation, which is currently reacting sharply to the dynamics of the commodity areas. The key issue with importing oil and natural gas is still open. The European authorities have not yet developed a unified attitude towards the Russian oil embargo, although certain steps are being taken in this direction.

Meanwhile, traders continue to monitor the results of the presidential elections in France. After counting 97% of the votes in the first round, incumbent President Emmanuel Macron takes the lead with about 27.6% of the vote. Second place goes to the head of the right-wing National Rally party, Marine Le Pen. The next round of elections is due on April 24.

Bollinger bands are moderately decreasing on the daily chart, and the price range is expanding from below, letting the "bears" renew local lows. The MACD indicator is trying to reverse into an upward plane, keeping the sell signal (the histogram is below the signal line). Stochastic shows a similar trend, reversing upwards near its lows, signaling that the euro is oversold in the ultra-short term.

Resistance levels: 1.09, 1.0957, 1.1, 1.1051 | Support levels: 1.086, 1.0835, 1.08, 1.0767.

During the Asian session, the EURUSD pair is declining, opening with a slight positive gap. Now the "bears" have leveled the gap, and the instrument is retesting 1.0880 for a downward breakdown.

The market's general situation changes slightly, and the demand for risky assets remains under pressure. Despite the growing sanctions, Russia continues to conduct a special military operation on the territory of Ukraine, while peace negotiations have almost completely faded. Last week, the EU countries agreed on a new, already the fifth package of sanctions, which, among other things, provides for new restrictions on the import of Russian coal: a complete ban on the purchase, import, or transit of solid fuel. The bill will take effect from August 10, and before that, the parties can fulfill contracts concluded before April 9. Thus, the EU authorities want to prevent the worsening of the situation with inflation, which is currently reacting sharply to the dynamics of the commodity areas. The key issue with importing oil and natural gas is still open. The European authorities have not yet developed a unified attitude towards the Russian oil embargo, although certain steps are being taken in this direction.

Meanwhile, traders continue to monitor the results of the presidential elections in France. After counting 97% of the votes in the first round, incumbent President Emmanuel Macron takes the lead with about 27.6% of the vote. Second place goes to the head of the right-wing National Rally party, Marine Le Pen. The next round of elections is due on April 24.

Bollinger bands are moderately decreasing on the daily chart, and the price range is expanding from below, letting the "bears" renew local lows. The MACD indicator is trying to reverse into an upward plane, keeping the sell signal (the histogram is below the signal line). Stochastic shows a similar trend, reversing upwards near its lows, signaling that the euro is oversold in the ultra-short term.

Resistance levels: 1.09, 1.0957, 1.1, 1.1051 | Support levels: 1.086, 1.0835, 1.08, 1.0767.

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 12, 2022 at 10:01

Участник с Dec 08, 2021

325 комментариев

Crude Oil, the oil market is preparing for a new trend

Benchmark Brent Crude Oil prices are correcting downwards, trading just above $100 a barrel.

The escalation of the military conflict on the territory of Ukraine, which has become the cause of unprecedented anti-Russian sanctions, causes investors to fear that there will be a shortage of supply on the market due to the refusal of some countries to import Russian energy resources. However, OPEC Secretary General Mohammed Barkindo acknowledged that the European Union has little to replace the oil it imports from Russia, and because of the sanctions, the world market may face the loss of about 7M barrels of Russian oil per day.

The pressure on the market comes from unprecedented measures to release reserve reserves of their oil in 120M barrels by countries participating in the International Energy Agency, such as the United States, Japan, and South Korea, to stabilize market prices. Also, to the release by the IEA countries of 120M barrels, 60M barrels will fall on the main member of the agency, the United States, which will supply an additional 120M barrels of its reserves to the market independently. Japan has already released 15M barrels, and South Korea is preparing to increase its supply by 7.23M barrels.

The market has another reason. It is no secret that the largest positions are formed on the stock exchange in double positions called "spread." There is a historical situation when the index of the ratio of the US dollar to a basket of world currencies, USD Index, and Brent Crude Oil cost the same. Quotes of both the dollar index and oil are around 100, which creates the possibility of working on expanding the difference in these prices in both directions at once. In other words, both positions are being formed on the rise in oil/fall in the dollar index and the fall in oil/rise in the dollar index. In any case, the amount of money in this position is already huge, which is evident from the volatility, and, therefore, this will lead to serious price fluctuations soon.

On the global chart, the price continues to trade within the formation of the global Triangle pattern. Technical indicators reversed and gave a sell signal: the range of fluctuations of the Alligator EMA began to expand downwards, and the histogram of the AO oscillator moved into the sell zone.

Resistance levels: 103.44, 118.07 | Support levels: 96.20, 81.44

Benchmark Brent Crude Oil prices are correcting downwards, trading just above $100 a barrel.

The escalation of the military conflict on the territory of Ukraine, which has become the cause of unprecedented anti-Russian sanctions, causes investors to fear that there will be a shortage of supply on the market due to the refusal of some countries to import Russian energy resources. However, OPEC Secretary General Mohammed Barkindo acknowledged that the European Union has little to replace the oil it imports from Russia, and because of the sanctions, the world market may face the loss of about 7M barrels of Russian oil per day.

The pressure on the market comes from unprecedented measures to release reserve reserves of their oil in 120M barrels by countries participating in the International Energy Agency, such as the United States, Japan, and South Korea, to stabilize market prices. Also, to the release by the IEA countries of 120M barrels, 60M barrels will fall on the main member of the agency, the United States, which will supply an additional 120M barrels of its reserves to the market independently. Japan has already released 15M barrels, and South Korea is preparing to increase its supply by 7.23M barrels.

The market has another reason. It is no secret that the largest positions are formed on the stock exchange in double positions called "spread." There is a historical situation when the index of the ratio of the US dollar to a basket of world currencies, USD Index, and Brent Crude Oil cost the same. Quotes of both the dollar index and oil are around 100, which creates the possibility of working on expanding the difference in these prices in both directions at once. In other words, both positions are being formed on the rise in oil/fall in the dollar index and the fall in oil/rise in the dollar index. In any case, the amount of money in this position is already huge, which is evident from the volatility, and, therefore, this will lead to serious price fluctuations soon.

On the global chart, the price continues to trade within the formation of the global Triangle pattern. Technical indicators reversed and gave a sell signal: the range of fluctuations of the Alligator EMA began to expand downwards, and the histogram of the AO oscillator moved into the sell zone.

Resistance levels: 103.44, 118.07 | Support levels: 96.20, 81.44

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 13, 2022 at 10:09

Участник с Dec 08, 2021

325 комментариев

XAGUSD, metal quotes are recovering

Silver prices show a weak increase during the Asian session, retesting the level of 25.5. The instrument has been developing a fairly active uptrend since April 6, retreating from local lows since the end of last month and receiving support from statistics on record inflation in the world. Given the high Consumer Price Index in the US, which reached 8.5% in March, as well as the growing geopolitical uncertainty against the backdrop of the development of the Russian-Ukrainian conflict and severe anti-COVID restrictions in China, the demand for defensive assets remains elevated.

Macroeconomic statistics released the day before showed an increase in annual consumer inflation in the US to 8.5%, which was a new record high for 41 years. At the same time, a sharp tightening of the US Federal Reserve's monetary policy is expected in May: in addition to the expected rate hike by 50 basis points at once, a quantitative tightening program may also be launched to correct its balance.

Additional support for the metal comes from the prospect of a gradual lifting of COVID restrictions in China, while the restoration of industrial activity. The Chinese authorities announced the easing of a number of quarantine measures in parts of Shanghai, which will affect almost 5 million people, since there were no new cases of coronavirus infection over the past two weeks. Silver, unlike gold, is more actively used in industry, and therefore reacts sharply to such factors.

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range remains practically unchanged, limiting the development of "bullish" dynamics in the short term. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic is showing similar dynamics; however, the indicator line is already approaching its highs, indicating the risks of overbought instrument in the ultra-short term.

Resistance levels: 25.58, 26, 26.27, 26.57 | Support levels: 25.35, 25, 24.67, 24.42

Silver prices show a weak increase during the Asian session, retesting the level of 25.5. The instrument has been developing a fairly active uptrend since April 6, retreating from local lows since the end of last month and receiving support from statistics on record inflation in the world. Given the high Consumer Price Index in the US, which reached 8.5% in March, as well as the growing geopolitical uncertainty against the backdrop of the development of the Russian-Ukrainian conflict and severe anti-COVID restrictions in China, the demand for defensive assets remains elevated.

Macroeconomic statistics released the day before showed an increase in annual consumer inflation in the US to 8.5%, which was a new record high for 41 years. At the same time, a sharp tightening of the US Federal Reserve's monetary policy is expected in May: in addition to the expected rate hike by 50 basis points at once, a quantitative tightening program may also be launched to correct its balance.

Additional support for the metal comes from the prospect of a gradual lifting of COVID restrictions in China, while the restoration of industrial activity. The Chinese authorities announced the easing of a number of quarantine measures in parts of Shanghai, which will affect almost 5 million people, since there were no new cases of coronavirus infection over the past two weeks. Silver, unlike gold, is more actively used in industry, and therefore reacts sharply to such factors.

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range remains practically unchanged, limiting the development of "bullish" dynamics in the short term. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic is showing similar dynamics; however, the indicator line is already approaching its highs, indicating the risks of overbought instrument in the ultra-short term.

Resistance levels: 25.58, 26, 26.27, 26.57 | Support levels: 25.35, 25, 24.67, 24.42

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 14, 2022 at 13:25

Участник с Dec 08, 2021

325 комментариев

Gold, Exchange-traded fund continue to buy gold

XAUUSD is correcting upwards at 1973. Yesterday, the World Gold Council (WGC) published a report on the state of the market in Q1 2022, which noted a clear positive momentum for the price of the precious metal.

According to the published report, the main influence on the quotes was the increased demand from ETF funds and private investors. In particular, the volume of gold held by ETF funds increased by 269 tons in the quarter alone compared to data at the end of 2021, which is the most dynamic increase since 2020. In addition, the US Mint noted the increased interest of market participants in bullion gold coins in Q1 2022, with total sales of 518K troy ounces, showing a record pace since 1999.

High demand for contracts is also confirmed by data from the US Commodity Futures Trading Commission (CFTC). According to last week's report, the number of net speculative positions in gold was 245.5K, well above the average of 200K at the end of January this year.

In addition, investors continue to evaluate data on March inflation in the United States, which reflected an increase in consumer prices by 8.5% in annual terms, which is the highest value since December 1981. At the same time, core inflation, excluding food and energy prices, slowed down somewhat compared to the February level. Now the market is waiting for decisive steps from the US Federal Reserve. In particular, the interest rate is expected to be raised by 50 basis points at once at the meeting in May.

On the daily chart of the asset, the price is correcting within the global rising channel, being near the resistance line. Technical indicators maintain the buy signal: fast EMAs on the Alligator indicator again began to expand the range of fluctuations in the direction of growth, and the histogram of the AO oscillator moved into the buy zone, forming the first bar above the transition level.

Support levels: 1958, 1915 | Resistance levels: 1983, 2050

XAUUSD is correcting upwards at 1973. Yesterday, the World Gold Council (WGC) published a report on the state of the market in Q1 2022, which noted a clear positive momentum for the price of the precious metal.

According to the published report, the main influence on the quotes was the increased demand from ETF funds and private investors. In particular, the volume of gold held by ETF funds increased by 269 tons in the quarter alone compared to data at the end of 2021, which is the most dynamic increase since 2020. In addition, the US Mint noted the increased interest of market participants in bullion gold coins in Q1 2022, with total sales of 518K troy ounces, showing a record pace since 1999.

High demand for contracts is also confirmed by data from the US Commodity Futures Trading Commission (CFTC). According to last week's report, the number of net speculative positions in gold was 245.5K, well above the average of 200K at the end of January this year.

In addition, investors continue to evaluate data on March inflation in the United States, which reflected an increase in consumer prices by 8.5% in annual terms, which is the highest value since December 1981. At the same time, core inflation, excluding food and energy prices, slowed down somewhat compared to the February level. Now the market is waiting for decisive steps from the US Federal Reserve. In particular, the interest rate is expected to be raised by 50 basis points at once at the meeting in May.

On the daily chart of the asset, the price is correcting within the global rising channel, being near the resistance line. Technical indicators maintain the buy signal: fast EMAs on the Alligator indicator again began to expand the range of fluctuations in the direction of growth, and the histogram of the AO oscillator moved into the buy zone, forming the first bar above the transition level.

Support levels: 1958, 1915 | Resistance levels: 1983, 2050

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 15, 2022 at 08:34

Участник с Dec 08, 2021

325 комментариев

AUDUSD, the instrument ends the week in the "red" zone

AUDUSD shows a moderate decline during the Asian session, testing 0.74 for a breakdown. The instrument is preparing to finish yet another trading week in the "red" zone; however, due to the active growth of the Australian currency last Tuesday, the total losses can be characterized as insignificant.

In addition to the rising US dollar, quotes are under pressure from weak macroeconomic statistics from Australia, published the day before. Employment Change in March was recorded at around 17.9K, which was below market expectations at the level of 40K and significantly inferior to 77.4K shown in February. At the same time, Full-Time Employment decreased from 121.9K to 20.5K, while the dynamics of Part-Time Employment improved from -44.5K to -2.7K. The Unemployment Rate remained at 4%, while many experts were confident that it would stay below this psychological level. At the same time, Consumer Inflation Expectations rose from 4.9% to 5.2% in April, while analysts had projected a decline to 4.6%.

Investors continue to monitor the consequences of the Russian-Ukrainian conflict. The Australian government imposed targeted financial sanctions on 14 Russian state-owned enterprises of strategic and economic importance. In particular, PJSC Gazprom, PJSC Rostelecom, JSC United Shipbuilding Corporation, JSC Ruselectronics, PJSC Novorossiysk Commercial Sea Port, PJSC Alrosa, JSC Russian Railways, and others were included in the list.

On the daily chart, Bollinger Bands are moderately declining. The price range expands, making way to new local lows for the "bears". MACD is preserving a stable sell signal (located below the signal line). Stochastic, having tried to reverse upwards at the beginning of the current week is directed downwards again, indicating the continuing risks of the instrument being oversold in the ultra-short term.

Resistance levels: 0.745, 0.75, 0.755, 0.76 | Support levels: 0.74, 0.7366, 0.73, 0.725

AUDUSD shows a moderate decline during the Asian session, testing 0.74 for a breakdown. The instrument is preparing to finish yet another trading week in the "red" zone; however, due to the active growth of the Australian currency last Tuesday, the total losses can be characterized as insignificant.

In addition to the rising US dollar, quotes are under pressure from weak macroeconomic statistics from Australia, published the day before. Employment Change in March was recorded at around 17.9K, which was below market expectations at the level of 40K and significantly inferior to 77.4K shown in February. At the same time, Full-Time Employment decreased from 121.9K to 20.5K, while the dynamics of Part-Time Employment improved from -44.5K to -2.7K. The Unemployment Rate remained at 4%, while many experts were confident that it would stay below this psychological level. At the same time, Consumer Inflation Expectations rose from 4.9% to 5.2% in April, while analysts had projected a decline to 4.6%.

Investors continue to monitor the consequences of the Russian-Ukrainian conflict. The Australian government imposed targeted financial sanctions on 14 Russian state-owned enterprises of strategic and economic importance. In particular, PJSC Gazprom, PJSC Rostelecom, JSC United Shipbuilding Corporation, JSC Ruselectronics, PJSC Novorossiysk Commercial Sea Port, PJSC Alrosa, JSC Russian Railways, and others were included in the list.

On the daily chart, Bollinger Bands are moderately declining. The price range expands, making way to new local lows for the "bears". MACD is preserving a stable sell signal (located below the signal line). Stochastic, having tried to reverse upwards at the beginning of the current week is directed downwards again, indicating the continuing risks of the instrument being oversold in the ultra-short term.

Resistance levels: 0.745, 0.75, 0.755, 0.76 | Support levels: 0.74, 0.7366, 0.73, 0.725

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 21, 2022 at 08:15

Участник с Dec 08, 2021

325 комментариев

Crude Oil, multidirectional trading dynamics

During the Asian session, WTI Crude Oil prices show multidirectional dynamics, holding close to $103 per barrel.

Yesterday, EU representatives reaffirmed their intention to phase out the import of Russian energy resources, which increased the likelihood of new prohibitive measures being included in the sixth sanctions package. According to the Secretary of State of the Ministry of Foreign Affairs of France, Clément Beaune, there are currently active discussions on the embargo with partners from the EU, the US, the UK, and Japan. Meanwhile, shipments of Russian oil by sea have already fallen by 25% (3.12M barrels per day). Also, traders evaluate the dynamics of industrial growth rates globally and, in particular, in China, one of the largest importers of petroleum products.

The instrument was supported yesterday by an unexpectedly sharp reduction in US oil reserves. Thus, according to the US Energy Information Administration (EIA), for the week of April 15, the indicator fell by 8.02M barrels after an increase of 9.382M barrels over the previous period. However, analysts expected the positive dynamics to continue at 2.417M barrels. At the same time, US strategic reserves decreased by 4.7M barrels, while production slightly accelerated to 11.9M barrels. Inventories of gasoline fell by 800K barrels, significantly lower than the expected value of 1.2M barrels.

[img]https://i.ibb.co/qJm69ZL/oil-1.png[/img]

Bollinger bands are moving flat on the daily chart: the price range remains practically unchanged, reflecting the ambiguous nature of trading in the short term. The MACD indicator reversed upwards but keeps its previous sell signal (the histogram is below the signal line). Stochastic practically did not react to the appearance of ambiguous trading dynamics on Wednesday and still signals in favor of developing a downtrend in the nearest time intervals.

Resistance levels: 103, 105, 107.67, 110 | Support levels: 101.37, 100, 98, 96

[img]https://i.ibb.co/5kxSGvy/oil-2.png[/img]

During the Asian session, WTI Crude Oil prices show multidirectional dynamics, holding close to $103 per barrel.

Yesterday, EU representatives reaffirmed their intention to phase out the import of Russian energy resources, which increased the likelihood of new prohibitive measures being included in the sixth sanctions package. According to the Secretary of State of the Ministry of Foreign Affairs of France, Clément Beaune, there are currently active discussions on the embargo with partners from the EU, the US, the UK, and Japan. Meanwhile, shipments of Russian oil by sea have already fallen by 25% (3.12M barrels per day). Also, traders evaluate the dynamics of industrial growth rates globally and, in particular, in China, one of the largest importers of petroleum products.

The instrument was supported yesterday by an unexpectedly sharp reduction in US oil reserves. Thus, according to the US Energy Information Administration (EIA), for the week of April 15, the indicator fell by 8.02M barrels after an increase of 9.382M barrels over the previous period. However, analysts expected the positive dynamics to continue at 2.417M barrels. At the same time, US strategic reserves decreased by 4.7M barrels, while production slightly accelerated to 11.9M barrels. Inventories of gasoline fell by 800K barrels, significantly lower than the expected value of 1.2M barrels.

[img]https://i.ibb.co/qJm69ZL/oil-1.png[/img]

Bollinger bands are moving flat on the daily chart: the price range remains practically unchanged, reflecting the ambiguous nature of trading in the short term. The MACD indicator reversed upwards but keeps its previous sell signal (the histogram is below the signal line). Stochastic practically did not react to the appearance of ambiguous trading dynamics on Wednesday and still signals in favor of developing a downtrend in the nearest time intervals.

Resistance levels: 103, 105, 107.67, 110 | Support levels: 101.37, 100, 98, 96

[img]https://i.ibb.co/5kxSGvy/oil-2.png[/img]

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 21, 2022 at 11:21

Участник с Dec 08, 2021

325 комментариев

[img]https://i.ibb.co/gS7mBwb/silver-1.png[/img]

After reaching local highs of around 26 dollars per ounce, the quotes of the trading instrument show a local sideways trend and are now around 25.05.

The XAGUSD pair is preparing to continue growing against the backdrop of a positive report from the Silver Institute on the state of the precious metal market and experts' forecasts for the current year. Thus, in 2021, global industrial demand amounted to 508.2M ounces, adding 9% to the value of the previous year, while silver bullion sales increased immediately by 36% to 278.7M ounces, the highest figure in the last seven years, and total demand for the year increased 19% to 1.05B ounces.

As for the forecast for 2022, analysts expect continued positive dynamics and investor interest in the assets of the metal group. Industrial demand for silver is estimated to increase by 6% to 539.6 M ounces, while overall supply could rise by 3% to 1.03B ounces. In general, the overall forecast for the year is positive, and according to the specialists of the Silver Institute, the deficit in the world market will be about 70M ounces.

[img]https://i.ibb.co/GQFWPTr/silver.png[/img]

The price moves within the global ascending corridor, declining after reaching the resistance line. Technical indicators keep a buy signal, but their readings work out a local correction: indicator Alligator's EMA fluctuations range began to narrow, and the histogram of the AO oscillator forms downward bars in the buying zone.

Resistance levels: 26, 27.4 | Support levels: 24.55, 23.1

After reaching local highs of around 26 dollars per ounce, the quotes of the trading instrument show a local sideways trend and are now around 25.05.

The XAGUSD pair is preparing to continue growing against the backdrop of a positive report from the Silver Institute on the state of the precious metal market and experts' forecasts for the current year. Thus, in 2021, global industrial demand amounted to 508.2M ounces, adding 9% to the value of the previous year, while silver bullion sales increased immediately by 36% to 278.7M ounces, the highest figure in the last seven years, and total demand for the year increased 19% to 1.05B ounces.

As for the forecast for 2022, analysts expect continued positive dynamics and investor interest in the assets of the metal group. Industrial demand for silver is estimated to increase by 6% to 539.6 M ounces, while overall supply could rise by 3% to 1.03B ounces. In general, the overall forecast for the year is positive, and according to the specialists of the Silver Institute, the deficit in the world market will be about 70M ounces.

[img]https://i.ibb.co/GQFWPTr/silver.png[/img]

The price moves within the global ascending corridor, declining after reaching the resistance line. Technical indicators keep a buy signal, but their readings work out a local correction: indicator Alligator's EMA fluctuations range began to narrow, and the histogram of the AO oscillator forms downward bars in the buying zone.

Resistance levels: 26, 27.4 | Support levels: 24.55, 23.1

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 25, 2022 at 12:19

Участник с Dec 08, 2021

325 комментариев

AUDUSD, the pair is developing a strong downtrend

The Australian dollar shows a steady decline during the morning session, updating local lows from February 28. The instrument has been developing a downtrend since last Thursday, when the Fed Chairman Jerome Powell once again announced the need to raise interest rates by 0.50% at once at the May meeting. In addition, the regulator may launch a quantitative tightening program, which its representatives have also often spoken about recently. Investors took the official's speech as an additional signal to reduce risky positions, which provoked a noticeable strengthening of the US currency.

The macroeconomic statistics released on Friday from Australia failed to slow down the development of the "bearish" dynamics for the instrument, despite the fact that the data turned out to be quite positive in general. The Commonwealth Bank Manufacturing PMI in April rose from 57.7 to 57.9 points, while analysts had expected growth to only 57.8 points. The Services PMI for the same period strengthened from 55.6 to 56.6 points, but the market expected a much more noticeable increase to 58.5 points. At the same time, the Composite PMI rose from 55.1 to 56.2 in April.

In addition, China recorded the highest daily death rate of the population from COVID-19 this year, and the record for the incidence in Shanghai was 21K people. The city authorities announced a new round of quarantine measures last week, including daily testing of citizens for coronavirus. China remains one of the few countries that have adopted a "zero tolerance" policy, imposing mandatory quarantine for those who come into contact with infected citizens in order to contain the spread of the disease.

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is expanding, but at the moment it is not keeping up with the surge of "bearish" sentiment. MACD is going down preserving a stable sell signal (located below the signal line). Stochastic retains a steady downtrend but is located in close proximity to its lows, which indicates the risks of oversold AUD in the ultra-short term.

Resistance levels: 0.72, 0.725, 0.73, 0.7341 | Support levels: 0.715, 0.71, 0.705, 0.7

The Australian dollar shows a steady decline during the morning session, updating local lows from February 28. The instrument has been developing a downtrend since last Thursday, when the Fed Chairman Jerome Powell once again announced the need to raise interest rates by 0.50% at once at the May meeting. In addition, the regulator may launch a quantitative tightening program, which its representatives have also often spoken about recently. Investors took the official's speech as an additional signal to reduce risky positions, which provoked a noticeable strengthening of the US currency.

The macroeconomic statistics released on Friday from Australia failed to slow down the development of the "bearish" dynamics for the instrument, despite the fact that the data turned out to be quite positive in general. The Commonwealth Bank Manufacturing PMI in April rose from 57.7 to 57.9 points, while analysts had expected growth to only 57.8 points. The Services PMI for the same period strengthened from 55.6 to 56.6 points, but the market expected a much more noticeable increase to 58.5 points. At the same time, the Composite PMI rose from 55.1 to 56.2 in April.

In addition, China recorded the highest daily death rate of the population from COVID-19 this year, and the record for the incidence in Shanghai was 21K people. The city authorities announced a new round of quarantine measures last week, including daily testing of citizens for coronavirus. China remains one of the few countries that have adopted a "zero tolerance" policy, imposing mandatory quarantine for those who come into contact with infected citizens in order to contain the spread of the disease.

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is expanding, but at the moment it is not keeping up with the surge of "bearish" sentiment. MACD is going down preserving a stable sell signal (located below the signal line). Stochastic retains a steady downtrend but is located in close proximity to its lows, which indicates the risks of oversold AUD in the ultra-short term.

Resistance levels: 0.72, 0.725, 0.73, 0.7341 | Support levels: 0.715, 0.71, 0.705, 0.7

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 25, 2022 at 13:05

Участник с Dec 08, 2021

325 комментариев

USDCHF, trading near record highs

During the Asian session, the USDCHF pair is actively growing, testing the level of 0.9580 for a breakout and holding near the record highs of June 2020, renewed at the end of last week after the speech of the head of the US Federal Reserve, Jerome Powell.

The regulator chairman confirmed his intention to start an aggressive adjustment of the monetary policy parameters and raise the interest rate by 50 basis points at the next meeting in May to combat the inflation rate, which has been a record for 40 years. Also, the agency is likely to launch a quantitative easing program, which will allow it to reduce its balance sheet, which currently stands at about 9T dollars, mainly consisting of Treasuries and mortgage-backed securities.

[img]https://i.ibb.co/Z20jS13/5.png[/img]

Against the backdrop of rising buying sentiment, the US currency ignored the national macroeconomic data on Friday. The PMI Markit index in the manufacturing sector in April rose from 58.8 to 59.7 points, while analysts expected a slight decline to 58.2 points. In turn, the business activity index in the service sector for the same period fell from 58 to 54.7 points with neutral market forecasts. The composite business activity index corrected from 57.7 to 55.1 points, which was noticeably worse than analysts' expectations of 58.1 points.

On the daily chart, Bollinger Bands are steadily growing: the price range is expanding, letting the "bulls" renew the highs. The MACD indicator grows, keeping a strong buy signal (the histogram is above the signal line). Stochastic also maintains an upward direction but is near its highs, signaling that the dollar may become overbought in the ultra-short term.

Resistance levels: 0.96, 0.965, 0.97, 0.975 | Support levels: 0.9535, 0.95, 0.9459, 0.94

During the Asian session, the USDCHF pair is actively growing, testing the level of 0.9580 for a breakout and holding near the record highs of June 2020, renewed at the end of last week after the speech of the head of the US Federal Reserve, Jerome Powell.

The regulator chairman confirmed his intention to start an aggressive adjustment of the monetary policy parameters and raise the interest rate by 50 basis points at the next meeting in May to combat the inflation rate, which has been a record for 40 years. Also, the agency is likely to launch a quantitative easing program, which will allow it to reduce its balance sheet, which currently stands at about 9T dollars, mainly consisting of Treasuries and mortgage-backed securities.

[img]https://i.ibb.co/Z20jS13/5.png[/img]

Against the backdrop of rising buying sentiment, the US currency ignored the national macroeconomic data on Friday. The PMI Markit index in the manufacturing sector in April rose from 58.8 to 59.7 points, while analysts expected a slight decline to 58.2 points. In turn, the business activity index in the service sector for the same period fell from 58 to 54.7 points with neutral market forecasts. The composite business activity index corrected from 57.7 to 55.1 points, which was noticeably worse than analysts' expectations of 58.1 points.

On the daily chart, Bollinger Bands are steadily growing: the price range is expanding, letting the "bulls" renew the highs. The MACD indicator grows, keeping a strong buy signal (the histogram is above the signal line). Stochastic also maintains an upward direction but is near its highs, signaling that the dollar may become overbought in the ultra-short term.

Resistance levels: 0.96, 0.965, 0.97, 0.975 | Support levels: 0.9535, 0.95, 0.9459, 0.94

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 26, 2022 at 08:19

Участник с Dec 08, 2021

325 комментариев

Crude Oil, "black gold" quotes remain under pressure

Brent Crude Oil prices show a slight corrective growth, recovering from the "bearish" start of the week, which led to the renewal of local lows from April 12. Analysts attribute the current increase in quotes to technical factors, while the general news background still exerts moderate pressure on oil.

First of all, traders are concerned about the risks of lower demand for energy in China. The authorities are reporting an outbreak in Beijing, which again threatens a large-scale lockdown that will affect millions of people and lead to a marked reduction in industrial production. In the capital, 22 non-imported cases of COVID-19 were detected the day before, as a result of which a number of gyms and children's clubs suspended work. China remains one of the few countries that have adopted a "zero tolerance" policy, imposing mandatory quarantine for those who come into contact with infected citizens in order to contain the spread of the disease.

The growing US dollar, which is actively in demand as a safe haven, also has a negative effect on oil. Today, traders will focus on the data on the dynamics of Durable Goods Orders. Analysts' current forecasts are quite optimistic and suggest a 1% increase in March volumes after a 2.1% decline a month earlier. Also during the day, the weekly report of the American Petroleum Institute (API) on the dynamics of stocks for the week ended April 22 is going to be released. The previous publication reflected a sharp decline in the rate of 4.496 million barrels.

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is almost unchanged, reflecting ambiguous dynamics of trading in the short term. MACD is going down, demonstrating a fairly stable sell signal (located below the signal line). The indicator is trying to consolidate below the zero level. Stochastic keeps a downward direction but is already approaching its lows, which indicates the risks of oversold instrument in the ultra-short term.

Resistance levels: 104, 106, 109, 112 | Support levels: 100, 96.5, 93.34, 90

Brent Crude Oil prices show a slight corrective growth, recovering from the "bearish" start of the week, which led to the renewal of local lows from April 12. Analysts attribute the current increase in quotes to technical factors, while the general news background still exerts moderate pressure on oil.

First of all, traders are concerned about the risks of lower demand for energy in China. The authorities are reporting an outbreak in Beijing, which again threatens a large-scale lockdown that will affect millions of people and lead to a marked reduction in industrial production. In the capital, 22 non-imported cases of COVID-19 were detected the day before, as a result of which a number of gyms and children's clubs suspended work. China remains one of the few countries that have adopted a "zero tolerance" policy, imposing mandatory quarantine for those who come into contact with infected citizens in order to contain the spread of the disease.

The growing US dollar, which is actively in demand as a safe haven, also has a negative effect on oil. Today, traders will focus on the data on the dynamics of Durable Goods Orders. Analysts' current forecasts are quite optimistic and suggest a 1% increase in March volumes after a 2.1% decline a month earlier. Also during the day, the weekly report of the American Petroleum Institute (API) on the dynamics of stocks for the week ended April 22 is going to be released. The previous publication reflected a sharp decline in the rate of 4.496 million barrels.

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is almost unchanged, reflecting ambiguous dynamics of trading in the short term. MACD is going down, demonstrating a fairly stable sell signal (located below the signal line). The indicator is trying to consolidate below the zero level. Stochastic keeps a downward direction but is already approaching its lows, which indicates the risks of oversold instrument in the ultra-short term.

Resistance levels: 104, 106, 109, 112 | Support levels: 100, 96.5, 93.34, 90

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 27, 2022 at 08:32

Участник с Dec 08, 2021

325 комментариев

[img]https://i.ibb.co/WDg7FGx/usdjpy-forum.png[/img]

Quotes of USDJPY fell to a weekly low the day before, but today the yen is trying to regain its positions, despite the fact that the observed correction is largely associated with a slowdown in the growth of the US currency. Now the instrument is trading around 127.7.

Macroeconomic statistics from Japan turned out to be positive and supported the quotes of the national currency. The Unemployment Rate in the country in March fell to 2.6% from 2.7% a month earlier, despite the fact that analysts did not expect changes in the indicator. In turn, the Jobs / Applicants Ratio rose to 1.22 from the February value of 1.21, which coincided with analysts' forecasts. Also noteworthy is the Core CPI from the Bank of Japan, which stood at 1.1% in March, slightly up from 1.0% in the previous month. Investors are waiting for the results of the meeting of the Japanese monetary policy regulator, which will be held tomorrow. Prime Minister Fumio Kishida has already called for keeping the current monetary policy parameters and not raising interest rates to prevent a rapid fall in the yen.

In turn, the US dollar is holding at its highs, having exceeded the level of 102.000 in the USD Index the day before against the backdrop of disappointing data on the Conference Board Consumer Confidence Index for April, which fell to 107.3 points, despite preliminary estimates of 108.0 points. In addition, New Home Sales also corrected downward in March from 835K to 763K.

[img]https://i.ibb.co/R2qXgVg/usdjpy.png[/img]

The instrument is trading in a global uptrend, correcting within the local Flag pattern. Technical indicators hold a steady buy signal, which is working out a slight correction: the range of EMA fluctuations on the Alligator indicator is expanding, and the histogram of the AO oscillator is high in the purchase zone.

Support levels: 126.94, 123.77 | Resistance levels: 128.96, 133

Quotes of USDJPY fell to a weekly low the day before, but today the yen is trying to regain its positions, despite the fact that the observed correction is largely associated with a slowdown in the growth of the US currency. Now the instrument is trading around 127.7.

Macroeconomic statistics from Japan turned out to be positive and supported the quotes of the national currency. The Unemployment Rate in the country in March fell to 2.6% from 2.7% a month earlier, despite the fact that analysts did not expect changes in the indicator. In turn, the Jobs / Applicants Ratio rose to 1.22 from the February value of 1.21, which coincided with analysts' forecasts. Also noteworthy is the Core CPI from the Bank of Japan, which stood at 1.1% in March, slightly up from 1.0% in the previous month. Investors are waiting for the results of the meeting of the Japanese monetary policy regulator, which will be held tomorrow. Prime Minister Fumio Kishida has already called for keeping the current monetary policy parameters and not raising interest rates to prevent a rapid fall in the yen.

In turn, the US dollar is holding at its highs, having exceeded the level of 102.000 in the USD Index the day before against the backdrop of disappointing data on the Conference Board Consumer Confidence Index for April, which fell to 107.3 points, despite preliminary estimates of 108.0 points. In addition, New Home Sales also corrected downward in March from 835K to 763K.

[img]https://i.ibb.co/R2qXgVg/usdjpy.png[/img]

The instrument is trading in a global uptrend, correcting within the local Flag pattern. Technical indicators hold a steady buy signal, which is working out a slight correction: the range of EMA fluctuations on the Alligator indicator is expanding, and the histogram of the AO oscillator is high in the purchase zone.

Support levels: 126.94, 123.77 | Resistance levels: 128.96, 133

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 27, 2022 at 13:57

Участник с Dec 08, 2021

325 комментариев

EURUSD, 2020 low's update

Today, the EURUSD pair renewed the 2020 low at 1.065, falling under the pressure of escalating the military conflict in Ukraine.

The decision of Russian President Vladimir Putin to sell natural gas to "unfriendly" countries for rubles is forcing European officials to refuse supplies and look for an alternative, more expensive options, which leads to inflation rising to a record high of 7.4% YoY. Analysts suggest that the negative trend will continue, and in April, the figure will reach 7.5%. Also, German Economic Minister Robert Habeck said on Tuesday that the country can now stop importing Russian oil, and Poland is ready to help it search for new suppliers, which has already indicated its position on refusing to renew existing contracts. Authorities hope to find alternatives in the coming days, the official said.

Against the backdrop of high inflation, the European Central Bank (ECB) is forced to adjust the current parameters of monetary policy. There are no official statements about the upcoming interest rate hike, however, according to analysts at Goldman Sachs Group, the regulator may adjust the rate by 25 basis points in July, and by 2023 the value will reach 1.25%. If ECB officials confirm this information, we can expect the EUR/USD pair to strengthen, and until then, the instrument is waiting for trading in a downtrend.

The US dollar is rising ahead of the US Federal Reserve's interest rate decision on May 4th. It is expected that it will rise by 0.5% to 1%, which will help fight against high inflation.

The long-term trend is downward. Today, the asset has reached the support level of 1.0650, and after its breakdown, it may drop to 1.05, 1.035.

As part of the medium-term downtrend, the price reached the target zone 3 (1.0608 - 1.0589), after the breakdown of which the fall will continue with the target around zone 4 (1.0416 - 1.0397). Otherwise, we can expect a correction to the area of the key trend resistance 1.0799 - 1.078.

Resistance levels: 1.0850, 1.117 | Support levels: 1.065, 1.05

Today, the EURUSD pair renewed the 2020 low at 1.065, falling under the pressure of escalating the military conflict in Ukraine.

The decision of Russian President Vladimir Putin to sell natural gas to "unfriendly" countries for rubles is forcing European officials to refuse supplies and look for an alternative, more expensive options, which leads to inflation rising to a record high of 7.4% YoY. Analysts suggest that the negative trend will continue, and in April, the figure will reach 7.5%. Also, German Economic Minister Robert Habeck said on Tuesday that the country can now stop importing Russian oil, and Poland is ready to help it search for new suppliers, which has already indicated its position on refusing to renew existing contracts. Authorities hope to find alternatives in the coming days, the official said.

Against the backdrop of high inflation, the European Central Bank (ECB) is forced to adjust the current parameters of monetary policy. There are no official statements about the upcoming interest rate hike, however, according to analysts at Goldman Sachs Group, the regulator may adjust the rate by 25 basis points in July, and by 2023 the value will reach 1.25%. If ECB officials confirm this information, we can expect the EUR/USD pair to strengthen, and until then, the instrument is waiting for trading in a downtrend.

The US dollar is rising ahead of the US Federal Reserve's interest rate decision on May 4th. It is expected that it will rise by 0.5% to 1%, which will help fight against high inflation.

The long-term trend is downward. Today, the asset has reached the support level of 1.0650, and after its breakdown, it may drop to 1.05, 1.035.

As part of the medium-term downtrend, the price reached the target zone 3 (1.0608 - 1.0589), after the breakdown of which the fall will continue with the target around zone 4 (1.0416 - 1.0397). Otherwise, we can expect a correction to the area of the key trend resistance 1.0799 - 1.078.

Resistance levels: 1.0850, 1.117 | Support levels: 1.065, 1.05

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 29, 2022 at 07:47

Участник с Dec 08, 2021

325 комментариев

Quotes of EUR/USD are trading at the lowest levels since 2017 around 1.0520. The downtrend in the asset is intensifying against the backdrop of the negative impact of the possible consequences of the previously adopted anti-Russian sanctions, and, in particular, the ban on the import of raw materials and fertilizers. After the refusal of countries "unfriendly" to Russia to adhere to the new scheme of paying for energy resources in rubles, the PJSC Gazprom announced the termination of gas supplies to Poland and Bulgaria. Meanwhile, the German authorities showed solidarity on the issue of a complete ban on the purchase of Russian fuel, noting the need for a gradual transition to the use of alternative sources. Thus, the country withdrew its objections to a complete embargo on the supply of "black gold" from the Russian Federation and joined the rest of the EU members in this matter.

In the meantime, inflationary pressures in Germany and in the euro area as a whole continue to grow, which is reflected in macroeconomic indicators. German Consumer Price Index in April year on year reached 7.4% for the first time since 1974, rising from 7.3% a month earlier and yielding to analysts' forecast at 7.2%, while Italian Consumer Confidence Index corrected to 100.0 points from 100.8 points. The Consumer Price Index in Spain showed a downtrend and reached 8.4% after 9.8% shown in the previous period; however, despite the decline in inflation, Unemployment Rate in the country is fixed at a high level: 13.65% against 13.33%, shown in March.

In turn, the US currency could not ignore the negative fundamental background and came under pressure from weak data on the labor market, after which it began a downward correction, dropping from 103.700 to 103.400 in the USD Index. Thus, according to statistics, the Continuing Jobless Claims amounted to 1.408 million, exceeding the projected 1.403 million. Another increase in the Core Personal Consumption Expenditures index should also be noted: the value in Q1 increased to 5.20% from 5.00%.

The instrument is trading below the support line of the wide descending channel, which the price crossed the day before. Technical indicators maintain the global sell signal: the fast EMAs of the Alligator indicator are below the signal line, and the histogram of the AO oscillator continues to decline in the sell zone, forming descending bars.

Support levels: 1.0470, 1.0170 | Resistance levels: 1.0760, 1.1170

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 29, 2022 at 09:06

Участник с Dec 08, 2021

325 комментариев

Crude Oil, the market is stable

Benchmark Brent Crude Oil prices are correcting, trading just above 108 dollars per barrel amid production cuts by Russia, one of the largest exporters of "black gold". It is reported that production decreased by 9% compared to March values against the backdrop of the desire of Western countries to abandon the supply of resources after the start of a special military operation by Russian troops in Ukraine.

According to statistics, the most serious reduction was made by PJSC Rosneft, reducing production by 20%, and two other major market players, PJSC Gazpromneft and PJSC Surgutneftegaz, adjusted the figure by 4% each. Against this backdrop, OPEC+, which is scheduled to meet on May 5, is considering to continue increasing production levels by 432K barrels per day instead of the traditional monthly increase by 400K to slightly compensate for the existing losses of Russian oil.

Meanwhile, the British-Dutch oil and gas corporation Royal Dutch Shell refused to purchase refined products with any content of Russian raw materials, including fuel mixtures, while the French Total Energies plans to stop the lubricants business in Russia by the end of the month.

As for local trends, the day before, the Energy Information Administration (EIA) announced an expected increase in inventories held by US firms by 0.692M barrels after a serious reduction last week by 8.020M barrels, which had a positive impact on asset quotes.

On the daily chart, the price continues to trade as part of the formation of the global Triangle pattern. Technical indicators are in a state of uncertainty and do not give a clear signal to either side: the fast Alligator indicator EMAs crossed each other, and the histogram of the AO oscillator is forming ascending bars, being at the transition level.

Support levels: 101, 90.2 | Resistance levels: 111.85, 129.38

Benchmark Brent Crude Oil prices are correcting, trading just above 108 dollars per barrel amid production cuts by Russia, one of the largest exporters of "black gold". It is reported that production decreased by 9% compared to March values against the backdrop of the desire of Western countries to abandon the supply of resources after the start of a special military operation by Russian troops in Ukraine.

According to statistics, the most serious reduction was made by PJSC Rosneft, reducing production by 20%, and two other major market players, PJSC Gazpromneft and PJSC Surgutneftegaz, adjusted the figure by 4% each. Against this backdrop, OPEC+, which is scheduled to meet on May 5, is considering to continue increasing production levels by 432K barrels per day instead of the traditional monthly increase by 400K to slightly compensate for the existing losses of Russian oil.

Meanwhile, the British-Dutch oil and gas corporation Royal Dutch Shell refused to purchase refined products with any content of Russian raw materials, including fuel mixtures, while the French Total Energies plans to stop the lubricants business in Russia by the end of the month.

As for local trends, the day before, the Energy Information Administration (EIA) announced an expected increase in inventories held by US firms by 0.692M barrels after a serious reduction last week by 8.020M barrels, which had a positive impact on asset quotes.

On the daily chart, the price continues to trade as part of the formation of the global Triangle pattern. Technical indicators are in a state of uncertainty and do not give a clear signal to either side: the fast Alligator indicator EMAs crossed each other, and the histogram of the AO oscillator is forming ascending bars, being at the transition level.

Support levels: 101, 90.2 | Resistance levels: 111.85, 129.38

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

Apr 29, 2022 at 15:04

Участник с Dec 08, 2021

325 комментариев

The Australian currency is declining against the US dollar amid historically strong Consumer Price Data in Q1 2022. Now AUDUSD is trading in a downtrend, at around 0.7155.

The country's inflation rate reached 5.1% for the first time in more than 20 years, adding 2.1% for the current quarter and demonstrating the highest growth rate on record, while the Export Price Index rose from 3.5% to 18.0%. Investors are looking forward to the Reserve Bank of Australia meeting scheduled for May 3, during which, as predicted, the interest rate could be increased by 15 basis points to 0.25%, in which case the pre-election position of Prime Minister Scott Morrison could seriously deteriorate. Even now, in addition to ordinary citizens, Australian officials are also expressing their dissatisfaction with his policies. The day before, the candidate for Finance Minister from the Labor Party, Jim Chalmers, accused the Prime Minister of rising prices and falling living standards. He noted that the current price increase is only the beginning, and major financial shocks await citizens ahead.

On the daily chart, the price is within the Expanding Formation pattern, approaching the support line. Technical indicators continue holding a steady sell signal: the range of the Alligator indicator EMAs fluctuations is expanding in the direction of decline, and the histogram of the AO oscillator forms descending bars.

Support levels: 0.7087, 0.6965 | Resistance levels: 0.7280, 0.757

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

May 02, 2022 at 07:36

Участник с Dec 08, 2021

325 комментариев

USDCHF, D1

On the daily chart, the price continues its active growth, which began in April. Last week, the trading instrument reached its highest values since May 2020 at the level of 0.9758, if it is broken out, the uptrend may continue; however, at present, the development of a downward correction of quotations to the area of 0.9572 (retracement of 23.6%), 0.9533 (extension of 100.0%, Ascending Fan line of 38.2%) is not excluded. In general, the potential for strengthening USD/CHF is quite high, which is signaled by the upward reversal of Bollinger Bands and the increase in the MACD histogram in the positive zone, but Stochastic is reversing downwards in the overbought zone and may leave it, having formed a sell signal.

USDCHF, W1

On the weekly chart, the price is actively breaking through the Opposite Descending Fan and is currently testing the level of 0.9670 (retracement of 61.8%), but has not consolidated above it yet. If successful, the growth of the trading instrument may continue to the levels of 0.9900 (the area of March 2020 highs) and 1.0192 (retracement of 100.0%). Otherwise, a corrective decline to the levels of 0.9510 (retracement of 50.0%) and 0.9350 (retracement of 38.2%) is possible. The uptrend in the asset continues, which is signaled by an upward reversal of Bollinger Bands and Stochastic, as well as an increase in the MACD histogram in the positive zone; however, the price chart leaving the upper Bollinger Band does not exclude a downward correction.

In the near future, a downward correction to the levels of 0.9572 (retracement of 23.6%, D1) and 0.9510 (retracement of 50.0%, W1) is possible. If the price consolidates above 0.9758 (the Opposite Descending Fan line of 61.8%, W1), USDCHF will probably continue to strengthen towards 0.99 (the March 2020 highs area) and 1.0192 (retracement of 100.0%, W1).

Resistance levels: 0.9758, 0.99, 1.0192 | Support levels: 0.967, 0.9572, 0.951

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

May 03, 2022 at 11:23

Участник с Dec 08, 2021

325 комментариев

Market in anticipation of an increase in interest rates in the US

NZDUSD has been showing a downtrend since the end of last month, this week reaching its lowest levels since June 2020 around 0.6410. The pressure on the instrument is due to two main factors: the expectation of tightening of monetary policy by the US Federal Reserve and a decrease in prices for dairy products, which are New Zealand's main export goods.

On Wednesday, May 4, a meeting of the US Fed will be held, at which, as expected, the interest rate may be increased by 50 basis points, and it may also be announced that the regulator's balance sheet will be reduced, which will correct the record inflation growth in the country, that has reached forty-year high, and support the national currency. Many experts believe that a sharp increase in rates could lead to a recession in the US economy; moreover, according to preliminary data in Q1 2022, it has already decreased by 1.4%. However, US Fed officials hope that a significant decline will not happen and are ready to take risks, considering a significant increase in prices a more serious problem than a possible slowdown in economic development.

Meanwhile, milk prices have continued their downward correction since mid-March, shedding 3.6% despite a general increase in the cost of raw materials and food products. Today, the Global Dairy Trade will publish new statistics, and if the current trend continues, the New Zealand currency may be under significant pressure.

The price fell below 0.6470 (Murray [5/8], Fibonacci retracement 50.0%), which opens the way to 0.6347 (Murray [4/8]) and 0.6295 (Fibonacci retracement 61.8%). The key for the "bulls" seems to be the level of 0.6591 (Murray [6/8]), consolidation above which will allow the trading instrument to continue its upward movement to the area of 0.6714 (Murray [7/8], the center line of Bollinger Bands) and 0.6835 (Murray [8/8]). However, this option is less likely at the moment, as technical indicators show that the downtrend continues: Bollinger Bands are reversing downwards, MACD is increasing in the negative zone, and Stochastic is horizontal in the oversold zone.

Resistance levels: 0.6591, 0.6714, 0.6835 | Support levels: 0.6347, 0.6295

Solid ECN, a True ECN Broker

Участник с Dec 08, 2021

325 комментариев

May 03, 2022 at 14:22

Участник с Dec 08, 2021

325 комментариев

European currency under pressure

The euro continues to trade at extremely low levels against its major counterparts, with the exception of the US dollar. Quotes of EURGBP are currently being corrected around 0.8391.

Macroeconomic data published the day before were weak: the Manufacturing PMI of Italy fell in April to 54.5 points from 55.8 points last month, and the same indicator in Germany declined to 54.6 points from 56.9 points, and only in France the value remained unchanged at the level of 55.7 points. Thus, the Composite Manufacturing PMI for the EU countries amounted to 55.5 points, which coincided with the March statistics and signals a slowdown in the eurozone economy.

In turn, the British currency currently looks much more confident than the European one. Today, data on the UK Manufacturing PMI for April will be published, and if the actual data coincide with the analysts' forecast, which suggests that the figure will remain unchanged at 55.3 points, this may serve as additional support for the pound.

Meanwhile, the issue of energy security in the EU and the UK is becoming increasingly acute. At the end of last week, German Chancellor Olaf Scholz announced that the country would not use its veto power over the EU decision to declare an embargo on Russian oil. He also announced the readiness to stop the supply of Russian coal this summer and refuse to import oil until the end of the year against the backdrop of a serious reduction in the purchase of "blue fuel". Meanwhile, the UK Treasury Chancellor said at a meeting with representatives of energy companies that the government is considering the option of imposing an additional tax on enterprises that are not ready to invest in protecting energy security. With gas prices skyrocketing, market participants, in his opinion, should include funding for a package of measures for the design of alternative energy sources and reducing imports in their development plans, since bills for ordinary citizens have doubled in the last year alone and will continue to grow in the autumn, which led to to social tension. Thus, the UK Labor Party is calling for a lump-sum tax on excess profits earned by companies such as BP Plc. and Shell Plc.

The asset is trading within the global Diamond pattern, and after reaching the resistance line, it forms a reversal. Technical indicators are holding a global buy signal, which is starting to weaken: fast EMAs on the Alligator indicator started to converge, and the AO oscillator histogram is forming descending bars, being in the buy zone.

Support levels: 0.8359, 0.8251 | Resistance levels: 0.8463, 0.8587

Solid ECN, a True ECN Broker

*Коммерческое использование и спам не допускаются и могут привести к аннулированию аккаунта.

Совет: Размещенные изображения или ссылки на Youtube автоматически вставляются в ваше сообщение!

Совет: введите знак @ для автоматического заполнения имени пользователя, участвующего в этом обсуждении.