Edit Your Comment

Newbie Question : USD/JPY Pair more volatile?

Участник с Jan 14, 2017

3 комментариев

Jan 20, 2017 at 08:18

Участник с Jan 14, 2017

3 комментариев

Hello,

I am new to forex and I am trying to understand things well before I trade with lvie accounts. I understand how profits/losses are calculated but I don't seem to get why profit/losses with USD/JPY pair differ from other pairs such as EUR/USD.

For example, when testing strategies in Demo Account. A buy of 2500 Size (.25 lots) gives me a a higher profit/loss ~between $50-$500 for USD/JPY pair. But, when I test the strategy against EUR/USD with same position size -2500, I get a lower profit loss range ($5-$50). Two Questions:

Q1.If profit/loss depends on pips then why so much difference in $ amount ? Is it that USD/JPY pair is much more volatile and there is a greater opportunity for profits or risk for loss?

Q2. Does entering a Position(long) of 2500 USD/JPY mean I need to have greater than $2500 in my account? Conversely, does entering a Short position with a size 2500 means selling $2500 USD to buy JPY? The math would say-

To put it in mathematical terms , here is how I am calculating profit when buying

Buying- 0.25 lots @114.50

Enter Long Calculation : 2500 X 114.50 = 286250 YEN

Selling -.25 Lots @114.70

Exit Long Calculation : 2500 X 114.70 = 286750 YEN

Difference =500 YEN . Applying current conversion rate results in 500/114.70 = $1 Profit @ 20 Pips

In the demo account however, I get a much higher profit amount ~$1000. What am I not getting???

Thank you for your help!!

I am new to forex and I am trying to understand things well before I trade with lvie accounts. I understand how profits/losses are calculated but I don't seem to get why profit/losses with USD/JPY pair differ from other pairs such as EUR/USD.

For example, when testing strategies in Demo Account. A buy of 2500 Size (.25 lots) gives me a a higher profit/loss ~between $50-$500 for USD/JPY pair. But, when I test the strategy against EUR/USD with same position size -2500, I get a lower profit loss range ($5-$50). Two Questions:

Q1.If profit/loss depends on pips then why so much difference in $ amount ? Is it that USD/JPY pair is much more volatile and there is a greater opportunity for profits or risk for loss?

Q2. Does entering a Position(long) of 2500 USD/JPY mean I need to have greater than $2500 in my account? Conversely, does entering a Short position with a size 2500 means selling $2500 USD to buy JPY? The math would say-

To put it in mathematical terms , here is how I am calculating profit when buying

Buying- 0.25 lots @114.50

Enter Long Calculation : 2500 X 114.50 = 286250 YEN

Selling -.25 Lots @114.70

Exit Long Calculation : 2500 X 114.70 = 286750 YEN

Difference =500 YEN . Applying current conversion rate results in 500/114.70 = $1 Profit @ 20 Pips

In the demo account however, I get a much higher profit amount ~$1000. What am I not getting???

Thank you for your help!!

Участник с Dec 17, 2015

28 комментариев

Jan 20, 2017 at 13:44

Участник с Dec 17, 2015

28 комментариев

Robsingh posted:

Q2. Does entering a Position(long) of 2500 USD/JPY mean I need to have greater than $2500 in my account?

Not necessary, it depends on the required margin / leverage you are using for your account as well as the margin call and stop out levels set by your broker. If you trade at 1:100, to open a position of 2500 USD you need to have more than 25 USD in your account, for example. 2500 is actually .025 lots.

Участник с Dec 17, 2015

28 комментариев

Jan 20, 2017 at 13:48

Участник с Dec 17, 2015

28 комментариев

Robsingh posted:

For example, when testing strategies in Demo Account. A buy of 2500 Size (.25 lots) gives me a a higher profit/loss ~between $50-$500 for USD/JPY pair. But, when I test the strategy against EUR/USD with same position size -2500, I get a lower profit loss range ($5-$50).

These are 2 separate instruments, 2 separate markets, so the same position (long/short) will certainly result in different outcome, so I am not sure what is not clear in this case. Maybe I couldn't get you point correctly.

Участник с Jan 14, 2017

3 комментариев

Jan 22, 2017 at 07:49

Участник с Jan 14, 2017

3 комментариев

janettte posted:Robsingh posted:

For example, when testing strategies in Demo Account. A buy of 2500 Size (.25 lots) gives me a a higher profit/loss ~between $50-$500 for USD/JPY pair. But, when I test the strategy against EUR/USD with same position size -2500, I get a lower profit loss range ($5-$50).

These are 2 separate instruments, 2 separate markets, so the same position (long/short) will certainly result in different outcome, so I am not sure what is not clear in this case. Maybe I couldn't get you point correctly.

Thank you for the reply.

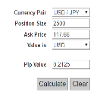

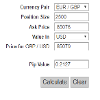

I understand that the results will be different. What I don't understand is - when look at Pip value for JPY and another pair , the value is approx the same (image attached)

But JPY has a greater profit/loss potential/risk for the same lot size (backtest image attached)

Участник с Apr 18, 2017

659 комментариев

May 08, 2017 at 11:05

Участник с Apr 18, 2017

659 комментариев

You can use GBP/JPY, this is the most volatile trading pair in Forex! By the way, USD/JPY is my favorite trading pair! For the reason that, I get more than 90% accuracy on USD/JPY from my personal trading tool! Actually, in my live trading I am always interested on major Forex pairs, these all are reliable to use!

Участник с Nov 21, 2015

5 комментариев

May 08, 2017 at 14:57

Участник с Nov 21, 2015

5 комментариев

Robsingh posted:

For example, when testing strategies in Demo Account. A buy of 2500 Size (.25 lots) gives me a a higher profit/loss ~between $50-$500 for USD/JPY pair. But, when I test the strategy against EUR/USD with same position size -2500, I get a lower profit loss range ($5-$50).

The ting that one particular strategy "works well" in one pair DOESN'T mean that it will also work on another one...the reasons depends on the strategies you are using everytime ;)

Участник с Feb 12, 2016

507 комментариев

May 09, 2017 at 11:26

Участник с Feb 12, 2016

507 комментариев

Robsingh posted:

Hello,

I am new to forex and I am trying to understand things well before I trade with lvie accounts. I understand how profits/losses are calculated but I don't seem to get why profit/losses with USD/JPY pair differ from other pairs such as EUR/USD.

The reason for this is because when you trade (for example 1.0 standard MT4 lot):

* USD/JPY - You are buying or selling 100,000 USD vs JPY (PnL result is in JPY); Point here is the 3rd digit

* EUR/USD - You are buying or selling 100,000 EUR vs USD (PnL result is in USD); Point here is 5th digit

You have different currencies and different exchange rates with different place of decimal point and you will have also different pip value.

Участник с Apr 18, 2017

659 комментариев

Jun 13, 2017 at 12:46

Участник с Apr 18, 2017

659 комментариев

Robsingh posted:

Hello,

I am new to forex and I am trying to understand things well before I trade with lvie accounts. I understand how profits/losses are calculated but I don't seem to get why profit/losses with USD/JPY pair differ from other pairs such as EUR/USD.

For example, when testing strategies in Demo Account. A buy of 2500 Size (.25 lots) gives me a a higher profit/loss ~between $50-$500 for USD/JPY pair. But, when I test the strategy against EUR/USD with same position size -2500, I get a lower profit loss range ($5-$50). Two Questions:

Q1.If profit/loss depends on pips then why so much difference in $ amount ? Is it that USD/JPY pair is much more volatile and there is a greater opportunity for profits or risk for loss?

Q2. Does entering a Position(long) of 2500 USD/JPY mean I need to have greater than $2500 in my account? Conversely, does entering a Short position with a size 2500 means selling $2500 USD to buy JPY? The math would say-

To put it in mathematical terms , here is how I am calculating profit when buying

Buying- 0.25 lots @114.50

Enter Long Calculation : 2500 X 114.50 = 286250 YEN

Selling -.25 Lots @114.70

Exit Long Calculation : 2500 X 114.70 = 286750 YEN

Difference =500 YEN . Applying current conversion rate results in 500/114.70 = $1 Profit @ 20 Pips

In the demo account however, I get a much higher profit amount ~$1000. What am I not getting???

Thank you for your help!!

Among JPY pairs, GBP/JPY is the most volatile one! It’s known as dragon pair because of it’s nature! I actually always use volatile currency pair since it produces my daily trading target so quickly! On the other hand, USD/JPY is average volatile as like others major currency pairs!

*Коммерческое использование и спам не допускаются и могут привести к аннулированию аккаунта.

Совет: Размещенные изображения или ссылки на Youtube автоматически вставляются в ваше сообщение!

Совет: введите знак @ для автоматического заполнения имени пользователя, участвующего в этом обсуждении.