Edit Your Comment

Profit / loss analysis and trading talks

Участник с May 19, 2020

321 комментариев

May 22, 2024 at 09:13

Участник с May 19, 2020

321 комментариев

Raven1209 posted:

@MarcellusLux

Caught the price nudging past the TP after I closed out—classic, right?:) Though I was about 90% confident I'd hit that level eventually, but those 10% doubts...

Regarding the SL, it was more of a guideline—marked in red but not formally set. The price went close the first time (1.07931), but didn't reach the red line, and the second peak (1.07892) was even lower, which was reassuring. No major improvements to my strategy just yet since the profit was made. But definitely thinking about a more patient stance going forward.

About take profit and the classic “In order not to lose profit, I closed it earlier” I sincerely believe that this is not a big mistake, compared (for example) to closing loss without reaching a stop loss level. The situations are similar but actually lead to different consequences. I had such mistakes and I worked with them to eliminate them.

@Marcellus8610

Участник с Sep 29, 2022

68 комментариев

May 22, 2024 at 17:25

Участник с Sep 29, 2022

68 комментариев

@khalidkhan82118 When it comes to deciding whether to hold out for more or take the current profit, it really comes down to my past trading experiences and what the market is showing me at the moment. I use a mix of looking at the charts and trusting my instincts to make these calls.

When I’m unsure about closing a position, I focus on what the market trends are telling me and stick to my original trading plan, but I’m ready to adjust if things change sharply.

Regarding my SL strategy, as I've already said, I prefer to use it as a flexible guideline rather than a strict rule. This way, I can adjust better to sudden market changes without getting kicked out of my position too early. It’s a bit riskier, but it often works out by letting my trades develop fully.

@MarcellusLux Thanks, Marcellus! I appreciate the kind words and your tips!

When I’m unsure about closing a position, I focus on what the market trends are telling me and stick to my original trading plan, but I’m ready to adjust if things change sharply.

Regarding my SL strategy, as I've already said, I prefer to use it as a flexible guideline rather than a strict rule. This way, I can adjust better to sudden market changes without getting kicked out of my position too early. It’s a bit riskier, but it often works out by letting my trades develop fully.

@MarcellusLux Thanks, Marcellus! I appreciate the kind words and your tips!

Участник с Dec 28, 2023

41 комментариев

May 24, 2024 at 16:00

Участник с Dec 28, 2023

41 комментариев

MarcellusLux posted:Raven1209 posted:

@MarcellusLux

Caught the price nudging past the TP after I closed out—classic, right?:) Though I was about 90% confident I'd hit that level eventually, but those 10% doubts...

Regarding the SL, it was more of a guideline—marked in red but not formally set. The price went close the first time (1.07931), but didn't reach the red line, and the second peak (1.07892) was even lower, which was reassuring. No major improvements to my strategy just yet since the profit was made. But definitely thinking about a more patient stance going forward.

You come across as a prudent trader. I hope that your trading will reward you for your work. It's good practice to have a maximum possible risk level, and not having a set stop loss level programmatically does not make your trade any riskier.

Why doesn't the absence of a stop loss make trading riskier? Most people say that placing a stop loss is necessary to minimize risk.

Участник с May 25, 2024

1 комментариев

May 25, 2024 at 08:34

Участник с May 25, 2024

1 комментариев

Gert12 posted:MarcellusLux posted:Raven1209 posted:

@MarcellusLux

Caught the price nudging past the TP after I closed out—classic, right?:) Though I was about 90% confident I'd hit that level eventually, but those 10% doubts...

Regarding the SL, it was more of a guideline—marked in red but not formally set. The price went close the first time (1.07931), but didn't reach the red line, and the second peak (1.07892) was even lower, which was reassuring. No major improvements to my strategy just yet since the profit was made. But definitely thinking about a more patient stance going forward.

You come across as a prudent trader. I hope that your trading will reward you for your work. It's good practice to have a maximum possible risk level, and not having a set stop loss level programmatically does not make your trade any riskier.

Why doesn't the absence of a stop loss make trading riskier? Most people say that placing a stop loss is necessary to minimize risk.

Not using a stop-loss can make trading riskier because it leaves your positions open to the full brunt of market volatility. Most traders agree that a stop loss is a critical safeguard, as it automatically exits a trade at a predefined loss threshold, helping to prevent emotional decision-making and protect your capital from significant downturns.

Участник с May 23, 2024

20 комментариев

May 27, 2024 at 07:00

Участник с May 23, 2024

20 комментариев

RallyRider posted:Gert12 posted:MarcellusLux posted:Raven1209 posted:

@MarcellusLux

Caught the price nudging past the TP after I closed out—classic, right?:) Though I was about 90% confident I'd hit that level eventually, but those 10% doubts...

Regarding the SL, it was more of a guideline—marked in red but not formally set. The price went close the first time (1.07931), but didn't reach the red line, and the second peak (1.07892) was even lower, which was reassuring. No major improvements to my strategy just yet since the profit was made. But definitely thinking about a more patient stance going forward.

You come across as a prudent trader. I hope that your trading will reward you for your work. It's good practice to have a maximum possible risk level, and not having a set stop loss level programmatically does not make your trade any riskier.

Why doesn't the absence of a stop loss make trading riskier? Most people say that placing a stop loss is necessary to minimize risk.

Not using a stop-loss can make trading riskier because it leaves your positions open to the full brunt of market volatility. Most traders agree that a stop loss is a critical safeguard, as it automatically exits a trade at a predefined loss threshold, helping to prevent emotional decision-making and protect your capital from significant downturns.

Regarding stop loss, this is inevitable. Setting a stop loss is a necessary measure to minimize risk. This is the key to surviving in a one-sided market and will only allow your profits to continue to increase.

Участник с May 19, 2020

321 комментариев

May 28, 2024 at 15:39

Участник с May 19, 2020

321 комментариев

Gert12 posted:MarcellusLux posted:Raven1209 posted:

@MarcellusLux

Caught the price nudging past the TP after I closed out—classic, right?:) Though I was about 90% confident I'd hit that level eventually, but those 10% doubts...

Regarding the SL, it was more of a guideline—marked in red but not formally set. The price went close the first time (1.07931), but didn't reach the red line, and the second peak (1.07892) was even lower, which was reassuring. No major improvements to my strategy just yet since the profit was made. But definitely thinking about a more patient stance going forward.

You come across as a prudent trader. I hope that your trading will reward you for your work. It's good practice to have a maximum possible risk level, and not having a set stop loss level programmatically does not make your trade any riskier.

Why doesn't the absence of a stop loss make trading riskier? Most people say that placing a stop loss is necessary to minimize risk.

The use of stop losses is situational and can be justified or harmful during various market events.

If a trader starts using stop loss in any case (using just for the fact of usage), this will lead to losses and cause dependence on stop levels. I consider a much more important aspect to be the correct assessment of probabilities and control of possible risk taking into account these probabilities.

If it seems to you that I am standing against using stop losses, then you are wrong. If you look at my trading, you will notice that I use this risk control option, but not on 100% of my trades.

@Marcellus8610

Участник с May 19, 2020

321 комментариев

May 28, 2024 at 15:43

Участник с May 19, 2020

321 комментариев

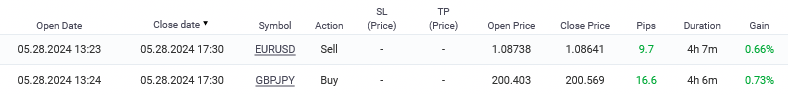

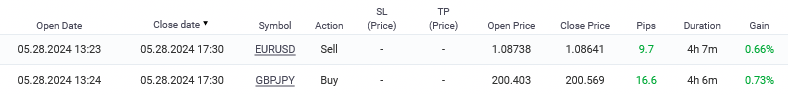

LUX trading today was quick and didn't follow any long term goals. The task was to catch the minimum impulse after the impact of key historical levels.

The EUR/USD was close to continuing to rise and I was ready to accept some drawdown, but the sell chosen due to a clear MACD signal on the 30-minute chart and a high RSI level in the overbought zone. The price was not ready to break through the key level of 1.08800 and consolidate for further testing of 1.08900.

The GBP/JPY is currently in a very promising position for continued growth. But I was not ready to hold the position for a long time, fearing the psychological aspect and the growth cancelling due to the approach to 70 RSI and the long term developing MACD divergence, which can be seen on the hourly chart. I opened a short-term position after several attempts to break through the 200.400 and MACD signal with a move to the positive value zone on the 15-minute chart. However, the important fact is that after breaking through the 2015 high key level at 196.00, GBP/JPY has not been at its current price level above the 200.00 mark since 2008.

The EUR/USD was close to continuing to rise and I was ready to accept some drawdown, but the sell chosen due to a clear MACD signal on the 30-minute chart and a high RSI level in the overbought zone. The price was not ready to break through the key level of 1.08800 and consolidate for further testing of 1.08900.

The GBP/JPY is currently in a very promising position for continued growth. But I was not ready to hold the position for a long time, fearing the psychological aspect and the growth cancelling due to the approach to 70 RSI and the long term developing MACD divergence, which can be seen on the hourly chart. I opened a short-term position after several attempts to break through the 200.400 and MACD signal with a move to the positive value zone on the 15-minute chart. However, the important fact is that after breaking through the 2015 high key level at 196.00, GBP/JPY has not been at its current price level above the 200.00 mark since 2008.

@Marcellus8610

Участник с Aug 19, 2021

203 комментариев

May 28, 2024 at 17:38

Участник с Aug 19, 2021

203 комментариев

Oh, if we have already talked about stop loss. I know other theory about SL. The more often you put a stop loss, the more often it works and you lose. 😄😄😄

Do I agree with this? Yes and no. But now SL more often saves me from big losses. lol

Do I agree with this? Yes and no. But now SL more often saves me from big losses. lol

Участник с May 10, 2023

30 комментариев

May 30, 2024 at 09:42

Участник с May 10, 2023

30 комментариев

MarcellusLux posted:

LUX trading today was quick and didn't follow any long term goals. The task was to catch the minimum impulse after the impact of key historical levels.

The EUR/USD was close to continuing to rise and I was ready to accept some drawdown, but the sell chosen due to a clear MACD signal on the 30-minute chart and a high RSI level in the overbought zone. The price was not ready to break through the key level of 1.08800 and consolidate for further testing of 1.08900.

The GBP/JPY is currently in a very promising position for continued growth. But I was not ready to hold the position for a long time, fearing the psychological aspect and the growth cancelling due to the approach to 70 RSI and the long term developing MACD divergence, which can be seen on the hourly chart. I opened a short-term position after several attempts to break through the 200.400 and MACD signal with a move to the positive value zone on the 15-minute chart. However, the important fact is that after breaking through the 2015 high key level at 196.00, GBP/JPY has not been at its current price level above the 200.00 mark since 2008.

https://www.myfxbook.com/files/MarcellusLux/recent_trades_May_28_%28IedYE8%29_for_LK.png

Interesting take! rsi, macd, and ema are classic combinations of indicators that help achieve good accuracy in trading.

Участник с Sep 02, 2022

57 комментариев

May 30, 2024 at 17:56

Участник с Sep 02, 2022

57 комментариев

MarcellusLux posted:

LUX trading today was quick and didn't follow any long term goals. The task was to catch the minimum impulse after the impact of key historical levels.

The EUR/USD was close to continuing to rise and I was ready to accept some drawdown, but the sell chosen due to a clear MACD signal on the 30-minute chart and a high RSI level in the overbought zone. The price was not ready to break through the key level of 1.08800 and consolidate for further testing of 1.08900.

The GBP/JPY is currently in a very promising position for continued growth. But I was not ready to hold the position for a long time, fearing the psychological aspect and the growth cancelling due to the approach to 70 RSI and the long term developing MACD divergence, which can be seen on the hourly chart. I opened a short-term position after several attempts to break through the 200.400 and MACD signal with a move to the positive value zone on the 15-minute chart. However, the important fact is that after breaking through the 2015 high key level at 196.00, GBP/JPY has not been at its current price level above the 200.00 mark since 2008.

https://www.myfxbook.com/files/MarcellusLux/recent_trades_May_28_%28IedYE8%29_for_LK.png

If you look in the short term, the pair reached the level of 200.00 and began a slight rebound downwards. But in the future I am betting on the growth of the GBPJPY.

Участник с May 31, 2024

7 комментариев

May 31, 2024 at 10:15

Участник с May 31, 2024

7 комментариев

"rsi, macd, and ema" are classically used indicators but I have never found them useful as predictive tools. They lag so much that they are worthless. I like price action only analysis

Участник с Jan 15, 2024

37 комментариев

May 31, 2024 at 11:30

Участник с Jan 15, 2024

37 комментариев

Any indicators are essentially a waste of time, with rare exceptions like MA. However, it's crucial to understand what you’re using these values for. The core focus should always be on events impacting prices.

Участник с Dec 28, 2023

41 комментариев

Jun 03, 2024 at 12:13

Участник с Dec 28, 2023

41 комментариев

ChaKie posted:MarcellusLux posted:

LUX trading today was quick and didn't follow any long term goals. The task was to catch the minimum impulse after the impact of key historical levels.

The EUR/USD was close to continuing to rise and I was ready to accept some drawdown, but the sell chosen due to a clear MACD signal on the 30-minute chart and a high RSI level in the overbought zone. The price was not ready to break through the key level of 1.08800 and consolidate for further testing of 1.08900.

The GBP/JPY is currently in a very promising position for continued growth. But I was not ready to hold the position for a long time, fearing the psychological aspect and the growth cancelling due to the approach to 70 RSI and the long term developing MACD divergence, which can be seen on the hourly chart. I opened a short-term position after several attempts to break through the 200.400 and MACD signal with a move to the positive value zone on the 15-minute chart. However, the important fact is that after breaking through the 2015 high key level at 196.00, GBP/JPY has not been at its current price level above the 200.00 mark since 2008.

https://www.myfxbook.com/files/MarcellusLux/recent_trades_May_28_%28IedYE8%29_for_LK.png

Interesting take! rsi, macd, and ema are classic combinations of indicators that help achieve good accuracy in trading.

Are there any other combinations of indicators?

Участник с Oct 31, 2022

2 комментариев

Jun 03, 2024 at 13:19

Участник с Oct 31, 2022

2 комментариев

lexusxxx posted:MarcellusLux posted:

LUX trading today was quick and didn't follow any long term goals. The task was to catch the minimum impulse after the impact of key historical levels.

The EUR/USD was close to continuing to rise and I was ready to accept some drawdown, but the sell chosen due to a clear MACD signal on the 30-minute chart and a high RSI level in the overbought zone. The price was not ready to break through the key level of 1.08800 and consolidate for further testing of 1.08900.

The GBP/JPY is currently in a very promising position for continued growth. But I was not ready to hold the position for a long time, fearing the psychological aspect and the growth cancelling due to the approach to 70 RSI and the long term developing MACD divergence, which can be seen on the hourly chart. I opened a short-term position after several attempts to break through the 200.400 and MACD signal with a move to the positive value zone on the 15-minute chart. However, the important fact is that after breaking through the 2015 high key level at 196.00, GBP/JPY has not been at its current price level above the 200.00 mark since 2008.

https://www.myfxbook.com/files/MarcellusLux/recent_trades_May_28_%28IedYE8%29_for_LK.png

If you look in the short term, the pair reached the level of 200.00 and began a slight rebound downwards. But in the future I am betting on the growth of the GBPJPY.

It feels like you trade without using indicators at all. How do you trade without indicators??

Участник с May 31, 2024

7 комментариев

Jun 03, 2024 at 14:59

Участник с May 31, 2024

7 комментариев

indicators can be helpful as long as you know their limitations and what they are really showing. The problem comes when people think that indicators produce trade signals

Участник с Aug 19, 2021

203 комментариев

Jun 04, 2024 at 18:35

Участник с Aug 19, 2021

203 комментариев

rightstufffred posted:

indicators can be helpful as long as you know their limitations and what they are really showing. The problem comes when people think that indicators produce trade signals

Oh that’s right friend.

Участник с Sep 02, 2022

57 комментариев

Jun 05, 2024 at 14:50

Участник с Sep 02, 2022

57 комментариев

MarcellusLux posted:Gert12 posted:MarcellusLux posted:Raven1209 posted:

@MarcellusLux

Caught the price nudging past the TP after I closed out—classic, right?:) Though I was about 90% confident I'd hit that level eventually, but those 10% doubts...

Regarding the SL, it was more of a guideline—marked in red but not formally set. The price went close the first time (1.07931), but didn't reach the red line, and the second peak (1.07892) was even lower, which was reassuring. No major improvements to my strategy just yet since the profit was made. But definitely thinking about a more patient stance going forward.

You come across as a prudent trader. I hope that your trading will reward you for your work. It's good practice to have a maximum possible risk level, and not having a set stop loss level programmatically does not make your trade any riskier.

Why doesn't the absence of a stop loss make trading riskier? Most people say that placing a stop loss is necessary to minimize risk.

The use of stop losses is situational and can be justified or harmful during various market events.

If a trader starts using stop loss in any case (using just for the fact of usage), this will lead to losses and cause dependence on stop levels. I consider a much more important aspect to be the correct assessment of probabilities and control of possible risk taking into account these probabilities.

If it seems to you that I am standing against using stop losses, then you are wrong. If you look at my trading, you will notice that I use this risk control option, but not on 100% of my trades.

I agree with you. Personally, I am cautious about sl. I'm afraid I'll lose more than I could earn while it hesitates. I try not to put it anywhere now. Or rather, my EA does not put sl.

Участник с May 19, 2020

321 комментариев

Jun 06, 2024 at 10:50

Участник с May 19, 2020

321 комментариев

lexusxxx posted:MarcellusLux posted:

LUX trading today was quick and didn't follow any long term goals. The task was to catch the minimum impulse after the impact of key historical levels.

The EUR/USD was close to continuing to rise and I was ready to accept some drawdown, but the sell chosen due to a clear MACD signal on the 30-minute chart and a high RSI level in the overbought zone. The price was not ready to break through the key level of 1.08800 and consolidate for further testing of 1.08900.

The GBP/JPY is currently in a very promising position for continued growth. But I was not ready to hold the position for a long time, fearing the psychological aspect and the growth cancelling due to the approach to 70 RSI and the long term developing MACD divergence, which can be seen on the hourly chart. I opened a short-term position after several attempts to break through the 200.400 and MACD signal with a move to the positive value zone on the 15-minute chart. However, the important fact is that after breaking through the 2015 high key level at 196.00, GBP/JPY has not been at its current price level above the 200.00 mark since 2008.

https://www.myfxbook.com/files/MarcellusLux/recent_trades_May_28_%28IedYE8%29_for_LK.png

If you look in the short term, the pair reached the level of 200.00 and began a slight rebound downwards. But in the future I am betting on the growth of the GBPJPY.

Yes, the current GBP/JPY not so confident in short term as it was above 200.00. However, I suppose this is a temporary correction and the growth is highly possible, I agree with your opinion. At least the level of 215.800 may be a possible key level to reach.

@Marcellus8610

Участник с May 19, 2020

321 комментариев

Jun 06, 2024 at 11:02

Участник с May 19, 2020

321 комментариев

RrrubR posted:lexusxxx posted:MarcellusLux posted:

LUX trading today was quick and didn't follow any long term goals. The task was to catch the minimum impulse after the impact of key historical levels.

The EUR/USD was close to continuing to rise and I was ready to accept some drawdown, but the sell chosen due to a clear MACD signal on the 30-minute chart and a high RSI level in the overbought zone. The price was not ready to break through the key level of 1.08800 and consolidate for further testing of 1.08900.

The GBP/JPY is currently in a very promising position for continued growth. But I was not ready to hold the position for a long time, fearing the psychological aspect and the growth cancelling due to the approach to 70 RSI and the long term developing MACD divergence, which can be seen on the hourly chart. I opened a short-term position after several attempts to break through the 200.400 and MACD signal with a move to the positive value zone on the 15-minute chart. However, the important fact is that after breaking through the 2015 high key level at 196.00, GBP/JPY has not been at its current price level above the 200.00 mark since 2008.

https://www.myfxbook.com/files/MarcellusLux/recent_trades_May_28_%28IedYE8%29_for_LK.png

If you look in the short term, the pair reached the level of 200.00 and began a slight rebound downwards. But in the future I am betting on the growth of the GBPJPY.

It feels like you trade without using indicators at all. How do you trade without indicators??

I mentioned the way I trade in the post you quoted. Anyway, if you are interested in my trading, I suggest you find my website in the bio and find out the details, or request more specific information you are interested in.

@Marcellus8610

Участник с Jan 15, 2024

37 комментариев

Jun 07, 2024 at 11:00

Участник с Jan 15, 2024

37 комментариев

Gert12 posted:ChaKie posted:MarcellusLux posted:

LUX trading today was quick and didn't follow any long term goals. The task was to catch the minimum impulse after the impact of key historical levels.

The EUR/USD was close to continuing to rise and I was ready to accept some drawdown, but the sell chosen due to a clear MACD signal on the 30-minute chart and a high RSI level in the overbought zone. The price was not ready to break through the key level of 1.08800 and consolidate for further testing of 1.08900.

The GBP/JPY is currently in a very promising position for continued growth. But I was not ready to hold the position for a long time, fearing the psychological aspect and the growth cancelling due to the approach to 70 RSI and the long term developing MACD divergence, which can be seen on the hourly chart. I opened a short-term position after several attempts to break through the 200.400 and MACD signal with a move to the positive value zone on the 15-minute chart. However, the important fact is that after breaking through the 2015 high key level at 196.00, GBP/JPY has not been at its current price level above the 200.00 mark since 2008.

https://www.myfxbook.com/files/MarcellusLux/recent_trades_May_28_%28IedYE8%29_for_LK.png

Interesting take! rsi, macd, and ema are classic combinations of indicators that help achieve good accuracy in trading.

Are there any other combinations of indicators?

I think there is no point in trying to justify market movements with meaningless lines when movements are caused by specific events in the political and economic arena.

*Коммерческое использование и спам не допускаются и могут привести к аннулированию аккаунта.

Совет: Размещенные изображения или ссылки на Youtube автоматически вставляются в ваше сообщение!

Совет: введите знак @ для автоматического заполнения имени пользователя, участвующего в этом обсуждении.

_for_LK.png)