GBPUSD gains some confidence for new higher high

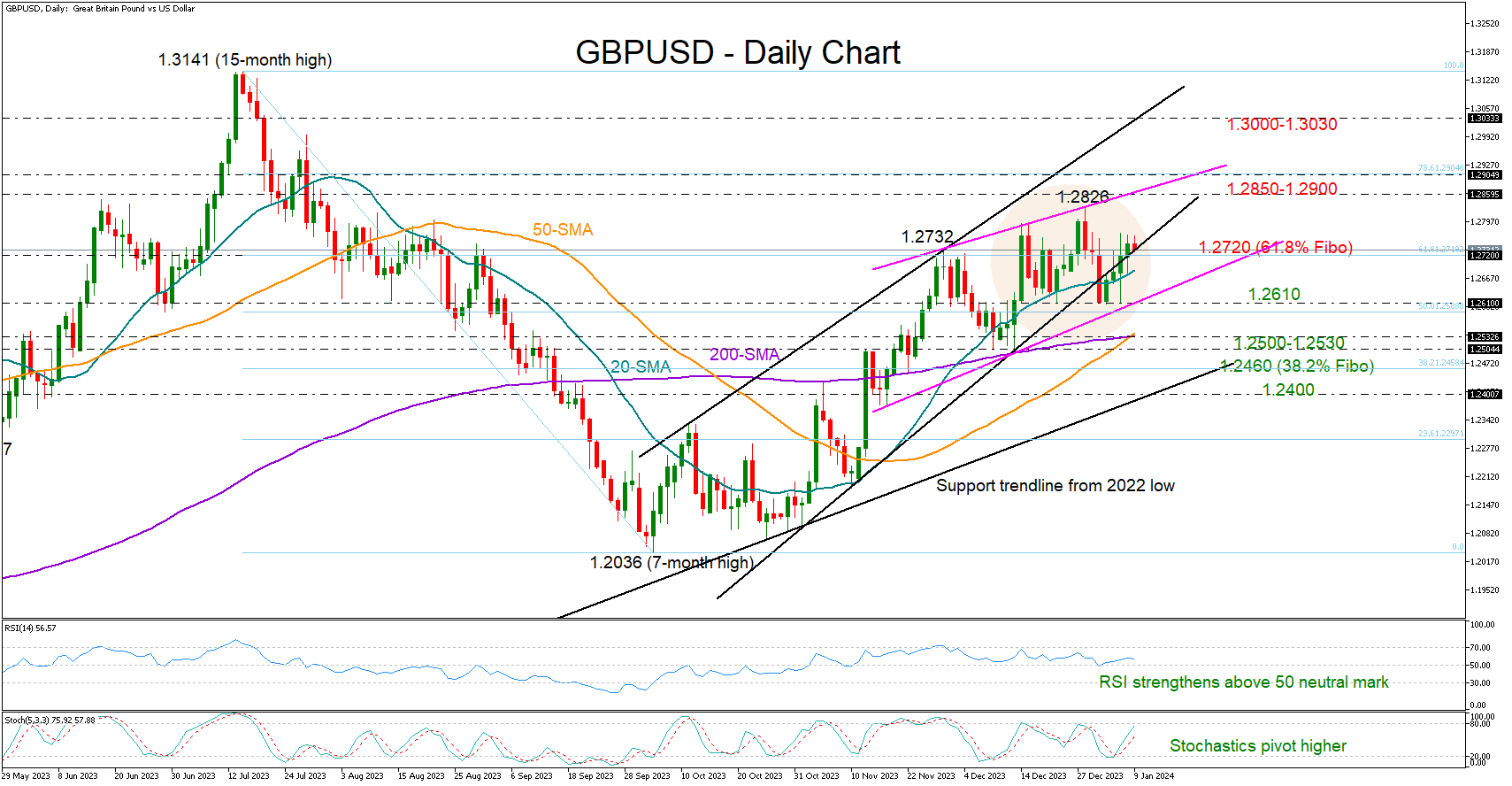

GBPUSD stepped on the 20-day simple moving average (SMA) and climbed back above the broken short-term support trendline from October at 1.2720, reviving hopes that the soft four-day bullish wave could gain extra legs in the coming sessions.

The positive trajectory in the RSI and the stochastic oscillator is endorsing the bullish case, increasing the odds for a bounce towards the 1.2850-1.2900 resistance region. Note that the short-term ascending line from November 2023 is passing through this area. Hence, a decisive close above it could encourage a direct flight towards the 1.3000 psychological mark and the tentative ascending line, which connects the highs from October and November.

On the downside, the 20-day SMA will remain under the spotlight at 1.2686. A break below that line is expected to see a test near the crucial floor of 1.2610. If the bears drive below that base, confirming a negative head and shoulders pattern, the price could tumble towards its 50- and 200-day SMAs, which are currently trying to complete a golden cross around 1.2532. Additional declines from there might last till the 2020 upward-sloping trendline at 1.2400, unless the 1.2460 barrier blocks the way down.

All in all, GBPUSD has restored some optimism in the short-term picture after the close above the 1.2720 bar. Overall, the outlook may not deteriorate unless the 1.2610 floor cracks.