Can the AI chip boom survive a new tech cold war?

The AI revolution is accelerating - but it’s entering a battlefield. As global semiconductor revenue soared to a record $656 billion in 2024 (up 21% year over year, per Gartner), the optimism around AI chip growth is running into a more complicated truth: the world’s leading chipmakers are now caught in the crossfire of a deepening tech cold war.

A bar chart showing 2024 global semiconductor revenue at $656 billion, up 21% from 2023.

Source: Gartner (April 2025)

This new era of tension - marked by tightened export controls, retaliatory tariffs, and mounting national security scrutiny - is forcing companies like Nvidia and Intel to rethink where they sell and how they build, invest, and lead.

Nvidia’s export block and strategic pivot

Nvidia is at the center of the storm. The AI chip juggernaut recently took a $5.5 billion hit tied to new U.S. restrictions on exporting its popular H20 chips to China. The requirement for an export license, imposed indefinitely, underscores Washington’s effort to limit China’s access to high-performance AI chips.

Markets reacted sharply - Nvidia’s shares dropped 6% in after-hours trading - but the company is already pivoting. A newly announced $500 billion investment in U.S.-based AI supercomputing facilities shows Nvidia is shifting its strategy to align with reshoring trends and national security goals.

In effect, the company is doubling down on domestic dominance. While the export controls may hurt short-term sales, they shield Nvidia from future policy shocks and deepen its control over critical AI infrastructure.

Intel’s reset and refocus

Intel, facing its own transformation arc, is taking a different path. The company recently sold a 51% stake in its Altera unit to Silver Lake, valuing the business at $8.75 billion. The move frees Altera to operate independently while Intel focuses on its foundry services and manufacturing scale.

It’s a strategic move aimed at sharpening Intel’s edge in a world where manufacturing sovereignty is becoming a core geopolitical concern. By shedding non-core units and reinforcing its U.S.-based production, Intel is trying to future-proof its role in the global chip supply chain.

Analysts say it’s less about revenue now and more about survival through strategic clarity.

The trade war reignites

Meanwhile, tensions between the U.S. and China are flaring once again. The U.S. recently delayed tariffs on consumer electronics like smartphones and laptops, briefly lifting tech sentiment. But that was quickly met with China’s pledge to raise tariffs on U.S. imports by up to 125%, reigniting fears of a prolonged trade war.

Both Nvidia and Intel are feeling the squeeze. Markets are volatile, supply chains are at risk, and demand forecasts are clouded by uncertainty. Yet despite all this, AI remains a powerful tailwind.

Oppenheimer’s Rick Schafer calls AI the “best and safest growth vector” amid macro instability. Industries ranging from healthcare to robotics to autonomous vehicles are increasing their AI chip needs, even as global policy makes access to those chips more fraught.

AI's ascent meets geopolitical resistance

The question isn’t whether AI demand will fade - it’s whether the companies supplying the AI age can stay agile under pressure. Nvidia is investing inward to weather the storm, and Intel is restructuring to reclaim relevance. Both are adapting, but neither is immune.

As earnings season kicks off for key players like TSMC, Intel, and Nvidia, the spotlight will fall not just on margins and market share but on strategy. In this new era, success will be defined not only by how fast a chip runs but also by where it’s built, where it’s allowed to go, and who controls the gate.

A boom under siege

The AI chip boom isn’t over - but it’s entering a more complex phase. The golden age of unfettered global tech trade is behind us. What lies ahead is a fragmented, policy-driven landscape where resilience, political foresight, and local investment matter as much as innovation.

Nvidia and Intel are early test cases. Their ability to adapt could determine whether the AI chip boom continues or becomes a new tech cold war casualty.

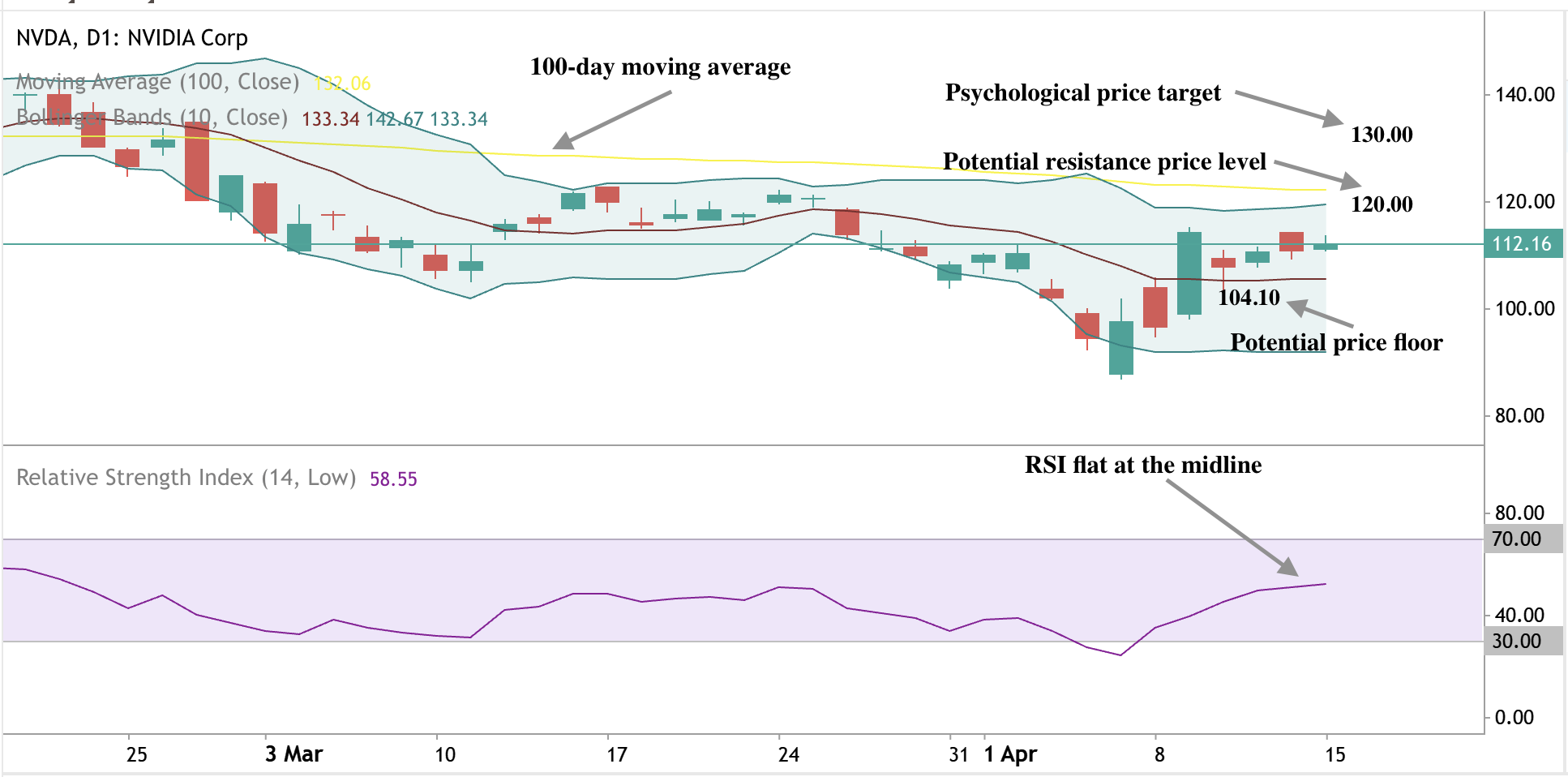

Technical analysis: Buying the dips?

Nvidia’s stock is hovering around the $112 mark, with signs of recovery evident on the daily chart. The RSI flatlining at the midline suggests low momentum, hinting that we might see some consolidation. Prices remaining below the moving average suggest the major trend is still downward unless there is a significant uptick below the moving average.

Should prices slide, a potential price floor is at the $104.10 level. Should we see a significant uptick, we could see resistance at $120.00, with a potential price target at $130.00.

Nvidia daily stock chart showing recent recovery signs, with RSI flatlining and price below the moving average.

Source: Deriv MT5

After a significant uptick last week, Intel is seeing considerable sell pressure around the $19.83 price level. Prices below the moving average could signal that the latest down move could continue the larger trend. RSI pointing downwards adds to this narrative. Should prices continue the slump, $19.25 is the key price level to watch. Should we see a bounce, prices could be held at $21.00 and $22.40.

Source: Deriv MT5