Cryptocurrency traders pause after growth

Market picture

Crypto market capitalisation was near $1.42 trillion on Monday morning, roughly where we saw it a week earlier. Failure to build on the growth at the end of last week caused moderate pressure on prices across a wide range of coins.

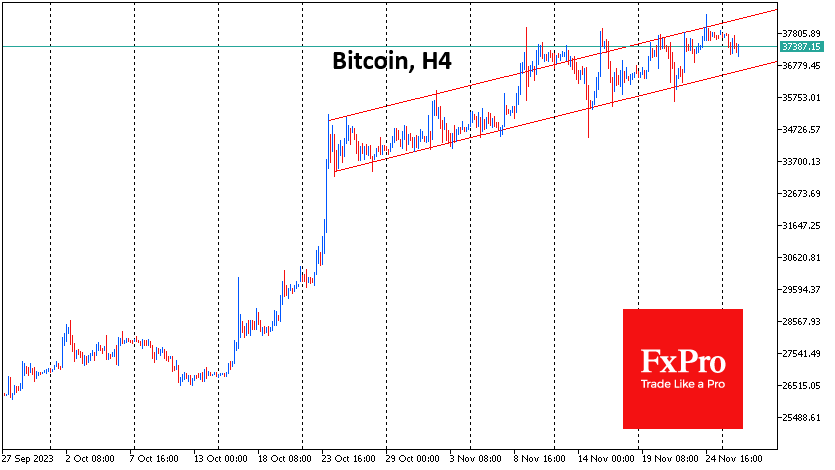

For example, the Bitcoin exchange rate was pulling back to $37.0K, having remained within an uptrend for over a month now, with the lower boundary now at $36.6K and the upper boundary at $38.3K. Only a decline below the lower boundary will question the sustainability of the uptrend. Until then, the prevalence of buying on declines in the major cryptocurrencies is very likely.

As a result of another recalculation, Bitcoin mining difficulty increased by 5%. The index reached an all-time high at 67.96 T. The average hash rate for the period since the previous change in the value was 486 EH/s. According to CryptoQuant data, selling pressure from miners is at its lowest level since 2017. Meanwhile, 82% of Bitcoin holders are in profit, and only 15%.

Ethereum failed to hold above $2100 levels for the third time this year. Before that, there were attempts in April and early November. The second most important cryptocurrency rolled back to $2050, which does not look scary yet but sets up for increased pressure in the short term.

News background

The US Commodity Futures Trading Commission (CFTC) has warned crypto exchanges that it will aggressively pursue crypto platforms operating in the US market if they seek to circumvent the CFTC's customer protection regime.

The surge of interest in spot bitcoin ETFs amid the wait for US regulatory approval could potentially attract up to $70bn of new capital into BTC. The forecast assumes that 10 per cent of the money currently invested in mainstream stock and bond ETFs will move into bitcoin ETFs.

The outflow from the GBTC fund, when converted to a spot ETF, would be $2.7bn, JPMorgan forecasts. GBTC fund shares were previously sold at a discount, and after conversion, their price should be equal to the price of BTC. At the same time, many traders will decide to lock in profits, which will put pressure on the price of the first cryptocurrency.

Crypto analyst Dan Gambardello suggested that during the next bull rally in the crypto market, Cardano (ADA) could rise to $11, thanks to the growth of Bitcoin. ADA's growth will also be helped by the growing decentralised finance (DeFi) ecosystem, which uses Cardano's blockchain. According to Gambardello, Cardano has an advantage over Ethereum in terms of reliability, security, and decentralisation.

ECB President Christine Lagarde, who often criticises cryptocurrencies, admitted that her son invested in digital assets but failed to guess the trend and lost almost all his invested money.

By the FxPro Analyst team

-11122024742.png)

-11122024742.png)