GBPUSD pulls back into the negative zone

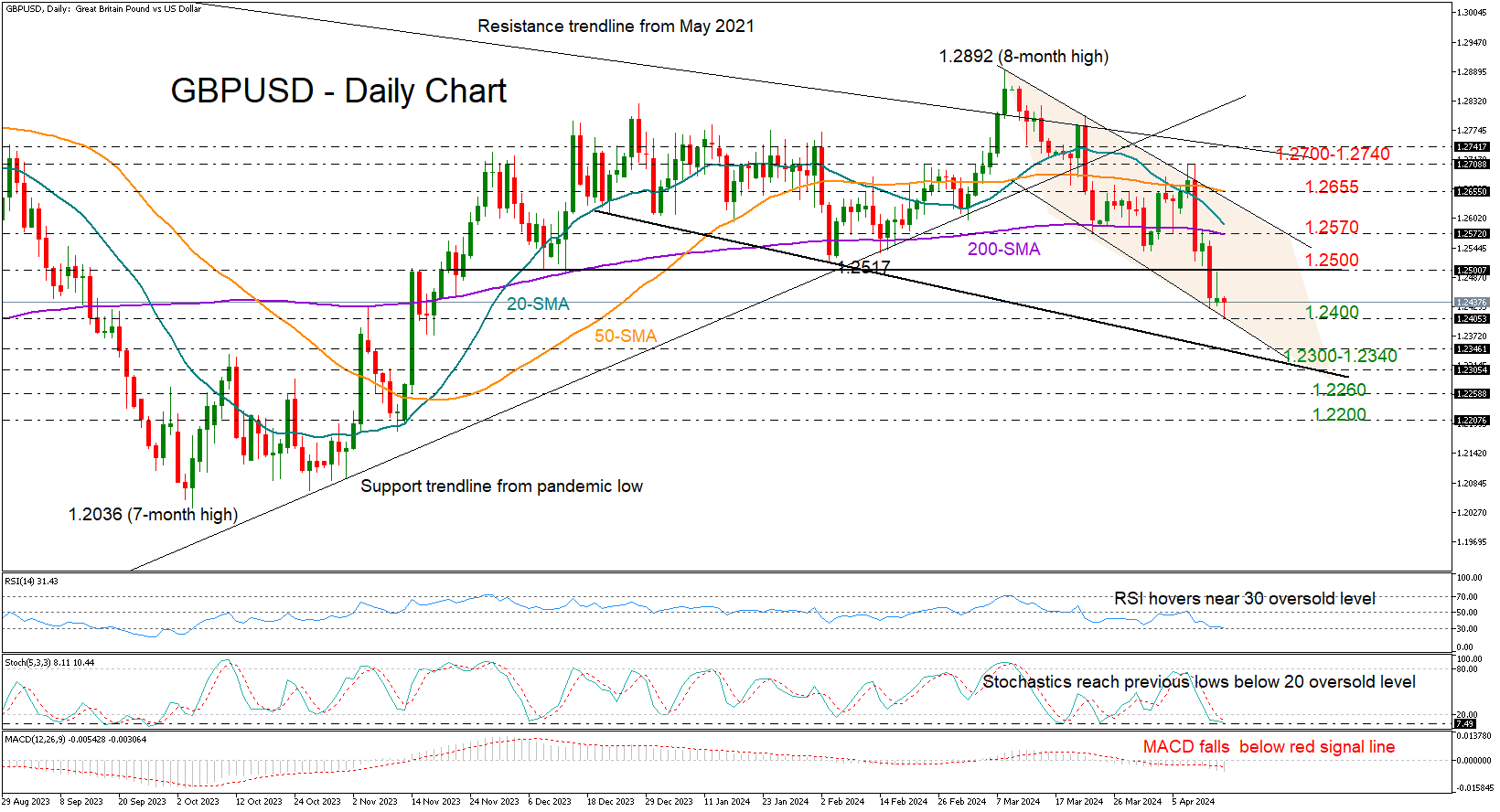

GBPUSD tried to breach the psychological barrier at 1.2500 and re-establish itself within the 1.2488-1.2892 range. But its efforts proved unsuccessful, with the pair charting a new lower low of 1.2405 during Tuesday’s early trading hours – the lowest level since November 2023.

The bears might take a breather soon as the stochastic oscillator has reached its previous support area below 20, and the RSI is hovering around the 30 oversold level, suggesting the bulls could be on their way.

However, the short-term outlook will remain negative until the price runs sustainably above the downward-sloping channel and the 50-day SMA at 1.2655. Discouragingly, the weakening SMAs and the narrowing gap between the 20- and 200-day SMAs are currently dampening hopes for a bullish trend reversal. Nonetheless, if the bulls succeed in taking charge above 1.2655, the spotlight will shift to the 1.2700-1.2740 level. Another victory there is expected to result in a test near the broken support trendline from the pandemic low near 1.2820.

If selling forces persist, the pair could tumble towards the tentative support line at 1.2340, while a steeper decline could even challenge the 1.2300 round level. A continuation lower could then examine the former constraining region of 1.2260 ahead of the 1.2200 psychological mark.

In summary, the rejection near the 1.2500 number on Tuesday suggested the bearish wave has yet to bottom out. While some consolidation cannot be excluded, a close below 1.2400 could clear the way towards 1.2340.