EBC Markets Briefing | UK stock market at high stake on Wednesday

The FTSE 100 tumbled on Tuesday with bidding for two large companies close to a key deadline. Foreign capitals are seizing on discounted stock market valuations to snap up assets at bargain prices.

Royal Mail is poised to accept a £3.5 billion takeover offer from Czech billionaire Daniel Kretinsky, paving the way for the postal service to fall into foreign ownership for the first time in its 500-year history.

The stock was rejected from the benchmark index a few years ago as its business stagnated.

Its parent company, International Distributions Services, was up 17.7% this year due to the prospect of acquisition.

Anglo America has already rejected three offers from BHP and both sides would have to agree on the structure. The Australian mining group wants Anglo to spin off two South African units as a condition of any deal.

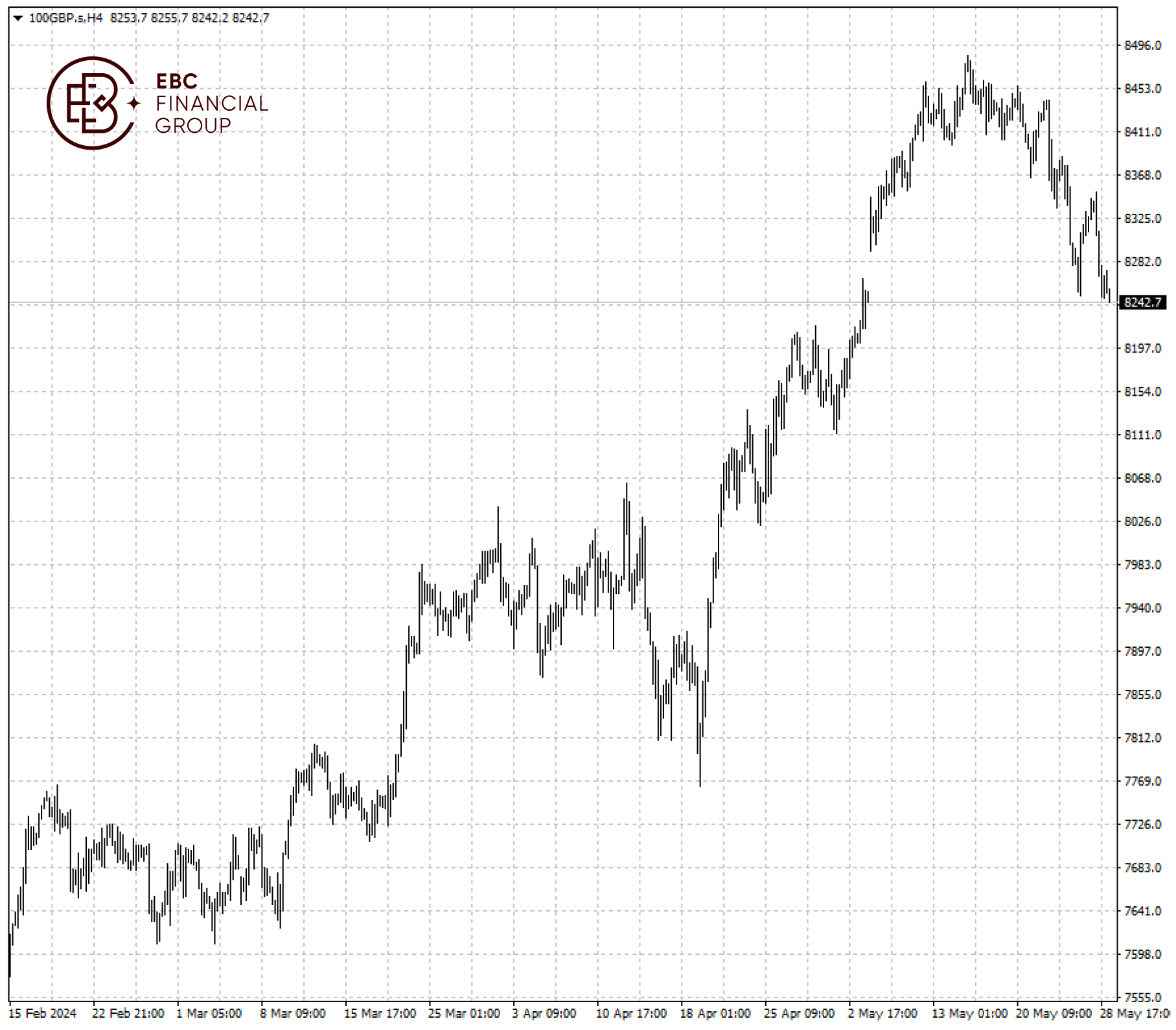

Its shares have soared around 30% so far, powering the FTSE 100 to a record high this month. For both companies, this latest milestone subject to political challenges is the end of the day on Wednesday.

The Labour party has sought confirmation from Kretinsky that the Royal Mail business would continue to be run from the UK, while BHP’s offer prompted consternation among some of South Africa’s politicians.

If the regulatory bodies involved eventually suspend both cases, growing optimism in the stock market will likely start to fade, leading to steeper pullback towards 8,100 – the support area hit in early May.

EBC Investment Strategy Report Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial Group or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.