Nasdaq hits record as US CPI seals December cut; ECB up next

Fed passes US CPI hurdle

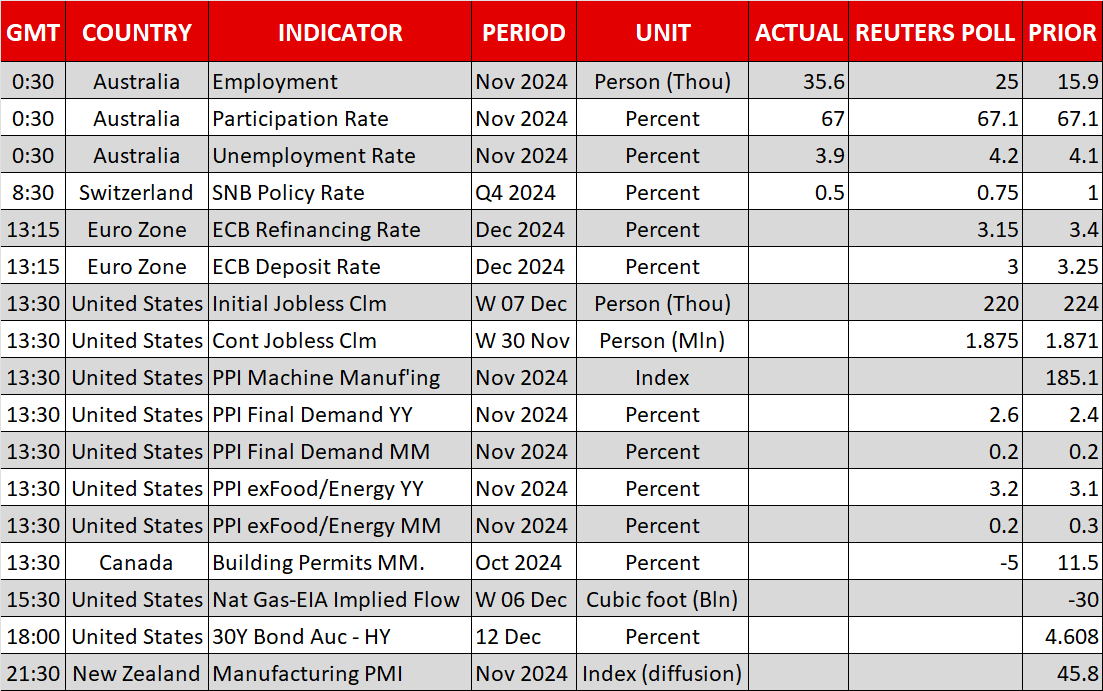

Inflation in the United States accelerated in November, with the consumer price index ticking up to 2.7% y/y from 2.6% in October. However, the increase was in line with expectations and underlying inflation was unchanged at 3.3% y/y. Moreover, key components that had been worrying policymakers for some time now moderated in November, in a sign that the Fed’s fight against inflation is at a turning point.

Shelter costs – a measure of housing inflation – eased to 4.7% y/y, which is the slowest since February 2022, while another important metric, core services CPI, fell to 4.1% y/y.

Hence, despite the headline figure rising to the highest since July, the data is much more encouraging when looking under the bonnet.

Investors ratcheted up their expectations of a 25-basis-point rate cut by the Fed next week, which is almost fully priced in now. The question now for the markets is how many rate cuts the FOMC will flag for 2025.

Techs push Nasdaq to all-time high

That doesn’t seem to be a huge concern for Wall Street for the time being, though, as the S&P 500 and the Nasdaq Composite rallied on Wednesday on relief that there were no nasty surprises in the CPI report. The latter even closed at a new all-time high, surpassing the 20,000 level for the first time, while the Nasdaq 100 also set a new record.

Asian stocks marched higher too on Thursday, led by the Tokyo’s Nikkei 225 index, which is being boosted by the yen’s latest slide. But shares in Europe were more muted amid the ongoing political uncertainty in France and Germany.

SNB opts for big rate cut; will ECB follow suit?

Rate cuts in the region do not seem to be doing much in terms of lifting sentiment. The Swiss National Bank cut its policy rate by 50 bps instead of the consensus 25 bps. A larger move was only about 60% priced in by investors, so unsurprisingly, the Swiss franc has tumbled against both the US dollar and euro after the SNB’s decision.

The euro, on the other hand, was steady ahead of the expected rate cut by the European Central Bank later today. Although there are some bets that the ECB will also cut rates by 50 bps, a smaller 25-bps reduction is much more probable.

However, any downward revision by the ECB to its inflation projections could spark a bit of selloff for the euro.

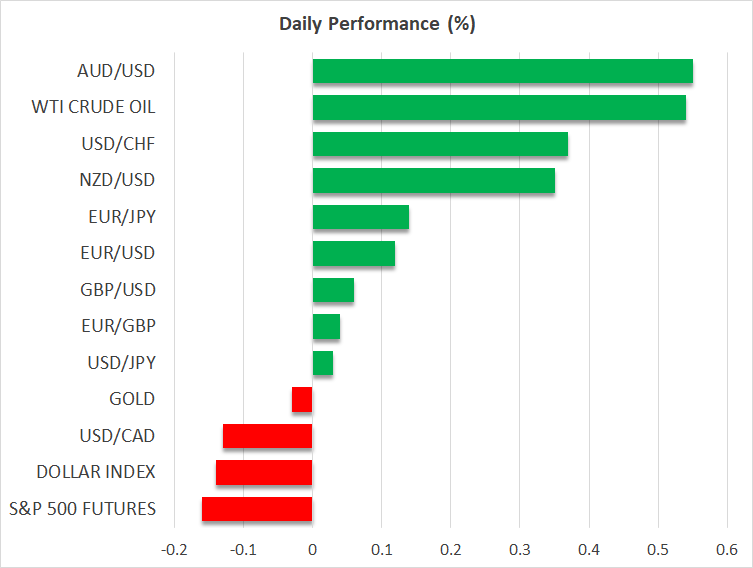

Yen slips again, aussie and oil climb

The Japanese yen continued to struggle on Thursday as expectations that the Bank of Japan will raise interest rates again next week suffered another setback. The BoJ seems to be going out of its way to communicate to the markets that a rate hike is off the table in December.

Following Bloomberg’s story yesterday, BoJ sources have turned to Reuters today to signal that policymakers can afford to take time out to analyze the data before hiking again.

The Australian dollar, meanwhile, bounced back from yesterday’s dive, recovering above $0.6410 as employment in Australia grew solidly in November, denting hopes of an early RBA rate cut.

Oil futures were also on the up as the Biden administration is contemplating tightening sanctions on Russian oil, while Trump’s nominee for national security advisor raised the prospect of tougher curbs on Iranian energy exports.

.jpg)