US data to test the improved risk appetite

The mixed US inflation report boosted equities

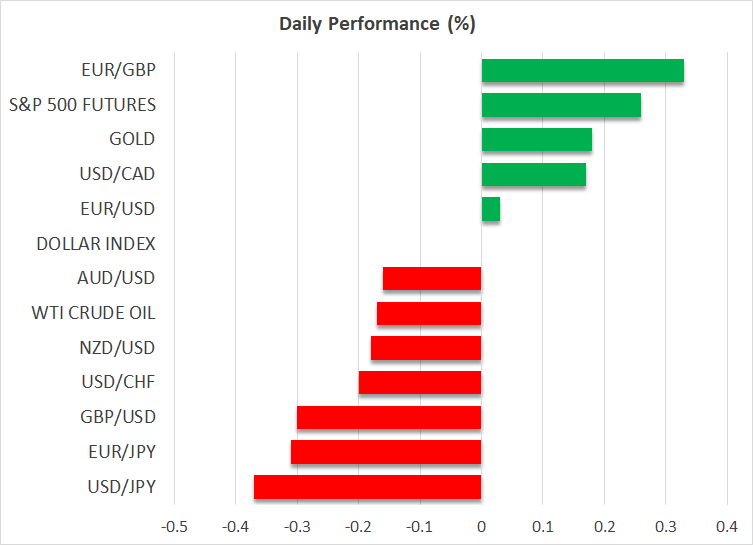

The much-awaited December US CPI report failed to record an upside surprise, with the core year-on-year print coming in 0.1% below expectations. This data fueled a risk-on reaction, with equity indices recovering aggressively, the S&P 500 index reclaiming the 6,000 level and bitcoin rallying towards $100k again.

The lack of stronger price pressures kicked off a repricing of Fed rate cut expectations. While on Monday the market was indicating one rate cut by December 2025, the first 25bps rate cut is now priced in for the July meeting, with a 50% probability for another 25bps rate cut before year-end. The current pricing sounds more sensible considering the broader environment, despite the positive developments in the Middle East.

Fed doves quickly took advantage of the mixed data to support their claims that the disinflation process will continue in 2025. But they also acknowledged that, with Trump’s second presidency beginning in just five days, the outlook remains highly uncertain, despite recent commentary that the new president might opt for a more measured trade strategy than currently expected.

Contrary to stocks’ performance, the dollar shook off its initial underperformance and quickly reasserted its dominance in the FX space. This reaction has a few interpretations, including the fact that dollar bulls might not believe that the Fed will deliver a rate cut in 2025, thus ignoring the current repricing of Fed rate cut expectations, and that traders prefer the safety and more positive outlook of the US economy compared to the rest of the world.

The latter could also explain the rally in gold. Despite the positive news from the Middle East and the stronger dollar, the demand for this precious metal remains potent, pushing it higher above the $2,700 level.

Busy US data calendar today

Yesterday’s overall market reaction was indicative of the importance attached to the US CPI report, but, unfortunately for risky assets and Fed doves, it was just one data point. A series of weak economic releases is needed to firmly put bigger Fed rate cuts back on the agenda.

The focus today turns to US retail sales and weekly jobless claims. The markets are craving weaker data prints to support the current risk-positive sentiment and to prepare for Monday’s Trump Inauguration Day with high spirits. Therefore, the risk for market participants is a positive set of data releases today, particularly an upside surprise in the retail sales data that could cause an acute retreat in equities and boost the dollar even further.

Is the BoJ preparing for a rate hike?

The yen is making a noticeable comeback this week, outperforming its main rivals. The key reason is probably the increased expectation of a BoJ rate hike next week. The continued positive commentary from Governor Ueda and the solid data prints have firmly opened the door to a 25bps rate move, well ahead of the March Shunto wage negotiations round. Crucially, markets are driven by expectations and hence a potential disappointment next week won’t be taken lightly by yen traders.

The UK remains in trouble

The pound remains under pressure, hovering against the dollar at the lowest level since October 2023, as UK data continue to paint a mixed picture. Yesterday’s weaker inflation was followed by weaker GDP and industrial production data published earlier today, prompting renewed commentary from UK Chancellor Reeves. While UK yields might benefit from a potential decline in US Treasury yields, the UK’s fiscal position will remain a grave issue, which the UK government will be forced to address sooner or later.