US downgrade will focus attention on other countries

US downgrade will focus attention on other countries

Fitch Ratings unexpectedly cut the US long-term credit rating by one notch to AA+. In response, markets have begun a gradual but broader risk repricing.

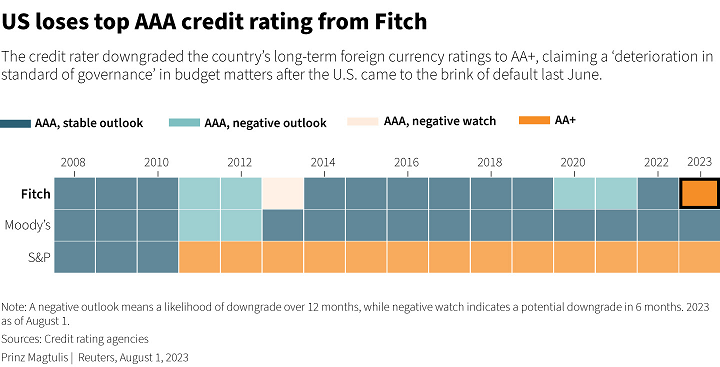

The suddenness of Fitch's move is disconcerting, given that the rating was not under review and the outlook was stable. Moreover, another season of the sovereign debt ceiling saga ended a few months ago, and the next episode is not expected in the coming quarters. Standard & Poor’s actions, which made a similar move twelve years ago, were more logical. Then, for the first time in modern history, the states were faced with gridlocked lawmakers in the debate over the national debt ceiling. But since then, the repetition of the same scenario has made markets less and less reactive, as evidenced by their performance this spring.

Fitch's rationale for this move is nothing new: deteriorating governance, chronic budget deficits and repeated negotiations to raise the debt ceiling.

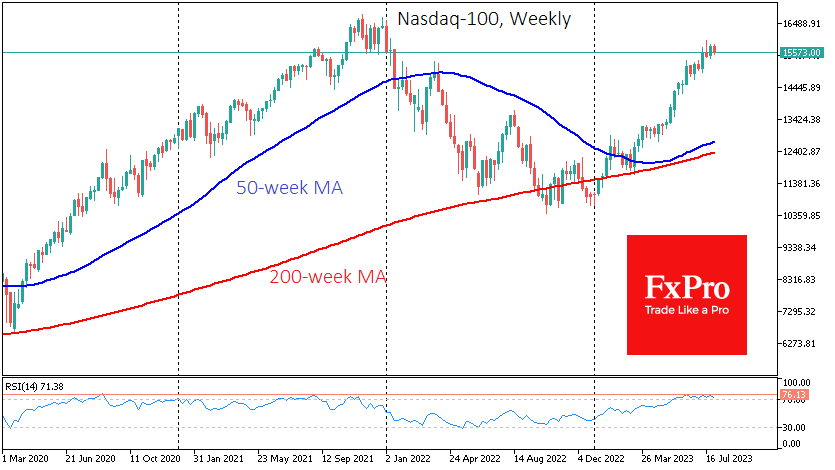

In 2011, after a similar move by the S&P500, the Nasdaq100 lost almost 17%, and the S&P500 lost 18% in four weeks of declines before regaining ground. Such amplitude is unlikely to be repeated, if only because the US economy is now in better shape, with unemployment at multi-decade lows and solid wage growth promising sales and corporate profits.

This news should trigger forced portfolio rebalancing by large funds in the coming days. In addition, the overbought conditions that have built up in recent weeks are now working against equity indices, increasing the potential for profit-taking. In short, if markets needed a reason to profit from the spring rally, they have it.

Perhaps in the most pessimistic scenario, the Nasdaq100 is unlikely to fall below 12500 from the current 15700, with more likely targets around 13500. The optimistic scenario suggests increased buying once it breaks below 15000.

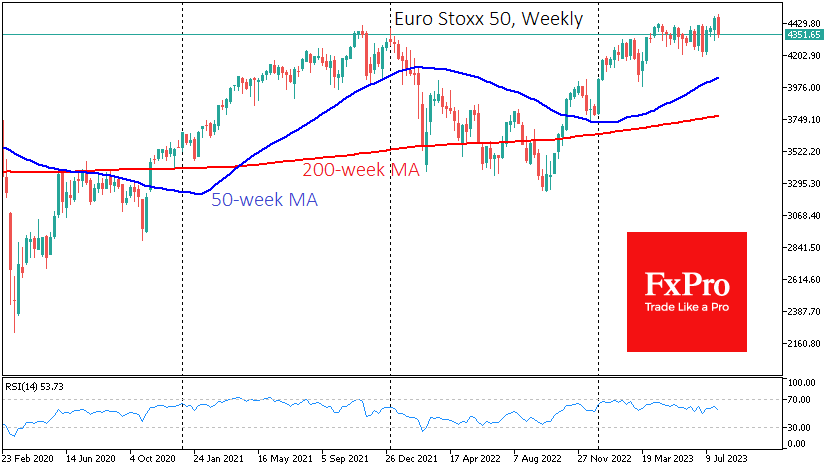

For the S&P500, the worst-case sell-off scenario could end near 4000 from the current 4577. More likely downside targets are around 4200, and it could end near 4400 in an optimistic scenario.

Unlike the actions of the monetary authorities, rating actions can affect both a country's currency and equity markets, leading to a sell-off in the event of a downgrade.

However, a downgrade of the US credit rating will force investors to scrutinise other markets. Twelve years ago, problems in Greece, Spain and Italy became a significant concern within months. Now, even more than in southern Europe, the debt burden of China and other major emerging markets should be the focus of attention. There is also the question of whether Japan can keep up with the increased servicing of its enormous debt.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)