Edit Your Comment

Reasons why you should NOT trade cryptocurrencies

Jan 25, 2010からメンバー

1288 投稿

Nov 21, 2018 at 08:14

Jan 25, 2010からメンバー

1288 投稿

"Left holding the bag":

https://en.m.wikipedia.org/wiki/Bagholder

https://en.m.wikipedia.org/wiki/Bagholder

Nov 21, 2018 at 08:36

Feb 22, 2011からメンバー

4573 投稿

BluePanther posted:"Left holding the bag":

https://en.m.wikipedia.org/wiki/Bagholder

Well BTC is still 4 times the value compared to MAR 2017

Jan 25, 2010からメンバー

1288 投稿

Nov 21, 2018 at 12:05

Jan 25, 2010からメンバー

1288 投稿

togr posted:BluePanther posted:"Left holding the bag":

https://en.m.wikipedia.org/wiki/Bagholder

Well BTC is still 4 times the value compared to MAR 2017

And your point is?

Jan 25, 2010からメンバー

1288 投稿

Nov 21, 2018 at 12:10

Jan 25, 2010からメンバー

1288 投稿

togr posted:BluePanther posted:"Left holding the bag":

https://en.m.wikipedia.org/wiki/Bagholder

Well BTC is still 4 times the value compared to MAR 2017

Did you buy in at MAR 2017? If so, you still have time. Take my advice before you get "left holding the bag".

Your choice though.

Jan 25, 2010からメンバー

1288 投稿

Nov 21, 2018 at 12:24

Jan 25, 2010からメンバー

1288 投稿

togr posted:davidwatson posted:Adribaasmet posted:

I think, investing on crypto with a long term view (like couple of years) would be much profitable than trading!

I'm with you on this.

Well it should be

Crypto is down a lot know but in nearby years it should change

BluePanther posted:

This thread is in response to Leo23's discussion: "Trading the cryptocurrencies Bitcoin,Etherium, Litecoin etc...."

https://www.myfxbook.com/community/general/trading-cryptocurrencies-bitcoinetherium-litecoin-etc/1513362,1

Sharing (information) is caring. 😎 Feel welcome to share your personal and professional opinion on cryptocurrencys, especially if Leo23 has blocked you from his thread. Please backup all opinions with evidence where possible. Unfounded opinions, posts contrary to generally-accepted social norms of respect, and posts in breach of myfxbook's Terms of Use are deemed inappropriate and may be reported.

Please refrain from pure conjecture, or opinions without supporting evidence.

This thread aims to gather evidence supporting reasons why one should NOT trade cryptocurrencies.

Oct 09, 2018からメンバー

41 投稿

Nov 21, 2018 at 12:30

Oct 09, 2018からメンバー

41 投稿

togr posted:BluePanther posted:"Left holding the bag":

https://en.m.wikipedia.org/wiki/Bagholder

Well BTC is still 4 times the value compared to MAR 2017

it is, but the way it is falling, i can't say if it is going to rise again soon. it is going to take a long fall before rising again and that might be end to next year. just my thoughts.

Jan 25, 2010からメンバー

1288 投稿

Nov 21, 2018 at 13:17

Jan 25, 2010からメンバー

1288 投稿

Farhan1 posted:

Could be a good buy low - sell high opportunity. There is still a lot of hype around crypto. If buyers start coming in around 4000k thinking that it is a cheap time to buy then the price could sky rocket again

Opinion: Victims of bitcoin insanity are quickly piling up (Nov 20, 2018)

Ivan Martchev (Investment strategist)

"Chipmaker Nvidia last week issued revenue guidance for the current quarter of $2.7 billion, falling well short of analysts’ consensus estimates of $3.4 billion. The culprit? The deflating bitcoin bubble!

Some explanations for earnings and revenue warnings you just can’t make up.

The global cryptocurrency mania — not only for bitcoin BTCUSD, +4.79% but similar absurdities — led to strong demand for graphics processing units (GPUs), which Nvidia is a leader in, as they are used to run the computations necessary to “mine” cryptocurrencies. As the air has rapidly left the global crypto bubble, mining those worthless lines of code has gotten less lucrative and, hence, the demand for GPUs has rapidly declined."

"...As I’ve explained previously several times, the term “market cap” when used to describe a cryptocurrency is absurd. Market cap is short for “market capitalization,” or the total worth of all publicly traded stock of an operating company. It is supposed to discount all earnings (or cash flows) as far as all investors in the company’s stock (dubbed “the market”) can see and, thus, value the company that way.

The way we know bitcoin, and all other cryptos, are a bubble is by making the glaringly obvious observation that they cannot produce any cash flow whatsoever, making the term “market cap’ absurd. That’s not to say blockchain as a technology cannot be useful without the unnecessary step of buying a digital token called bitcoin, which is calculated to limit the amount of bitcoins at 21 million and thus make their price rise as more poor souls cram themselves into this line of code in search of riches. (For more, see “Bitcoin is perfectly tracking major bubble phases.”)

As history has proven on multiple occasions, most bubbles end with the majority of investors losing massive amounts of money as they hold and hope for the bubble to reflate. Regrettably, after bubbles pop, they can take decades to recover and “take out” the bubble price high, or, worst-case scenario, disappear. I think bitcoin will be a worst-case scenario situation."

"...To be absolutely clear, I will never make an investment by looking at a chart alone. I have to understand what makes the chart “tick” and what makes an investment, as in the case of specific stocks, rise or fall. Since there never will be any profits, or cash flows for that matter, generated by bitcoin, ever, it is conceivable that it will go to zero, nada or nil. It does not take a genius to figure that one out.

That said, let me put my amateur technician’s hat on. It appears that bitcoin has broken below a major support level at $6,000 (see chart). The chart shows declining peaks and even lows that got taken out last week at that key level. If one reads the chart as $6,000 being the climactic low that was hit after the top was set on Dec. 18, 2017, and $12,000 is the first major rebound off that climactic low, then the bitcoin chart has formed a “bearish wedge,” or a “descending triangle” pointing from $12,000 to $6,000. The measured move of that breakdown is $6,000 (or the width of the triangle) below the support level of $6,000.

Jan 25, 2010からメンバー

1288 投稿

Nov 21, 2018 at 13:22

Jan 25, 2010からメンバー

1288 投稿

togr posted:BluePanther posted:"Left holding the bag":

https://en.m.wikipedia.org/wiki/Bagholder

Well BTC is still 4 times the value compared to MAR 2017

Well BTC has lost 70% since its high

Sep 12, 2015からメンバー

1933 投稿

Nov 22, 2018 at 08:30

Feb 22, 2011からメンバー

4573 投稿

BluePanther posted:togr posted:BluePanther posted:"Left holding the bag":

https://en.m.wikipedia.org/wiki/Bagholder

Well BTC is still 4 times the value compared to MAR 2017

Well BTC has lost 70% since its high

You do not get it.

BTC has lost value this way more times and it always end up much stronger.

Jan 25, 2010からメンバー

1288 投稿

Nov 22, 2018 at 11:19

Jan 25, 2010からメンバー

1288 投稿

togr posted:BluePanther posted:

Well BTC has lost 70% since its high

You do not get it.

BTC has lost value this way more times and it always end up much stronger.

Thanks. I appreciate your optimistic opinion, but your post is better-suited for the thread: https://www.myfxbook.com/community/general/trading-cryptocurrencies-bitcoinetherium-litecoin-etc/1513362,1

This thread does not condone trading cryptocurrencies.

Jan 25, 2010からメンバー

1288 投稿

Nov 22, 2018 at 11:19

Jan 25, 2010からメンバー

1288 投稿

togr posted:

You do not get it.

BTC has lost value this way more times and it always end up much stronger.

Are you looking purely at technicals? Because with any market instrument the fundamentals must support the valuation - and unless world economies fundamentally change then crypto will remain a niche with little practical value, and hence lower worth.

The hype and craze is fading, and the underlying fundamentals are becoming conspicuously apparent.

Jan 25, 2010からメンバー

1288 投稿

Nov 22, 2018 at 11:20

Jan 25, 2010からメンバー

1288 投稿

togr posted:

You do not get it.

BTC has lost value this way more times and it always end up much stronger.

Are you looking purely at technicals? Because with any market instrument the fundamentals must support the valuation - and unless world economies fundamentally change then crypto will remain a niche with little practical value, and hence lower worth.

The hype and fantasy is fading, and the underlying fundamentals are becoming conspicuously apparent.

Nov 22, 2018 at 15:30

Feb 22, 2011からメンバー

4573 投稿

BluePanther posted:FuYating posted:

Bitcoin is hear to stay and has become more a more mature market now. Just because the S&P falls 70% we don't assume that it will go to zero. I see this as a good place to buy. If price falls further then I will be buying moretogr posted:

And it gather 20,000% since its low :)

So you are bullish BTC, so compare this:

USDTRY is currently trading around 5.28 after reaching a high in August 2018 of approximately 7.10.

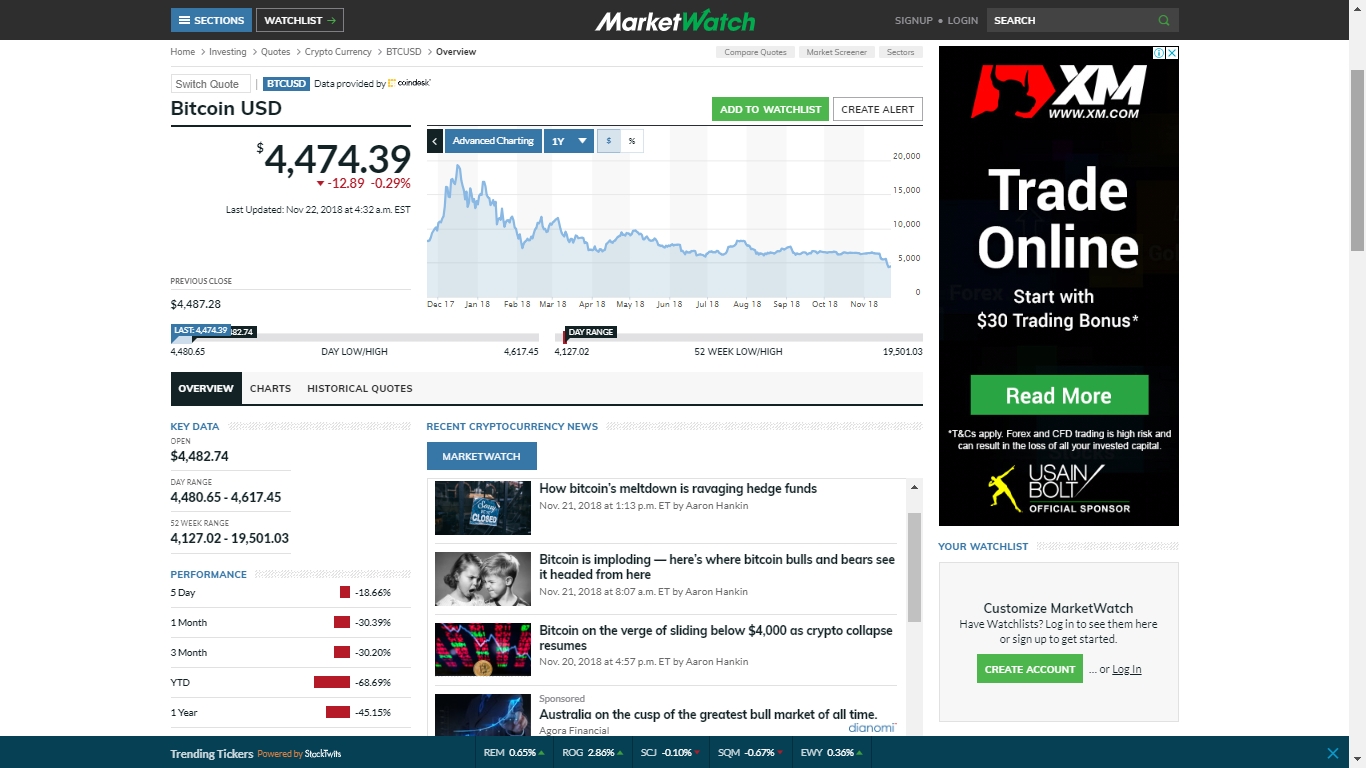

BTCUSD is currently trading around 4500 after reaching a high in December 2017 of approximately 19,140.

In other words:

The Turkish Lira (TRY) is converted 5:1 into USD.

BitCoin (BTC) is converted 4500:1 into USD.

The value of the Turkish Lira (TRY) is based upon financial confidence in its economy using tangible metrics.

The value of BitCoin (BTC) is based upon pure expectation and speculation as an acceptable form of payment, using many intangible metrics.

"This also doesn’t satisfy what gives Bitcoin a “floor” in value, but then an equity never has a floor. Equity can go to zero, but that doesn’t mean that in the meantime it’s not worth something."

https://www.businessinsider.com.au/why-bitcoin-has-value-2013-12?r=US&IR=T

I did not say I am bullish.

I said there is no need to panic.

As BTC is such volatile instrument it can lose 75% of its value and recover.

Jan 25, 2010からメンバー

1288 投稿

Jan 25, 2010からメンバー

1288 投稿

Nov 23, 2018 at 09:32

Jan 25, 2010からメンバー

1288 投稿

FuYating posted:

Bitcoin is hear to stay and has become more a more mature market now. Just because the S&P falls 70% we don't assume that it will go to zero. I see this as a good place to buy. If price falls further then I will be buying more

Your analogy is poor. You must realise:

The “S&P” is an index, an aggregate of multiple independent instruments: “The Standard & Poor's 500, often abbreviated as the S&P 500, or just the S&P, is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ” (https://en.m.wikipedia.org/wiki/S%26P_500_Index)

BitCoin is a single individual instrument: “Bitcoin (₿) is a cryptocurrency, a form of electronic cash. It is a decentralized digital currency without a central bank or single administrator that can be sent from user-to-user on the peer-to-peer bitcoin network without the need for intermediaries.” (https://en.m.wikipedia.org/wiki/Bitcoin)

You are comparing “apples” with “oranges” - there is no comparison.

My point is:

- the S&P has 500 separate components which would need to concurrently become worthless for S&P to lose value;

- BitCoin is a single instrument and the greater potential to become worthless.

*商用利用やスパムは容認されていないので、アカウントが停止される可能性があります。

ヒント:画像/YouTubeのURLを投稿すると自動的に埋め込まれます!

ヒント:この討論に参加しているユーザー名をオートコンプリートするには、@記号を入力します。