Edit Your Comment

The fallacy of Martingale/Grid systems

May 03, 2024 at 10:52

Mar 17, 2021からメンバー

17 投稿

The vast majority of martingale/grid grid systems, or variations of are destined to blow up accounts (or result in unrecoverable drawdown). New traders may not be aware of these gambling methods, which require a near infinite source of funds to pull off.

How to spot a martingale/grid system

1) Short account life.

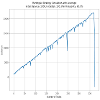

2) Unrealistic equity curves that only ever go up (unless they blow up!).

3) Equity will have significant areas of drawdown if the account hasn't blown up.

4) Increasing position sizes as the account gets further into drawdown.

Be wary of these systems, they look great until they aren't. This is a form of time-based gambling. (an very small minority of scenarios may be an exception).

Example equity curve attached.

How to spot a martingale/grid system

1) Short account life.

2) Unrealistic equity curves that only ever go up (unless they blow up!).

3) Equity will have significant areas of drawdown if the account hasn't blown up.

4) Increasing position sizes as the account gets further into drawdown.

Be wary of these systems, they look great until they aren't. This is a form of time-based gambling. (an very small minority of scenarios may be an exception).

Example equity curve attached.

May 08, 2024からメンバー

3 投稿

May 11, 2024 at 04:38

(編集済みのMay 11, 2024 at 04:38)

May 08, 2024からメンバー

3 投稿

I have yet to see one prune outlier trades effectively. I'm not saying it can't be done, it just I've never seen it. Anyone I have heard of that uses them, plans on running them until failure, while doing withdrawals until they blow up. Then they start over and see how far they can get.

Argue for your limitations, and sure enough, they are yours.

Jun 05, 2024からメンバー

10 投稿

Jun 15, 2024 at 07:04

Apr 17, 2024からメンバー

15 投稿

Gwydaer posted:

The vast majority of martingale/grid grid systems, or variations of are destined to blow up accounts (or result in unrecoverable drawdown). New traders may not be aware of these gambling methods, which require a near infinite source of funds to pull off.

How to spot a martingale/grid system

1) Short account life.

2) Unrealistic equity curves that only ever go up (unless they blow up!).

3) Equity will have significant areas of drawdown if the account hasn't blown up.

4) Increasing position sizes as the account gets further into drawdown.

Be wary of these systems, they look great until they aren't. This is a form of time-based gambling. (an very small minority of scenarios may be an exception).

Example equity curve attached.

Dude, one thing you have to understand is that with any EA strategy, you have to have manual wind control or you may end up failing. This is because there are so many uncertainties in the market, such as the Fed meeting, or the monthly non-agricultural employment data.

So, it is very necessary to trade with artificial dare and good risk control. Moreover, many trading strategies, can only be applied to a certain market situation, for example, some strategies are only applicable to the up and down vibration of the market, but in the unilateral market, it is easy to lose money.

Therefore, the strategy I use, with 24-hour manual risk control, 2 years of time, very stable.

Newton once said: If I can see farther than others, it is because I am standing on the shoulders of giants.

Jun 12, 2024からメンバー

6 投稿

Jun 23, 2024 at 07:12

Apr 17, 2024からメンバー

15 投稿

ScoutQueen posted:

What do you mean by " manual wind control "?

Because the machine can not recognize the reality of the situation, for example, today's meeting of the Federal Reserve announced a major decision, but the bot can not be recognized, this time the market appeared in the bot prediction of the opposite trend, then your bot trading strategy will be a serious loss.

Because the bot trading I used before had no human manual risk control, I ended up losing a lot of money.

Now I use bot trading strategy are manual risk control strategy.

Newton once said: If I can see farther than others, it is because I am standing on the shoulders of giants.

May 17, 2024からメンバー

2 投稿

Feb 21, 2024からメンバー

2 投稿

Oct 29, 2009からメンバー

74 投稿

Jul 12, 2024からメンバー

7 投稿

Jul 12, 2024 at 12:32

Dec 30, 2023からメンバー

5 投稿

OptiflowCapital posted:

I use two martingal systems on gold...

I have drawdown protection on both, I turn it off at major events.

Runs great.

Same here, it's not the system that matters, but the approach and methodology used to trade it. And, by the way, martingale is not the same as grid-based system, besides multiplying position sizes they have nothing it common.

*商用利用やスパムは容認されていないので、アカウントが停止される可能性があります。

ヒント:画像/YouTubeのURLを投稿すると自動的に埋め込まれます!

ヒント:この討論に参加しているユーザー名をオートコンプリートするには、@記号を入力します。