FX Rogue Wave 2.6 Manual Placement (による forex_trader_20011)

そのユーザーはこのシステムを削除しました。

Edit Your Comment

FX Rogue Wave 2.6 Manual Placement 討論

forex_trader_20011

Oct 08, 2010からメンバー

407 投稿

Jul 09, 2014 at 22:58

Oct 08, 2010からメンバー

407 投稿

I am very happy you are enjoying it!

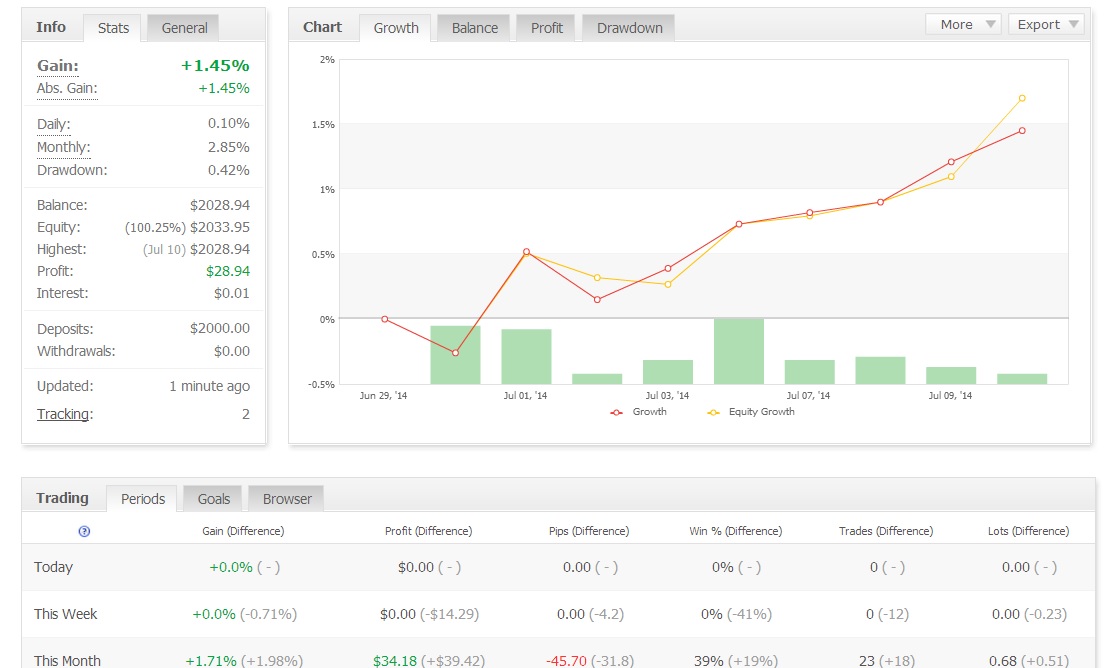

I am currently through about 30 hours of a 40 hour optimization. The only settings that are different on this account are the MACD settings.

FastEMA = 1

SlowEMA = 24

MACDSMA = 30

This backtest (which I will post when complete) allows for only needing to run 4 orders instead of 7. This means you can run the account with $500 per .01 instead of $2000 per .01. This means faster growth and a better equity curve.

I am currently through about 30 hours of a 40 hour optimization. The only settings that are different on this account are the MACD settings.

FastEMA = 1

SlowEMA = 24

MACDSMA = 30

This backtest (which I will post when complete) allows for only needing to run 4 orders instead of 7. This means you can run the account with $500 per .01 instead of $2000 per .01. This means faster growth and a better equity curve.

Jul 10, 2014 at 11:45

Feb 24, 2014からメンバー

190 投稿

Hi Scotty,

Question for you. Ok So there was a massive drop in the EURJYP this am. I got hurt by it a bit, then it went in sell mode and I was doing well. Now my question is like this, my channel was at 10 pips or so and after the spread was at 8 pips. So it stopped out twice (see history http://www.myfxbook.com/members/askew8/fx-wave/961737) but then when it took off in the right direction after hitting the 3rd set, it dropped for a little over 60 pips. This recovered the loss and then some but I had to manually close it at 54 pips to ensure I kept this gain. Isnt the SL supposed trail to ensure profit? At what point does it do this? Is there any way to maybe set the EA to set a hard TP at like a 1:4 ratio as well as having the trailing stop to almost always ensure a good profit when headed in the right direction? As well as being able to recoup losses from the previous sets by trailing the stop after it has moved in a position to where it is able to be stopped out with no loss on the whole set?

Please let me know if this makes any sense...

Question for you. Ok So there was a massive drop in the EURJYP this am. I got hurt by it a bit, then it went in sell mode and I was doing well. Now my question is like this, my channel was at 10 pips or so and after the spread was at 8 pips. So it stopped out twice (see history http://www.myfxbook.com/members/askew8/fx-wave/961737) but then when it took off in the right direction after hitting the 3rd set, it dropped for a little over 60 pips. This recovered the loss and then some but I had to manually close it at 54 pips to ensure I kept this gain. Isnt the SL supposed trail to ensure profit? At what point does it do this? Is there any way to maybe set the EA to set a hard TP at like a 1:4 ratio as well as having the trailing stop to almost always ensure a good profit when headed in the right direction? As well as being able to recoup losses from the previous sets by trailing the stop after it has moved in a position to where it is able to be stopped out with no loss on the whole set?

Please let me know if this makes any sense...

forex_trader_20011

Oct 08, 2010からメンバー

407 投稿

Jul 10, 2014 at 12:10

Oct 08, 2010からメンバー

407 投稿

Hi Askew,

If the set file on 2.6 or lite version on 2.5 is being used, a yellow line should be drawn along with the red and blue entry points.

When ChannelStopLoss and AutoChannelTS are set to true, the channel is used to measure SL and TP.

This yellow line is the Order Close line. This is a visual marker of where the EA intends to close an open order when hit. With an 8 pip spread, the order should close within 8 pips of this line. 8 pips is very high and can cause stop outs on tight channels like you mentioned of 10 pips.

The 2.6 version has hard TP and SL that can be used instead of the channel.

Just use the TP and SL settings and turn to false the ChannelStopLoss and AutoChannelTS.

If the set file on 2.6 or lite version on 2.5 is being used, a yellow line should be drawn along with the red and blue entry points.

When ChannelStopLoss and AutoChannelTS are set to true, the channel is used to measure SL and TP.

This yellow line is the Order Close line. This is a visual marker of where the EA intends to close an open order when hit. With an 8 pip spread, the order should close within 8 pips of this line. 8 pips is very high and can cause stop outs on tight channels like you mentioned of 10 pips.

The 2.6 version has hard TP and SL that can be used instead of the channel.

Just use the TP and SL settings and turn to false the ChannelStopLoss and AutoChannelTS.

Jul 10, 2014 at 13:03

Feb 24, 2014からメンバー

190 投稿

Hi. Thanks for the quick response!

I think I made a mistake when I said the spread was 8 pips. It was a 10 pip channel and the spread was 2 pips so that 8 pips of wiggle room. I didn't pay attention to where the yellow lines were but even if there were still out of reach at the moment, when does the trailing stop come into effect? Does that happen once the yellow line is breached? I am just asking because to have a 10 pip channel, and to be in the $ for over 50pips and not have the trailing come to save some of that profit seems like a tough pill to swallow. Thoughts?

I think I made a mistake when I said the spread was 8 pips. It was a 10 pip channel and the spread was 2 pips so that 8 pips of wiggle room. I didn't pay attention to where the yellow lines were but even if there were still out of reach at the moment, when does the trailing stop come into effect? Does that happen once the yellow line is breached? I am just asking because to have a 10 pip channel, and to be in the $ for over 50pips and not have the trailing come to save some of that profit seems like a tough pill to swallow. Thoughts?

forex_trader_20011

Oct 08, 2010からメンバー

407 投稿

Jul 10, 2014 at 13:18

Oct 08, 2010からメンバー

407 投稿

The set files and lite versions use a 100% trailing stop. Meaning, when the yellow line is breached, the TS kicks in. At 100%, it should close immediately. I left it in so folks could play with it, but closing at the 1x or 1.1x channel had the most consistent profit rate and provided a 1:1 risk/reward ratio.

The strange thing is, if the channel for that sequence was only 10 pips, then the yellow line (or order close) should have occurred when the price was 10 pips out. In live trading, I have seen the price "hop over" an entry point, but not a close point.

Perhaps check the MT4 journal and experts tabs for an communication errors. Perhaps the EA attempted to close the order at that point and it did not go through. But the TS should have kicked in.

If something like that occurs, feel free to email me a screen shot and the logs and I will be happy to troubleshoot further. But without seeing it, I am only educated guessing.

The strange thing is, if the channel for that sequence was only 10 pips, then the yellow line (or order close) should have occurred when the price was 10 pips out. In live trading, I have seen the price "hop over" an entry point, but not a close point.

Perhaps check the MT4 journal and experts tabs for an communication errors. Perhaps the EA attempted to close the order at that point and it did not go through. But the TS should have kicked in.

If something like that occurs, feel free to email me a screen shot and the logs and I will be happy to troubleshoot further. But without seeing it, I am only educated guessing.

forex_trader_20011

Oct 08, 2010からメンバー

407 投稿

Jul 14, 2014 at 01:43

(編集済みのJul 14, 2014 at 01:44)

Oct 08, 2010からメンバー

407 投稿

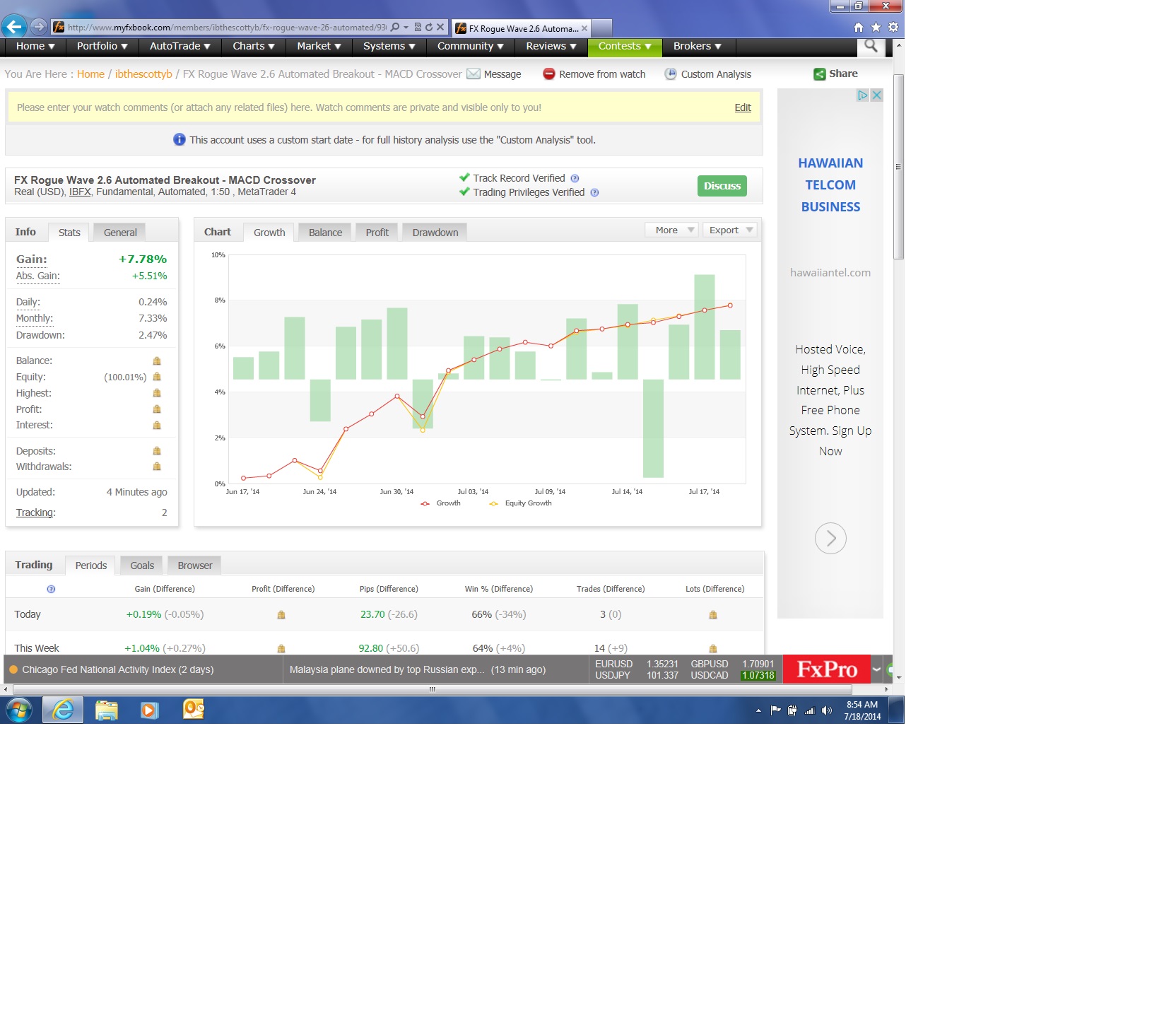

Well, after several hundred hours of backtests on the EURJPY, I still cannot find a prettier equity curve than the MACD set file with 7 orders potentially used in sequence. This is the set file included with the EA. Not the settings mentioned above.

70%-80% per year is not bad.

70%-80% per year is not bad.

Dec 15, 2010からメンバー

784 投稿

Jul 14, 2014 at 11:20

Feb 24, 2014からメンバー

190 投稿

ibthescottyb posted:

Well, after several hundred hours of backtests on the EURJPY, I still cannot find a prettier equity curve than the MACD set file with 7 orders potentially used in sequence. This is the set file included with the EA. Not the settings mentioned above.

70%-80% per year is not bad.

So this is the one that it requires $2000 per .01? Correct?

Dec 15, 2010からメンバー

784 投稿

forex_trader_20011

Oct 08, 2010からメンバー

407 投稿

Jul 31, 2014 at 15:45

Feb 24, 2014からメンバー

190 投稿

Hey Scotty,

Been testing the demo for a while and I have a question that I never really seem to happen. When in the middle of a set, if the channel size changes (say there is a massive candle up/down), I've noticed that the channel doesn't reset based on the new channel. I have to readjust the channel manually and it then starts back at #1 on the set and doesn't have the ability to recoup any of the losses that it lost.

Any thoughts?

Been testing the demo for a while and I have a question that I never really seem to happen. When in the middle of a set, if the channel size changes (say there is a massive candle up/down), I've noticed that the channel doesn't reset based on the new channel. I have to readjust the channel manually and it then starts back at #1 on the set and doesn't have the ability to recoup any of the losses that it lost.

Any thoughts?

*商用利用やスパムは容認されていないので、アカウントが停止される可能性があります。

ヒント:画像/YouTubeのURLを投稿すると自動的に埋め込まれます!

ヒント:この討論に参加しているユーザー名をオートコンプリートするには、@記号を入力します。