Gold and Silver Trader

そのユーザーはこのシステムを削除しました。

Edit Your Comment

Gold and Silver Trader 討論

Aug 16, 2011からメンバー

106 投稿

Mar 10, 2015からメンバー

24 投稿

Apr 26, 2020 at 12:18

Mar 10, 2015からメンバー

24 投稿

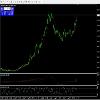

The precious metal ended the trading week stronger, but the main goal is still right on the course. The more governments stimulate their economies, the more expensive gold will become.

Analysts of the precious metals market believe that the current measures of incentives in the framework of confusion, combine impressive prerequisites for increasing purchases of gold. In addition, in the current conditions, gold is considered as a protective, not a risky option for saving money. And demand increases regardless of the stock market.

Gold futures are approaching their maximum extremes of 7 years ago.

Unparalleled in history, the steps taken by the authorities to preserve the financial system, turn capital into flight to safe assets such as gold.

The Japanese national Bank, the ECB and the Federal Reserve, at their next upcoming meetings, may still agree on the next financial injection into their economies.

The house of representatives in the United States has approved another plan to provide monetary support in the fight against the pandemic. For now, this bill is awaiting President trump's approval.

Gold will be in demand as long as financial incentives are widely applied to economies.

When the panic around the disease subsides, gold will be in a strong overbought zone, which will cause a strong pullback. Therefore, the assault on seven-year highs may be slightly pushed back to a later date.

The gold metal received another portion of positive news for itself, in the form of statistics on unemployment in the States. The report's figures indicate that the peak of the jump in unemployment has not yet passed. And the number of citizens requesting benefits in these 5 weeks exceeds 26 million.

The price of oil in the past trading week, for the first time in history, crossed the zero line, which further increased fears and fears for the world economy, thereby creating prerequisites for the strengthening of the precious metal.

Analysts of the precious metals market believe that the current measures of incentives in the framework of confusion, combine impressive prerequisites for increasing purchases of gold. In addition, in the current conditions, gold is considered as a protective, not a risky option for saving money. And demand increases regardless of the stock market.

Gold futures are approaching their maximum extremes of 7 years ago.

Unparalleled in history, the steps taken by the authorities to preserve the financial system, turn capital into flight to safe assets such as gold.

The Japanese national Bank, the ECB and the Federal Reserve, at their next upcoming meetings, may still agree on the next financial injection into their economies.

The house of representatives in the United States has approved another plan to provide monetary support in the fight against the pandemic. For now, this bill is awaiting President trump's approval.

Gold will be in demand as long as financial incentives are widely applied to economies.

When the panic around the disease subsides, gold will be in a strong overbought zone, which will cause a strong pullback. Therefore, the assault on seven-year highs may be slightly pushed back to a later date.

The gold metal received another portion of positive news for itself, in the form of statistics on unemployment in the States. The report's figures indicate that the peak of the jump in unemployment has not yet passed. And the number of citizens requesting benefits in these 5 weeks exceeds 26 million.

The price of oil in the past trading week, for the first time in history, crossed the zero line, which further increased fears and fears for the world economy, thereby creating prerequisites for the strengthening of the precious metal.

Aug 16, 2011からメンバー

106 投稿

Apr 26, 2020 at 22:36

Aug 16, 2011からメンバー

106 投稿

amoniuae posted:

Hi Sir,

I am interested and I like to know I can get access to Gold and Silver Trader.

Thank you

Hello,

Sorry, this is a test only account at the moment and would not suggest not accessing until there is at least 6 months of live account history.

Check my profile and you can see another account called 'Gold Trader' this has more history.

Regards,

Cameron

Aug 16, 2011からメンバー

106 投稿

Apr 26, 2020 at 22:41

Aug 16, 2011からメンバー

106 投稿

Globtroter posted:

The precious metal ended the trading week stronger, but the main goal is still right on the course. The more governments stimulate their economies, the more expensive gold will become.

Analysts of the precious metals market believe that the current measures of incentives in the framework of confusion, combine impressive prerequisites for increasing purchases of gold. In addition, in the current conditions, gold is considered as a protective, not a risky option for saving money. And demand increases regardless of the stock market.

Gold futures are approaching their maximum extremes of 7 years ago.

Unparalleled in history, the steps taken by the authorities to preserve the financial system, turn capital into flight to safe assets such as gold.

The Japanese national Bank, the ECB and the Federal Reserve, at their next upcoming meetings, may still agree on the next financial injection into their economies.

The house of representatives in the United States has approved another plan to provide monetary support in the fight against the pandemic. For now, this bill is awaiting President trump's approval.

Gold will be in demand as long as financial incentives are widely applied to economies.

When the panic around the disease subsides, gold will be in a strong overbought zone, which will cause a strong pullback. Therefore, the assault on seven-year highs may be slightly pushed back to a later date.

The gold metal received another portion of positive news for itself, in the form of statistics on unemployment in the States. The report's figures indicate that the peak of the jump in unemployment has not yet passed. And the number of citizens requesting benefits in these 5 weeks exceeds 26 million.

The price of oil in the past trading week, for the first time in history, crossed the zero line, which further increased fears and fears for the world economy, thereby creating prerequisites for the strengthening of the precious metal.

Thanks Maxim for the analysis.

The other aspect is the physical supply shortage. The Perth Mint only has minted silver, they have no cast inventory of silver. In 20 years I have never seen this lack of inventory.

Will be very interesting to see where things are once the dust settles.

Regards,

Cameron

*商用利用やスパムは容認されていないので、アカウントが停止される可能性があります。

ヒント:画像/YouTubeのURLを投稿すると自動的に埋め込まれます!

ヒント:この討論に参加しているユーザー名をオートコンプリートするには、@記号を入力します。