Gold Trader

そのユーザーはこのシステムを削除しました。

Edit Your Comment

Gold Trader 討論

Aug 16, 2011からメンバー

106 投稿

Jan 07, 2020 at 12:10

Aug 16, 2011からメンバー

106 投稿

Hello followers,

Sorry for the gap in trades. Todays trades were the first for over a week (which has included holidays).

Gold Trader is designed to pick up over-sold conditions and gold over the last week has shot up over $100 without triggering a trade.

Fortunately a trade came up today and the gap from Monday morning open was partially closed.

Will wait to see how the rest of the month plays out. The situation with Iran/US has seen a lot of money move from currencies to gold (as a safe haven). Plus December, January, February and August are historically good months for gold.

Thanks for your patience folks and all the best,

Cameron

Sorry for the gap in trades. Todays trades were the first for over a week (which has included holidays).

Gold Trader is designed to pick up over-sold conditions and gold over the last week has shot up over $100 without triggering a trade.

Fortunately a trade came up today and the gap from Monday morning open was partially closed.

Will wait to see how the rest of the month plays out. The situation with Iran/US has seen a lot of money move from currencies to gold (as a safe haven). Plus December, January, February and August are historically good months for gold.

Thanks for your patience folks and all the best,

Cameron

Aug 16, 2011からメンバー

106 投稿

Jan 14, 2020 at 10:52

Aug 16, 2011からメンバー

106 投稿

Hello Followers,

It has been a crazy end of December and start of January for Gold.

We have seen an extremely strong run up to over $1600 and consequent sell-off back to $1536. The gap between $1550 and $1560 has now well and truly being filled.

What I have found is that the Gold Trader strategy picks up more trades when the market is ranging or consolidating as the big moves are missed.

It has been a crazy end of December and start of January for Gold.

We have seen an extremely strong run up to over $1600 and consequent sell-off back to $1536. The gap between $1550 and $1560 has now well and truly being filled.

What I have found is that the Gold Trader strategy picks up more trades when the market is ranging or consolidating as the big moves are missed.

Aug 16, 2011からメンバー

106 投稿

Jan 23, 2020 at 02:58

Aug 16, 2011からメンバー

106 投稿

Hello Followers,

Has been a sideways move over the last 2 weeks after that massive move up and consequent sell-off.

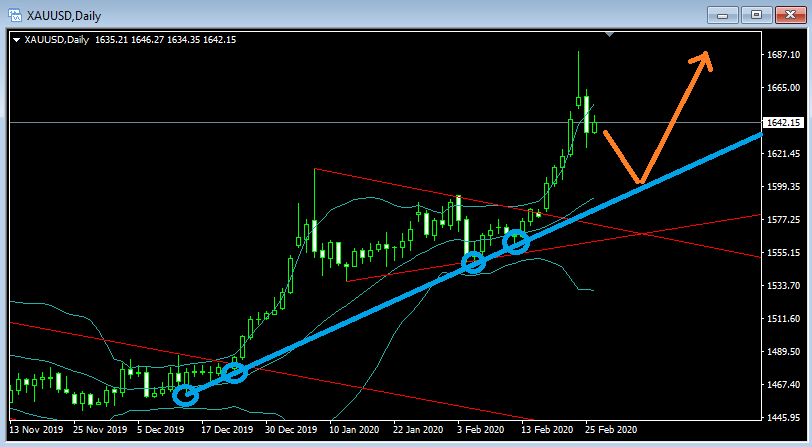

You can see a new bullish trend-line formed and could see some bounces off this and then would expect a move back to the previous recent highs over coming months.

One of the characteristics of Gold Trader is that it does not pick up on the big moves, just the small ones. Therefore on months where there has been a big move the returns are smaller whereas months where there is ranging, the returns tend to be higher.

Feel free to get back to me with any comments, feedback or questions.

Has been a sideways move over the last 2 weeks after that massive move up and consequent sell-off.

You can see a new bullish trend-line formed and could see some bounces off this and then would expect a move back to the previous recent highs over coming months.

One of the characteristics of Gold Trader is that it does not pick up on the big moves, just the small ones. Therefore on months where there has been a big move the returns are smaller whereas months where there is ranging, the returns tend to be higher.

Feel free to get back to me with any comments, feedback or questions.

Aug 16, 2011からメンバー

106 投稿

Feb 01, 2020 at 08:49

Aug 16, 2011からメンバー

106 投稿

Hello Followers,

Sorry, I turned off the system early last week as I always do not trade on the last few days of the month. Plus we had the Brexit event that I thought could impact the markets. Also, I had a couple of days R&R so prefer to be around when the Gold Trader system is live to monitor.

Will be cautious on Monday as Gold had a strong move upwards on Friday. Plus normally the first week of the month is a bit edgy in anticipation of the NFP.

http://www.myfxbook.com/members/camerongill/gold-trader/3398307

Last week we saw a nice bounce off the daily trend-line which is a good sign for the gold bulls.

Sorry, I turned off the system early last week as I always do not trade on the last few days of the month. Plus we had the Brexit event that I thought could impact the markets. Also, I had a couple of days R&R so prefer to be around when the Gold Trader system is live to monitor.

Will be cautious on Monday as Gold had a strong move upwards on Friday. Plus normally the first week of the month is a bit edgy in anticipation of the NFP.

http://www.myfxbook.com/members/camerongill/gold-trader/3398307

Last week we saw a nice bounce off the daily trend-line which is a good sign for the gold bulls.

Aug 16, 2011からメンバー

106 投稿

Feb 04, 2020 at 23:54

Aug 16, 2011からメンバー

106 投稿

Hello Followers,

We have just had a huge sell-off on Gold and am sure some of the gold bulls out there would have had their fingers burnt.

The Technical people would be saying the bull run is over and with the daily trend-line break we can expect either a bounce off the back of the trend-line broken and then downside, or a continuation down after break.

The Fundamentals will be saying it was a sell-off and bullish trend to continue.

I am between the two at the moment and am waiting for a break above the broken trend-line back for normal continuation.

A $50 drop is a fair sell-off.

We have just had a huge sell-off on Gold and am sure some of the gold bulls out there would have had their fingers burnt.

The Technical people would be saying the bull run is over and with the daily trend-line break we can expect either a bounce off the back of the trend-line broken and then downside, or a continuation down after break.

The Fundamentals will be saying it was a sell-off and bullish trend to continue.

I am between the two at the moment and am waiting for a break above the broken trend-line back for normal continuation.

A $50 drop is a fair sell-off.

Aug 16, 2011からメンバー

106 投稿

Feb 07, 2020 at 02:38

Aug 16, 2011からメンバー

106 投稿

Hello Followers,

We are at a delicate point on the gold daily chart.

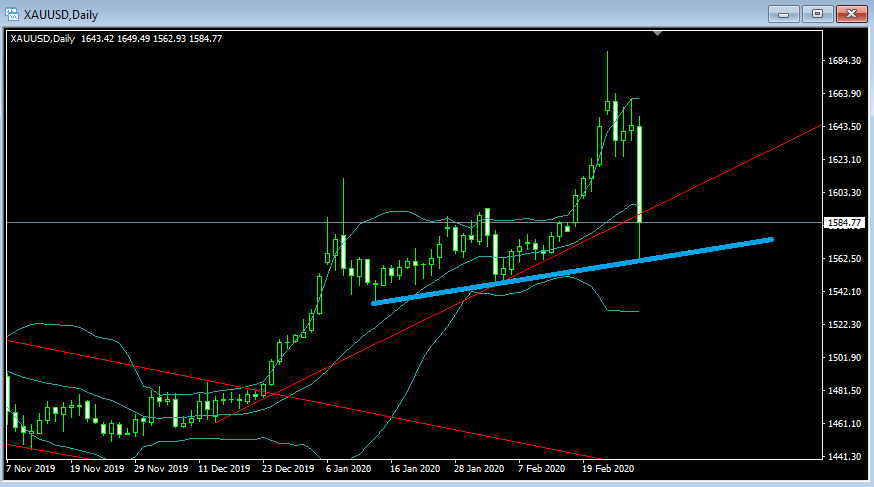

The major sell-off broke the bullish trend-line and the price has since come back up to the back of the broken line.

What we now see is a tipping point between a bounce off the bottom of the trend-line to head much lower, or an alternative break of trend-line for continuation of bullish trend back up over the 1600 mark.

Today (Fri) we have the Non Farm Payrolls and analysts are expecting an improving, which will put downward pressure on the gold pairs, especially XAUUSD. However, there may be a surprise and if the NFP is less than expected would be very interesting to see how gold chart reacts. All I know is that today some traders will make money, and other traders will lose money! Gold Trader does not generate trades on Fridays, a conscious choice to pause as Friday is commonly a volatile day and also often includes major economic announcements.

Will be a very interesting next couple of days and would expect a move in one direction or the other. A sideways move is less likely.

Aug 16, 2011からメンバー

106 投稿

Feb 13, 2020 at 00:00

Aug 16, 2011からメンバー

106 投稿

Hello Followers,

We have not seen a break above the recent trend-line on the gold chart so have revised the trend-lines to include a lower bullish trend-line...

What I suspect is that we are going to see some channeling between these two lines and then at some point a break of either the upper or lower line. This break is building in momentum so when it does occur we can normally expect a decent break.

The Gold Trader strategy (http://www.myfxbook.com/members/camerongill/gold-trader/3398307) tends to perform better when there is ranging as it does not carry the larger moves.

Aug 16, 2011からメンバー

106 投稿

Feb 13, 2020 at 23:29

Aug 16, 2011からメンバー

106 投稿

GOLD FOMO:

You may have heard analysts and commentators saying getting into gold before it is too late & it is going to 'infinity and beyond'. They also often mention 'FOMO' which is 'fear of missing out'.

My thoughts are that whilst there are going to be strong moves on the price of gold, everything goes in cycles and there are as many forces pushing the price of gold down as there are pushing the price of gold up. These downward forces include; short sellers, profit takers, central banks not wanting people to lose confidence in fiat currency, commercial traders and the list goes on. We now have such excessive global cheap debt that my suspicion is that commercials/central banks/governments are using cheap money to write naked shorts on gold that pushes the price down and buying physical at the same time when the price is low. Central banks can create money out of thin air whereas gold is a scarce and precious resource. Plus it is common knowledge that many countries are now starting to prepare for a dollar collapse so are purchasing bullion as a hedge.

Charts as we know them are simply a view of psychology and as the price goes up it gets to a point where people start to think if the commodity/currency is too expensive and over-valued (over bought). At this point they will generally sell and wait to buy back in when the price goes down to a point where they think it is a good buy again. Gold is a little different as people are buying for a longer term safe-haven and although the majority of volume on spot gold is speculative, the bullion purchases are definitely longer term investments. The counter-balance is that the price of gold is measured against typically the USD, when the USD drops the price of gold goes up. So what can happen is that positive sentiment and demand is focused on gold PLUS the dollar can be dropping which accelerates the price action.

My personal opinion is that silver is more under-valued than gold and silver also has more industrial usages than gold. However silver is quite unpredictable, a bit like a family with 2 children, one (the golden one) is reliable, respectful and predictable, whereas the other (the silver one) is unpredictable, can be nice one day and terrible the next.

So, do you trade gold on FOMO, do you jump in and then regret it if the price goes down? Or do you jump in and make a squillion if the price rockets up? The reality is that the people talking about FOMO'ing in are selling when the people buying on fear. Is it better to have regret of not getting into a trade and missing a move than getting in a losing your 'hard-earned'?

There has to come a day of reckoning when the past actions of central banks and governments are realized. Gold may hit $25,000 oz. Silver may be $1,000 oz. However at that stage a loaf of bread may also be $500! My preference is to spread risk, not have too much debt and aim for consistent returns rather than trying to nail the big price moves.

You may have heard analysts and commentators saying getting into gold before it is too late & it is going to 'infinity and beyond'. They also often mention 'FOMO' which is 'fear of missing out'.

My thoughts are that whilst there are going to be strong moves on the price of gold, everything goes in cycles and there are as many forces pushing the price of gold down as there are pushing the price of gold up. These downward forces include; short sellers, profit takers, central banks not wanting people to lose confidence in fiat currency, commercial traders and the list goes on. We now have such excessive global cheap debt that my suspicion is that commercials/central banks/governments are using cheap money to write naked shorts on gold that pushes the price down and buying physical at the same time when the price is low. Central banks can create money out of thin air whereas gold is a scarce and precious resource. Plus it is common knowledge that many countries are now starting to prepare for a dollar collapse so are purchasing bullion as a hedge.

Charts as we know them are simply a view of psychology and as the price goes up it gets to a point where people start to think if the commodity/currency is too expensive and over-valued (over bought). At this point they will generally sell and wait to buy back in when the price goes down to a point where they think it is a good buy again. Gold is a little different as people are buying for a longer term safe-haven and although the majority of volume on spot gold is speculative, the bullion purchases are definitely longer term investments. The counter-balance is that the price of gold is measured against typically the USD, when the USD drops the price of gold goes up. So what can happen is that positive sentiment and demand is focused on gold PLUS the dollar can be dropping which accelerates the price action.

My personal opinion is that silver is more under-valued than gold and silver also has more industrial usages than gold. However silver is quite unpredictable, a bit like a family with 2 children, one (the golden one) is reliable, respectful and predictable, whereas the other (the silver one) is unpredictable, can be nice one day and terrible the next.

So, do you trade gold on FOMO, do you jump in and then regret it if the price goes down? Or do you jump in and make a squillion if the price rockets up? The reality is that the people talking about FOMO'ing in are selling when the people buying on fear. Is it better to have regret of not getting into a trade and missing a move than getting in a losing your 'hard-earned'?

There has to come a day of reckoning when the past actions of central banks and governments are realized. Gold may hit $25,000 oz. Silver may be $1,000 oz. However at that stage a loaf of bread may also be $500! My preference is to spread risk, not have too much debt and aim for consistent returns rather than trying to nail the big price moves.

Aug 16, 2011からメンバー

106 投稿

Feb 17, 2020 at 01:29

Aug 16, 2011からメンバー

106 投稿

Hello Followers,

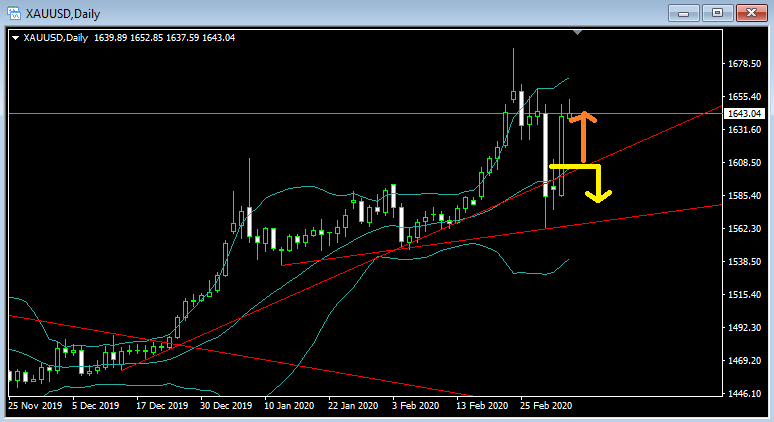

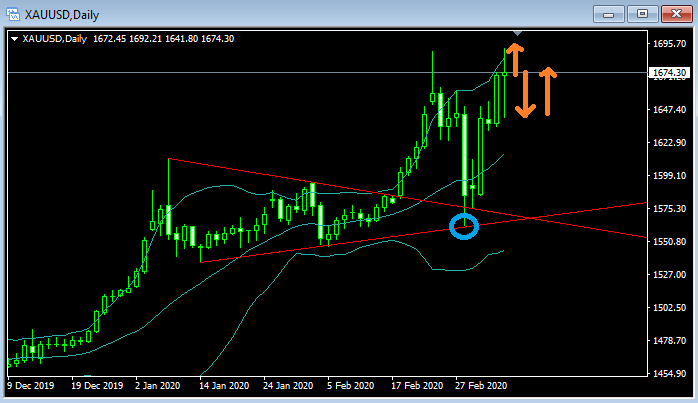

Have updated the daily XAUUSD view...

We are now seeing a different wedge view and either we are going to see a move down to the bottom trend-line or there is a chance we get a break above the upper line. The reason for the suspected break is when looking at the silver daily chart we are seeing a move above the upper trend-line (lower chart).

This is very interesting as typically silver moves would be lagging the gold moves.

The key factors are the virus, the US stock market highs (and nervousness around this) and the USD devaluation.

We have an interesting few days ahead of us!!

Aug 16, 2011からメンバー

106 投稿

Feb 24, 2020 at 02:39

Aug 16, 2011からメンバー

106 投稿

Hello Followers,

Gold keeps pushing north and started Monday with a decent gap. Normally these gaps are filled.

Unfortunately for Gold Trader, it does not ride these big moves and only really generates trades when the markets are ranging. Normally charts range 80% of the time and we are in one of those 20% of the times when gold takes a major move.

My thinking is that the buyers are going to be taking some profit in the next couple of days. Otherwise the other signal is that the sellers are shrinking up and longer term buyers are taking charge, if that is the case it is not good for the USD.

Aug 16, 2011からメンバー

106 投稿

Feb 26, 2020 at 01:45

Aug 16, 2011からメンバー

106 投稿

Hello Followers,

We have had a huge couple of weeks on gold. The virus has seen gold become a safe-haven and we have seen stock markets across the globe retracing off highs. This could be the start of a global stock market correction, one that you would normally see in October. From a cycle perspective, a correction is well overdue.

Looking at the gold chart we can see a major new 7 year high and has now settled back...

My feeling is that we are going to see a re-test of the new blue trend-line that I have draw on the daily chart. From there I would expect a bounce back up, however this may take some time to recover considering the strength of the recent gains.

Unfortunately those traders calling a triple top have been stopped out or blown their account. These people are now very quiet on the forums! People need to remember that with gold it is different than forex/currencies and that when trading EURUSD you can focus on the EUR fundamentals and monitor correlations however with XAUUSD the major impact on XAU is the USD technicals. We all know that the dollar is near end of life and it is now a matter of time before a replacement comes along or we move to some form of gold/silver standard. Just my opinion anyway...

Aug 16, 2011からメンバー

106 投稿

Feb 29, 2020 at 08:33

Aug 16, 2011からメンバー

106 投稿

Hello Followers,

We had a massive end of month sell off on gold after a big week of red on the stock markets.

The most recent trend-line was broken and there is a chance of a bounce back, however it appears that there will be further downward pressure on the pair. Would be very surprised if it went below 1500, however anything is possible.

My thinking is that the USD or EUR should be dropping more than XAU. If this is the case we may see a move back to the new blue trend-line and then bounce up.

You will notice that Bitcoin has also dropped considerably.

Next week will be interesting. It appears that the coronavirus may be a true global pandemic and this is halting factories, closing down cities and causing much panic.

Don't they say that when there is blood in the streets, then that is the time to buy...

Aug 16, 2011からメンバー

106 投稿

Mar 04, 2020 at 03:26

Aug 16, 2011からメンバー

106 投稿

Hello followers,

Have not had any trades come up so far this month.

I do not want to get into trades too early and the EA entries are just not being triggered.

What is interesting is that a gold/silver analyst that I check weekly was promoting sell orders at 1508. These would have been triggered and would now be in a decent draw-down.

The last few days demonstrate why Gold Trade is buy only as if it included shorts I would expect to have been caught in the recent move.

The obvious reason for the quick bullish move back to higher region is the lowering of interest rate and panic around virus. Many reserve banks are talking further stimulus, which is not good for fiat currencies.

We have NFP on Friday so will wait and see.

There is a chance no trades will be generated this week.

Aug 16, 2011からメンバー

106 投稿

Mar 06, 2020 at 23:46

Aug 16, 2011からメンバー

106 投稿

Hello Followers,

We had quite a roller-coaster yesterday and in the last week we have seen further bullish momentum on gold.

Will be interesting to see what Gold and Silver Club analyst reports next week as he was talking short orders at 1609. We had a consequent move up to 1690.

Unfortunately for the Gold Trader strategy it does not pick up on those major moves, only ranging long trades. Fortunately for Gold Trader strategy it does not get caught up in major sell-offs (well hasn't to date anyway!).

Looking at the chart we can see that move on Friday where the Non Farm Payrolls reading was announced and was opposite to expectations. So we saw a move up prior in anticipation of a negative reading for USD, then the announcement which saw the move down, and then finally I think that traders thought that the announcement was fudged and bought back in to move back up.

Next week will be interesting and am hoping that Gold Trader picks up a few trades. Last week was an extremely quiet week.

Aug 16, 2011からメンバー

106 投稿

Mar 11, 2020 at 00:59

Aug 16, 2011からメンバー

106 投稿

Hello Followers,

GOLD TO SILVER RATIO:

Keep an eye on the Gold to Silver ratio. It is a bit less than 100:1 and indicating that gold is over-valued and silver is way under-valued.

Silver has had a rough run recently and cannot explain why this would be the case. Silver has more industrial applications than gold and perhaps the recent closing of factories due to virus fears has been reflected in the price. However, fundamentally we have a dollar that is crashing and silver (and gold) are both solid commodities and stores of value.

The reason why Gold Trader is not Gold & Silver Trader is due to the fact that the correlations between the two are not accurate, silver chart tends to me way more volatile and it feels that silver is very jumpy whereas gold is more reliable for trend-lines and technical analysis. It is very clear that the volumes ($ not oz) on gold are higher than silver.

GOLD TO SILVER RATIO:

Keep an eye on the Gold to Silver ratio. It is a bit less than 100:1 and indicating that gold is over-valued and silver is way under-valued.

Silver has had a rough run recently and cannot explain why this would be the case. Silver has more industrial applications than gold and perhaps the recent closing of factories due to virus fears has been reflected in the price. However, fundamentally we have a dollar that is crashing and silver (and gold) are both solid commodities and stores of value.

The reason why Gold Trader is not Gold & Silver Trader is due to the fact that the correlations between the two are not accurate, silver chart tends to me way more volatile and it feels that silver is very jumpy whereas gold is more reliable for trend-lines and technical analysis. It is very clear that the volumes ($ not oz) on gold are higher than silver.

May 14, 2019からメンバー

26 投稿

Dec 25, 2019からメンバー

20 投稿

Mar 12, 2020 at 18:25

Dec 25, 2019からメンバー

20 投稿

I would not say that silver is an asset that is rarely used in trading. I have many acquaintances who actively earn on metal values and it brings them pleasure. Another thing is that news that would be related to silver happens an order of magnitude less frequently than news on gold or platinum. On the other hand, silver is less susceptible to strong jumps, and as a rule, the price of this goes from level to level, which allows you to competently think out long-term positions.

*商用利用やスパムは容認されていないので、アカウントが停止される可能性があります。

ヒント:画像/YouTubeのURLを投稿すると自動的に埋め込まれます!

ヒント:この討論に参加しているユーザー名をオートコンプリートするには、@記号を入力します。

.png)