EBC Markets Briefing | Mounting geopolitical tensions support gold

Gold retreated from its highest level since early August on Tuesday, but inflows could help it maintain the strength ahead of US inflation data. The recent extreme volatility shocked financial markets.

Israeli forces pressed on with operations in Gaza’s second largest city amid an international push for a ceasefire deal and prevent a slide into a wider regional conflict with Iran and its proxies.

The US has sent a guided missile submarine to the Middle East, as tensions grow in the region. Officials said an aircraft carrier which was already heading to the area would sail there more quickly.

Meanwhile Ukrainian forces rammed through the Russian border and swept across some western parts of Russia's Kursk region, a surprise attack that laid bare the weakness of Russian border defence in the area.

Gold demand in India crept up last week due to a correction in price. Retail sales of gold jewellery in China remain subdued but there's an increased interest in gold bars as a safe-haven asset, MKS PAMP said.

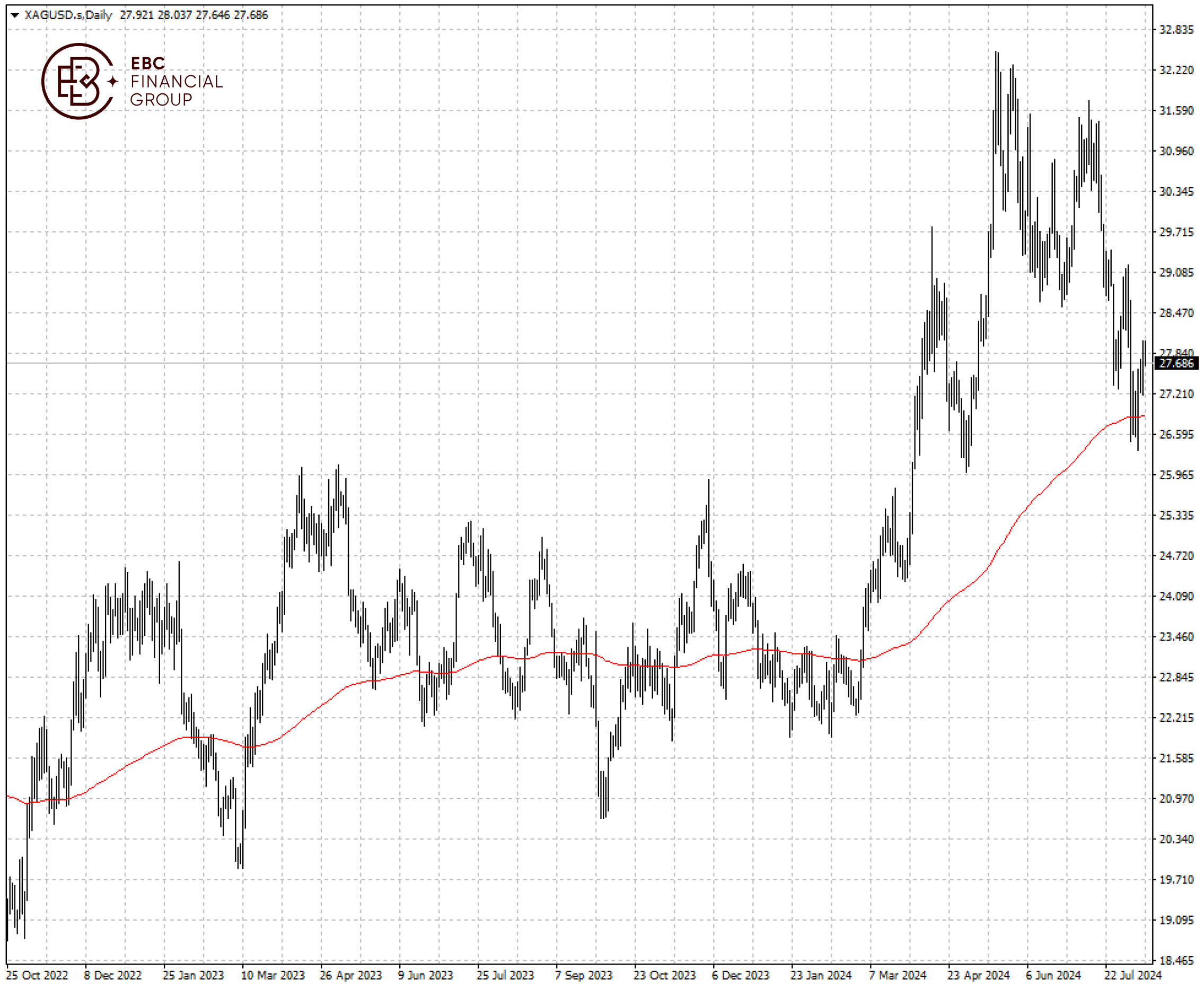

Industry experts warn that silver inventories are on the brink of depletion by 2025, driven by surging industrial demand in critical sectors like electronics, solar energy, and electric vehicles.

Silver has plunged from $31 since July. The ongoing rally was rejected by $28 on Monday, so there could be limited room for upside in the short term with potential support at 200 EMA.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Brand Influence or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.