Fed’s Dovish Tone Weakens Dollar, Lifts Majors | 15th October 2025

Dollar Slides on Dovish Fed

Global markets opened the week with renewed optimism as the US Dollar softened across major peers following dovish comments from Federal Reserve Chair Jerome Powell. Investors interpreted Powell’s remarks as a sign the Fed is preparing for a potential rate cut before year-end, which weighed on Treasury yields and boosted risk sentiment. Meanwhile, commodity-linked currencies like the Australian and Canadian Dollars saw mild support, though oil prices remained pressured by oversupply concerns and fragile demand outlook.

WTI Crude Oil Forecast

Current Price and Context

WTI remains subdued near $58.00, pressured by persistent concerns over global oversupply and cautious demand outlook. Despite modest optimism surrounding US–China trade relations, weak refinery margins and slower global manufacturing recovery continue to weigh on crude sentiment.

Key Drivers

Geopolitical Risks: Middle East tensions remain contained, reducing safe-haven demand in oil.

US Economic Data: Softer US inflation expectations signal slower industrial activity, limiting oil demand.

FOMC Outcome: Dovish Fed tone implies slower growth momentum, indirectly dampening oil demand outlook.

Trade Policy: Limited progress on US–China trade issues continues to cloud the energy trade flow outlook.

Monetary Policy: Prospects of Fed rate cuts weaken the USD but fail to offset oversupply pressures in oil.

Technical Outlook

Trend: Sideways to slightly bearish.

Resistance: $59.20

Support: $57.40

Forecast: WTI may trade in a narrow range with a bearish bias unless global demand indicators improve.

Sentiment and Catalysts

Market Sentiment: Bearish amid persistent oversupply narrative.

Catalysts: Upcoming US inventory data and OPEC’s monthly report.

USD/CAD Forecast

Current Price and Context

USD/CAD trades below 1.4050, softening after the Fed’s dovish stance weighed on the greenback. A mild rebound in oil prices has lent support to the Canadian Dollar, helping it outperform against the USD.

Key Drivers

Geopolitical Risks: Stable oil-producing regions ease CAD volatility.

US Economic Data: Weaker retail and CPI readings support expectations for future Fed cuts.

FOMC Outcome: Powell’s dovish tone pressures USD across the board.

Trade Policy: Stable North American trade environment supports CAD stability.

Monetary Policy: BoC maintains a cautious stance while Fed’s soft tone amplifies USD weakness.

Technical Outlook

Trend: Mildly bearish.

Resistance: 1.4080

Support: 1.3980

Forecast: Pair may extend losses toward 1.3980 if crude oil stabilizes and USD weakness persists.

Sentiment and Catalysts

Market Sentiment: Neutral-to-bearish for USD/CAD.

Catalysts: Canadian CPI and upcoming Fed minutes.

GBP/USD Forecast

Current Price and Context

GBP/USD extends gains toward 1.3350 as investors bet on Fed rate cuts, while the UK economic calendar remains light. The softer USD backdrop is providing upward momentum for the Pound despite ongoing concerns over UK growth.

Key Drivers

Geopolitical Risks: Calm political landscape in the UK limits volatility.

US Economic Data: Weak figures reinforce dovish Fed expectations.

FOMC Outcome: Markets price in higher odds of a December rate cut.

Trade Policy: Stable UK–EU trade dynamics support short-term GBP stability.

Monetary Policy: BoE remains cautious, mirroring global easing sentiment.

Technical Outlook

Trend: Bullish near-term.

Resistance: 1.3380

Support: 1.3280

Forecast: Further gains likely if Fed dovishness deepens and the USD weakens further.

Sentiment and Catalysts

Market Sentiment: Bullish as traders unwind USD long positions.

Catalysts: UK jobs data and Fed’s Powell follow-up remarks.

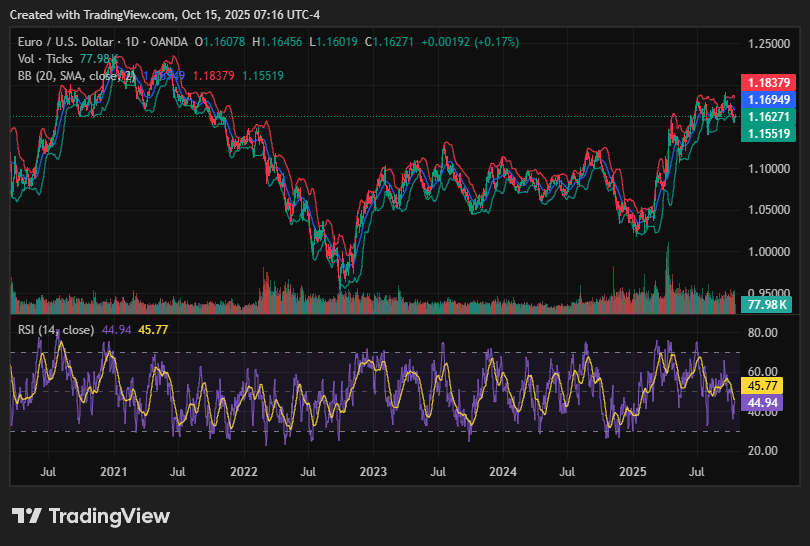

EUR/USD Forecast

Current Price and Context

EUR/USD advances above 1.1600 as the dollar weakens following dovish Fed remarks. The pair is drawing moderate support from expectations that the ECB will maintain its current policy stance, contrasting with the Fed’s tilt toward easing.

Key Drivers

Geopolitical Risks: Easing trade tensions lift investor sentiment in Europe.

US Economic Data: Soft inflation readings weigh on USD demand.

FOMC Outcome: Dovish tone encourages fresh buying in EUR/USD.

Trade Policy: Stabilizing EU–China trade relations provide moderate support.

Monetary Policy: ECB’s steady approach contrasts with Fed’s dovish bias, favoring the Euro.

Technical Outlook

Trend: Bullish short-term.

Resistance: 1.1650

Support: 1.1550

Forecast: Pair likely to remain supported while the Fed maintains an easing stance.

Sentiment and Catalysts

Market Sentiment: Optimistic toward EUR recovery.

Catalysts: Eurozone inflation data, Fed minutes.

AUD/USD Forecast

Current Price and Context

AUD/USD strengthens modestly, trading around 0.6590, lifted by a weaker USD and firming risk appetite. The Aussie benefits from renewed optimism around China’s economic outlook and dovish Fed expectations.

Key Drivers

Geopolitical Risks: Stable Asia-Pacific environment supports AUD resilience.

US Economic Data: Weaker CPI data heightens Fed cut expectations.

FOMC Outcome: Dovish comments drive fresh AUD demand.

Trade Policy: China’s improved trade sentiment bolsters AUD.

Monetary Policy: RBA’s neutral stance complements global easing tone.

Technical Outlook

Trend: Gradually bullish.

Resistance: 0.6620

Support: 0.6540

Forecast: AUD/USD could extend gains toward 0.6620 as long as USD softness continues.

Sentiment and Catalysts

Market Sentiment: Mildly bullish on risk-on tone.

Catalysts: China’s economic data and upcoming Fed minutes.

Wrap-up

Overall, the market’s focus remains squarely on the Fed’s policy trajectory and its impact on global growth expectations. A softer US Dollar has lent support to major currencies, while WTI crude continues to trade under pressure amid excess supply and geopolitical caution. Traders are now awaiting upcoming US economic data and FOMC minutes for further confirmation of the Fed’s easing stance, which could set the tone for the next leg of the market’s direction.

Ready to trade global markets with confidence? Join Moneta Markets today and unlock 1000+ instruments, ultra-fast execution, ECN spreads from 0.0 pips, and more! Start now with Moneta Markets!