An unexpected jump in US inflation

An unexpected jump in US inflation

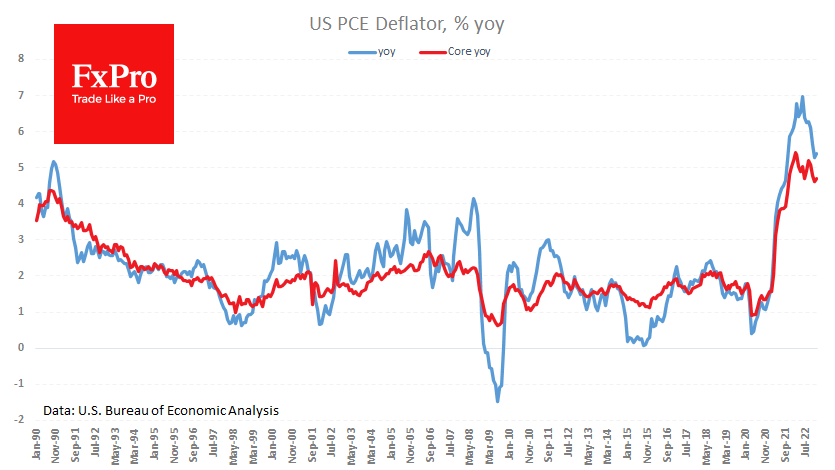

The US personal consumption price index (the Fed's preferred measure of inflation) unexpectedly rose in January, triggering a fresh bout of risk aversion in the financial markets. The index rose 0.6% m/m, against expectations of 0.4%. However, much more attention was paid to the acceleration in annual inflation from 4.6% to 4.7% instead of the expected slowdown to 4.3%.

The sudden (to markets and analysts, but not to the Fed) inflation spike is another argument that the central bank needs to do more to cool the economy.

Investors need to understand that commodity inflation has gone with the year 2022. In recent months US prices have been pushed up by an overheated labour market with the lowest unemployment rate since the late 1960s and a recovery in the services sector. The only way to beat this kind of inflation is to "cool the economy", which in the language of politicians and central bankers, means creating conditions where aggregate demand falls, i.e., job cuts in a hard-core scenario.

As always in such circumstances, politicians talk about the intention to create a "soft landing", but such intentions have not been realised in the past, and the decline has, at some point, become uncontrollable.

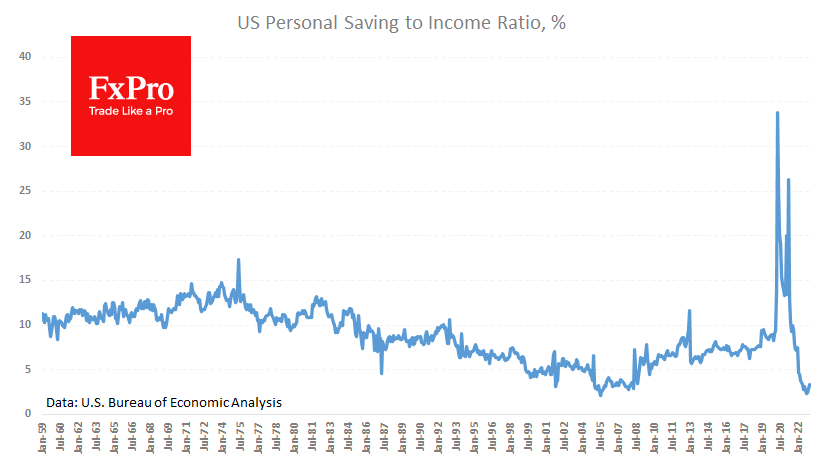

And it is worth noting that there are significant signs of economic deterioration. After two months of minimal cuts of 0.1%, spending jumped by 1.8% in January. Monthly income growth was three times lower at 0.6%. Americans saved just 3.3% of disposable income in January, last seen during the mortgage crisis of 2005-2008 - a rather difficult period for markets.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)