Advertisement

USDJPY Exchange Rate

US Dollar vs Japanese Yen Exchange Rate (USD to JPY)

-0.48% -74.6 pips

Bid/Ask:

156.168/156.914

Daily range:

155.652 - 156.924

1 minute range

5 minutes range

15 minutes range

30 minutes range

1 Hour range

4 Hours range

Daily range

Weekly range

Monthly range

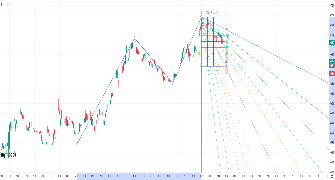

USDJPY Live Price Chart

Upcoming Events for USD and JPY

|

Event

|

Prev.

|

Cons.

|

|||

|---|---|---|---|---|---|

|

5h 48m

Low

|

USD | 1148.3 | |||

|

5h 48m

Low

|

USD | -3.8 | |||

|

5h 48m

Low

|

USD | 315.6 | |||

|

5h 48m

Med

|

USD | 6.38 | |||

|

5h 48m

Low

|

USD | 176.5 | |||

|

7h 18m

High

|

USD | 217.5K |

219K

|

||

|

7h 18m

High

|

USD | 1897K |

1900K

|

||

|

7h 18m

High

|

USD | 224K |

223K

|

||

|

9h 18m

Low

|

USD | 3.781% | |||

|

10h 18m

Low

|

USD | 3.58% |

FRB and BOJ Interest Rates

| Country | Central Bank | Current Rate | Previous Rate | Next Meeting |

|---|---|---|---|---|

| United States | Federal Reserve | 3.75% | 4.0% | 35 days |

| Japan | Bank of Japan | 0.75% | 0.5% | 29 days |

Latest USDJPY News

U.S. Consumer Confidence Deteriorates For Fifth Straight Month In December

Consumer confidence in the U.S. deteriorated for the fifth consecutive month in December, according to a report released by the Conference Board on Tuesday. The Conference Board said its consumer confidence index slid to 89.1 in December from an upwardly revised 92.9 in November.

RTTNews

|

15h 48min ago

U.S. Industrial Production Rises 0.2% In November, Slightly More Than Expected

A report released by the Federal Reserve on Tuesday showed industrial production in the U.S. increased by slightly more than expected in the month of November. The Fed said industrial production rose by 0.2 percent in November after edging down by 0.1 percent in October. Economists had expected industrial production to inch up by 0.1 percent.

RTTNews

|

15h 52min ago

U.S. Economy Grows Much More Than Expected In Q3

A report released by the Commerce Department on Tuesday showed the U.S. economy grew by much more than expected in the third quarter of 2025. The Commerce Department said real gross domestic product spiked by 4.3 percent in the third quarter after surging by 3.8 percent in the second quarter. Economists had expected GDP to jump by 3.3 percent.

RTTNews

|

16h 13min ago

U.S. Durable Goods Orders Plunge 2.2% In October, More Than Expected

Reflecting a steep drop in orders for transportation equipment, the Commerce Department released a report on Tuesday showing new orders for U.S. manufactured durable goods fell by more than expected in the month of October. The report said durable goods orders tumbled by 2.2 percent in October after climbing by an upwardly revised 0.7 percent in September.

RTTNews

|

16h 27min ago

Analysis for USDJPY

The yen was saved by interventions

Verbal interventions by the Japanese government helped the bears on USDJPY. The weakness of the US dollar and the fall in Treasury yields allowed gold to set its 50th record in 2025.

FxPro

|

20h 34min ago

Gold sets a record

The US dollar may strengthen against major global currencies. Debasement trading and geopolitics are helping gold.

FxPro

|

1 day ago

Technical Analysis on USDJPY, EURUSD, Gold

USDJPY retains bullish setup and rises above 20-SMA. EURUSD holds weak momentum. Gold remains directlionless

XM Group

|

5 days ago

The dollar's wings have been clipped

Christopher Waller's dovish rhetoric halted the bears' attack on EURUSD. Slowing British inflation caused the pound to fall, while the Bank of Japan is preparing to raise rates.

FxPro

|

5 days ago

USDJPY Exchange Rates Analysis

USDJPY Historical Data - Historical USDJPY data selectable by date range and timeframe.

USDJPY Volatility - USDJPY real time currency volatility analysis.

USDJPY Correlation - USDJPY real time currency correlation analysis.

USDJPY Indicators - USDJPY real time indicators.

USDJPY Patterns - USDJPY real time price patterns.

USDJPY Technical Analysis

Technical Summary:

Sell

| Pattern | Buy (2) | Sell (6) |

|---|---|---|

| Belt-hold |

m1, m5

|

|

| Doji |

m30, h1, mn

|

|

| High-Wave |

m30, h1, mn

|

|

| Long Legged Doji |

m30, h1, mn

|

|

| Long Line |

m5

|

|

| Rickshaw Man |

m30, mn

|

|

| Spinning Top |

h1, h4

|

m15, m30, mn

|

Legend:

Buy

Sell

Neutral

Live Spreads

| Brokers | USD/JPY |

|---|---|

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

.jpg) Open Account

Open Account

|

- |

Charts Activity

-

USDJPY,M5 by Pedrojuan Jul 15 at 09:32

-

USDJPY,M30 by EdAb Jul 10 at 13:52

-

USDJPY,M5 by Pedrojuan Jul 09 at 07:27

-

USDJPY,M30 by Pedrojuan Jun 06 at 15:25

-

USDJPY,H4 by Miketrading245 Apr 21 at 16:43

Heat Map

| 1 minute | |

| 5 minutes | |

| 15 minutes | |

| 30 minutes | |

| 1 hour | |

| 4 hours | |

| Daily | |

| Weekly | |

| Monthly |