AUDUSD shows signs of reversal

AUDUSD shows signs of reversal

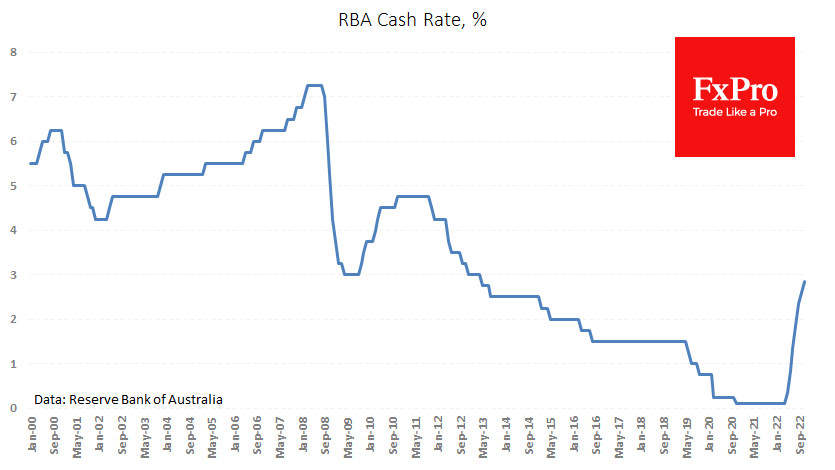

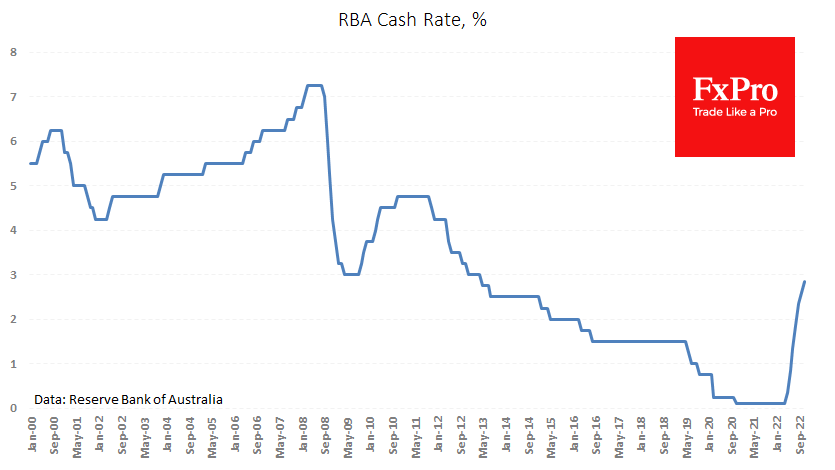

The Reserve Bank of Australia duplicated its move of a month ago by raising the rate by 25 points to 2.85%, in line with economists' average expectations. This contrasts sharply with a 75-point rate hike from the ECB and expectations of similar moves from the Fed and Bank of England later this week.

However, it is worth bearing in mind that the RBA makes rate decisions every month and globally does not lag.

A solid trade surplus generates a natural flow of capital into the country, lowering rates. In addition, lower inflation in Australia compared to Europe or the US leaves the RBA with more room for manoeuvre. Abrupt rate hikes create shockwaves for the economy, while the ability to act more smoothly will put less pressure on the economy and return to growth more quickly when market conditions change.

The slower rate hikes by the RBA early last month triggered a prolonged sell-off in the Aussie, which rewrote lows from April 2020, dropping to 0.6160 at one point. However, by the November meeting, players had already recalibrated their expectations.

The AUDUSD had been gaining the previous two weeks and has remained on the plus side since the beginning of this one after a more than 13% collapse from August to mid-October. We have seen this kind of dynamic more than once on long-term reversals, as we witnessed in 2020 and before that in 2016 and 2009.

However, uncertainty hangs over this bullish scenario in the form of market reaction to the Fed's rate decision comments coming out today. If they do not overturn the markets, the Australian dollar could continue to be in demand.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)