Dollar and stocks bounce back on easing trade tensions, gold slips

US and China to resume trade talks after spat

Market sentiment continued to improve at the start of the new trading week following the turnaround late on Friday after President Trump attempted to play down the latest escalation in trade frictions between the US and China. Trump sought to ease fears that he intends to make good on his threat to hike tariffs on Chinese imports by 100% by saying “it’s not sustainable”, although he also suggested that he would if he was forced to.

Crucially, the two countries have agreed to resume negotiations, with Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng due to meet in Malaysia later this week. Progress in the talks is imperative if the planned meeting between Trump and China’s President Xi at the end of the month is to go ahead.

With the Trump administration fuming about China’s recent restrictions on rare earth exports, the failure to halt the flow of fentanyl and the plunge in purchases of American soybeans, any deal between the two leaders could pave the way for a more permanent trade agreement when the current truce expires on November 10.

The danger is that neither leader wants to be seen as weak for their domestic audiences and with Beijing holding strong cards with rare earths and soybeans, Trump may have blinked first by appearing to backtrack on his threat.

Global stock markets cheer easing trade tensions

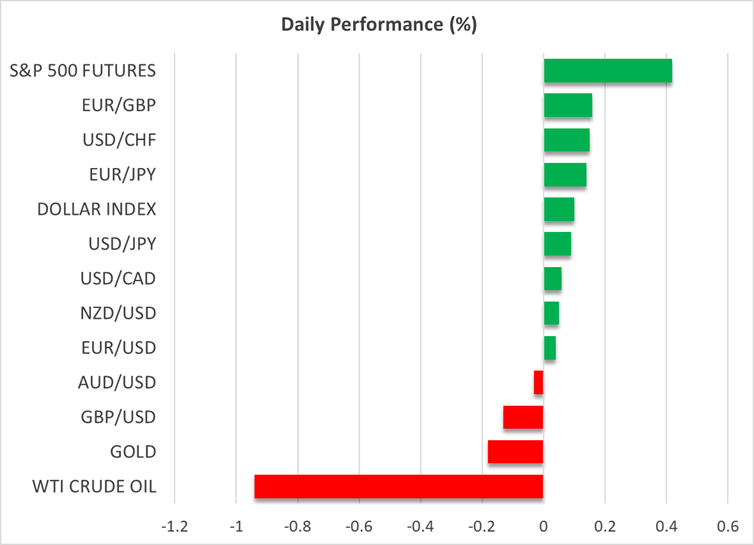

For the markets, however, this can only be a good thing as the lack of desire on both sides to escalate the row further and willingness to negotiate has raised hopes that the standoff will be short lived. US stocks rebounded on Friday, with all three main indices even managing to finish the week higher.

Underpinning the positive mood is the strong start to the Q3 earnings season, which heats up this week, with Netflix and Tesla among the highlights.

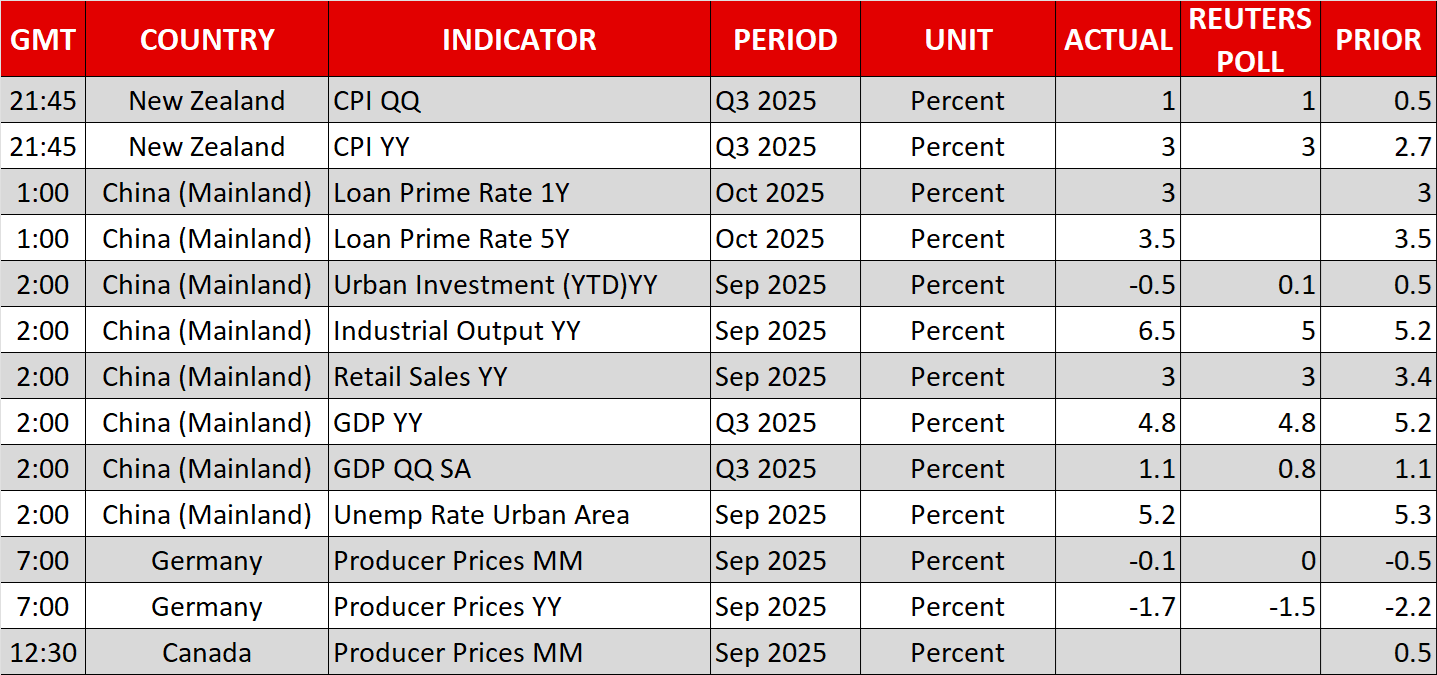

Asian stocks surged at the close on Monday and European markets are also positive. Chinese indices were additionally boosted by solid economic data out this morning. China’s GDP grew by a stronger-than-expected 1.1% q/q in the three months to September, although annual growth slowed to 4.8% y/y. But a rebound in industrial output in September backed the view that, so far, the impact of the US trade war on the economy has been minimal.

Yen caught between conflicting BoJ expectations

But the day’s best performer was the Nikkei 225 index in Tokyo, as Japanese stocks were buoyed by news that the ruling LDP party and the Innovation (Ishin) Party – the third biggest party in parliament by seats – are close to sealing a pact on forming a coalition.

Newly elected LDP leader Sanae Takaichi’s bid to become prime minister was left hanging after the party’s previous coalition partners pulled out. Hence, the 'Takaichi trade' whereby stocks rally on the hopes of more fiscal stimulus and the yen is sold off on expectations that the new government will oppose aggressive tightening by the Bank of Japan, is back on.

However, those bets are probably overdone and the end to the political stalemate is likely to be just as important a factor in the Nikkei’s surge today, while the yen has already crawled back some losses following some hawkish BoJ commentary. Board member Hajime Takata hinted that the bank has already “roughly achieved the BoJ’s 2% inflation target”, warranting another rate increase.

Dollar eyes CPI report, kiwi firmer after inflation rise

Despite the yen’s reversal today, the US dollar remains broadly higher against a basket of currencies, extending its recovery from Friday’s lows. With most Fed policymakers seemingly backing a rate cut later this month, the markets are dovishly positioned ahead of Friday’s delayed release of the September CPI report.

However, it’s not certain that an upside surprise would necessarily spook investors after Chair Powell reiterated last week that the labour market is a bigger concern right now.

As seen from today’s CPI figures out of New Zealand, investors have not scaled back their rate cut expectations for the RBNZ’s next meeting in November, despite inflation hitting the bank’s upper target band of 3.0%.

The kiwi was last trading slightly higher, around $0.5735.

Gold rally takes a breather

In commodities, oil futures were unable to benefit much from the improved risk appetite, but gold was steadier after Friday’s slump.

The precious metal succumbed to profit taking after stretching its record winning streak above $4,300/oz earlier in the day. With the dollar appreciating somewhat and Fed rate cut expectations unlikely to shift much before Friday’s US CPI data, some consolidation makes sense until then.

Meanwhile, Trump’s refusal to supply Ukraine with tomahawk missiles may also be weighing on gold as investors await the outcome of the proposed talks with Russia’s Putin to kickstart the peace efforts.

.jpg)